Next Week’s Market Forecast

Outlook for the Week of October 13th to 17th.

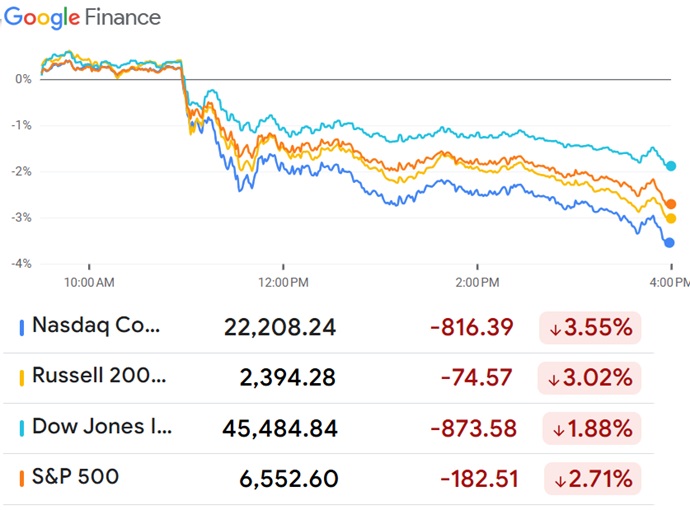

On Friday, as you’re well aware, the stock markets suffered the biggest drop since early April of this year after President Trump announced a massive 100% tariff against China. This is in retaliation for a couple of controversial measures taken by President Xi of China. Also, last Thursday, China companies were caught cheating on Iran/Russia oil sanctions. The mood of the Trump government appears to be running out of patience with Beijing.

Today, Tuesday the 13th, the President told the media “everything will be okay with China” and the indexes have regained about 60% of the Friday losses. The conciliatory talk by Trump might not matter though as Beijing so far is not backing down with its new trade measures, as much as they’re disliked.

Whether this is politics or actual trade damage, the outcome was sizable drops in the NASDAQ, DOW, S&P and the Russell 2000. The question for bright investors is where are the markets headed? And will Tuesday morning bring an even bigger decline? Should you sell off certain stocks? Investors have one more day to worry, and we know overthinking often leads to negative sentiment.

And this week is the start of earnings season, where it won’t take much to disappoint investors. Add this to the extended government shutdown and worries over the US debt interest payments, and you can sense a much bigger selloff by next Friday, if the Trump/Xi rhetoric deteriorate.

In any event, it could at least provide a buy-the-dip opportunity on some stocks. Forecaster Tom Lee, reiterated his belief in the 7000 S&P prediction. However, if markets slide hard with no news to prevent an escalation of trade tensions, then Tuesday might not be the bottom. Consumers’ and investors’ positive mood might take a few days to really decay.

Trump and XI Both Say They Won’t Back Down

As of Sunday afternoon, we haven’t heard anything to suggest President Trump is backing down. And the new tariffs could even be amplified or extended. Given this, the most likely prediction of what will the markets be like next week, is a strong downturn. Add to this, that the Asian markets haven’t had a chance to respond. They will decline with big drops and this will reverberate over to Europe and North America. You can view that data later tonight.

100% tariffs on the biggest trade partners is a major event. The reason we’re not seeing equities fall further is mostly denial, and a continuing exuberance and FOMO driven unrealism. Investors still believe the US is in the best growth scenario in decades with more to come. And US dominance in AI is the icing on the cake (see more on the best AI stocks to buy and AI small caps for even bigger gains). Valuations are grossly high and the markets are defined by a limited set of stocks. If a mood of negativity takes hold, consumers may pull back. Consider too, that it is wealthy consumers driving the retail markets. And with a continuing government shutdown and the implications for trade are obvious.

The long term is good, which will help control a cataclysmic sell off. The 2026 economy and stock market await.

Price of oil is dropping quickly, thus the drop in trade is being take seriously by commodity traders.

Statements out of China, further exascerbate the mood of the President. They accuse the U.S. of “double standards” while framing their actions on rare earth metals as “legitimate” measures under international law.” China says it will block exports of rare earths being used for military purposes, which Trump undoubtely intends as he builds the Golden Dome defense system. The docking fees China charged to US ships in Chinese ports comes at a bad moment too. China’s official statement about the trade conflict is not good, ” we do not want a trade war but we are not afraid of it.” Basically, they’re digging their heels in and not backing down. Of course, when goods are blocked from being delivered and production stops, China is pushed into a real crisis. Likely, after a month or so, they’ll back down.

