Will Home Prices Drop in Florida?

It might seem impossible for home prices to fall across the State of Florida when the US economy and Florida economy are doing well, yet, Corelogic believes quite a few of Florida’s cities are in for a price drop.

It’s bold to suggest a price drop in real estate because housing market momentum would suggest otherwise. Even if prices drop in the next few months, the outlook beyond 2024 is surely for higher demand with lower mortgage rates. More buyers will be able to pay higher prices because their mortgage payments will be lower. And their debt-to-income ratio will fall making more qualify for a home loan.

The low sales numbers from 2023 will be hard to recover from, but the state is expected to recover by 2025 when much lower mortgage rates will be available.

The Florida Housing Market Outlook

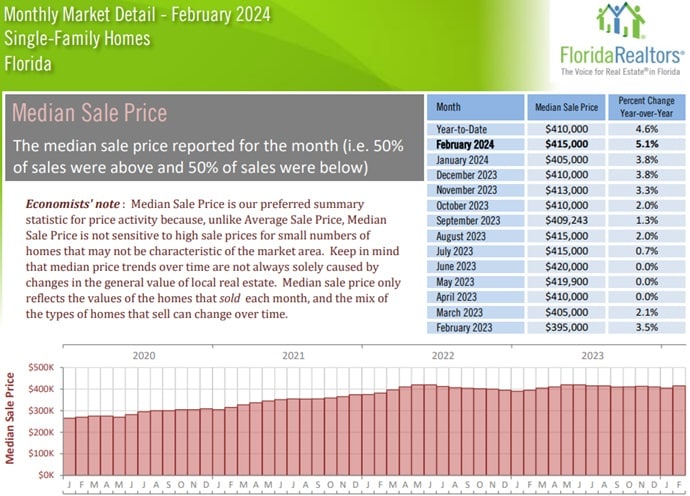

If you review the Florida housing market report, you will see the continuously rising price point for homes and condos. February’s median price rose 5.1% year over year to $415,000. That’s just short of the record during the low rate boom times in the summer of 2022, before rates killed sales.

Some are calling the prices eye-popping but compare them to California where the median house price hit $806,490 last month. With all the problems California is plagued with, its median price climbed 9.7% year over year and +2.2% in February. Nationwide, NAR believes home prices will climb 2.8% this year. Why would Florida be excluded?

Yet, should Florida’s overall home prices continue to rise, it doesn’t preclude some cities seeing price declines.

TALLAHASSEE, Fla.—Today, Governor Ron DeSantis celebrated Florida’s private sector job growth rate which increased by 0.4 percent (+37,900 jobs) in January 2024. This is double the national rate of 0.2 percent over the same period. Florida’s economic data continues to indicate economic stability and confidence among Florida’s workforce as the state’s labor force grew by 2.2 percent (+243,000) over-the-year in January 2024, which is faster than the national over-the-year rate of 0.8 percent, including 16,000 net new workforce participants in January 2024. — from flgov.com.

Why Florida Home Prices Could Drop in 2024:

- FED rate reductions let some locked-in mortgage holders decide to sell

- more new construction of houses being released

- condos flooding onto the market due to refinancing, HOA fees, and insurance premiums (expected to rise again in 2024)

- La Nina weather phenomena could make 2024/2025 season in Florida not great

- rising inflation causes the FED to keep interest rates as they are

- the economy slows and northern buyers give up on the Florida dream home pursuit

The key reason for the price drop then would be the flood of condo or house owners in HOAs who can’t afford to live in them anymore. Yet, buyers are ready so the crisis will likely disappear as sellers sell their homes.

Home Prices Now: Florida Realtors

While prices look as though they will fall as homeowners can sell, a large number of buyers from the North and abroad will also be looking to buy their next home. Florida has better supply than northeastern cities where supply is strongly suppressed. More babyboomers will be retiring and looking to buy in Florida and rent there. The opportunities for rental investors shouldn’t be understated.

The reason for the new listing rush (condos mostly) might have to do with home insurance rates, HOA fees, condominiums must have extra funds in reserve for repair and maintenance in the aftermath of the tower collapse a few years ago which means big assessments for condo owners, mortgage refinancing problems since rates are still high, and the cost of living in Florida vs the low wages for many residents.

Being in an extreme weather event region, insurance companies are reluctant to provide coverage in some areas while charging very high insurance rates for those they will cover. Without insurance, homeowners would likely sell. Investors are always interested in picking up Florida properties. The average cost of home insurance in the Sunshine State in 2023 was about $6,000.

As homes pour into the market, buyers have more choice and it becomes somewhat less of a seller’s market. Of course, almost all US housing markets are still seller’s markets.

Homeowners Trapped in Paradise?

The locked in low mortgage rate problem is preventing many sellers from listing their properties thus the low supply issue.

On the other side of the cost equation might be HOAs who are charging high management fees and dues. Many homeowners simply can’t afford them and must sell.

In the realm of new construction homes, Punta Gorda , one of my favorite places in Florida, with its beautiful waterway canals, is producing a large number of new home releases. This city (population 20,000) is building, with 4,794 home permits at an average offering price of $359,000. The region near Punta Gorda was hit hard by Hurricane Ian in September 2022, yet Punta Gorda suffered minimal damage.

Rebuilding is continuing in the area and that is drawing in investors who are building businesses near the Punta Gorda area. New housing will be needed to house the growing working population and a 1300-home development is being developed. Toll Brothers is among the builders in that new planned community.

With so much new construction and so many homeowners wanting to sell, it seems reasonable to expect home prices to decline a few percent this summer. However, never discount demand for Florida properties. It is the Sunshine State with many economic, lifestyle and business reasons for its amazing real estate success.

If the FED does drop the rates by 75 basis points this year as was predicted, it could unleash another wave of new listings, and this would likely push prices down.

If you’re a Florida property owner trying to time your sale, this might be the ideal time to sell.

As rates fall in 2025, a tidal wave of homes will be listed as the locked-in mortgagees will finally be able to sell their house and move on.

Check out the Florida housing market report, along with the Tampa market and Miami market reports.