What is the Future of the US Housing Market?

A Stable Optimistic Outlook for Housing for Next 3 to 5 Years

What about the housing market forecast for 2020? Buyers and sellers are looking for solid reliable predictions of home prices nationally and local forecasts their respective cities before they make their big decision.

This big picture guide should answer your pressing question, and lead you into details for your city market.

It’s looking good for construction, demand, price growth, and growing demand from a strong demographic with high employment, buying intent and funds to buy. You can see more transaction details on the latest housing market report for the US, and reports on California and Florida.

Will Home Prices Fall?

How is 2020’s housing market shaping up? Will home prices rise or fall? How is new construction shaping up?

Each market has its own unique supply and demand conditions and you’ll want to see some particulars here and on the Housing Market Forecast for 2020 report.

Gathering expert opinions from reputable organizations, including NAR, Corelogic, NAHB, and Freddie Mac we’re getting positive vibes about market in 2020 and the next 5 years.

This year’s housing market is an ideal opportunity to build home equity for buyers, and for sellers to retire or move your home equity into the stock market (indexed funds?). The expectations for the 2020 stock market are positive which bolsters our housing markets, supports home and multifamily construction and strengthens consumer spending.

The Battle over the Marketplace

However, the residential home and condo market is politically charged by government regulation, high taxes and poor support, lack of construction labor, high land prices, and low availability of property. The market for homes and condos is colored by conflict.

While investors are looking for home and apartment prices to appreciate strongly, another group of buyers and renters who are hoping for a housing market crash.

This is two opposing groups in a heated conflict that extends from Miami to New York to Chicago to Dallas to San Diego up to Los Angeles and San Francisco. 2019 was a year of relative moderation in price rises, a plateau of sorts.

What About Housing Supply?

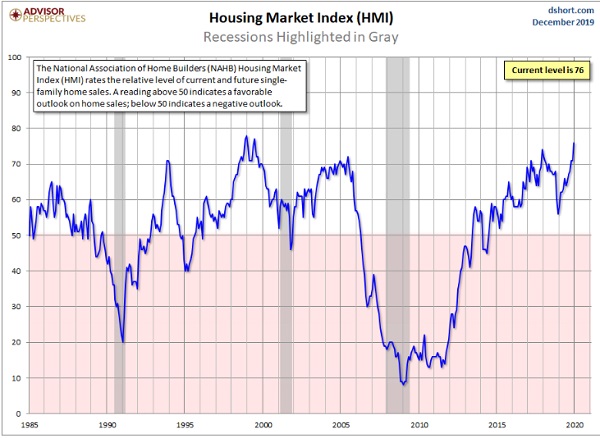

The housing market is composed of current stock, of which some is being upgraded/renovated and new residential construction. The new construction market grows the housing stock and when builders are happy, it signals a strong pool of homes coming onto the market.

New-home sales are forecasted to grow 11% to 750,000 units, and existing home supply will grow 4% to 5.6 million homes. Home sales are predicted to increase 4.3% over 2019 numbers.

What Does NAR and Corelogic Say?

NAR’s Lawrence Yun believes more home-building activity and consequent growth in supply should moderate home price gains. His forecasts for price growth are about 1.5% less than Corelogic’s estimates.

Yet, we’re all aware that much of the building going on is more in the mid to high price ranges which are out of the reach of most homebuyers. It’s a situation that continuously frustrates Millennial first time buyers looking to buy their first home.

Millennials are becoming the US national home buyer market and they’re getting older and less patient.

Yet Millennial purchases are up. 75% of them (according to Corelogic) are confident that they will qualify for a home loan. Millennial homebuyers are one of the groups who might be tired of ultra high prices and see the value in a housing market crash. However, recent surveys show buying is better than renting.

36% of Housing Markets are Overvalued — Corelogic

Homes are overvalued according to Corelogic who state that 36% of US housing markets are overvalued. Yet the US economy doesn’t seem to have anything stopping it from fueling up further demand.

