Are Homeowners Getting Ready to Sell?

While a few more buyers are able to buy a home, given savings and improving incomes are sellers willing and able to sell their homes?

Buyers aren’t sure whether home prices will rise or fall this year, even if experts predict price rises. For sure, listings are up and may grow substantially by June/July, typical of each year’s selling cycle. Availability is increasing, but not affordability because locked in homeowners simply can’t escape their low-rate mortgages.

Harris Poll 2024 Poll

A revised 2024 study of 2,047 U.S. adults and their sentiment by Harris Pollsters suggests more homeowners are readying to sell their homes but also that buyers might be waiting until 2025 before selling.

This poll digs into the attitudes of buyers.

Most Americans are under pressure whether as homeowners or renters. 44% of respondents said their city/neighborhood is very unaffordable. That paints a grim picture of big demand for homes at current prices.

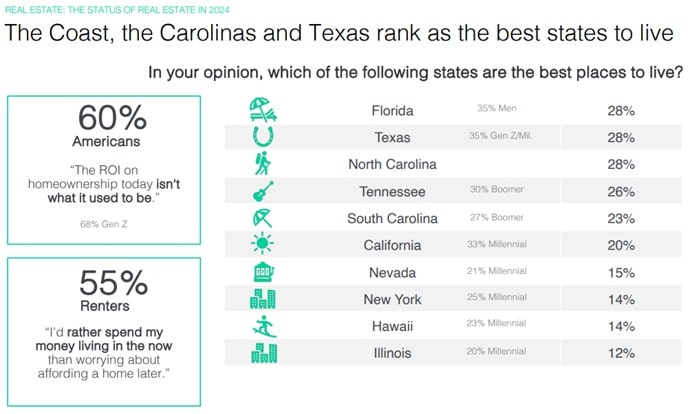

Most prospective buyers blame mortgage rates and an inability to save for the downpayment as the major obstacles going forward. 60% said they don’t value the forward ROI value on real estate as meaningful anymore. They’re more interested in moving to California, Carolinas, or Florida, where they can live the life they want, including working remotely.

Where They’d Like to Move To

Wishing and reality are a whole different ballgame. But that doesn’t stop Americans from visualizing a better life elsewhere. Where intent exists, action will surely follow (unless the FED keeps rates high forever). Clearly, Americans see the south as the place to be. Something is wrong with the north.

This likely reflects the exhaustion of life today, and that many older cities in the US are less livable and many Americans would like to be out of them. Florida and Texas with lower income taxes are very attractive to those in the north with tax fatigue.

Respondents had no faith that rent prices would drop. They are burdened by rent, utilities, insurance, property taxes, mortgage payments and HOA fees.

2/3rds plan to wait until 2025 to buy a home, making it much more difficult to reach and persuade them to buy. Realtors will need to be more assertive with online marketing and execute an amazing marketing plan to produce results for sellers.

However, 81% of respondents will would like to buy a home in future, but 61% doubt that will ever happen.

Competition from Other Buyers Hasn’t Been Factored In

If buyers don’t expect home prices to rise, they might be fooling themselves. Although price is in check for 2024, the lowering of mortgage rates in 2025, will bring everyone out of lockdown. Competition from newly enabled buyers especially should see home prices bid up strongly.

Given slower construction, massive persistent demand for housing, rising economy, and soon, more competition from other buyers, with inflation persisting in the next year, it is unlikely most will be buying for many years to come. Only an unforeseen housing market crash would change that trajectory.

Of course, buyers are finding homes to buy in less expensive regions of the country but even the logistics of moving to a city with lesser economic outlooks makes it a very difficult challenge. Most are staying put until they can manage a move or a sale of their current property. However, many will be making these moves in May, June, July and August while kids are out of school. Sometimes moves have to be made even when inconvenient or risky.

Of course demand in the Florida housing market, North Carolina, South Carolina, California housing market, and markets in Tennessee, Texas, Colorado, New York, and other states is still intense. Although inflation is jumping, it might only serve to add to the final price sellers receive. They believe they will get their price amidst a bidding war.

A poll conducted for NAR and posted on Realtor.com, showed some interesting things:

- 93% of prospective sellers had already begun the listing process and 28% are working with a real estate agent

- 36% of those hoping to sell have done some research on comparable home prices in their neighborhood and they’ve begun some home improvements to improve the selling price and salability

- about half of prospective sellers this fall would like to take advantage of current market prices, believing they will profit well on the sale and that is up from 24% last spring

- 77% of prospective sellers say they’d accept a lower offer to close quickly up from 54% last spring

But will home prices rise or fall?

Of course, Harris Polls has also discovered a big fall in confidence in the current government and Americans believe the country is on the wrong track. We’ll see GDP numbers, jobs numbers, consumer sentiment ratings, housing construction data, and lower interest rates as 2024 ends.

If sellers want a high price as more homes are listed, they’ll likely want to hire an agent who knows how to launch a bidding war and ensure a good bid. Find out more on what drives the housing market and what poses risk for a market crash.