Gilead Stock Price Forecast GILD

Gilead Sciences | GILD Stock Forecast

The Wuhan Corona Virus (Covid 19) has become the most damaging health threat of the last 100 hundred years.

The profit potential of a treatment or vaccine for Covid 19 is almost unlimited, with a potential customer base of 6 billion people. The race for a vaccine is on but won’t be delivered likely until 2021. Those afflicted by Covid 19 now or in a second wave of infections in the coming months and in the fall will want immediate relief.

New trials of Remdesevir, Gilead’s new drug, have shown to reduce the recovery from Corona Virus from 15 to 11 days. The drug appears to be suited more to treating the patient early to shorten hospitalization periods. That would alleviate stress on the medical system, particularly ICU units in hospitals. It would create significant savings for hospitals.

A further positive is that something is being learned about how to defeat the virus. Gilead could improve the drug based on clinical testing on live humans.

GILD stock price has jumped in the last few days. See the live quote below.

The spread of the Corona Virus out of China so quickly and without warning from China means such events could continue well into the future. With biotech companies working hard to find a vaccine, we need immediate treatments to prevent suffering in ICU units and more deaths.

[stock_market_widget type=”odometer” template=”generic” color=”default” assets=”GILD” theme=”car” api=”yf”]

Remdesivir, from Gilead Sciences

Remdesivir is an anti-rival medication developed by Gilead Sciences, which potentially could generate billions for the company if it can prevent its product from being stolen and sold by other companies and countries. China is currently trying to patent Gileads drug in China, which would eliminate Gilead’s potential opportunity.

Remdesivir (development code GS-5734) is an antiviral medication; a nucleotide analog, specifically an adenosine analogue, which inserts into viral RNA chains, causing their premature termination. It is being studied during 2020 as a possible post-infection treatment for COVID-19 illness. – from Wikipedia.

Gilead Sciences has developed a drug called Remdesivir which appears to resolves symptoms within a few days. Trials of the drug are ongoing. As corporate earnings reports sour and the social distancing requirements remains, a solution to this would be extremely profitable for the company that makes it. If the drug works, Gilead could be a key stock in the 2020 and 2021 stock market forecast.

“125 people with Covid-19 were entered into into Gilead’s two Phase 3 clinical trials. Of those people, 113 had severe disease. All the patients have been treated with daily infusions of Remdesivir. All of the patients were discharged in a week, except 2 that died.” — from statsnews.com

“The best news is that most of our patients have already been discharged, which is great. We’ve only had two patients perish,” said Kathleen Mullane, the University of Chicago infectious disease specialist overseeing the remdesivir studies for the hospital. — from statsnews.com

Gilead Stock Price Rocketing

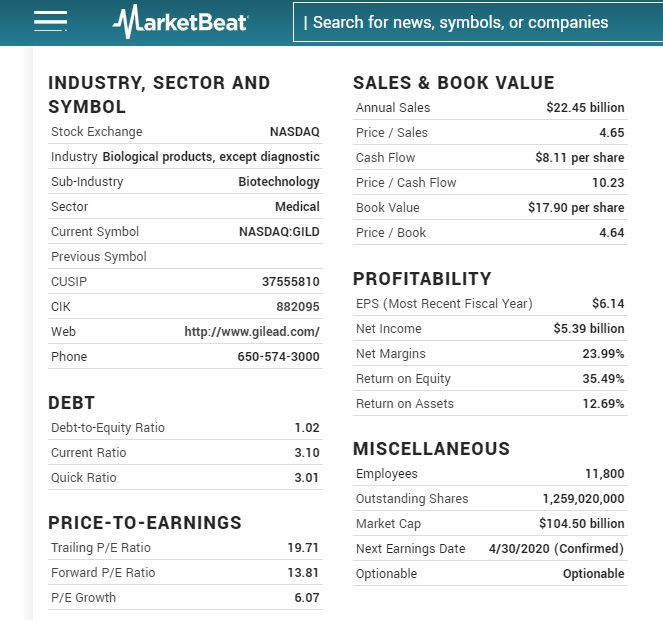

Gilead Sciences, Inc. is Foster City, San Mateo County, California headquartered biotechnology company which researches, develops and commercializes drugs, primarily antiviral drugs used in the treatment of HIV, hepatitis B, hepatitis C, and influenza. It has a market cap of above $100 Billion and yearly revenues of $22 billion.

Is Gilead one of the best stocks to buy in 2020? Gilead stock is listed on the NASDAQ index and is part of the NASDAQ Biotechnology Index as well as the S&P 500. Gilead Sciences, Inc. (NASDAQ:GILD) last quarterly earnings report on Tuesday, February, 4th showed $1.30 earnings per share (EPS) for the quarter, which missed the consensus estimate of $1.67 by 37 cents.

Gild Stock Quote

That’s a fairly normal situation for most stocks on the NASDAQ, however, none of that matters if Remdesivir is tested to be safe and effective. This would rewrite the company’s financials and make the Gilead stock price forecast look like a hockey stick. Check out the NASDAQ forecast and review other Corona Virus stocks.

Yahoo Finance Live said the company could earn $500 million and lift the stocks value by 20% if the drug is FDA approved.

Gilead Stock Price History

Gilead’s stock price was on a roller coaster with big highs last fall. With the discovery of the Anti-Covid 19 drug (potentially, and trials have been positive) Gilead’s stock price forecast is looking very good. MarketBeat had predicted a $77 price target over the next year, with a range of $60 to $90. But that 1 year forecast doesn’t reflect the new “wonder drug” value. The current Gilead Stock Price is $82.52 and is actually heading downward.

It looks like investors are cautious, It will be fascinating to watch the price of this Biotech stock this week. Some analysts are warning against the Gilead Remdesevir hype.

A Corona Virus vaccine could be 2 years away, with potentially billions of humans needing help with Covid 19 infections in the coming year.

When Covid 19 Reappears

There is concern of Covid 19 reappearing in the fall, and becoming a persistent threat that will change our lives and suppress our economy for years. Remdesivir, if made widely available could control the negative consequences. It could result in people being behaving less responsibly too, believing they can go and get a shot of Remdesivir if they get infected. That of course, would boost sales of Gilead’s new star product.

Gilead does a lot of research and produces a lot of products. Profits from Remdesivir could boost research and more products in other medical segments. They could become the major Biotech company if no other rival Corona Virus research company develops a similar product or a proven Vaccine.

Covid 19 is a crippling menace to the global and US economy that governments and companies would spare little expense to acquire it. China is likely trying to get some of the drug and begin copying it for Chinese populations. It’s not known how Gilead will stop this intellectual property theft threat.

If China can acquire a patent, it could steal the profits away from Gilead. The Gilead stock price forecast has to factor in theft, along with the price which Gilead might charge for the drug in the US and Europe.

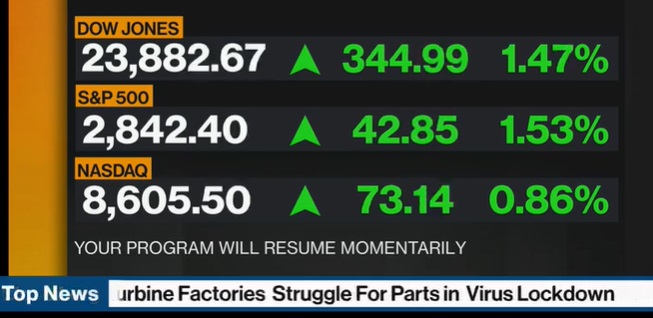

The market responds:

The Dow Jones index has responded well to the Gilead drug discovery and trials, yet the S&P and NASDAQ seem to be indifferent to it.

The FANG stocks are all the rage lately, given large caps can return to normal quicker as the work shutdown ends. See the Google stock forecast, Apple Stock forecast, Amazon stock forecast and the Tesla stock outlook. Get your 3 month, 6 month, 1 year, 3 year, 5 year, and 10 year projections here on the stock market forecast 2020 blog.

* the above post includes opinions of the author and do not connote recommendations of any kind regarding stocks to invest in. The material is provided as general information only. For all your stock investment decisions please refer to your financial investment advisor. Using AI stock prediction tools also presents risk as does the advice of any advisor. Educate yourself.

3 to 6 month Stock Market | Stock Market Tomorrow | Housing Market | Will the Stock Market Crash? | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Prediction