China Stocks Monday Morning Update: The CSI300 Index (.CSI300) declined 1.8% and the Shanghai Composite was down 1.3% by lunch break. In Hong Kong, the Hang Seng benchmark (.HSI) slumped 3.5% and the Hang Seng Tech index (.HSTECH), plummeted 4.5%.

As President Trump knows about a convincing bluff, sometimes you have to be holding all the cards.

That sets up a gloomy outlook for equity prices this week.

What’s Happening This Week

On Tuesday morning, after the Columbus Day holiday, we get the NFIB sentiment index indicating how small independent business owners feel about the current economic outlook.

On Wednesday morning, Empire State manufacturing survey is released giving insights into how manufacturers are viewing the economic environment. Keep in mind the survey took place before Friday’s big tariff announcement. Many manufacturers will be stressed without their China supplies.

And on Thursday, a slate of important indicators are released:

| Report | Estimate | Previous | ||

| *U.S. retail sales | Sept. | 0.4% | 0.6% | |

| *Retail sales minus autos | Sept. | 0.4% | 0.7% | |

| *Producer price index | Sept. | 0.3% | -0.1% | |

| *Core PPI | Sept. | — | 0.3% | |

| *PPI year over year | — | 2.6% | ||

| *Core PPI year over year | — | 2.8% | ||

| *Initial jobless claims | Oct | — | NA | |

| Philadelphia Fed manufacturing survey | Oct. | 10 | 23.2 | |

| Business inventories | Aug. | 0.2% | 0.2% | |

| Home builder confidence index | Oct. | — | 32 |

Above data courtesy of MarketWatch.

Caution: Stocks Beyond Peak with Rich Valuations

The peak prices and rich valuations doesn’t mean a market crash would happen, but with the tariff implementation and prices above support levels, a short-term correction seems logical. There’s no telling when hedge fund managers and other institutional investors will sell-off and harvest some profits. They likely know a correction will happen and would like to make some money on that.

Complicating this possibility is the fact that one FED governor says 3 rate cuts are needed. Dissention in the FED is news. Federal Reserve Gov. Michelle “Miki” Bowman dissented from the Federal Open Market Committee’s decision last week to maintain the current Fed rate of between 4.25% and 4.5%. The recent jobs report comes while countries were pushing last-minute tariff-free imports into the US. Now that this is ended, those supply chains will weaken and die. It’s up to US companies to pick up the slack.

Long Term View: Upward and Onward for Investors

A lot more money will come into US stock markets in the next 12 months, perhaps a flood. Foreign investment and money market transfers could see trillions arriving. If you’re a smart investor with a longer investment time window, nothing that is happening this week or in the next 3 months to 6 months should be of concern. It was setup for a solid 2025 finish and a fantastic 2026 forecast outlook.

Will continuous trade wars with China upset the forecast?

But will retail investors, who are always nervous, react and make this a big sell off? FOMO investors are the first to bail when the situation is hard to understand and actors are erratic (Trump, Powell). The big news is that Trump looks like he’s going to be able to oust J Powell, and get interest rates reduced in the fall. That’s an optimistic sign for a market broadening as small caps are deeply affected by the FED rate. With oil prices likely to fall (economic slowdown/tariffs/lower oil demand), you may want to jump on small cap ai stocks if they fall (buy the dip opportunity).

It doesn’t look like there are many buy the dip opportunities left. The US economy, after the Powell FED debacle ends is set to soar. US companies and US stocks are the place to be. The stock market forecast from equities analysts and forecasts is for a 7000 S&P by end of year. However, in October, we might see it dip toward 6100, before slowly reviving. 7000 might be in jeopardy with the sudden trade tensions.

Canada is the Canary in the Coal Mine

That’s the issue no one is discussing. Can Europe, Canada, Mexico, and China survive without US spending and imports? Canada in particular is on the verge of economic failure with a will go to the mat with Trump. Others say the same thing, but that will certainly ruin their economies. In the case of Canada, it could actually expose raw, long-time tensions within Canadian provinces to explode into a split of the country.

Wednesday’s Tariff Implementation did Hit Markets Hard

A few experts believe the tariffs have already been priced in, but as I said, it wasn’t so. It’s difficult for anyone to estimate how nations like Canada, UK, and Europe would react to last Wednesday’s tariff deadline. Most say they will fight endlessly and create a trade war. The realization of that when it sinks in with institutional and retail investors, will create a panic.

Trump has set the market wobbling every day with new comments, often contradicting he’s said previously and this more to come this week. A few analysts mention that a crash isn’t totally out of the picture. The countertariffs and supply issues could be damaging, something a few political onlookers might wish for.

