Is There Hope for American Home Buyers?

There has never been a time when the US housing market has been this stagnant, convoluted, uncertain for buyers, financially strained, and utterly unaffordable.

It’s frustrating for buyers and sellers, but more so because most Americans can’t grasp its current state or when buying conditions will brighten. For instance, rising inventory should lead to lower prices, but in this government-manipulated market, that’s not happening. Instead, governments thwart housing development and affordable mortgage financing. thus the market has sagged and is stagnant in some regions.

More Inventory Isn’t Helping

A report on CBS posed that relief is here because more homes are on the market. Clearly, the new listings aren’t helping and buyers aren’t biting. In fact, many are pulling out of offers.

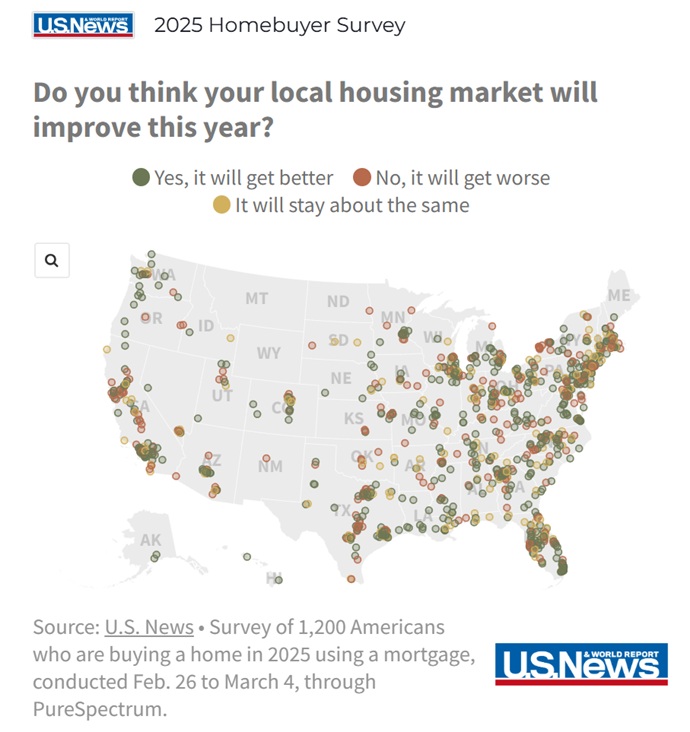

And this is the vexing matter: Most Americans and even housing market experts can’t understand what’s going on. 92% of Americans who would like to own a home said they were at least somewhat stressed about buying one in 2025 according to the U.S. News & World Report’s third annual Homebuyer Sentiment Survey. 80% are waiting for mortgage rates to drop before buying and 30% want to see mortgage rates below 5.5%.

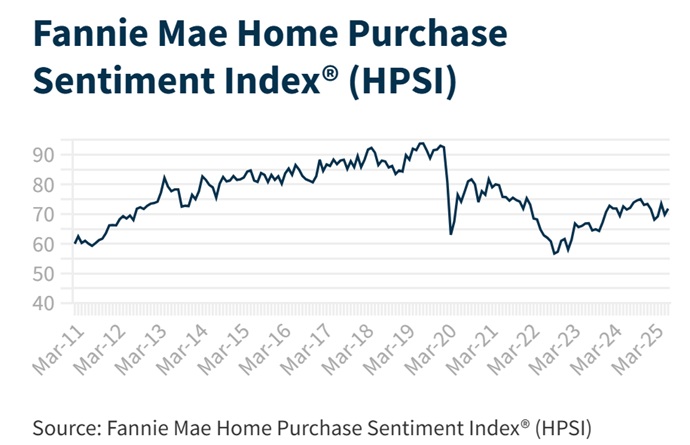

Fannie Mae publishes its HPSI report showing sentiment has improved but is now flagging.

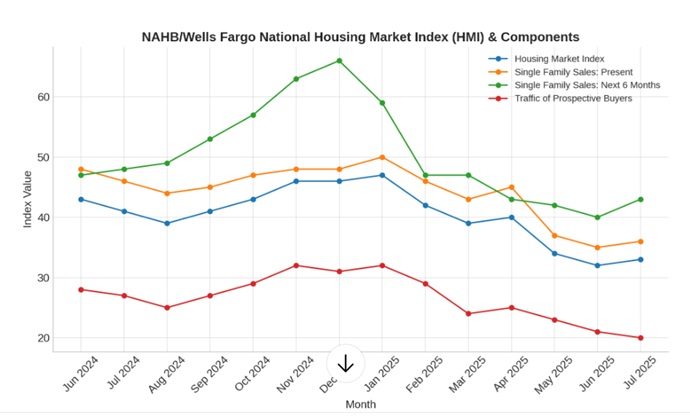

NAHB/Wells Fargo’s HMI report shows the flatness of the market but that single-family sales are projected to rise a little, even though buyer traffic has been falling.

