Investing in Student Housing – Off Campus New Builds

Investing in Student Housing is Hot!

A few months ago, the Canada Pension Plan’s Investment Board bought $2.1 Billion worth of student housing properties in the United States. The joint venture, with partners in Singapore and Chicago now owns 48 student housing communities with a total of nearly 32,200 beds.

That mega-investment gives you a heads up on the one of the best real estate investment opportunities going – Student housing investment. According to one report, student housing investment in 2017 is expected to equal the torrid rate of 2016.

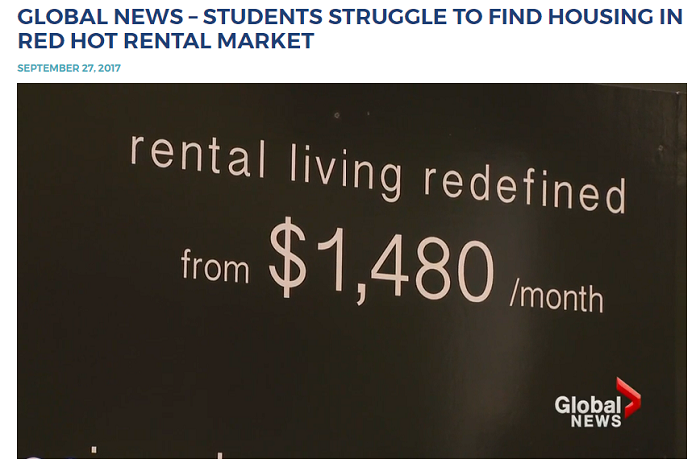

Student housing portfolios might outperform everything especially in cities such as San Francisco, Vancouver, and Toronto. With housing very rare and rental prices exceeding $1400 a month per student, the revenue numbers begin to look promising.

You might be skeptical about risks and management costs, yet the off campus student housing investment opportunity can include hiring property management companies. New purpose-built student housing communities offer a superb investment potential whether you invest in the investment firm, like a REIT, or if you buy a unit yourself and rent it out. Rumours of 10% to 14% ROI make it worthwhile to investigate.

In the US, land use agreements are growing and student housing projects grew $3 Billion in just half a year during the first part of 2016 according to a report from realtor.org.

CIBT Group Inc. Vancouver

I’ll introduce you to CIBT Group in Vancouver whose holding company manages $600 million in properties, communities, education services, and other services related to foreign student housing in Canada.

Bruce Campbell of Stone Castle Investment Discusses CIBT on BNN

These on campus and off campus communities are very attractive to foreign students since they attract other students from their native countries. Students feel more comfortable and their parents prefer to rent or buy these condos because they feel their son or daughter is more likely to succeed when they have comfortable living arrangements. It all makes good sense. The new purpose-built condo projects in cities like Vancouver are on their wishlist.

The shortage of condos in Vancouver and rising prices ensures demand for these properties/investments will stay strong. You may have to be invited to the investment education meetings first. Here’s an example of an invitation to the recent Viva Tower open house.

Vancouver and Richmond BC have a large number of colleges and universities in close proximity. This means the condos can house students from multiple post secondary institutions. UBC, Kwantlen Polytecnic, Langara College, OMNI college, and others are located in the city of Vancouver. And as we know, Vancouver real estate is in big demand and the focus has changed to the condo market.

New Builds and Pre-Construction Student Housing

Most built projects are fully bought and there’s little opportunity to purchase now. New preconstruction projects are where you can get in on this booming investment in student housing. CIBT Education is the leader in this field in Vancouver. They have a large portfolio of projects which you can invest in shares. This gives you the opportunity to capitalize on this booming market without owning individual properties and being responsible for upkeep and rental management.

If investment is a more attractive option for you rather than buying condo units outright, you can learn more about availability and ROI etc, from Joyce Soo of Sutton Group Seafair Realty in Richmond, British Columbia. She can be contacted at (604) 273-3155.

This post is not intended as professional investment advice. Prospective investors should speak with a licensed investment advisor and review closely the prospectus of any student housing investment fund.

See more on the Canadian housing market, Vancouver real estate market and Toronto real estate market.