Market Stumbles on Poor Jobs Data

The week of November 3rd to 7th looks like it will be one of the worst since April. Not enough for alarms, but this sag since Oct 30th is beginning to weigh on investors, who yesterday were rattled by the latest jobs report.

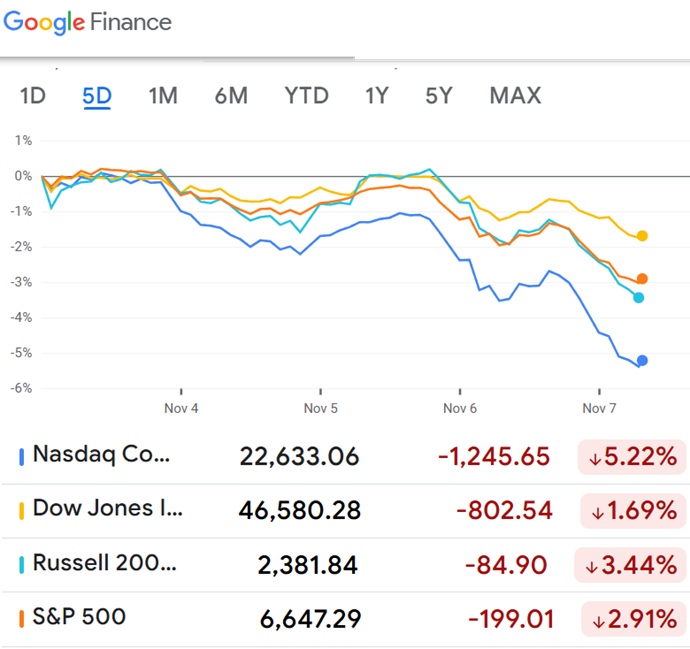

Yesterday, the Dow Jones fell 0.84%, S&P 500 declined by 1.12%, and the Nasdaq was off by 1.90%. A Reuters report suggests investors are concerned about mounting economic uncertainty and stretched valuations.

The NASDAQ led the fall on Friday, dropping more than 2% at one point with Tesla falling 3.86%, Nvidia down 3.0%, Google down 2.6%, Palantir off 1.22% and Bitfarms down 5.0%. It raises the question of whether to buy or sell the big tech stocks, i.e., the best AI stocks.

With all the indexes heading down with some force, are we in the midst of the much-feared correction, or even sliding into a stock market crash?

The VIX volatility and the AII Investor confidence index showed investors are struggling in the fog of data, often conflicting, given reports on US GDP are positive. Retail and Institutional investors aren’t sure what to think. It’s down one day and rocketing back up the next. The story is still being written.

Investors are still thinking of “buying the dip” which actually prevents the market from a free fall.

As this chart shows, the indexes have fallen, with the tech and AI-heavy NASDAQ down sharply by 5%.

US tech groups closely tied to the artificial intelligence boom have lost more than $1tn in market value since last Friday, with Wall Street on course for its worst week since President Donald Trump’s “liberation day” tariffs in April – Financial Times Report.

Talk of an AI bubble and a vulnerable cryptocurrency market aren’t unfounded. If AI stocks tumble, there’s little to hold the stock market up, thus making a selloff a big risk. Once a key level breaks, selling begets more selling. Should you sell your stocks now?

One ntable aspect of the jobs report was the weakness in small business jobs creation which was negative for October. Layoffs rose substantially and the US economy shed 9100 jobs. The FED’s rate cut decision was a helper, yet the FED only acts when the job market and short-term economic outlook are negative. Small biz generates most new jobs and employees a good chunk of the employed population. With big tech and AI creating more unemployment, a consumer led economic rebound is in jeopardy. Where will the lift come from?

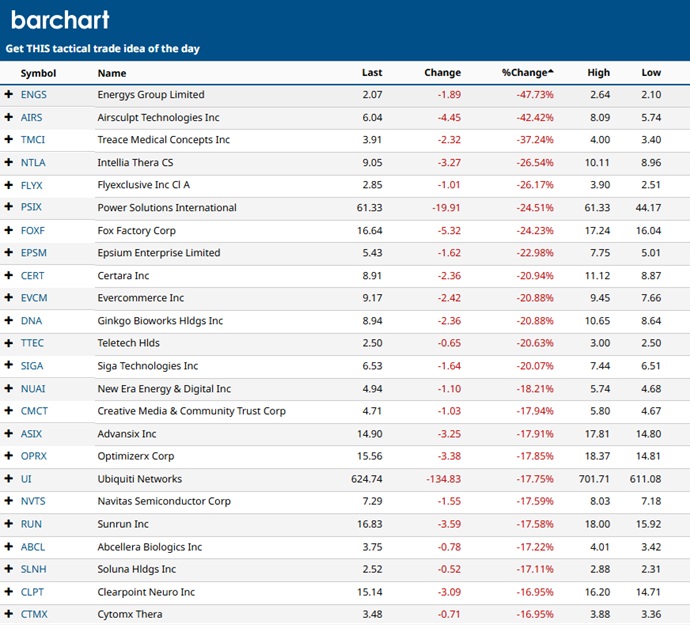

Biggest Losing Stocks This Week

The US government shutdown is obviously a factor in this week’s stock performance, with airport shutdowns being predicted, which in turn stifle the travel and transportation sectors. What’s most disturbing about the issues with tariffs and shutdowns its impact on small businesses. SMBs have bearing the brunt of high taxation, high credit costs, regulations, and a consumer base weakening at the lower end. Signs are that wealthier Americans are starting to reduce their spending. Starbucks stocks has slid considerably as an example.

Long Term Outlook Still Solid

Despite the recent events, some analysts including Tom Lee of Fundstrat are optimistic about the year end forecast. There have been highly media hyped threats for years now, yet the stock market has enjoyed its best bull run ever. If you’re a long term investor, needing to move money from the money markets and get it working for you, the stock market still offers up some good equities.

Consider that J Powell’s term is near its end, thus the new FED chair will be able to lower rates considerably, giving US businesses a massive booster shot for 2026 and the next 5 years. The 5-year forecast remains positive, so even a 7500 S&P 500 might be laughably low for year-end 2026. Enjoy your buy the dip opportunity.

See more on the stock market forecast and get ready for 2026’s great stock buying opportunities.

Title image courtesy of AI Image Generator Stock Cake.