Rare Earth Stocks

As technology products advance in performance and durability, the demand for special metals with special properties used in those products is growing too. We know these unique valuable metals as rare earths – a group of 17 metals used in the production of many high-demand products today such as x-ray machines, smartphones, batteries and nuclear power generation systems. As these products grow in production and usage, demand will rise.

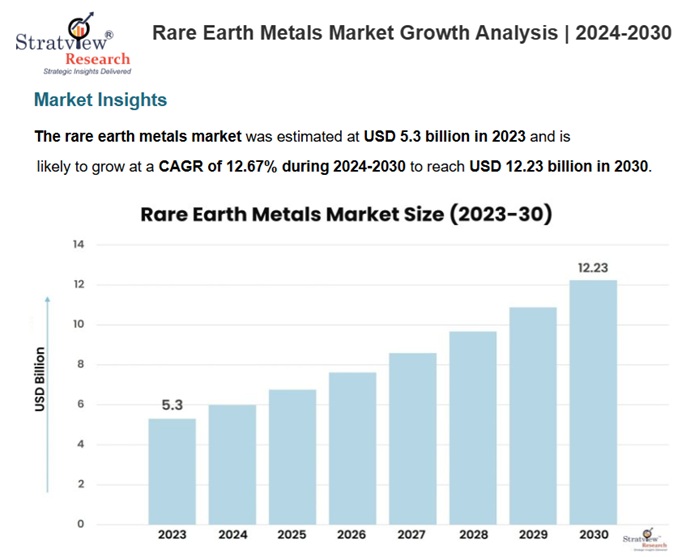

The supply of these elements is what is in question, particularly in the U.S. which is trying to repatriate manufacturing. And according to Stratview Research, the market is forecast to grow 12.67% CAGR from $5 billion to $12 billion by 2030. This demand for rare earths today means the very best of the rare earth stocks or ETFs should be on your radar.

They are speculative investments, just like gold and cryptocurrencies, but with that risk may come incredible rewards. The fate of these stocks might depend on US-China trade relations in the next few years. It has many of the earmarks of the AI stocks in terms of capitalization and bubbled-up valuations. You’ll find a list of rare earth companies/stocks to research below. Many have strong buy ratings.

The trade battle between the US and China is heating up demand for the rare earths, outside of China. China currently controls over 60% of global REE mining and more than 80% of refining.

China has a massive rare earth processing capability, giving it control of much of the REE market globally. This monopoly was concerning for everyone and this year even more so as China announced requirements for buyers to apply for licenses to export from China. President Trump was startled and angered by that announcement from China, and has retaliated by applying a 100% tariff on all products from China imported into the US. That move pushed the stock market downward temporarily, although positive corporate earnings and FED easing statements have almost faded the tariffs to the background.

U.S. Trade Representative Jamieson Greer said Wednesday that China’s recent restrictions on rare earths exports are a “global supply chain power grab. Greer and Treasury Secretary Scott Bessent spoke to reporters at the Treasury Department in Washington, D.C., where Bessent said Beijing’s actions amounted to a provocation. — NBC report

At this point, if the trade tiff holds, we might see a shortage of rare earth metals on the open market, and this will impact US industry. The hunt is on for more reliable sources in the US or its friendly, supportive neighbors. The mood between China and the US is souring as the US intends to go xChina. Given the US lacks an rare earth processing facility, the shortage issue remains. Even if REE’s are acquired, there is no way to refine them into usable materials.

Trump USA Takes Stock in Canadian Rare Earth Company

The rare earth market news has featured President Trumps efforts to acquire reliable REE sources. It’s had a sizable influence on a few stocks with impressive returns (see some of them below). Rare earth metals stock MP Materials (NYSE: MP) has returned 370% YTD, after the US government bought a 15% stake in the company.

The government also bought a stake in Lithium Americas (NYSE: LAC) which grew its price up more than 180% in the past 30 days.

Energy Fuels (NYSE) is a speculative rare earth stock that’s seen a phenomenal 60% stock price rise this year. Today, however, that stock has dropped 10% showing you the danger of investing in these stocks and penny stocks in oil and gas, gold, etc.

What are Rare Earths?

REEs are 17 metals including:

- Cerium

- Dysprosium

- Erbium

- Europium

- Gadolinium

- Holmium

- Lanthanum

- Lutetium

- Neodymium

- Praseodymium

- Promethium

- Samarium

- Scandium

- Terbium

- Thulium

- Ytterbium

- Yttrium

Whether it’s robots, AI chips, magnets, catalytic converters, or wind turbines, the rarity of these metals makes them a focus of international trade. The US, Europe and China are in a race to develop high technology systems and products involved in products and military applications such as in satellites.

