Competition is For Losers: The Simple 3 Point Success Plan to Build a Monopoly

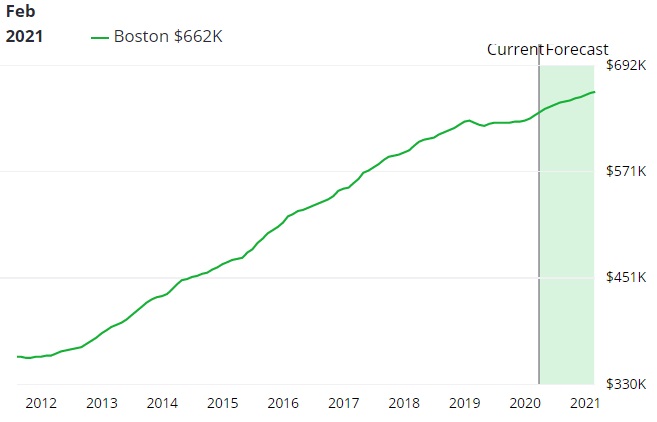

Time is Running Out: Grow, Monopolize or Die I don’t have to tell you the Real Estate sales profession is ultracompetitive and demanding, or that it’s getting worse. You experience that headache every day and night. Below, you’ll find 3 Keys to Carving out Your Monopoly. And if you’ve grown your website and sales success already,…