NAR expects the cities of Ogden, Utah; Las Vegas Nevada; Fort Collins and Colorado Springs Colorado; Dallas/Fort Worth Texas; Columbus, Ohio; Raleigh/Durham/Chapel Hill, North Carolina; Charlotte; Charleston, South Carolina; and Tampa/St. Petersburg, Florida to see the highest price gains in the next 3 to 5 years. They believe New York, and Los Angeles will see price drops of 5% or more in 2020, and Atlanta down 3.5%.

See the data and opinions on each of the major US markets including: Los Angeles , Miami, Tampa/StPetes/Sarasota, Atlanta, Houston, San Diego, San Francisco, Seattle, Sacramento, New York, Boston, Philadelphia and Chicago.

Lawrence Yun One Key Factor: Low Mortgage Rates

Low mortgage rates plus high building activity should translate to better availability in future, while wages are growing slightly (3.2%).

Will there be a housing market crash? What’s the likelihood of a collapse? Strong interest in the topic shows worries of the newly mortgaged and sellers who wonder if it’s time to finally let go of their property.

Doug Duncan, Fannie Mae’s chief economist offers his outlook for the market:

“Housing appears poised to take a leading role in real GDP growth over the forecast horizon for the first time in years, further bolstering our modest-but-solid growth forecasts through 2021 … residential fixed investment is likely to benefit from ongoing strength in the labor markets and consumer spending, in addition to the low interest rate environment … and global growth seems likely to reverse course and accelerate in 2020.”

That paints an optimistic picture for the US market making a crash of sales and prices highly unlikely.

What Was Home Construction Activity Like Last Year?

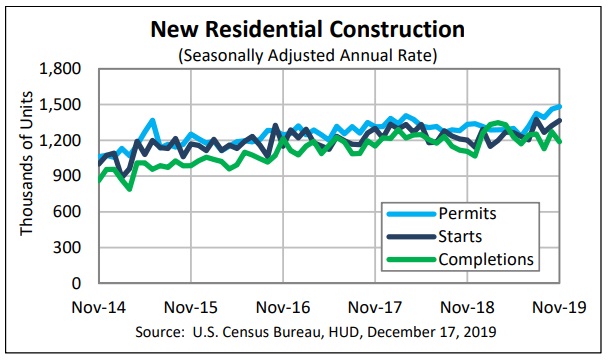

How many homes are coming into the available pool for purchase? According to one housing market expert, residential housing construction starts contracted during the first part of 2019 and then picked up strongly in the latter part.

The estimate is for a 1.3 million to 1.4 million start annual pace in 2020. The latest reported period for November is 1.37 million units, an increase of 3.2%.

Home Starts for both single-family and multifamily starts in November in the Northeast were up 0.9%. However, in the south part of the country, starts rose a healthy 7.4% higher in the South. Starts are down 5.8 percent in the Midwest and 8.7 percent in the West.

The new construction activity is not expected to keep pace with housing market demand.

Housing Market Supported by Jobs and Economy

The latest economic and jobs outlook reports keep trending positive which suggests that 2020 will be a year of home price increases. With housing shortages across the nation, demand far outstrips supply. And this should attract real estate investors in the US and from abroad.

According to the World Property Journal, home building permits were up 1.4% to 1.48 million units. That’s a significant upward trend in home construction. Multifamily permits are up 2.5%.

The experts predicted both a bubble bursting crash of the housing market, a stock market crash, and an economic recession. But, the reverse looks to be true. It’s a vital warning about political partisanship and how that shows itself after the forecast deadline.

See’s nar’s full infographic for NAR’s 2020-national-housing-forecast

SEO Consultant

Digital Marketing Services in San Diego and San Francisco: Looking to improve your company’s marketing success online? An SEO consultant expert uses advanced search engine optimization and authority building content strategy to dominate rankings.

3 to 6 month Forecast for the Dow S&P NASDAQ | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News