Should You Sell Your Stocks Right Now?

There is significant concern about the stock market right now. It comes from being too hot for too long with excessive valuations and some negatives around trade, inflation, and government debt.

The fact that gold, silver and other commodities are so hot at the same time as the current bull stock market run, should give smart investors a moment to pause and reflect. Perhaps this is a good time to sell your equities and harvest your profits? You might play it by ear as they say and wait for cries of anguish when a correction begins. Or you might think about this ahead of time.

The expert comments and economic signals are there, and are so complex, often hidden in the bushes. At some point, you might have to answer your question about selling your stocks.

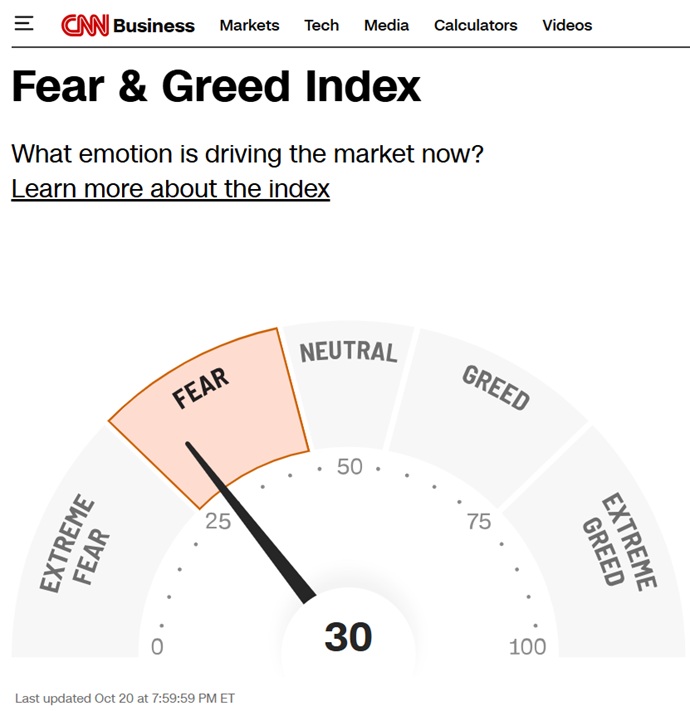

There are multiple worries about an AI bubble with uncertainty about AI profitability, along with a general stock market bubble being burst due to everything from inflation to tariffs to bank credit worries and government debt issues. The Warren Buffett Indicator (total market capitalization to GDP) has reportedly soared to an all-time high. CNN’s investor sentiment gauge is clearly leaning to fear, so more investors might be ready to push the sell button.

When Too Many Negative Signals Happen Together

We’re actually at the confluence of many social and economic waves that will affect decisions made about the economy and global trade (supply chains and exports). We’re seeing signs of cracks, but overall, the US economy and the US stock market do look very strong going forward.

Still, if a short-term correction or sell off is possible, it creates a time for portfolio review and consider divesting or reducing exposure to big losers. If you haven’t been keeping a keen eye on the performance of your companies/stocks, then this might be a hint to look into it more deeply. Are they truly golden with new opportunities, and how are their competitors doing lately?

Mike Wilson, chief U.S. equity strategist for Morgan Stanley, warned on Monday that a “larger than expected correction is likely” for U.S. equities if Trump and China fail to resolve their escalating trade tensions, as mounting uncertainty threatens the fragile early-stage bull market that began earlier this year. — from Forbes Report.

If you aren’t feeling warm and fuzzy anymore, you might focus on what will be the best stocks to buy for 2026 and beyond.

The answer for the “should I sell” question, for the long term, involves establishing your go-to stock choices and then just hanging on past the turbulence in the next year. Even now amidst concerns, experts are reiterating S&P 500 predictions above 7100. Earlier this year, that seemed grossly outlandish, that only fools believed in. Now, a year-end rally isn’t impossible.

If the tariff issues are eased and the FED rate declines, it could extend the US bull market indefinitely.

