Florida Housing Market

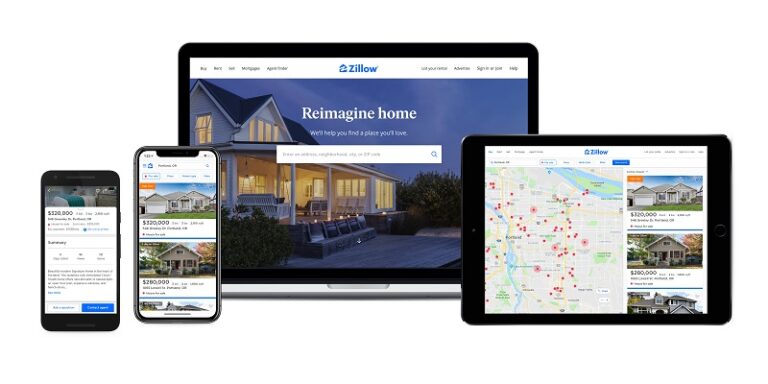

Florida Real Estate Market It’s a wonderful time in the Florida real estate market this spring. Sales are growing and buyers are returning. And this state offers unparalleled variety in locations, from quaint villages and small cities to ultramodern big city living. There has been plenty of new construction here, but most buy in Florida…