2020 Stock Market Correction

The 2020 stock market forecast was calling for more volatility. And with the pandemic, wow did ever happen! Good call except the cause was unforeseen.

(This is an old post)

If manufacturing comes back to the US, it is bound to stimulate investment, jobs, and of course stock performance. Yet, the monthly trade imbalance is up to $70 billion currently so there are some big worries ahead for the Biden government who seem to be preoccupied with nasty talk with both Russia and China.

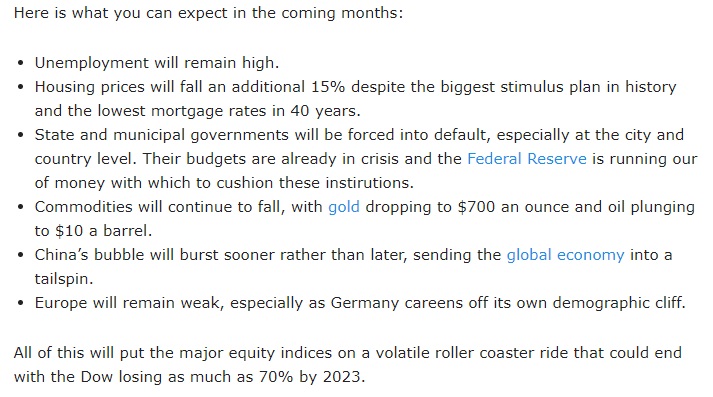

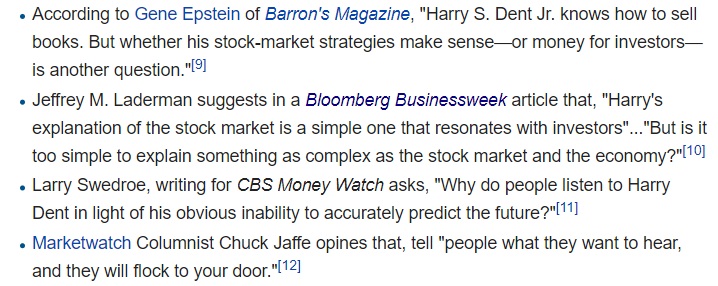

Expert stock market forecaster Harry Dent suggested the DOW might rocket to 3300 by 2020! Surprise, Harry was right. His latest doomsday talk is for another crash, perhaps by 2020.

So will you buy bonds or Amazon stock, Netflix Stock, Facebook stock, Google stock or Tesla Stock? What do the anti-trust charges against Google and Facebook mean for the markets. It may actually be very good for US companies.

Lots of stock market forecasts and predictions, yet the real meaning of volatility isn’t being communicated. While these dark days are concerning, the late spring should spawn a booming resurgence of the American economy.

The real issue for US companies is where they’ll get talented labor, how they’ll grow US market share, expand into foreign markets, and how they’ll find intelligent corporate leadership in an era of intense panic. It’s not just interest rates, jobs reports, or stock market indices.

The complainers are suspect. Like children complaining while waiting at the table for their dinner, political paparazzi can pose, posture, attack and sit on their hands all the while knowing President Trump will deliver an economic feast.

Smoke and Mirrors

Are these plunging US stock markets a reflection of the US economy? Is a stock market crash coming? Not likely. It’s just a volatile lull before US companies thrive, frolicking in a protectionist sandbox, knowing that big profits are just ahead. These are wonderful times for Americans. And many don’t appreciate it at all. They should be sent to their bedrooms without dinner. Will the housing markets crash as predicted, or are the real estate economics in 2019 going to be the savior?

Quite contrary to what is pushed to you on CNN/CNBC propaganda channels, smart 2019 stock market predictions are rosy.

Apple Forecast and Outlook

Apple lost 10% yesterday. That is a huge loss. Are FAANG and Apple’s woes a metaphor for multinational corporate outlook? The media have focused on Apple because it’s the biggest loser in this scenario. They outsource everything to foreign cheap labor pools. They’re a foreign company.

