October Stock Market Correction

This Friday morning saw stocks hitting new record highs, bubbling effusively with expectations of a 7000 S&P forecast. In fact, Fundstrat’s Tom Lee just this week reiterated his belief in the very positive 2025 year-end prediction of 7000.

Then today, markets plummeted to have their worst day since the April liberation day event. What drove today’s selloff was the 2 announcements by Donald Trump. He responded with disgust regarding China’s President Xi’s own announcement that foreign companies must now obtain a license to export products out of China that contain more than 0.1% of rare earths sourced from that country, or that are manufactured using Chinese extraction, refining, magnet-making or recycling technology.

The stock market didn’t react when Xi made the announcement, so it seems analysts still don’t know President Trump. In fact, he may let this issue stick for some time to establish a position for strength in further negotiations. Trump would need to see a hit to their economy and stock markets too.

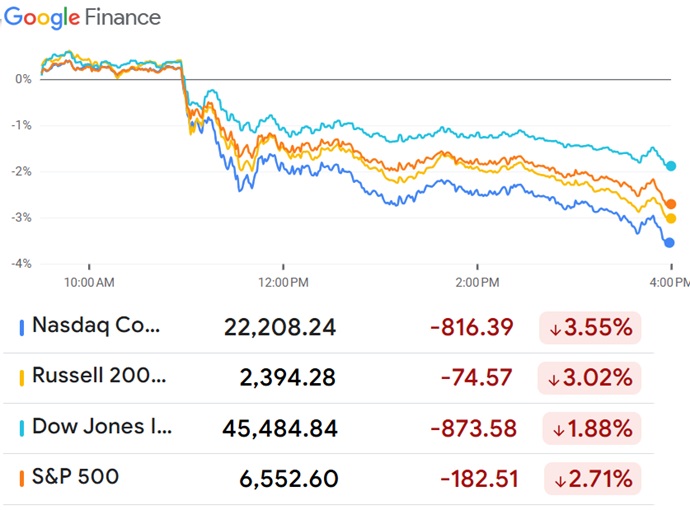

In retaliation, Trump threatened big tariffs in the morning, and by later afternoon announced 100% tariff rises on Chinese goods. It sent a shock through Wall Street sending the S&P sliding downward by 2.7%, NASDAQ down 3.55%, Dow Jones DJIA reduced by 622 points or 1.88%, and the Russell 2000 dropping by 3.02%. It reached its bottom at the end of trading today.

One expert suggests Tuesday morning will likely see perhaps a bigger drop, and that the S&P might even decline to 6150.

Some expectations existed of a strong correction coming, but most believe this event is a blip on the radar and that the bull rally is intact. Most believe 2026 will be a strong year for the stock market and perhaps the US economy too.

What investors might want to remember is that Xi might have made the rare earth metals export controls as a retaliation for the US microchip export restrictions on China, particularly those advanced chips from Nvidia. Stopping their rare earth exports to all countries is something Trump described as outrageous and unfair, and that other countries were extremely angry about it.

At one point near 4:00 pm, Bitcoin had lost $14,000 from its price of $122,000 to $208,000, but recovered slightly to rest at $122,000. China’s exchanges saw big drops of 1% or more, but not reflective of the danger to Chinese companies and the Chinese economy. We’ll likely see a delayed response on Monday.

Trump said he will not be meeting Xi at the upcoming Asia-Pacific Economic Cooperation summit scheduled soon. Xi, this morning announced docking fee charges on US vessels using Chinese ports (and Trump has docking fees on China ships). Continuing rancor between them could push the US into recession as the US is a big importer of goods from China. The threat of inflation and higher interest rates shouldn’t be underestimated.

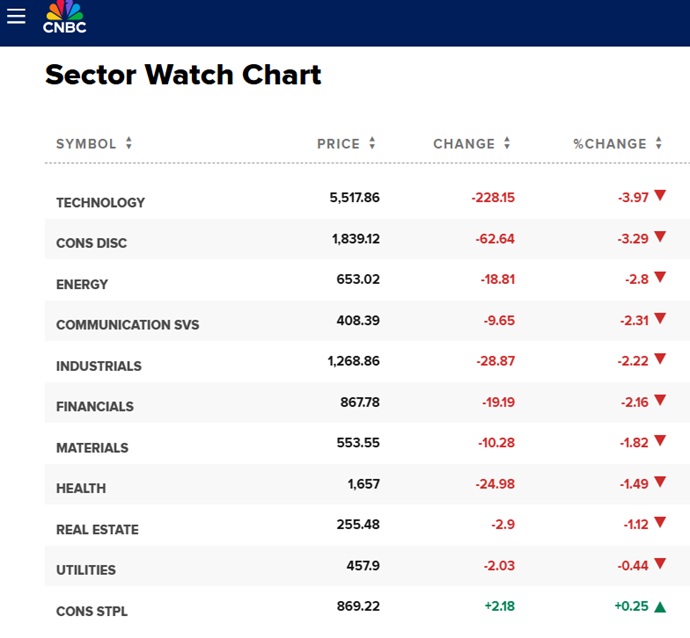

The NASDAQ in particular was hit hard with many AI stocks losing 5% to 7% of their value. AMD was hit hard after its stellar growth due to the Open AI deal. Nvidia lost 4.89% while Tesla lost 3.8% of its value. Palantir fell 5.4% while Apple fell 3.45% with Google Alphabet down 2.05% and META declining by 3.85%. Those are significant losses already and given the political animosity brewing, this tiff isn’t over. A rational projection is an even bigger loss next week.

This list of biggest losers below from Yahoo Finance shows some companies are either have shaky valuations or they’re very exposed to the China Trade.

Top Losing Stocks

Trump announced further tariffs on products recently and in meetings with a desperate Canadian trade team, showed no inclination to back down on tariffs on Canada, its major trading partner.

So the themes are these growing tariffs for foreign exporters dependent on US markets and an increasingly nervous investor base. Next week’s activity will depend on political statements and rhetoric over the weekend and on Monday morning.

The key question regarding this continuing, resilient bully market trend is just how much negativity it can withstand. The events today hit the big corporations hardest since they’re highly exposed to the China Trade. They need those rare earth metals and the 100% import duties make tech company’s physical products very expensive.

Wondering what the best stocks to buy now are? It might be a buy-the-dip moment early next week, given that stocks typically bounce back from these events, and since there is a rosy US 2026 market forecast.

Title image courtesy of Stockcake.