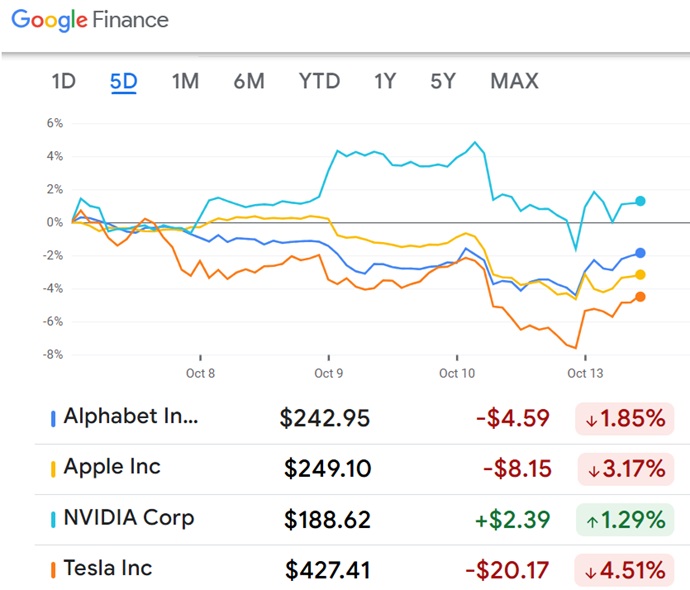

What happened last week was notable with Google and Palantir stock dropping almost 5% in one day. Will the indexes rebound by next Friday, or will panic set in and we’ll see the worst declines yet?

Sentiment Sours

“The US LEI fell again in February and continues to point to headwinds ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Consumers’ expectations of future business conditions turned more pessimistic.

As you’ll see below, consumer sentiment has soured yet there aren’t any numbers to support the dour outlook. Even wage growth fears are easing as the forecast is for a 3.9% rise, down just slightly. And in February 2025, US small business optimism fell as the NFIB Optimism Index slid 2.1 points to 100.7.

Chief Executive’s CEOs’ rating of current business conditions in the U.S. dropped a strong 20% from January (from 6.3 to 5 out of 10, on a scale where 1 is Poor and 10 is Excellent). That was the weakest rating since spring of 2020, when the pandemic shut down the economy. And CEOs’ forecast for one year from now fell 28 percent% —from 7/10 in January to 5/10 in March.

President Trump lauds the import tariffs as his key economic solution and speaks of the hundreds of billions in tax money the US government will enjoy. Yet, despite the obvious issues with it, last week he mentioned that “things will work out” and he would adjust the tariffs as needed. So far, the economic numbers look good given how bad it could have been. Next year, 2026, all this turbulence should be eased with the road ahead much clearer. The US should be fully on top of it in one year’s time. For the next 6 months however, the markets will be volatile and rhetoric heated.

The reciprocal tariffs mean US costs will rise considerably since US production capability isn’t sufficient. The US is lacking many of the inputs industry needs. This is why he is waffling and will likely try to ease tariffs on those key inputs. Automobiles however, will likely not be part of that easing. He reiterated his tariff on auto imports last week.

O’Reilly Automotive Nasdaq (ORLY) has caught the fancy of many investors as you can see in the chart below. With US auto industry hungry for parts, it is ideally positioned. And the tariff situation for auto parts seems better with delays on them being tariffed. Inevitably, US-based companies such as O’Reilly seem destined to dominate.

Should you Buy or Sell?

And in this uncertain environment, investors would be wise to sell or hold, and focus on the opportunities in the US forming. Experts believed the bottom was behind us, but the indexes just keep on falling. Yet, in the next few months, it might find its bottom. The economic slowdown will reduce corporate profits and send consumer sentiment and spending sliding (it was up .4% in February). So, the worst is yet to come.

Despite a strong downslide in the last few days, some equities managed to make gains.

Canadian Tariffs the Key Talking Point

This past week the markets took a plunge due to the uncertainty, not because of weak earnings or market fundamentals. It’s all about President Trump and the multiple tariffs he’s imposing on Canada, China and Europe. If he should decide to doll out some breaks to Canada and Mexico, it still doesn’t dissipate the negative effects overall. His intent with tariffs is clear — he believes they will serve many positive economic benefits. He’s also speaking about individual big investments from Taiwan’s TSMC and South Korea’s Hyundai for instance which amount to an impressive hundreds of billions of dollars.

Those are important for investors as decision points about buying US stocks.

