The High Cost of High Mortgage Rates

As the brewing battle between President Trump and the FED intensifies, US homeowners face some anguish regarding mortgages and homeownership.

With FED continuously creating excuses for keeping rates high with little evidence to support their decision, the housing market has suffered. Homeowners with mortgages can’t sell due to facing a high mortgage rate, so they’re locked into it. And given the exorbitant cost of homes, buyers can’t buy, especially when needing to finance at these high rates.

And of course, the residential real estate market is a key component of the US economy thus high rates hold back GDP, lower housing affordability, and increase the cost of living (inflation). Forcing the market into stagnation is something President Trump is wanting to end. He’s mentioning removing FED chair Jerome Powell, and has cited a wish to replace the FED entirely with a new organization. It’s hard to argue now, as the high interest rates for homes and personal and business credit pose serious financial issues for every American. Small businesses too, are awaiting lower interest rates to allow a return to healthy business levels for them, and a restoration of small cities and towns across America. The FED is holding all of this back.

Many homeowners would love to sell, but there are many reasons why they’re not.

3 Main Problems Putting Homeowners Between a “Rock and a Hard Place”

- The “Rate Lock-in Effect”:

- The Rock: Millions of U.S. homeowners have a 30-year fixed-rate mortgage enjoying a very low interest rate, often below 4% (many are even below 3%), taken out in 2021/2022. Currently the average 30-year fixed mortgage rate is rising and is at about 6.75%. Homeowners feel locked into their current mortgage contract.

- The Hard Place: If these homeowners want or need to move (new job, more kids, downsizing, kids changing schools, etc.), they face just refinance at a much higher rate. Monthly payments on the new mortgage would be serveral hundred to a thousand dollars more.

- Example: A homeowner with a $300,000 mortgage at 3% pays roughly $1,265/month (principal and interest). If they buy a new home and get a $300,000 mortgage at 6.75%, their payment jumps to about $1,947/month. That’s a $682 increase per month for the same loan amount.

- The Result for Homeowners: This “lock-in effect” forces them to stay put, which reduces the availability of housing inventory, keeps home prices higher and reduces affordability. Additionally, it affects worker mobility as few housing units are available. It creates a self-perpetuating cycle of limited supply and high prices. With lower rates, more homes can be listed and prices will fall.

- Adjustable-Rate Mortgage (ARM) Resets

- The Rock: A significant number of homeowners took out ARMs when initial rates were very low, hoping to refinance or sell before the fixed period ended. Now, these periods are expiring, and their rates are adjusting upwards. They too feel locked in while fearing financial hardship.

- The Hard Place: Their monthly payments are directly increasing, sometimes dramatically. Hundreds of thousands of ARMs have already reset or are scheduled to reset soon. Their ARMs were at 3-4% and they face up to 6% rates this year and perhaps next year. This leaves them with much less disposable income and can lead to financial distress. Higher interest rates affect their credit card, HELOC and bank loans payments.

- Rising Cost of Homeownership Beyond the Mortgage

The overall cost of homeownership has grown:

- Property Taxes: Property values have increased significantly in many areas, leading to higher property tax bills. In some states, property taxes have surged by over 50% in the last five years (e.g., Colorado, Georgia, Florida).

- Home Insurance: Insurance premiums have skyrocketed, particularly in regions prone to natural disasters (hurricanes, wildfires, floods). Insurance companies are pulling out of some high-risk areas, leaving homeowners with fewer, more expensive options. Some states such as Florida have seen staggering increases in recent years.

- Maintenance and Utilities: Inflation has also driven up the cost of home renovations and repairs, maintenance, and utilities, further squeezing household budgets.

What are the Costs of High Mortgage Rates for Homeowners?

- Financial Strain: Increased monthly payments (for ARMs) and higher overall homeownership costs mean less disposable income for food, clothing, transportation, and essentials of living and force Americans to dip into their 401ks and savings accounts, or rack up more credit card debt.

- Reduced Mobility: The lock-in effect severely restricts homeowners’ ability to move, impacting job opportunities, family planning, and lifestyle choices. People are staying in homes, cities or neighborhoods that no longer fit their lifestyle needs is stressful and curtails employment options.

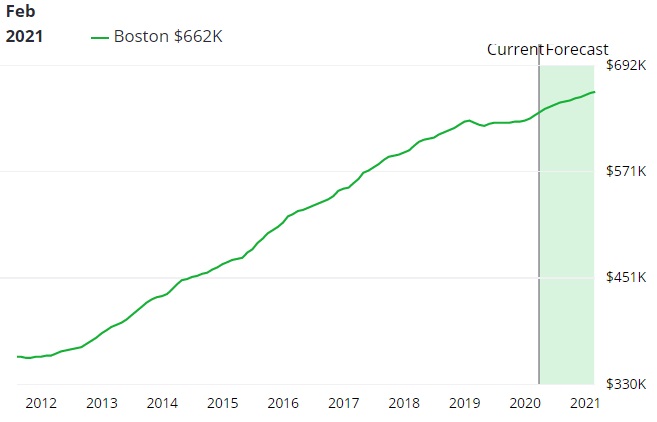

- Equity Erosion (Losses): While many homeowners still have significant equity, they could lose a lot of money via moving costs, paying higher mortgage payments (bank interest). A Cotality report says US homeowners lost $4200 in equity during 2024, compared to +$30,000 growth in 2023 to 2024. As home prices recede, they face lost potential returns.

- Increased Delinquencies: A recent uptick in serious mortgage delinquencies (90+ days past due) in some U.S. states indicates that the combined pressures of higher rates and rising property taxes/insurance are indeed pushing some homeowners to the brink of insolvency.

- Mental and Emotional Stress: The financial pressure and feeling of being “stuck” can take a significant toll on homeowners’ mental and emotional well-being, especially with the FED continuing with its higher for longer rhetoric.

The Solution to Homeowner’s Nightmares

Lowering the FED rate as President Trump has suggested, would ease mortgage rates allowing sellers to sell and stayers to afford their lifestyles. When the FED decides to fight imaginary inflation and projects future inflation scenarios (which it has failed to do), it’s likely solely for political reasons. Because for each FED governor in their states, their choice generates tremendous stress and financial loss for Americans who worked hard to build what they have. They’re hurting their constituents.

Indeed, the right solution is to fire Jerome Powell, and force the FED to abandon political imperatives and lower the FED rate.

The excessively high FED rate (much higher than the rest of the world) is crippling the US residential housing market, lowering GDP, and increasing inflation. Reducing the rates would reduce the very inflation the FED is projecting.

See more on the latest mortgages and about mortgage refinancing. The US housing market will heat up after the tariff turmoil and when rates are eased.

The growing US economy and possible lower interest rates brighten the 2026 housing market outlook and Realtors should be preparing their 2026 market-leading marketing strategy now. Get the first mover advantage as the President succeeds in getting mortgage rates reduced.

Title graphic courtesy of Stockcake photos.