Toronto Housing Market Report

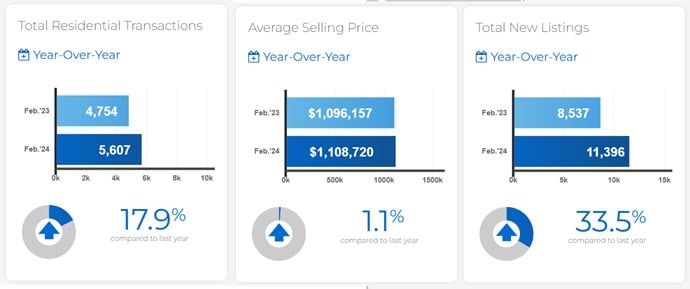

Despite rising mortgage rates, buyers in the Toronto housing market became more active in February.

New stats from TRREB show sales grew another 33% after a 33% growth during January. Clearly, buyers are once again interested in purchasing homes and aren’t deterred by excessive lending rates or ridiculously low affordability. Home listings also rose although sales were still stronger relative to that upward trend.

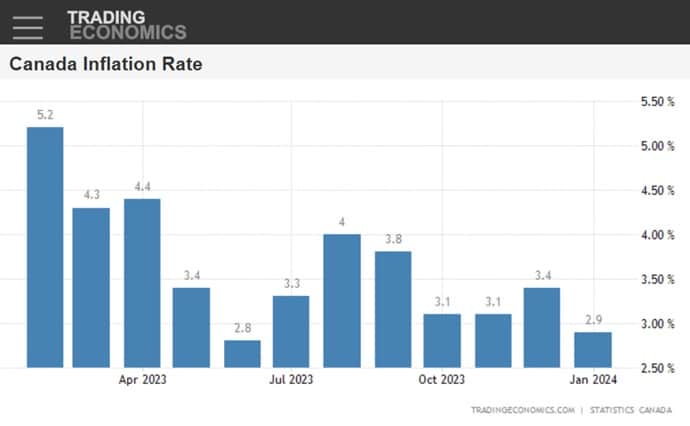

This early listing and sales listing activity shows 2024’s market will be much different. GDP and inflation are much lower in Canada than the US and the Bank of Canada may be inclined to lower the central bank rate earlier here. It’s likely this confidence that’s making buyers more assertive even before the selling season begins in earnest later this spring.

TRREB President Jennifer Pearce notes in a press release that the resurgence in sales and suggests home buyers have come to terms with the high mortgage rates but expect relief in coming years, and have actually saved more for their downpayments.

However, a Royal Lepage survey found that most buyers are waiting for lower rates before resuming their home search. They are waiting for rate cuts of at least 50 to 100 basis points. With more on the sidelines, it should help prevent an inflationary surge in summer. But many will have their interest reawakened, so those Realtors doing their digital marketing will create awareness that will pay off in 2025 as rates fall.

Home Price Forecast for 2024?

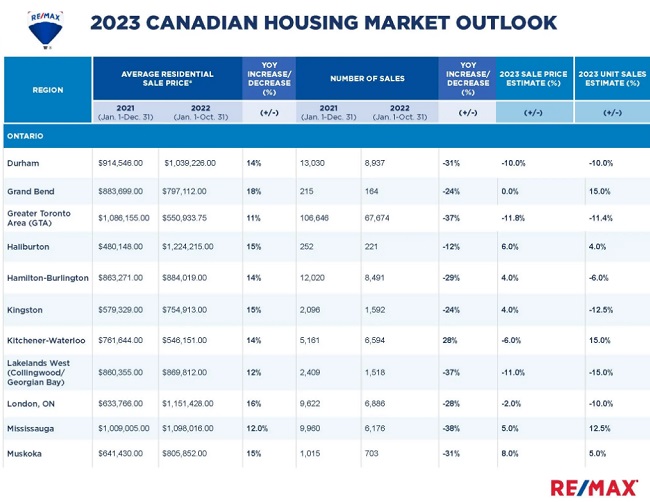

There doesn’t seem to be a consensus about sales and prices for 2024. Royal LePage is predicting a rise of 6% in GTA home prices by the end of the year. REMAX is predicting a 3% decline in home prices for the GTA region in 2024. New home construction is dropping given persistent high rates, and economic uncertainty and that many communities will not qualify for government building subsidies because they aren’t meeting building quotas.

Toronto Home Sales Rise

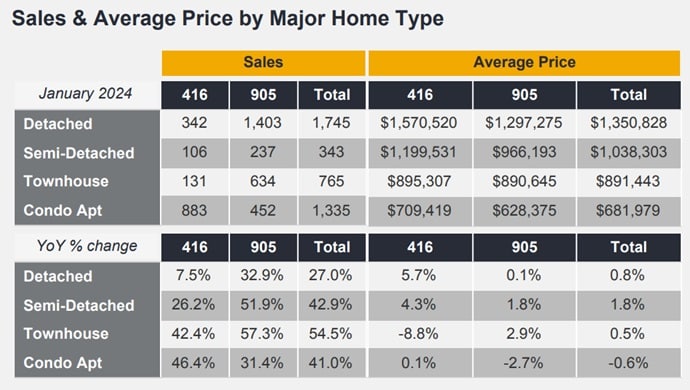

TRREB reports that 5607 home sales occurred in February 2024, an increase of 17.9% vs Feburary 2023, although sales have slowed from the previous two months. Home price grew 1.1% to an average of $1,108,720 and the HPI price index rose .4% YoY, and were up slightly vs January. TRREB’s Chief Market Analyst Jason Mercer expects rate cuts in the 2nd half will draw more buyers in and encourage renters to buy a home too.

Population growth in the GTA is also driving up home prices as well and will continue to power up demand for homes across the GTA. If lower rates power up the economy and wages, then sellers may get their price. The fastest price growth has happened in semi-detached properties in the 416 area code with a 3.5% YTD rise on a 26.4% rise in sales.

Condo sales across the GTA have improved by 20% to 22% however prices are down YTD by 1.2%.

Days on market rose 12.1% or 4 days to 37 days on average.

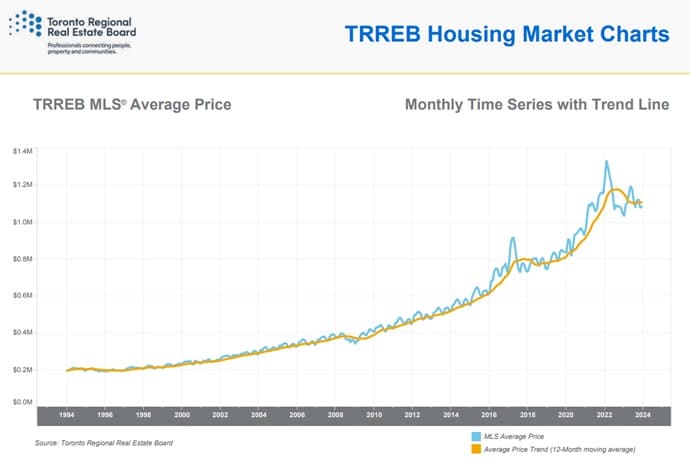

GTA Home Prices

While market is optimism is improving for Toronto area Realtors and for buyers and sellers, this promising spring market could cause the Bank of Canada to delay rate cutting. Increased spending by the Federal government may increase inflationary pressures.

Home prices and rent prices are an important component of inflation in Canada. The Bank of Canada aims to keep inflation at the 2 per cent midpoint of an inflation-control target range of 1% to 3%.