They push an advertised product consumers want. It’s not better. It’s the power of marketing. And the Democrats are playing on this product love, all the while hoping consumers will not think about what’s actually happening and only react to a threat to their favorite smartphone.

Hard to believe, but there are many upcoming US smartphones that will surpass these foreign made products.

As mentioned in the stock market prediction post, US business is undergoing a dramatic historic change. US companies are the new rising stars and likely are the ones you should be investing in right now. Forget Europe, Japan, and other distractions. The US is where all the action and profit is now.

After a long bout of “Free Trade Cancer”, some US companies are regaining their health while companies using cheap labor in Asia are are heading to the palliative care unit. The 25% US import tariffs are alive and big corporate stocks are plunging in value. Their business model is wrapped around cheapest labor sources, tax evasion, and free US market access. That’s gone.

“Apple ended the day down 10 per cent. Twenty-nine of 30 chipmakers in the Philadelphia Semi index fell, with Qorvo, Skyworks and Broadcom each off at least 8 per cent. 3M, Caterpillar and Dow DuPont dropped at least 3 per cent. Bristol-Myers sank 14 per cent, while Celgene jumped to the highest since October. Airlines tumbled after Delta cut its revenue forecast. American was off 7.5 per cent.” — from Yahoo Finance report.

Foreign multinationals especially are taking big hits. They depend on US investors and they’re quietly disappearing.

Bloomberg Reports

Bloomberg describes it as being a deceleration of the economy in its report. Bloomberg is completely political now so we’d have to believe their estimate of events is tainted. CNN, CNBC, Washington Post, New York Times and other democrat media are on the verge of something embarrassing — a total loss of face with their US audience. It gets tougher for them to explain away US business success.

Their total domination of US audiences is about to collapse, resulting in, oddly enough in faith in Donald Trump.

It’s always darkest before the dawn.

Summer is Coming

The S&P and NASDAQ suffered losses the last few days as well yet the biggest loser is the DOW Jones Industrial group of companies. Quite a few DOW Jones investors are losing confidence, but this is just January 3rd.

Simple logic really. President Trump is forcing them to bring manufacturing operations back to the US or lose their US customer market share. They resisted, imported like crazy during the fall, thinking they could grab some bridge profit that way. However, for CEO’s to react to change this way is very unprofessional. Hardly a surprise when investors give these big multinationals the thumbs down. They can see the future.

As this Yahoo Finance chart above shows, the DOW is plunging hard. It’s going to get worse. It’s not just Apple. It’s multinational corporations in general. For them, what goes around has finally around. No more cheapest labor tyranny. No more free tax and location incentives. No free US market access. President Trump drained the political swamp (well not really), now he’s aiming at companies that won’t employ Americans.

Who will break first? Multinationals. They have no power anymore other than to keep financing the Democrat Trump-bashing spectacle. Trump has until 2020. Corporate boards have to decide whether they can hold on for two years with very low profits and hope for a Democrat win. That won’t happen. Shareholders won’t wait, so you can imagine the battles happening in boardrooms right now.

They will give in, and the parade of high paying, high tech jobs will start showing up in California, Texas, Florida, New York, Massachusetts, and in the midwest too. Bezos, Cook, Buffet, and other’s bellyaching will soon end as the profit wave to the US mounts.

Is It All Wine and Roses?

No, the fact GM moved operations to Mexico shows an obvious weakness in Trump’s strategy. This could be why he doesn’t want to support Mexico. Multinationals could move operations to Mexico, or even Canada. No one wants to move to Canada or invest there. The key is he had to leave options for investors who still believe offshoring is necessary. The future of GM is negative.

Jerome Powell’s higher interest rate crusade looms too. He could crash all markets if he wants. He could invent whatever justification he needs and Trump couldn’t stop it. Higher interest rates during volatility and pessimism are poison.

Let’s watch how the US stock market predictions pan out? Bookmark this page and let’s continue this conversation about stock market profits and who is winning the investment Olympics.