Understand Where We are Now and What the Trajectory Is

In this post, we take that important leap to understand where we are now, what’s driving the market, what’s holding it back, so we can understand the forecast for the housing market, especially regarding the 2026 outlook.

The Trump tariffs are obviously the top story given their affect on jobs, cost of living, and cost of building. The slowing new construction sector will also affect resale home values – likely keeping them level this year.

However, housing experts (Zillow forecast) believe home prices will fall, about 2%. Yes, that’s good news, but not good enough to stimulate sales. As you know, there are endless hurdles for first time buyers and those wanting to sell their home and buy another.

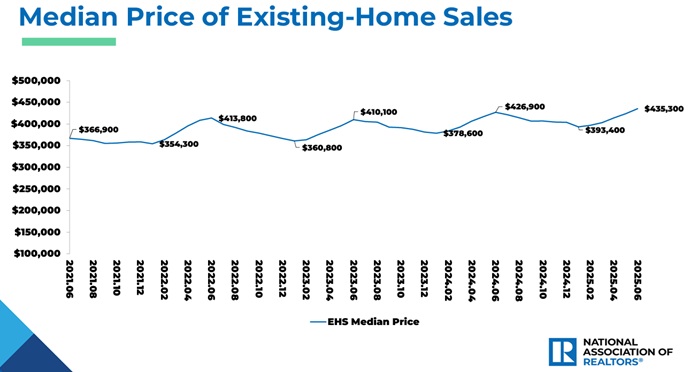

NAR shows home prices are not correlating to sales or inventory.

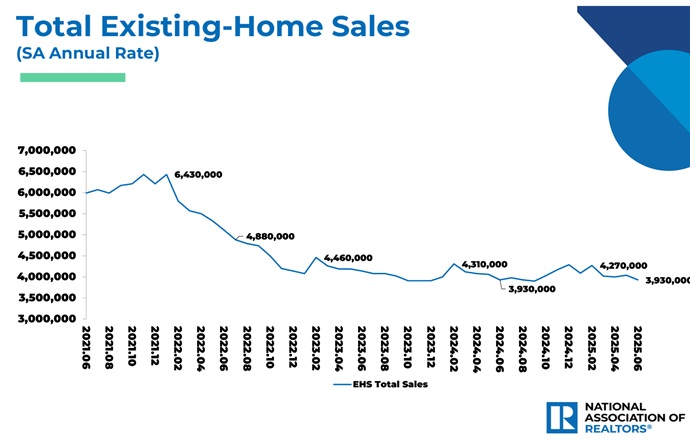

Home sales once again hit the lowest levels since the financial crisis of 2009.

Total Existing Home Sales History Chart. USA History. Image: NAR

What’s the Current State of the Market?

NAR’s resale report showed:

- Existing-home sales fell 2.7% (month-over-month) as momentum is slowing

- Single-Family Home saw a 3% decrease in sales in June to a seasonally adjusted annual rate of 3.57 million, up 0.6% from one year ago.

- Median home price rose 2% in June to $441,500 (year over year)

- Market divergence means price trends aren’t consistent across cities or regions.

- Condominiums and Co-op sales in June remained the same, yet are down 5.3% from June 2024.

- Condo prices rose .8% to $374,500 vs June 2024.

- Median existing-home price hit $435,300 for all housing types, up 2% from 12 months ago ($426,900) — a record high for the month of June and the 24th consecutive month of year-over-year price increases.

- new listings are outpacing sales, bringing inventory closer to prepandemic norm

- Home inventory declined .6% to 1.53 million units from May, yet increased 15.9% from June 2024 (1.32 million).