These metals are becoming standard in any high-performing high-tech products, so not having enough of them creates a sizable production and quality problem for companies and countries. Which of these elements are more valuable and marketable requires another post and is something you’ll need to review in your research.

The Key Driver of Prices: Trade Wars

It’s a dicey situation for President Trump who plans to bring manufacturing back from China to the USA. China wants to keep its monopoly as the world’s factory and doesn’t want to face tariffs or other fees and sanctions in trade. Trump would have to back down from his plan, or suffer the consequence of limited rare earth metals. A rational stance on this likely shows China will persist with its licensing requirements, and perhaps a blockade of exports to the US in particular. Trump has blocked the export of the highest-performance microchips to China.

So, if we believe that there will be a shortage of the rare and precious metals, we know the US will need to create small-scale refining facilities, and should have done this many years ago. And the hunt continues for reliable, high volume sources of the REEs (e.g, Canada (15.2 million tons, Argentina 3.3 million tons, and Australia 5.7 million tons)).

For investors who have been focusing on the best technology stocks, best ai stocks, and best small caps, the discussion of the best rare earth stocks should be enlivening. Let’s take a look at many of them now.

| # | Company (Exchange: Ticker) | Country | Rare Earth Business Opportunity | Barchart Rating |

| 1 | MP Materials Corp. (NYSE: MP) | USA | Operates the Mountain Pass mine in California, positioning itself as the only fully integrated mine-to-magnet producer in North America. | Strong Buy |

| 2 | Energy Fuels Inc. (NYSE American: UUUU) | USA | Processes rare earth element carbonate at its White Mesa Mill in Utah, aiming to establish an integrated US supply chain for separated REE products. | Strong Buy |

| 3 | Neo Performance Materials Inc. (TSX: NEO) | Canada | Specializes in midstream processing, transforming rare earth oxides into high-purity functional materials like magnetic powders and alloys for global manufacturers. | Buy |

| 4 | NioCorp Developments Ltd. (NASDAQ: NB) | USA | Developing its Elk Creek Project in Nebraska, which is positioned to be a domestic source of Niobium, Scandium, Titanium, and critical rare earth elements like NdPr, Dysprosium, and Terbium. | Moderate Buy |

| 5 | Ucore Rare Metals Inc. (TSX-V: UCU) | Canada | Developing its proprietary RapidSX separation technology to establish a commercial-scale rare earth separation facility, primarily focused on the US supply chain. | Weak Buy |

| 6 | Defense Metals Corp. (TSX-V: DEFN) | Canada | Advancing its Wicheeda Project in British Columbia, aiming to become a long-term, low-cost producer of Neodymium and Praseodymium (NdPr) rich rare earth concentrate. | Weak Buy |

| 7 | American Rare Earths Ltd. (OTCQB: ARRrf) | USA/Australia | Focused on developing large, low-cost, and scalable rare earth projects in the US, with a flagship deposit at Halleck Creek, Wyoming. | N/A |

| 8 | Rare Element Resources Ltd. (OTCQB: REEMF) | USA | Developing the Bear Lodge Project in Wyoming, which hosts a significant resource of light and heavy rare earth elements. | Strong Buy |

| 9 | Texas Mineral Resources Corp. (OTCQB: TMRC) | USA | Focused on developing the Round Top project in Texas, which is a significant resource of 16 critical minerals, including both heavy and light rare earth elements. | N/A |

| 10 | Canada Rare Earth Corp. (TSX-V: LL) | Canada | Pursuing the development of a global, vertically-integrated rare earth supply chain through mineral interests, processing, and long-term sales contracts. | Weak Buy |

| 11 | Search Minerals Inc. (TSX-V: SMY) | Canada | Focused on its Deepwater and other REE projects in Labrador, utilizing its proprietary Direct Extraction Process technology for low-cost recovery of valuable rare earths. | N/A |

| 12 | Critical Metals Corp. (NASDAQ: CRML) | USA/Europe | Holds an interest in the Tanbreez project in Greenland, aiming to secure a supply of heavy and light rare earth elements for US processing. | Strong Buy |

| 13 | Leading Edge Materials Corp. (TSX-V: LEM) | Canada | Developing the Norra Kärr project (in Sweden), one of the world’s most significant deposits of heavy rare earth elements, positioning for the European and North American markets. | Strong Buy |

| 14 | Aclara Resources Inc. (TSX: ARA) | Canada | Developing non-traditional Ionic Clay deposits in South America with an environmentally conscious extraction process, which can provide an alternative source of rare earths to the Western market. | Buy |

| 15 | Mkango Resources Ltd. (TSX-V: MKA) | Canada | Focused on the development of its advanced rare earths project in Malawi and rare earth magnet recycling technology (HyProMag), aiming for a circular economy solution. | Strong Buy |

| 16 | Commerce Resources Corp. (TSX-V: CCE) | Canada | Advancing the Ashram Rare Earth and Fluorspar Deposit in Quebec, which is one of the world’s largest rare earth deposits with a significant Heavy Rare Earth component. | Strong Buy |

| 17 | Idaho Strategic Resources, Inc. (NYSE American: IDR) | USA | Exploring its Lemhi Pass project in North Idaho, aiming to establish a domestic source of rare earth elements, particularly NdPr. | Moderate Buy |

| 18 | GéoMégA Resources Inc. (TSX-V: GMA) | Canada | Developing its Montviel project in Quebec and pursuing the commercialization of its unique rare earth separation technology, ISR process, for secure and sustainable supply. | Strong Buy |

| 19 | Appia Rare Earths & Uranium Corp. (CSE: API) | Canada | Exploring for high-grade critical minerals, including rare earth elements, at its Alces Lake and other projects in Canada. | Strong Buy |

| 20 | US Critical Metals Corp. (CSE: USCM) | USA | Focused on developing its projects in Montana and Nevada to establish domestic production of critical minerals, including rare earth elements. | N/A |

| 21 | ReElement Technologies (Subsidiary of American Resources Corp.) (NASDAQ: AREC) | USA | Focused on establishing commercial-scale rare earth and critical metal refining/separation facilities using a novel chromotography technology. | N/A |

| 22 | Niobay Metals Inc. (TSX-V: NBY) | Canada | Focused on the development of the James Bay Niobium project in Quebec, which also contains rare earth elements as a secondary product stream. | Strong Buy |

| 23 | Defense Metals Corp. (TSX-V: DEFN) | Canada | Advancing its Wicheeda Project in British Columbia, aiming to become a long-term, low-cost producer of Neodymium and Praseodymium (NdPr) rich rare earth concentrate. | Strong Buy |

| 24 | Northern Dynasty Minerals Ltd. (NYSE: NAK) (Pebble Project) | USA | Though primarily a copper/gold project, the Pebble deposit in Alaska contains a substantial resource of rare earth elements, offering a potential domestic supply alongside base metals. | Strong Buy |

| 25 | Uranium Energy Corp (NYSE: UEC) | USA | Primarily a uranium company, but may benefit from the processing of REE-bearing materials like monazite sands, diversifying its critical mineral portfolio. | Strong Buy |

| 26 | Avalon Advanced Materials Inc. (TSX: AVL) | Canada | Advancing its Nechalacho project and other critical mineral projects, focusing on providing a diverse supply of technology metals, including rare earths. | Strong Buy |

| 27 | Fortune Minerals Limited (FTMDF) | Canada | Fortune Minerals Ltd is engaged in the exploration and development of mineral properties in Canada. It is focused on advancing the vertically integrated NICO cobalt-gold-bismuth-copper project, comprised of a proposed mine and mill in Canada’s Northwest Territories. Fortune also owns the Sue-Dianne copper-silver-gold deposit and the Salkeld Lake exploration project, and holds net smelter royalty (NSR) interests on leases | N/A |

Rare Earth Stocks are an Enticing and Rare Opportunity

Rare earth stocks are an enticing investment opportunity, perhaps once in a lifetime. Given the essential role of these high-performing and rare metals in the high-tech industry, it stands to reason the US must do something to ensure it has an adequate supply, or suffer big losses in its product exports and a reputation for inferior products. These are important too for military applications, and given that Trump is spending hundreds of billions on the Golden Dome defense system, the demand should be high going forward.

Good luck finding opportunities in rare earth stocks, but be cautious, ask the right questions and discover the real value in them.

See more on the 2026 stock market forecast, and a look at cryptocurrency trading in assets such as Bitcoin and crypto stocks such as Coinbase.

Title image courtesy of Wikipedia.