Hottest Housing Markets 2024

NAR has released its new list of the hottest housing markets across the US and it’s a wild collection of hard-to-figure-out locations.

When’s the last time Buffalo, Cleveland and Cincinnati topped the most desirable housing markets in America? The hottest list this spring gives us a strong hint about the desperation of buyers and the changing economic conditions of a country withdrawing from made-in-China dependency.

With the economy looking fairly strong, housing supply shortages continuing, along with anticipated easing mortgage rates, we shouldn’t be surprised at the demand shift to the cities shown below.

Some like Las Vegas and Austin tend to be sketchy locations for price consistency and given we’re not out of danger with the economy or real estate sector, the hot markets show us where it’s risk on for buyers. The FED may not lower interest rates at all, so those hoping for reduced mortgage rates should beware.

The commercial real estate sector is a big worry. It’s highly leveraged with debt becoming due this year and next. The FED however might be strongly influenced by the massive US debt and deficit which are being carried via high interest rates. The FED problem will likely need to have intervention by the incoming President.

However, you’re wondering which markets are red-hot and why buyers are bidding up prices. In some cities, such as Buffalo or Rochester NY, it is likely the affordable home prices and its location next to a nice lake/riverfront that is drawing attention. More buyers are eager to buy wherever they can and they’re willing to move to own. Quality of life is still relevant.

Markets with lower-priced properties will continue to draw buyers given an improving economy will drive more competition in the major cities.

NAR points out that the fastest growing large metros in February are heating up due to more buyers forced to return to the head office and look for a home near business hubs. They said these metros saw 11% more views per listing than was typical across the U.S. in February, and properties spent 15 less days on the market than the U.S. median DOM.

NAR Market Hotness Index

The National Association of Realtors actually publishes a list of the hottest cities in the US. They may measure market hotness in a number of different ways:

- NAR hotness rank

- month to month

- year to year

- supply score

- demand score

- median days on market

- page views per property

- median listing price growth month-to-month

- median listing price growth year over year

Zillow’s Hottest US Housing Market List

Zillow’s forecast of hottest cities in 2024 are all in the east.

Their top list however, shows waterfront cities are enjoying the most interest and price growth. For their hottest market list, they assessed data from the 50 largest U.S. metro areas on these criteria:

- expected home value appreciation from December 2023 through November 2024

- anticipated change in home value appreciation from 2023

- new jobs per new housing unit permitted

- estimates of the net new number of households that own their home

- the speed at which homes are sold

Zillows® data scientist Anushna Prakash, who conducted the research said “I’m cautiously optimistic that the housing market will get back on stable footing in 2024. We shouldn’t see the massive price spikes of the early pandemic or fast-rising mortgage rates of recent years.”

Zillow’s Top Ten Includes:

- Buffalo

- Cincinnati

- Columbus

- Indianapolis

- Providence

- Atlanta

- Charlotte

- Cleveland

- Orlando

- Tampa

NAR’s 2024 Hottest City Index

NAR’s list uses several signals including views per user and days on market. As you can see the upper New England states are drawing intense interest, likely due to lower prices and the desire of Boston, New York, New Jersey buyer’s desire to leave the high-tax states. And with taxes rising as those cities struggle under mountainous debt loads, the exodus will likely increase. Interest rates look like they’ll stay level into 2025 with no relief till 2026.

In this list, price growth month to month, quarter to quarter, and YoY aren’t included so they’re more focused on buyer interest and intent.

|

February 2024—Top 20 Hottest Housing Markets

|

||||||

| Hottest Major Cities in US | Hotness Rank | Hotness Rank YoY | Viewers per Property vs U.S. | Median Days on Market | Days on Market YoY | Median Listing Price If Active Within Period |

| Manchester-Nashua, N.H. | 1 | -1 | 3.6 | 23 | -15 | $572,000 |

| Rochester, N.Y. | 2 | 0 | 3 | 24 | -4 | $250,000 |

| Worcester, Mass.-Conn. | 3 | -4 | 2.7 | 30 | -12 | $499,000 |

| Springfield, Mass. | 4 | -1 | 3 | 38 | 0 | $350,000 |

| Columbus, Ohio | 5 | 1 | 2.4 | 38 | -2 | $377,000 |

| Boston-Cambridge-Newton, Mass.-N.H. | 6 | -2 | 2.1 | 33 | -5 | $854,000 |

| Hartford-West Hartford-East Hartford, Conn. | 7 | 6 | 3.5 | 41 | 7 | $400,000 |

| Providence-Warwick, R.I.-Mass. | 7 | -5 | 2.3 | 38 | -7 | $500,000 |

| Concord, N.H. | 9 | -47 | 3.4 | 42 | -22 | $550,000 |

| Oshkosh-Neenah, Wis. | 10 | -23 | 2.6 | 41 | -18 | $325,000 |

| Akron, Ohio | 11 | -6 | 2.2 | 41 | -8 | $208,000 |

| Lancaster, Pa. | 12 | -9 | 2.1 | 39 | -10 | $420,000 |

| Trenton, N.J. | 13 | -37 | 1.9 | 36 | -19 | $385,000 |

| Bridgeport-Stamford-Norwalk, Conn. | 14 | -16 | 2.6 | 43 | -14 | $869,000 |

| Dayton, Ohio | 15 | 1 | 2.1 | 42 | -7 | $218,000 |

| Allentown-Bethlehem-Easton, Pa.-N.J. | 16 | 5 | 1.8 | 38 | -5 | $370,000 |

| Milwaukee-Waukesha-West Allis, Wis. | 17 | 8 | 1.7 | 37 | 1 | $354,000 |

| Reading, Pa. | 18 | -21 | 1.7 | 38 | -14 | $306,000 |

| Springfield, Ill. | 19 | -37 | 2 | 43 | -11 | $175,000 |

| Jefferson City, Mo. | 20 | -3 | 1.8 | 40 | -7 | $315,000 |

Hottest New Construction Markets

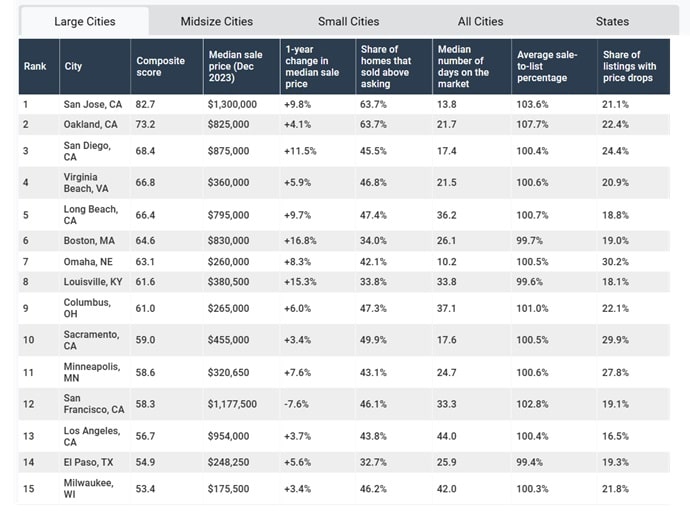

Construction Coverage.com has some valuable insights on the hottest markets for new construction homes. Turns out that California continues to have the highest demand and enabled buyers for homes. A lack of affordable resale homes is the key, and new construction is cheaper even with California’s onerous taxes and environmental regulations. Here’s their rankings for large US cities:

Good luck with your decision on moving to one of these amazing cities, and others that might be right for you. Oh, and check out this list of cheapest housing markets, in case you just need to save money. See more on the US Housing market forecast.

Forecast for Stocks | Stock Market Today | Real Estate Market 2024 | 5 Year Stock Forecast | Dow Jones Forecast 2024 | NASDAQ 2023 Forecast | Florida Real Estate | Boston Real Estate | Los Angeles Real Estate | Real Estate Housing Market | Home Equity Line of Credit | Home Equity Rising | Reverse Mortgages