Could the Housing Market Crash or at least Turn Down Hard?

There are plenty of homebuyers still wondering when home prices might fall back to affordable levels. And too, they ask if a housing market crash is possible.

Most economists and housing experts of recent believe there won’t be a crash. If terrible things were going to happen, something would have surely happened by now. And as you might be aware in last month’s housing market report, 70% of large metros saw home price rises.

So the pressure valve is releasing gently, which makes a future plunge unlikely. In fact, this downward trend will likely continue and likely take price pressures away, unless buyers who are saving cash, decide to take the leap to get the house they want, while expecting variable rates to drop in the next 5 years. Those buyers just have to make sure they have enough cash and just wait it out.

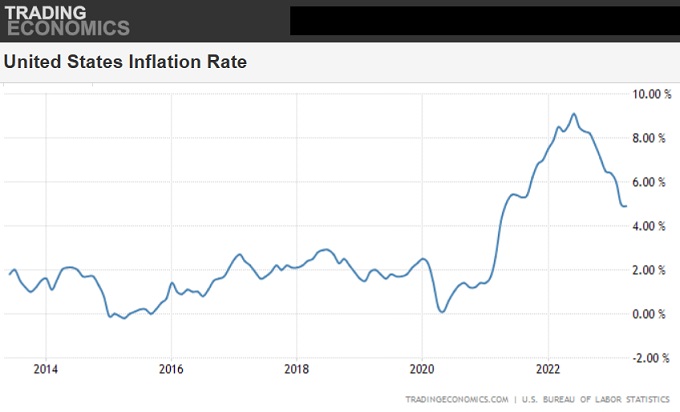

NAR’s Chief Economist Lawrence Yun forecasts that mortgage rates will fall closer to 6.0% in 2023 and then recede below 6.0% in 2024. He expects new and existing-home sales to bottom out in 2023 before an upturn in 2024. “Inflation will not reignite – inflation will come down closer to 3% by the year’s end,” Yun added.

Of all the real estate market crash signals, even the most recent one involving regional banks is not treated as an imminent threat either. All the threats are in check and because the FED is crushing inflation and speculation, the road ahead looks flat.

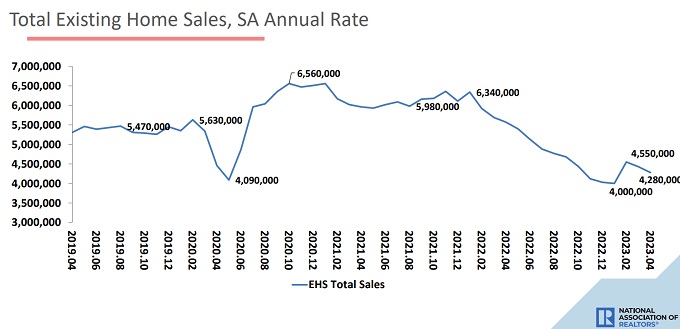

With speculators already out of the market and demand down, prices are in check and sales have diminished. So on the contrary, we might only be waiting for the rocket launch of a new bull market in 2024 which may take a while to get rolling. The rate effects won’t disappear till the end of 2024, making 2025 look good.

It seems the fundamental principle of vast undersupply to the market is keeping any possibility of a market crash at bay. It’s hard for experts to even conceive of a threat that could take the market down.

How about the Market in Austin TX?

The tech sector keeps getting hit hard such that the NASDAQ even had a bad week. Low oil and gas prices combined with a lagging tech sector with its layoffs does spell hard time for Austin’s housing market. Sales and prices and rent prices in Austin have dropped in response. However, in April, prices rose again! Austin’s a tremendous city with a bright future, so that might be its saving grace.

Home Prices Can Still Fall

After the summer peak demand season passes, the fall season suffering from the lagging effects of high FED rate increases could bring prices down generally across the country. The FED is waiting patiently for consumers to slow spending. With no significant unemployment, wage drops, or changes to the status quo, consumer spending might not plummet.

Yesterday’s inflation report saw inflation drop below 5% for the first time in two years. So progress in fighting inflation is happening. The story of persistent inflation might be with the unwillingness of foreign suppliers to drop their prices, supply chains issues, and with multinational corporations not willing to drop their prices. What could the inflation fighters do to deal with that?

Construction permits and new starts are down, but only because buyers can’t afford the high rate mortgages.

Mortgage refinancing is a small threat for 2024, 2025 and 2026 when millions of mortgages must be refinanced at much higher rates. Those mortgagees are hoping rates will have dropped by next year.

Year 2024 Might Not be as Bad as Anticipated

We’re still 6 months away from 2024, looking at a weak fall and winter season ahead, so rates might drop a couple percent by then. Certainly by 2025, homebuyers should be out of the danger zone.

The debt fault crisis passed with little real fear, and for two more years we don’t need to concern ourselves with it. In fact, without more pressing economic issues, there is little opportunity for the Biden admin to screw up either monetary or fiscally. Spending will ease thus reducing that inflationary cause.

Homeowners aren’t inclined to sell with few new listings appearing. Even if prices of homes rocket, many will not sell given they have to refinance at higher rates. That makes no sense, when finding a new place to live is difficult. So it’s a slow stagflation kind of period where it’s not dropping much and inflation is receding too.

It’s a very complicated scenario which is why many forecasters and TV experts avoid any kind of embarrassment-generating prediction. For those who like economic and housing market stability, it’s not a bad picture for 2025, 2025,2026 period. The 5 year forecast is one of steady increasing sales of homes, and yes, higher home prices.

Waiting for the Recovery

With all the cash that corporations have in money markets and cash that consumers have in banks, there’s lots of optimism that the housing market 5 year forecast is promising.

We’re all just waiting for the 2024 recovery to begin and move through the five year growth trend. With the likelihood of a new sitting US President, the picture brightens even further, given that candidates will have to answer to Americans regarding the housing crisis. More real effort there will lift the housing market and make Realtors and homebuyers a little happier.

Review the current housing market forecast for more details on sales happening right now.

Home Equity Lines of Credit | 5 Year Real Estate Outlook | Home Equity Conversion Mortgages | Mortgage Rate Forecast | Florida Housing Market | California Housing Market 2024 | Denver Housing Market | San Diego Housing Market 2024 | Atlanta Housing Market | New York Housing Market 2024 | Best Cities to Buy Property 2024 | Los Angeles Housing Market | Travel SaaS Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO