Russell Index Forecast

Are Russell Small Caps a Wise Choice as we Approach 2026?

Stock market analysts and market economists have been talking about a market broadening for some time. The gist of their forecasts revolved around investment flows into small caps, which are fundamental to what the Russell 2000 index is — an index of stocks that are not large caps.

The Russell 2000 index represents a comprehensive small-cap barometer and is reconstituted each year to ensure its larger stocks don’t distort the value and meaning of this true small-cap group of equities. However, the Russell 2000 could be renamed the not-S&P500 index. Investors look to the index at times for the best small cap stocks to buy. assuming they’re ready for big earnings growth with an improving economy. They’ll be focusing on the Russell 3000 too.

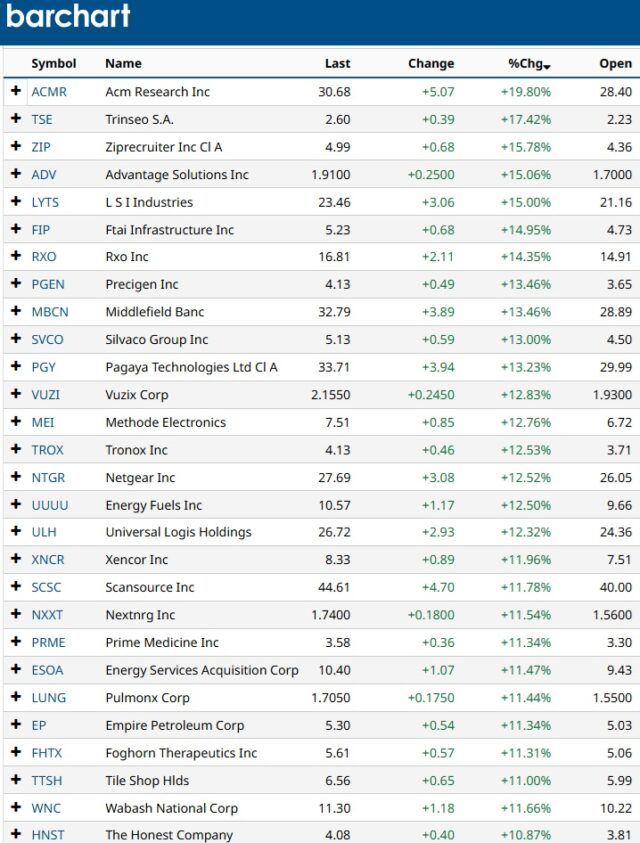

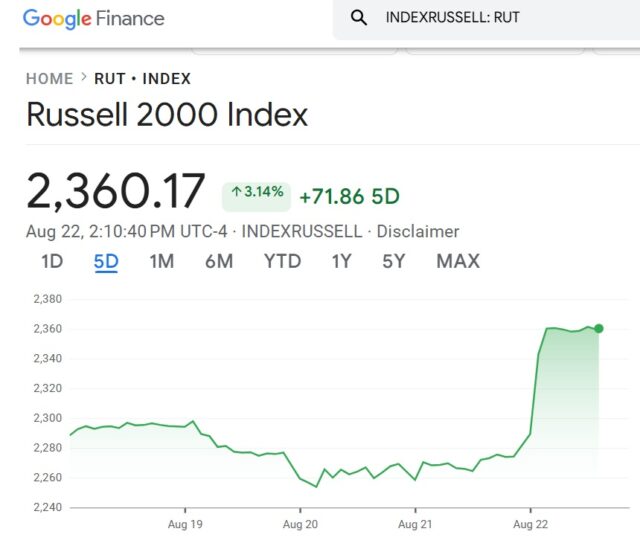

Today, the Russell rocketed 4% on the news of lower interest rates. High rates of course hurt small businesses and small cap corporations greatly. J Powell’s words alluded only to slight decreases in the FED rate. This means some analysts are still skeptical and there is room for massive increases in small-cap investing. Today’s top Russell stocks below show the phenomenal growth in some stocks, (e.g., Ziprecruiter, which touches on employment expectations). Yes, small companies are the most rewarding, have great growth opportunity, and will scale up. Even AI companies will be salivating at serving up AI solutions for these firms.

Russell Rose 60% in Trump’s First Term in Office

We have some history to review too. The Russell rose 60% during President Trump’s term in office, up to the Covid pandemic collapse. The outlook was promising until the Trump tariff threats, which although good for the US economy in the short term, will lead to a trade war and diminished trade for the US.

Why Would Money Rotate into Small Caps?

The reasoning for the Russell 2000/3000 small-cap hype is due to the expectation of lower interest rates which would benefit small businesses who would see lower financing costs. And of course, small business customers would have more to spend thus driving higher revenues for SMBs.

Investors believe a broadening of the stock market will happen and that investors will sell their S&P megacaps and buy small caps. It means the price of Amazon, Google, Microsoft, Tesla, Netflix, Apple and others might fall drastically. Since those stocks make up most of the S&P and NASDAQ, we’d expect the outflows would lead to a drastic decline. But the safety of the big caps is alluring, and many investors will become risk off soon. They’ll be looking for hedging strategies and even to sell short.

This interview is from one year ago on CNBC where the host says the “Wexword” is rotation. What do you think at this point right now, as the latest inflation report came in hot again?

Investing in small caps entails some risk such as:

- volatile prices due to lower capitalization and lower prices

- high risk due to lower capital reserves and need to borrow from credit markets

- exposure to foreign supply chains

- less liquid because fewer investors know about them and are willing to buy them

Validea offers its best Russell 2000 picks:

Growth of the Russell 2000 as you can see rivals that of the S&P in the last 3 months. The Dow Jones has lagged as well, which sets up an interesting combination with the small caps if you can find those stocks that will benefit when manufacturing returns. As this chart from Yahoo Finance shows, shows the Russell is back leading the pack. With lower interest rates and a flood of money coming in from the money markets and foreign investors, it’s difficult not to see the Russell doubling. Of course, the timeline is anyone’s guess, based on politics.

What is the Russell 2000 Index?

The Russell 2000 index is a gauge of the 2000 smallest market cap stocks in the Russell 3000 index. There is also a Russell 1000 index. The 2000 index seems to be a better gauge of the real economy and of how small businesses are faring.

The Russell 2000 index (US Small Cap 2000) is a the leading global index in the US, created in 1984 by the Frank Russell Company, which is part of the London Stock Exchange.

See more on the outlook for the best stock market sectors and in-depth views of critically important market data and news.

* investing in stocks entails risk. Ensure you’re well informed before investing serious amount of funds into small caps or mega caps. Finding a qualified investment advisor is a good choice, although be aware investors have lost large amounts upon the investing advice of licensed advisors. Stock prices vary by day and month and individual companies may suffer unforeseen setbacks. Day trading and speculation are very risky. Read more on the 6 month, 5 year and long term outlooks to get a broader look at where markets are headed. It’s your money, get the broadest view of the economy, sectors and stocks.

* This website (“www.gordcollins.com”) is provided by Gord Collins for general informational purposes only. By accessing or using this Site, you agree to be bound by the following Terms and Conditions, as well as all applicable laws and regulations. If you do not agree with these Terms, you should not use this Site. See the full disclaimer.