Mortgage Rates

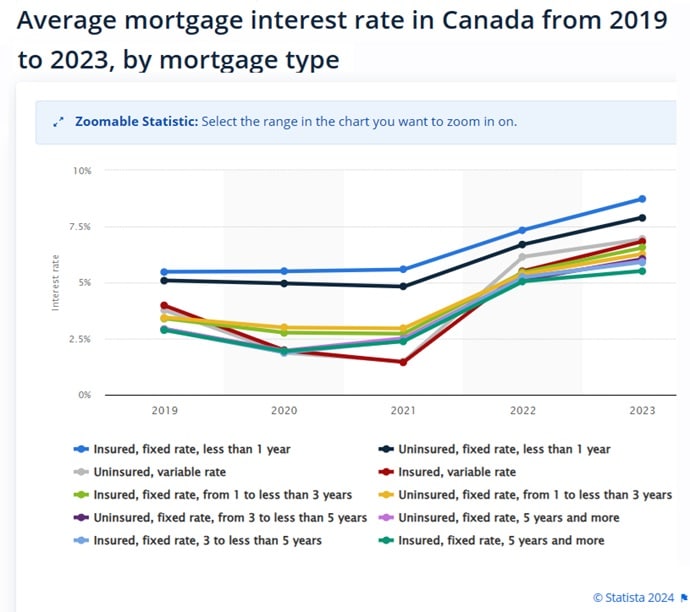

A few months ago BoC governor Tif Maklam said rates were restrictive enough and could preclude any more hiking of their key lending rate. A Reuter’s poll of Canadian economists suggested that the Bank of Canada will start cutting interest rates in April as inflation and the economy slow, and they forecasted that base borrowing costs will drop by at least one percentage point by end-2024.

Well fast forward to now in March, and there’s less certainty about cuts given the US economy is beginning to heat up again, as it would spill over across the border.

GTA City by city home prices (data courtesy of TRREB)

As the chart reveals, price rises for single detached homes have been steepest in Brampton, East Gwillimbury and Orangeville. Over the previous 7 years, home prices have increased the most in Burlington, Brampton, Milton, E Gwillimbury, Oshawa and Uxbridge. Given availability limits, these communities might once again see price surges in 2025/2025.

Mississauga’s saw a big 6% month-over-month price growth to a new $1,140,328 average home price. See more on the Mississauga housing market. Looking to buy a home in Mississauga, Milton or Oakville? Contact Damir Strk, with Remax, a well experienced Realtor you can trust and rely on.

| Toronto Region Cities | February 2024 | May 2023 | March 2022 | August 2017 | Price Change last 8 Months |

Price Change Past 7 years

|

| Burlington | $1,422,500 | $1,495,300 | $1,638,040 | $944,564 | -5% | 51% |

| Halton Hills | $1,141,000 | $1,265,500 | $1,564,270 | $984,812 | -10% | 16% |

| Milton | $1,299,900 | $1,325,000 | $1,712,357 | $866,650 | -2% | 50% |

| Oakville | $1,299,900 | $1,870,000 | $2,362,508 | $1,314,363 | -30% | -1% |

| Brampton | $1,710,000 | $1,281,000 | $1,573,497 | $766,831 | 33% | 123% |

| Caledon | $1,374,000 | $1,455,000 | $1,903,025 | $1,028,591 | -6% | 34% |

| Mississauga | $1,395,000 | $1,480,000 | $1,756,910 | $1,066,015 | -6% | 31% |

| Toronto West | $1,250,500 | $1,350,000 | $1,683,450 | $919,916 | -7% | 36% |

| Toronto Central | $2,215,000 | $2,400,000 | $2,725,902 | $2,113,130 | -8% | 5% |

| Toronto East | $1,195,000 | $1,247,000 | $1,529,864 | $887,620 | -4% | 35% |

| Aurora | $1,607,500 | $1,550,000 | $1,981,617 | $1,144,094 | 4% | 41% |

| E Gwillimbury | $1,410,000 | $1,245,000 | $1,621,299 | $966,047 | 13% | 46% |

| Georgina | $914,000 | $900,000 | $1,130,155 | $604,838 | 2% | 51% |

| King | $1,825,000 | $2,000,000 | $2,737,753 | $1,768,333 | -9% | 3% |

| Markham | $1,629,000 | $1,788,000 | $1,997,702 | $1,319,860 | -9% | 23% |

| Newmarket | $1,385,000 | $1,355,000 | $1,552,840 | $901,055 | 2% | 54% |

| Richmond Hill | $1,817,000 | $1,840,000 | $2,051,273 | $1,466,884 | -1% | 24% |

