Don’t Expect a Buyer’s Market in 2022

Without much support, other than cheap interest rates, the US housing market has soared for more than a decade, including the ultra rapid price rise in the last year.

It’s made a few very wealthy and a lot of Realtors, home sellers, real estate investors, and rental housing people feel this housing market is invincible. And since we all know supply and demand fundamentals, we can be sure a severe shortage of condos and houses means buyers will bid up home prices.

If you haven’t read the housing market forecast or the housing market predictions 2022 report, what are your thoughts about where prices will be one year from today? Here, you’ll see a case for even higher home prices next year with stats from Case Shiller and NAR.

Homebuyers are asking if there might be a buyers market in 2022 and if home prices will fall? Everyone’s looking ahead now at predictions for 6 months and even 5 years ahead. They’re praying for a big price drop. Should buyers buy now? Should homeowners sell their home now?

What is a Buyers Market?

A buyers market is when there are more sellers and those wanting to buy. A sellers market is the reverse of course, where there are few listings for the many who want to buy. Right now, we’re firmly in the midst of a strong sellers market overall. In some cities, where few want to live, there are listings (e.g., Chicago, yet sales were heating up there in May).

Why is this a Sellers Market Again?

- few affordable homes for sale

- builders aren’t able to build or can’t because of Covid

- homeowners are too uncertain to sell

- home sellers have no where to go due to few listings

- there are millions of buyers including eager, determined Millennials starting families

- millions of buyers are forced to rent currently but want to buy a home and if home prices fall, some would would jump in to buy

- economy will improve, more buyers will have jobs again

A report in the National Mortgage News, quotes Veros Real Estate Solutions CEO Darius Bozorgi said in a press release that “Buyer demand is strong in nearly every market in the country. We are squarely in a seller’s market and buyers have no choice but to put forward the best offer they can, frequently making offers above asking price, to secure the home they want to own.”

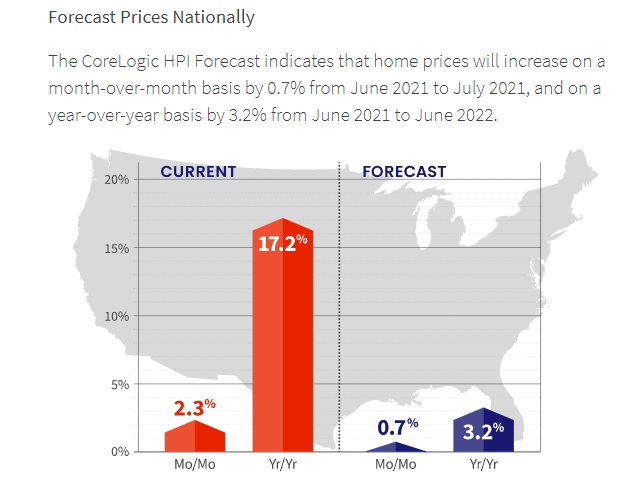

Home prices nationwide will increase 7% through the second quarter of 2022 with no signs of the hot sellers’ market slowing through the next few months, according to Veros Real Estate Solutions.

Some Experts Still Believe Demand Will Fall

Housing economists predict home prices will flatten as demand wanes. The demand they’re referring to might be the end of Covid pandemic relocation activity. But will the pandemic activity continue right into 2022? It depends if Covid variants are a persistent threat which they appear to be. And a good forecast is predicated on the hope that another more dangerous variant doesn’t appear.

Some economists data suggests Millennials who were buying have already bought a house, and that all others who would like to sell and progress with their lives are going to stay put or stay renting or live with their parents longer.

There’s still lots of housing crash talk, but with an economic recovery and new infrastructure stimulus bills about to pass, why would wishful home buyers just give up? We know there is pent up demand, and it keeps being unleased, such as this spring when bidding wars erupted in almost every US city.

As reopening continues and workers return to their jobs, credit ratings and savings will rise again and fewer small businesses will be in bankruptcy situations. As long as interest rates stay low, Americans will want to keep buying homes. And these won’t be cheap starter homes either. The amount of money many Americans is staggering and they all want lots of room now.

Inflation’s Going to Bring it All Crashing Down Right?

There’s talk of inflation ruining the big party, but again experts say inflation will be transitory and as business ramps up production in reopening, prices will decline. Airline prices for instance have jumped and food prices too, along with lumber for construction. Yet global supply chains will get back to normal soon. And as more demand appears, reopening businesses will increase production and satisfy the market.

Inflation will rise and stay higher than everyone anticipates, but it won’t stop the economy. It may raise new home prices yet new construction will pick up pace. In cities where construction is allowed (not NIMBY cities), builders are going strong knowing the work from home era has stabilized. People will want single detached homes.

Immigration Will Increase

An we’re not talking about unvaccinated illegal aliens running across the Texas border. As legal immigrants pour into the country again, including wealth foreign students, they will be competing for US homes. NAR reports that during April 2020–March 2021, existing homes purchased by foreign buyers dropped 27% to $54.4 billion, and the number of homes purchased fell 31% to 107,000 units.

Corporate Investors See the Potential in Houses too!

Yes, corporate investors are buying more houses and it’s ruffling a few feathers. Slate reported that corporate investors snapped up 15% of U.S. homes for sale in the first quarter of this year. More monied buyers means higher prices.

Yet corporate investors are responding to a market opportunity of house renters. When interest rates and mortgage rates go up, more people will have to rent. They won’t be getting mortgages especially as house prices are rising. And with inflation high, they’ll have less discretionary income. The rental market looks really good.

There is Little Support for a Price Slide

So the 2022 prediction for the housing market has to be for steady prices or even higher prices.

“At a broad level, home prices are in no danger of a decline due to tight inventory conditions, but I do expect prices to appreciate at a slower pace by the end of the year,” says Lawrence Yun, NAR’s Chief Economist.

With the Covid 19 pandemic behind us in 2022, there is less to suppress the economy. It’s back to normal, but this time, there isn’t enough housing. The problem is intense, so expect some political effort to be made to help the market. That might help grow supply which will make some buyers happy.

In any event, housing prices can’t decline. Wealthy real estate holders (billionaires) would never stand for such a loss, unless they can capitalize on it.

Stimulus Gasoline about to be Poured on the Fire

Since the Democrats are all in on the $5 Trillion infrastructure ($5,000,000,000,000), how could the housing market collapse or housing price fall. Even with delays in the bill’s passing, everyone is certain it’s going to happen.

Sorry, but the forecast for a buyer’s market is not going to happen. Get ready for higher prices in 2022, and 2023, unless the Fed tries to jack up interest rates. That’s when you might see a crash. But crashes don’t last long, when American consumers are so well fixed financially. And if the burgeoning poor should somehow be invited that party, then prices will only rise.

The last word on the housing market is that home prices have been nurtured by governments. They’ve done little to help ease the housing crisis, homeless crisis, or even to help small landlords who were hit by the eviction moratorium and cancelled rent payments.

With supply crushed, governments can only act to kill demand, which they might not do until 2023 with rising interest rates. If prices flatten in 2022, it’s because everyone sees a 2024 Crash coming.

See the housing market reports for 2023 and beyond for many major US metros including: Denver, Dallas, Houston, San Antonio, Austin, Salt Lake City, Las Vegas, Tulsa, Seattle, Boston, New York, New Jersey, Chicago , San Antonio, Austin, Colorado Springs, Salt Lake City, and Los Angeles won’t see many distressed home opportunities in this cycle.

Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO