EIA Predicts Big Price Drop in Brent and WTI Oil

EIA, the US Energy Information Administration made it’s predictions for future oil prices and surprisingly, they believe oil prices will fall.

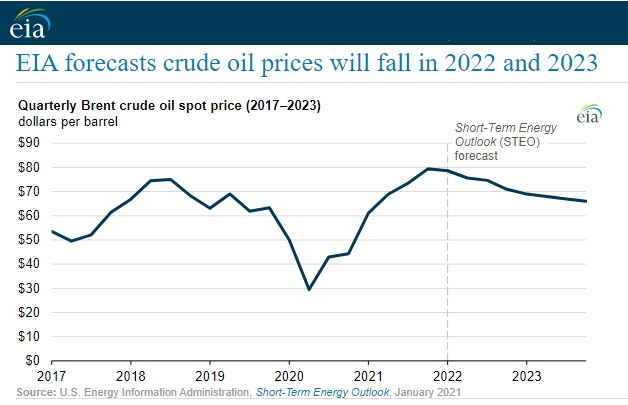

In their latest price forecast, a shocking one, they predict the price of Brent crude oil will average $75/b in 2022 and $68/b in 2023. That would translate to an average of $65 and $72 a barrel for WTI crude over the next two years.

The attribute their price projection to a reversion of low oil inventories to higher inventory increases in 2022 and 2023. Yet, if prices were to drop that low, it would certainly discourage investment in US shale production and other exploration which would reduce supply. It would certainly deflate investment in oil stocks and Canadian oil stocks since revenues and earnings would fall.

It’s my view that reduced consumption won’t happen and that supply will be an issue. Thus oil prices should continue rising and settle perhaps at $90 a barrel which creates plenty of profit and activity for oil companies.

The EIA forecast might be taken with a grain of salt, as EIA has missed its forecasts in the past, also calling for low prices then. Yet, prices continue their climb in February, with a short respite this weekend, to rise 20%, above $92 a barrel, the highest level since 2014. In Canada, WCS oil climbed over $80.

McKinsey & Company in their latest energy forecast had this to day:

Based on our Global Energy Perspective reference-case demand insights, current OPEC+ intervention will be sufficient to help balance the market in 2021, with prices remaining at a sustained level of $50 to $55/bbl through to 2025.

How accurate has their oil price and supply predictions been?

Saudi Aramco announced today another price increase for its customers of about 30 cents to 50 cents per barrel, depending on the grade of oil.

Goldman Sachs has already raised its price target for Brent crude to $100, and speculators are talking $150 a barrel price. Some US observers believe President Biden would act somehow to reduce the price. His gambit did work in early November, but as spring and summer 2022 near, a lack of supply is bound to make moves unlikely. Another big release of US reserves would only have a temporary effect this time.

Any draconian efforts by the US administration would only serve to discourage investment in drilling and exploration, which would ensure even higher crude prices down the road.

Conflicts with Russia would have the effect of supply disruptions and the risk is to the upside there. In 10 months, the US mid term elections will happen, and a Republican win would likely lead to easing restrictions on oil exploration and production, and this could lower oil prices.

The sentiment against carbon emissions however, should prevent full blown support for oil production which then puts upward pressure on prices.

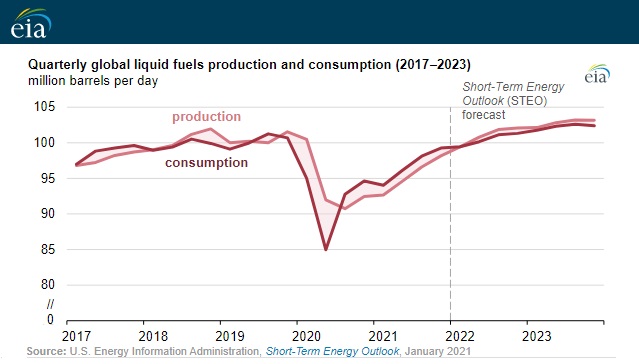

EIA forecasts that petroleum consumption across the globe will grow by 3.6 million barrels per day in 2022 to average 11.8 million barrels a day this year and 12.41 million barrels a day in 2023. They attribute the increased oil consumption to the growing demand in United States and China (the account 39% of the consumption growth). They predict global petroleum consumption will rise 1.8 million barrels per day in 2023.

They’re also calling for lower gasoline prices in the two year forecast period.

And again that growth, they forecast global oil inventories will increase by 500,000 barrels a day in 2022, which will put downward pressure on crude oil prices. They also believe oil production will rise 1.8 million barrels per day in 2023 from 2022, averaging 102.8 million barrels per day.