| Vaughan | $1,620,000 | $1,725,000 | $2,044,573 | $1,348,649 | -6% | 20% |

| Stouffville | $1,438,000 | $1,395,000 | $1,978,605 | $1,024,941 | 3% | 40% |

| Ajax | $1,097,500 | $1,120,000 | $1,373,496 | $708,185 | -2% | 55% |

| Brock | $779,000 | $747,450 | $1,057,415 | $508,615 | 4% | 53% |

| Oshawa | $850,000 | $861,000 | $1,099,404 | $550,677 | -1% | 54% |

| Pickering | $1,190,000 | $1,280,000 | $1,511,459 | $812,643 | -7% | 46% |

| Scugog | $962,500 | $945,000 | $1,298,531 | $719,375 | 2% | 34% |

| Uxbridge | $1,300,000 | $1,350,000 | $1,560,469 | $792,233 | -4% | 64% |

| Whitby | $1,100,000 | $1,161,000 | $1,399,956 | $733,811 | -5% | 50% |

| Orangeville | $827,500 | $890,000 | $1,194,537 | $612,974 | -7% | 35% |

| Bradford | $1,145,000 | $1,180,000 | $1,458,031 | -3% | n/a | |

| Innisfil | $820,000 | $900,000 | $1,230,745 | $549,492 | -9% | 49% |

Housing Affordability Can be Eased if Homeowners Decide to Cash in on the Bonanza

It’s a frightening context for real estate and housing given rental listings are down significantly from last year. This is a crisis of significant proportions given immigrants are pouring in over our borders. Homeless deaths rocketed over 200 last year.

The issue of NIMBYism and municipal regulations is clouding the housing market forecast for Toronto, Mississauga, Brampton, Markham, and the rest of York Region. Doug Ford announced the recently passed Bill 23: More Homes Faster Act which may help if the effort is sincere. Still with hundreds of thousands of new immigrants entering the GTA to live in the next 2 years, it may be too little too late.

The lack of outcry about housing prevention in the GTA area is alarming. Builders are already pulling back on construction projects due to expected buyer withdrawal and economic recession. Politicians and wealthy homeowners may not want to see real estate values fall, and they have a belief in a high density/high cost, anti-sprawl agenda.

TREBB’s President Kevin Crigger knows it and reiterated what his predecessors said many times “Evidence-based decision-making should inform government policies, and we encourage representatives at all levels of government to think big and act decisively to improve needed housing supply in a significant way.”

So when homeowners do sell their homes and condos, it is the best short term solution to the housing crisis in the GTA and across Canada.

Remax 2023 Toronto Housing Forecast

Remax forecasts home prices in Toronto will fall 11.8% by end of 2023 and only 5% in Mississauga.

Right now is a good time time to sell your home. just before an expected drop this winter and spring. And you can sell your home fast with perhaps no commission, or sell it for more using a Realtor with a strong digital marketing strategy.

The Toronto condo segment has recovered well and is expected to continue given the shortage of units, the demand from new immigrants, returning workers to the high density housing in GTA urban areas (Toronto).

The lack of housing supply is making finding a home in the GTA very difficult. It is real estate in Vaughan, Bradford, Newmarket, Aurora, Richmond Hill, Milton, Stouffville, Pickering and Whitby that everyone is after.

With mortgage rates at historic lows and loan refinancing still frequent, the market is loosening up. However, with Covid still actives, US trade tensions heightening, and the US election in two months, we’re hearing more talk about a housing market crash. And a Toronto housing market crash is possible if the US economy should collapse.

As you can see in the monthly Toronto GTA region prices and sales details, upward momentum is strong. The growth in prices in each regions is astonishing and there is little to suggest it will slow into the fall season.

See more on the Vancouver real estate market, Calgary real estate market, Okanagan real estate market and the York region real estate market.

Compare Toronto’s property market outlook to the US housing market forecast. You can view the prices for each city and MLS district below. Also, keep an eye on Toronto condo prices as the pandemic passes.

Homebuyers are still willing to look beyond the green spaces belt, but they’ll look at Aurora, Bradford, Stouffville, and Newmarket first before heading north.

US Housing Market Outlook | Florida Housing Market | California Housing Market | Canada Housing Market | Real Estate Blog | Toronto Housing Market Crash | Toronto Condo Market | Calgary Housing Market | Vancouver Housing Market | Newmarket Housing Market | Mississauga Housing Market | Kelowna Vernon Housing Market | Housing Market Forecast | Best Cities to Buy Property