Redfin: Number of Home Listings Drops Again

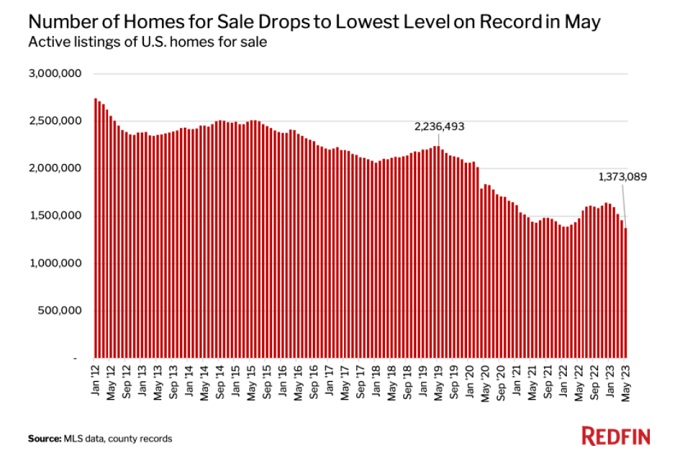

According to Redfin’s latest residential US housing market report, the number of homes listed for sale in May dropped to a new record low.

In a post by Lily Katz, the real estate company indicated the lower volume listed is due to high prices and borrowers who are trapped in their current low-rate mortgages. Mortgages rose again slightly to 6.43% in May.

In this nasty cycle, the higher home prices contribute to higher inflation, thus in response, higher FED rates which raises mortgage rates even higher.

It’s also resulting in more intense competition for existing homes as 37% of sales reported by Redfin were sold above their list price.

Year over year, the number of homes available for sale fell by 7.1% to 1.4 million. That is the lowest level in Redfin’s records. Katz continues with the fact that there were 2.2 million sales in May 2019. Newly listed resale homes for sale dropped by 25.2% year over year.

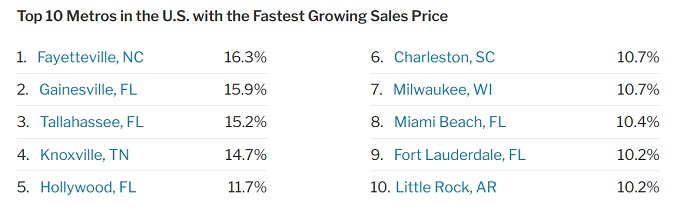

Hottest US Metros in May

Major cities in the US southeast remain much in demand, with notable more affordable homes in Arkansas, Tennessee and the Florida panhandle region. These states also have favorable taxation that draws buyers from high-tax states.

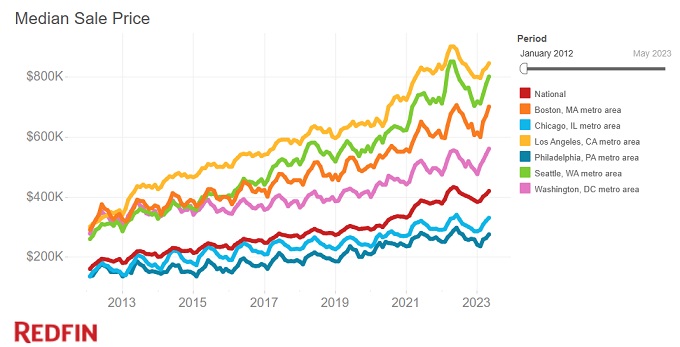

She noted that the median home price rose 2.8% vs April to $419103 and is down 3.1% from 12 months ago.

On a seasonally adjusted basis, homes sold dropped 1.2% where 421067 were sold. That is down 21.4% from last year. Seasonally adjusted, new listings dropped .9% from April and are down a whopping 25.25 from just one year ago.

This means the US has 1.8 months of supply down .4% from April. Four to five months of supply is considered balanced The share of homes selling with a price drop was 14.5%, down a couple of points from April, while the share of homes selling above final list price rose 37.5% or 3.9 ppts.

When Will the Housing Market Fully Recover?

While the FED is suggesting it will add 50 more basis points to the FED lending rate, there is a growing belief the recession may be behind us. And that’s despite jobless claims and lots of talk about a market setback. Many thought we would see a housing market crash in 2023, but with only a slight rise in mortgage rates, it’s very unlikely.

Are you asking the question of whether home prices will rise? As Redfin reported in another release, this 2023 spring and summer season was not as strong as expected. With no mortgage rate drops expected, the 2023 fall season will likely be subdued in sales, but prices should remain firm. We may not see a real turnaround until well into 2024.

Everyone must wait for interest rates to drop. First-time buyers in particular are making up less of the purchase market.

Housing Blog | Real Estate Housing Market | Real Estate Forecast | Dream Homes | Zillow Housing Report | Housing Market Predictions for Next 5 years | Home Prices Rising? | Oregon Housing Market | Supply and Affordability | Support Your Market | Austin Texas Housing Market | California Housing Market | Florida Housing Market | Dallas Housing Market | Los Angeles Housing Market | Boston Housing Market | Mortgage Rates | Economic Outlook US