President Trump reported that $17 trillion in new investments have been brought into the US this year, a whopping amount that can’t be ignored. These are numbers that built China’s industrial world domination, so why would the US not enjoy the same stellar growth in the next decade? Anything in the trillions is eye-opening and likely to boost the US economy considerably, which means 2026 could be a sensational year for investors.

This means finding the best ai stocks, microprocessor chip stocks, rare earth stocks, gold stocks might be irrelevant. You’ll need to review plenty of high performers with great forward earnings projections, and not be mesmerized by blue-chip tech stocks like Tesla, Google, Nvidia or cryptocurrencies and cryptostocks. Yet, the big tech stocks aren’t a bad place to hedge against a market setback.

Market Peaks and Glaring Weaknesses

If the markets are at a peak (forecasters now looking for more growth and 7100+ for the S&P500), then a slide is a natural outcome.

It’s the uncertainty and turbulence caused by big changes in trade that are worrisome. They’re exposing the weaknesses of the US economy and its undeveloped infrastructure. While manufacturing repatriation is good for the US, its own productive capacity is arising from a 3-decade-long period of neglect. However, President Trump’s fast-turnaround ambition is a difficult thing to achieve if the rest of the world won’t sympathize, or worse, try to interfere.

The trade and tariff spat between Xi of China and Trump is the number one issue perplexing the top analysts. It caused a market setback just last week. It’s not a market fundamental signal, but instead a human issue, one affected by strong emotions. In this environment, traditional market analysis takes a beating, and investors can become very edgy.

But consider everything else going on. The US debt ($37+ Trillion) is silently imposing significant weight on the economy and Democrats and Republicans won’t agree on dealing with the now $2 trillion dollar interest payments, and funding continuous massive government spending bills.

The Trump admin’s attempt to trim the fat out of the government is being met with strong resistance, thus the government shutdown is in effect, which causes significant productivity losses in the economy.

Is Age-Old Advice Still Sage?

The usual investment advice for retail investors of buy, sell, or hold— might not be effective. With stock market technology improving, other stock investment strategies might work better for an individual investor’s financial goals, risk tolerance, and time horizon. See more on the rising reliance on AI stock market prediction.

What’s losing now, might be a winner again soon, so buy the dip might be good reasoning in the coming months. Regardless, you’ll want to make sure you have a better awareness of the investment backdrop of political directions, economic factors, and what weaknesses might grow in importance (e.g., government debt, consumer debt, housing market crash).

Top 10 Reasons Investors are Concerned about Stocks Right Now:

Top 10 Investor Concerns

1. High Stock Valuations and Market Concentration:

- Many stocks, particularly in the tech and AI-related sectors (e.g., the “Magnificent Seven”), appear overvalued based on historical metrics like the Shiller Price-to-Earnings (P/E) ratio, and analysts’ forward earnings projections might actually be subjective based on this year’s data. President Trump could change the investment context in one day if he decides. Experts and data are no guarantee of a bull market trend.

2. Credit Quality Issues and Banking Sector Stress:

- Emerging credit losses, especially in commercial real estate and private credit, are raising concerns about the broader health of the regional banking industry and the potential for wider financial instability.

3. Geopolitical and Trade Tensions (Tariffs):

- Ongoing U.S.-China trade tensions and the imposition of tariffs create significant issues for global supply chains, corporate profits, and economic growth, leading to stock market volatility.

4. Federal Reserve Policy and Interest Rate Uncertainty:

- Investors are constantly monitoring the Federal Reserve’s stance on interest rate cuts. If the Fed cuts rates slower than expected or needs to maintain higher rates for longer due to stubborn inflation, it could hurt stocks by increasing borrowing costs and making bonds more attractive.

5. Persistent Inflation and Economic Slowdown:

- While inflation is moderating, it remains above target, and the risk of stagflation (high inflation with slow economic growth) or a recession remains a significant worry that would severely impact corporate earnings.

6. U.S. Fiscal Health and Government Debt:

- Mounting government debt and the cost of servicing it are pushing up long-term bond yields, which competes with stocks for investor capital and signals fundamental fiscal challenges.

