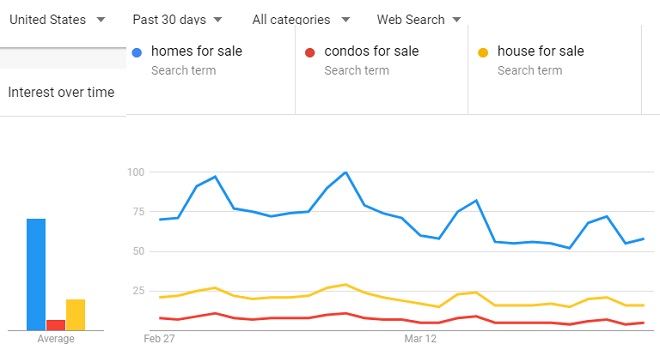

Real Estate Lead Generation

Realtors Biggest Pain From Dallas to New York and San Francisco CA, Big Picture realtors hate technical details. You want easy to understand, tangible, measurable deliverables such as guaranteed leads yet the legit real estate marketing world has little to offer. Success is complicated and not everything comes in neat packages. SEO and social media and websites…