The crux of EIA’s oil price predictions then center on increased production, thus flooding the market. Because for the WTI oil price to drop from $92 to $65, a substantial increase in crude would have to happen. Given Mexico is planning to stop their exports from the Gulf, and Venezuela is running out of crude too, it doesn’t support supply growth.

EIA doesn’t refer to the global recovery, and the recovery of the travel which will create a huge increase in demand. Despite the shutdowns globally due to the Corona Virus, global demand has kept strong. Agencies seem to be underestimating the size of demand next summer, if the pandemic does ease.

Nine Point Partner’s Eric Nuttall concurred with the forecast of subdued demand and his opinion is a valued one. However the lower forecast for consumption makes little sense and requires further study and illumination. More explicit details of the demand picture need to be presented.

S&P Global believes the global oil market will be oversupplied Q1 2022. Yet OPEC+ sustainable spare production capacity will fall to 800,000 b/d by June if it keeps raising its daily releases, which then creates “an uncomfortably thin market buffer in the second half of 2021.” — SP Global report.

So it sounds like the low estimates are for a perfect supply environment with big capacity when that is less likely to be. With world tensions and trade tensions high, something is bound to happen this year.

US GDP rose 6.9% in the 4th quarter of 2021, and forecasts are for a strong 3.8% rise this year. Jobs growth in January was phenomenal and wages are up 5.8% year over year. That doesn’t sound like Americans will see subdued spending. Exports improved 24.5% in the final quarter.

Leslie Preston, director and senior economist at TD Economics said “final domestic demand is likely to be stronger in the first half of 2022 than it was in the latter half of 2021. And most economic forecasts see the second half of 2022 as the real recovery period.

However, forecasts point to a sharp slowdown due to the withdrawal of Fed stimulus and rising interest rates. Indeed, the US government could induce a recession to get rid of issues that might cost them the upcoming elections. It would be an unpopular move since employment numbers would drop.

OPEC Oil Price Forecast

OPEC+ in contrast said it expects 2022 world oil demand to grow 4.15 million barrels per day (bpd). They believe consumption will also pass above the 100 million bpd mark in the third quarter of 2022. The last time that happened was in 2009 when it was 100 million barrels daily for the full year.

OPEC stated that world demand from its member countries will be 28.9 million barrels per day. While OPEC pledged a set volume of oil to be released, some member countries are unable to meet their production quotas. Recently, they raised out put by 400,000 barrels per day but seem reluctant to raise any further.

US Shale Oil to the Rescue?

The U.S. Energy Information Administration (EIA) estimates that crude oil production was 11.7 million barrels a day in November. Crude production estimates are for perhaps 700,000 b/d to 900,000 b/d during 2022. These numbers are far less that 2018 and 2019, when oil production rose by 1.9 million b/d and 1 million b/d in those years.

Exxon and Chevron have forecasted output boosts by 25% and 10% respectively this year.

Although shale production in the US will increase, the companies can’t ramp up production quickly like they did years ago. Reinvestment and exploration are needed, and it’s believed debt fueled speculation won’t happen this time around, thus production growth will be lower.

The number of drilled but uncompleted shale wells has dropped strongly since August of 2020. Oilfield services companies are expecting to raise their production fees by 10% in 2022. This adds to the ultimate price of oil.

Bloomberg reports that Chief Executive Officer Ryan Lance of Conoco Philips is warning that US shale oil production will hit as high as 900,000 barrels a day in 2022. Again, that’s well below the 1.9 million per day in 2018, as we head into the first year of full economic recovery.

You can’t help but think much of these agency estimates of oil prices and production are politically motivated. The lack of details on consumption sources is alarming.

Based on economic growth and diminished exploration, the pendulum is on the side of $100 a barrel oil. The fact there is no response on the supply side so far, and no real commitment to production growth, the case for investing in oil stocks is strong. Check out some of the best oil stocks to consider and take a look at Canadian oil stocks and the unique situation in Canada’s oil patch that could see their fortunes rocket.

* The content and opinions contained in this post are those of the author and do not constitute investment advice. This information is for exploring opportunities and entertainment. Please refer to your stock investment advisor for guidance and opinions on investible oil stocks and when to buy.

Stock Market Projections | XOM Stock Price Forecast | Oil Price Forecast 2024 | Best Oil Stocks | GOOG | Google Finance Housing Market Projections | 6 Month Stock Market Forecast | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates