Homebuyers Income Jumped Last Year

For Realtors, the 2024 housing market outlook is a little brighter. More listings, more sales, and homebuyers’ incomes have risen.

Really, isn’t that all the good news Realtors need? Lawrence Yun, chief economist of the National Association of Realtors® himself predicts home sales likely will climb 14% this year. There’s a lot of talk about lower rates and how they’ll stimulate the market, but of late, the talk from the FED is for fewer rate cuts, and some economists believe there will be none at all.

Mortgage rates may not fall at all, and if some regional banks fail, it’s likely to push rates up. So hold onto your hat for a wild ride in 2024.

Sadly, the latest inflation reports are trending up as the economy is doing well. That would lead the FED to keep rates where they are. This is highly likely, but maybe that’s okay for buyers who are ready to buy at 6.6% rates. The FED is guided by old data and perhaps an outdated idea on how to reduce inflation. In fact, lowering rates would free up supply in the economy from transportation to food to housing. The Democrat’s penalties on energy production too are causing higher fuel costs which raises prices in almost every area of the economy.

While NAR doesn’t poll Realtor’s sentiment about the economy, FED or the Biden White House, it likely isn’t too positive. Realtors have been hit the hardest by the rate hikes and disregard of the housing market.

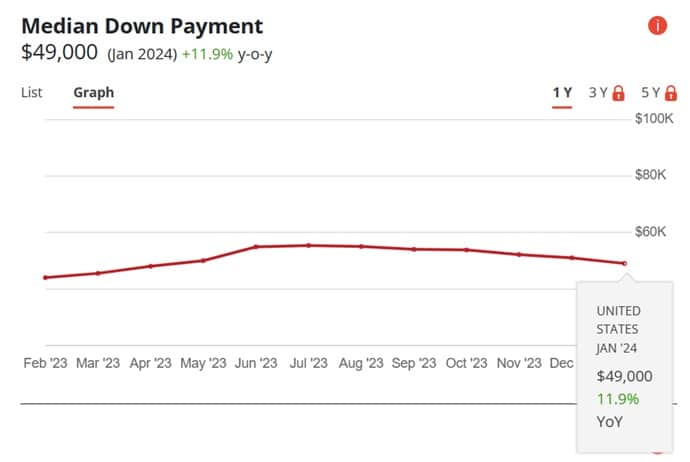

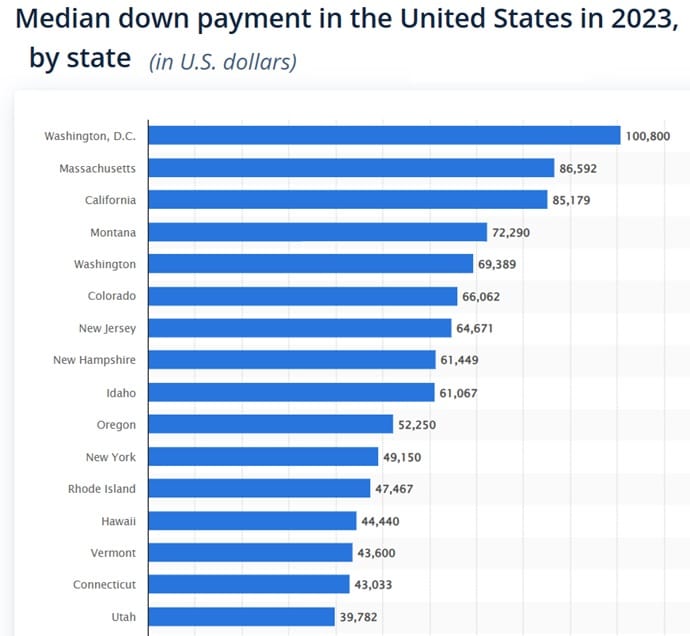

According to AttomData, the median downpayment on a home across the country reached $51,250 in January. Given growing incomes and rising prices, that number will rise as it does every summer season.