It would be unreasonable to think he can or would eliminate the tariffs and let these companies down. He’s set a course for the US economy, regardless of the pain, to support American manufacturing and create jobs in the USA. Countries such as France, UK, Germany, China, Japan, Mexico and Canada will all take a hit.

This means the NASDAQ, Dow Jones, S&P and Russell2000 may take a big drop again on Tuesday in anticipation of Wednesday’s event. There will be comments and speeches of course, and they will catch the fancy of optimistic stock market experts, economists and retail investors who simply can’t fully be convinced this is happening. It’s a fantastic buy the dip opportunity to own US stocks which in one year will have grown substantially. Any forecast beyond 2025 is positive.

Kyle Bass of Hayman Capital, on Friday, said that these small corrections are actually good for economy and stock market, and will prevent a major damaging crash. A stock market crash has been deeply discounted despite the threats, yet we still haven’t see what these other nation’s retaliatory response will be. Many have said they will not back down. President Trump has warned he’s willing to add on futher tariffs and escalate the battle all the way.

Investors aren’t sure how to process everything that’s happening and many are selling off to avoid the risk. The rising price of gold tells us what the world believes. It hit a record of $3,038 at one point today.

I’ve been calling for this plunge for a little while, however many market experts including Tom Lee keep talking about a rally. Liz Sonders too, believes a sharp V-shaped recovery is just ahead and inflation isn’t a concern. Well, consumer price inflation rate rose strongly again in February on a firm upward curve every month. With tariffs applied, these prices are about to take a big leap.

Consumers are negative, sentiment dropped last week and that likely will recede further in early April. We know their sentiment has a big impact on stock prices, including the overvalued AI bubble stocks. It will take some powerful political events to make consumers believe all is well. As we know the US travel market is taking a beating, and foreign travel revenues will drop this summer travel season coming. That means many young Americans won’t have that needed summer job.

Let’s check back in on Monday on the live stock market today post.

Sectors to Watch

Consumer discretionaries, technology stocks, and industrials are seeing the most damage. China’s threatened action against Nvidia’s top chips sent its stock price down however, there is concern the microchips are in a bubble. This week’s retaliatory tariffs in response to Wednesday’s tariff hike by the US will hit industrials and tech even harder. Investors seem to know this.

Utilities was the only sector in the green, reflecting a recession scenario.

Investor Sentiment Survey

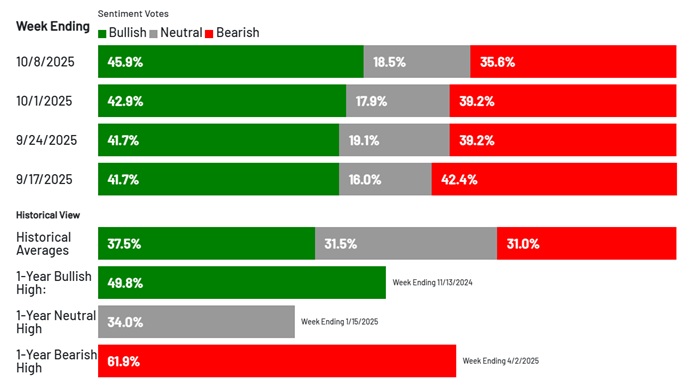

Below is AAII.org’s recent survey. Today’s investor survey might look very different. I’m not sure how relevant the investor sentiment survey is. Too often, it’s media manipulated and not reflecting the opportunity that’s actually being offered.

Investors apparently feel more bearish and gloomy than last fall! And it appears they were wise!

60% of respondents expect a rate cut in September. The FED’s J Powell has been talking about the harm of continued high rates to the US economy and the FED governors are likely ready to drop it 25 basis points (IMHO).

See more on the 3 month, 6 month, and 5 year stock market outlooks, and the current stock market forecast.

Next week’s events from TradingView

Weekly forecast hunters are pursuing clues about the direction of the Dow Jones, S&P, and NASDAQ for specific stocks or ETF’s worth buying or those they should dump. The NASDAQ, S&P, Russell, and Dow Jones are all looking positive right now, and the stock market forecast is looking much brighter as the FED pulls back on its injury of the US economy.

Stock Market Predictions | Best S&P Sectors |AI Stock Forecast | Stock Trading | Best Stocks to Buy | Stock Market Today | Stock Market News | S&P 500 Forecast | Dow Jones Forecast | Best Oil Stocks | Stock Market Today

* This website (“www.gordcollins.com”) is provided by Gord Collins for general informational purposes only. By accessing or using this Site, you agree to be bound by the following Terms and Conditions, as well as all applicable laws and regulations. If you do not agree with these Terms, you should not use this Site. See the full disclaimer.