- Overvalued homes with prices beginning to moderate

- Homeowners continue to hang onto their homes until rates drop

- Homeowners hang onto homes to get their price

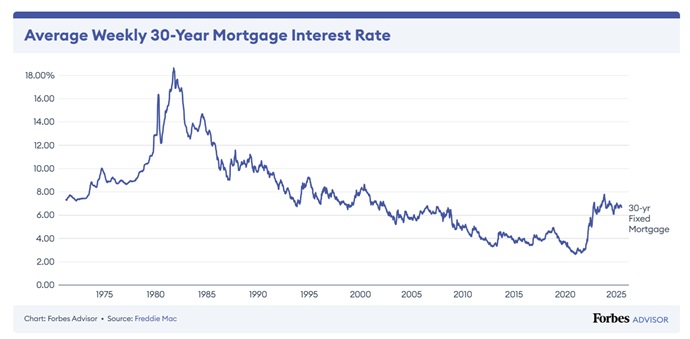

- Mortgage rates are high, and don’t look to be falling anytime soon

- Demand for mortgages have fallen

- More buyers are withdrawing offers – and getting cold feet

Cautious Projections of the Timeline for Reduced Mortgage Rates

NAHB projects the 30-year mortgage rate to average around this rate by the end of 2025, and just above 6% by the end of 2026. However, as you know, President Trump is disappointed in J. Powell and wants to replace him. Next May, for certain, Powell will be relieved of his role. It’s almost certain rates will fall then. Trump would like to see it sooner. If economic indicators fall, as they seem to be, J Powell would be under great pressure to lower the FED rate.

Uncertainty, from tariffs, prices, job loss, and whether the FED will lower rates make buyers reluctant to sign a massive mortgage document at 7%, with the risk of a recession. Right now, buyers and housing market experts are waiting to see if the Trump Tariffs bring inflation beginning in August, now that we’ve passed the August tariff deal deadline.

Net effect: demand is likely to be muted or fall in many places — especially where local economies are exposed to trade shocks, tourism declines, or sectors vulnerable to AI automation — while construction/rehab costs may keep some price pressure on the supply side.

There is Hope for Homebuyers, in 2026

Housing moves in cycles, and we’re shifting toward one that’s friendlier to buyers — so your patience right now could mean more opportunity and less pressure in the fall and into 2026.

High interest rates controlled by the FED are big factor. Mortgage rates in the high 6’s on today’s purchase prices are not sustainable for buyers. Which is why no one is buying. Better financing deals and lower home prices might be just ahead. And some homeowners are locked in at low pandemic rates, unable to sell and begin a new mortgage.

So far, nothing the FED has forecasted has come true, and it looks like they’re late to respond again. That’s generated a big cost and lost opportunity effect for the economy and it’s crushed the housing market. High interest rates cause inflation, as home buyers must pay a much bigger mortgage and taxes and fees on top of the total price paid.

However, the tariffs may actually raise consumer and business prices, even if US businesses are benefitting from them. The 2% drop in home prices then looks reasonable. 2026 brings easing of the tariff issues and a stronger domestic economy. Lower oil prices and rising productivity from AI will also boost incomes thus supporting Americans quest to own their own home.

The burgeoning size of the Gen Z and Millennial age groups is another factor supporting demand. FOMO is a factor as young people struggle with careers, down payments, and good credit ratings.

Factors that will Brighten the Housing Market Outlook

- Listings will continue to grow

- Real estate investors jumped into the market in 2025, suggesting they expect home prices will rise right through the next 5 years

- Home prices are on the decline

- Mortgage rates likely will decline

- Job losses are already mounting in some cities leading to more homes being listed there

- An economic slowdown will release more homes to those with buying capacity

- Slower new home construction will help support demand for resale homes

- Home prices will rise in 2026 on the heels of wage growth, lower mortgage rates, helping buyers and sellers finally transacting.

How can we feel good about opportunities for the housing market ahead? Optimism largely rests on lower interest rates, improving US economy, and a resolution of trade conflicts.

However, the financial and real estate markets are exceedingly complex, and of course, affected by politics. If you can guess how President Trump will engage with world leaders on trade, and how the FED will face off against him, and whether this long-expected inflation ever happens, then you’re smarter than most.

See more on the housing market forecast and the outlook for 2026, and why it’s likely going to be a good year for buyers and Realtors. Realtors are awaiting a much better market in 2026 and the next 5 years.

Are you a Realtor strategizing your lead generation for next year? SEO + Content Strategy + Social Engagement is a powerful mix. Real estate SEO remains the number one lead generator. Give me a call to discuss how I can be your lead generation partner.