Buyers Have More Money to Spend

NAR reported that homebuyers had the good fortune of seeing a 22% rise in their incomes, and that downpayments on homes jumped to their highest level in 20 years. A rise in income is essential to offset a time of unaffordability, second only to the ultra-high era of the early 80s, during that housing market crash. Existing-home sales plummeted almost 50% the peak trough period between 1978 and 1982, before rebounding alongside lower mortgage rates. Of course, the same will happen in 2025/2026 as rates are forced down.

This had to cheer up even the most jaded real estate agents who no doubt suffered in 2023, one of worst years on record for the housing market.

Realtor Sentiment Rose in January

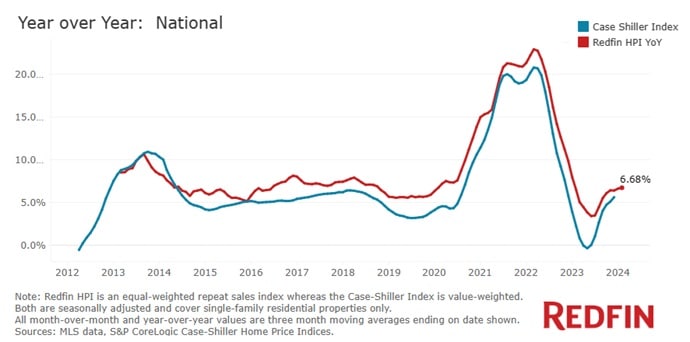

The market is almost 2 months past the last Realtor Sentiment Survey posts in January, however sales are rising and home prices are up showing demand is good in February according to Redfin’s February Sales Report.

Redfin reports sales rose slightly by .5% during February and the average price grew 2.7% to $412,778. That median price was up 6.6% year over year, the largest jump since September 2022.

Redfin reports new listings rose 3.8% last month, and were up 14.8% YoY, to 548,285 units, and total homes for sale grew .8% to 1,601,260 (annual, seasonally adjusted). Homes are selling 2 days faster on average (although NAR Realtors report 3 days slower), and price drops declined by .1 ppts. Average Sale to listing price rose by .4 ppts to 8=98.7%.

All good stats as far as I can see. New listings grew fastest in Austin, TX (44.6%), Dallas (38.1%) and Charleston, SC (36.8%). And active listings increased fastest in Cape Coral, FL (60.6%), North Port, FL (52.5%) and Fort Lauderdale, FL (25.5%).

Median home sales increased most year over year in Newark, NJ (16.5%), Anaheim, CA (15.8%) and Grand Rapids, MI (15.8%). Cities with the highest sold above listing price include San Jose (65.3%), Rochester, NY (62.8%), and Oakland, CA (62.3%).

Home prices in some cities are up strongly vs 12 months ago. They’re more on the east coast, however San Jose did see the highest increase.

The average 30-year-fixed mortgage rose slightly to 6.78% last month from 6.64% in January. Despite the FEDs higher for longer sentiment, it’s clear buyers aren’t deterred and in some cases might be aggressive and desperate to get deals done.

It’s obvious to anyone that FED’s insistence on high rates is resulting in higher costs, decreased new construction, and locking in homeowners who would really like to sell their home.

Realtors Outlook for Spring Selling Season

For the next 3 months, 36% of Realtors expect an increase in buyer traffic (up 16% from last year), and 28% expect an increase in home seller traffic (leads) which was up 13% from one year ago.

California Realtors seem to be particularly optimistic. Despite declining sales/listings up to March 15th, they have strong optimism for the immediate period ahead despite high prices in the Golden State.

The California housing market report will be updated shortly. Please bookmark for changes by the end of this week.

Housing Market in California | Florida Housing Market | Home Buying Strategy | Home Selling Tips | First Time Homebuyer Tips | When to Buy a House | Best Cities to Buy a Home | Best Time to Sell | Real Estate Leads