7. Slowing Labor Market and Consumer Spending:

- Evidence of a slowing job market (e.g., slowing payroll growth, rising unemployment) and signs of waning consumer confidence/spending suggest the resilient U.S. economy may be losing momentum, which could lead to lower corporate revenues.

8. Corporate Earnings Growth Headwinds:

- Despite generally solid earnings reports recently, investors are concerned about the sustainability of profit growth into the future, particularly if tariff costs are passed through and economic growth cools.

9. U.S. Political and Policy Uncertainty (e.g., Government Shutdown):

- Domestic political impasses, such as the potential for a government shutdown, create short-term volatility and can delay the release of key economic data, clouding the market outlook.

10. The Unwind of Artificial Intelligence (AI) Hype:

- Much of the market’s recent gains are tied to enthusiasm for AI. If the promised productivity and revenue gains from AI adoption fail to materialize rapidly or meet lofty expectations, the market could face a sharp, sudden correction.

Why Would I Want to Buy Stocks Right Now?

We’re in a volatile period, where some good stocks are hit with price drops. Yet, there are plenty of equities that might deliver significant profits and growth potential.

Today, it seems short-term events and headline news have momentary effects on stock prices. That could reflect a lack of confidence in major stock analysts and their market projections. And we know how fast these markets have recovered lately to then soar to new record heights. This reflects how strong investor confidence/euphoria is, but is this overexuberance and foolish pursuits of the FOMO investor crowd?

You’d want to buy good quality stocks that reflect company’s real sales, strong customer base, and strong balance sheets. And with a backdrop of a strong, highly invested US economy, it’s difficult to see how the stock market won’t continue on an upward trend for many years. The market hasn’t even broadened into small caps, nor the economy shifted to small company growth and profitability. Still lots of room to grow.

Volatility Isn’t All that Bad, and some Want More!

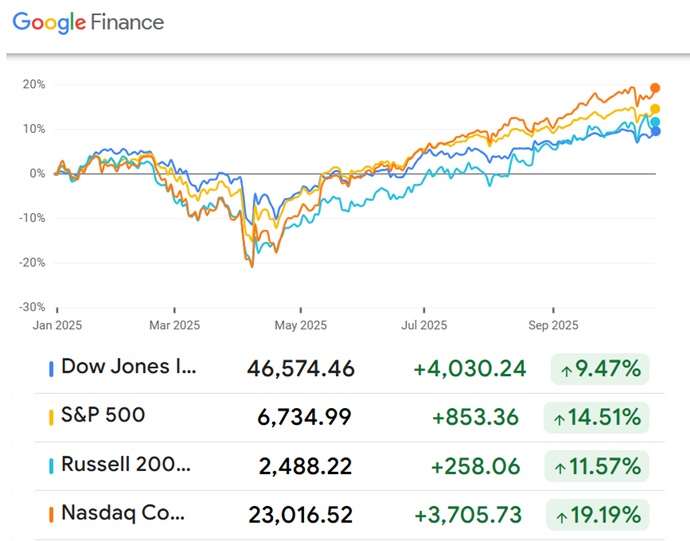

The Dow Jones, S&P 500, NASDAQ and Russell 2000 indexes have all recovered to hit new highs. It’s the v-shaped rally that some people don’t like. But those who have become wealthy from gold stocks, oil stocks, cryptocurrency stocks, rare earth stocks and more don’t mind the volatility at all.

In fact, without volatility and mini-corrections, they wouldn’t prosper at all in their investing. And given the complexity of change we’re undergoing, few people can visualize and predict how the US economy will play out. This leads to a greater focus on the now, which is highly slanted to AI stocks, with most capital investment going into them. We’re so deep into the AI revolution, that giving up on it would lead to a global recession. Confidence is that AI and microprocessors and massive data centers are the future.

Technology stocks that have been extremely hot such as Nvidia, Palantir, AMD, Bitcoin stocks, cryptocurrencies, Google, Tesla, META, might cool dramatically if AI hits some bumps in the road.

See more on the 5 year equities market outlook and what lowering interest rates might launch.

Title image courtesy of Stockcake Images.