A Glorious Day for Investors

Markets rocketed with the Dow hitting an all-time high at 45,737 as J. Powell suggested a coming lowering of the FED rate. It doesn’t matter what he said, as investors only look for signals of the trend and when it will happen.

At Friday’s closing bell, the Dow Jones rose 1.89%, the S&P 500 jumped 1.52%, the NASDAQ rose 1.88% and the Russell 2000 rocketed 3.85% holding their gains all day.

Today’s big event has to relax everyone, and give us confidence that the long-standing misery that’s holding the US back is easing — perhaps ending. Investors believe it fully even though there’s no actual rate cut. It’s just an observation/outlook stated in a speech. And let’s not forget that the US economy has been in despair for decades, plagued by deepening debt, deficit spending, and vicious trade deficits, and regulations that have cripplied the nation’s manufacturing prowess and GDP.

Lower Rates are Nitro for the Economy

Lowering rates may be the most powerful economic booster yet, easing up on mortgage and business financing costs, stimulating investment, and lowering the cost of living and doing business. And the tariff issues are not deterring investors from diving in. Perhaps in the next two months, we could see a flood of money moving from the money and bond markets to equities. Right now, investors should be on the hunt for the best stocks to buy now. The bull market is ready to rumble.

Everyone from small business owners to homeowners and job seekers are feeling a blissful optimism about the road ahead, something they haven’t experienced in a long time. Analyst Tom Lee of Fundstrat added his thoughts on CNBC today, discussing which sectors are looking strong and likely to grow as the new bull market gets in gear.

The v-shaped recovery that everyone hated, is shifting to an accelerating raging bull. No one’s talking about irrational exuberance but why wouldn’t investors get carried away? Recently, Palantir’s stock price rocketed, pushing its P/E ratio up to 600. It’s since come back to earth as war tensions ease. Some stocks on the Russell index rocketed today up to 19%.

Consider the depressive era the USA is arising from, and you have to believe that this feel-good period is going to loosen up investing wallets, for frothiness with some stocks soaring. Will it be retailers, home builders, AI stocks, or the best small caps? We thought the gold rush was over, but is it?

Tom Lee’s Take on the Early Innings of this 2025 Bull Market

I like Tom, he’s a star in investing now, and fun to hear from. The one guy you want to listen to and enjoy listening to. He’s saying to watch for a big drop in the mortgage rates. And he thinks the ISM could rise back above 50, an unusual event. He said he believes 6800 to 7000 is possible for the S&P 500. He still likes Ether, due to the Genius Act and Project Crypto, and compares it to 1971 when the US went off the gold standard. He thinks Blockchain is bigger. And he believes AGI and AI instructions will have to go through smart contracts on Blockchain. So crypto and Bitcoin might tag along on that ride?

A New Bull Market?

Analysts call in the early innings of a new bull run, driven by lower interest rates and cost-efficient AI infrastructure.

Zach’s Research describes the new market outlook this way:

“this bull market has a very robust foundation. Paradigm-shifting technological advances in AI, digital assets, and quantum computing are converging with a supportive political backdrop, a coming interest rate cutting cycle, and a resurgent IPO market. These are the very conditions that have historically marked the early stages of immense equity gains.”

They continue,

“One of the most powerful forces behind equity bull markets is liquidity. Lower rates reduce borrowing costs for consumers and businesses, improving corporate earnings and encouraging new investment. Historically, markets tend to re-rate higher during these periods as valuations expand and investors are emboldened to take on more risk. In fact, nearly every major bull run of the past century coincided with falling rates.”

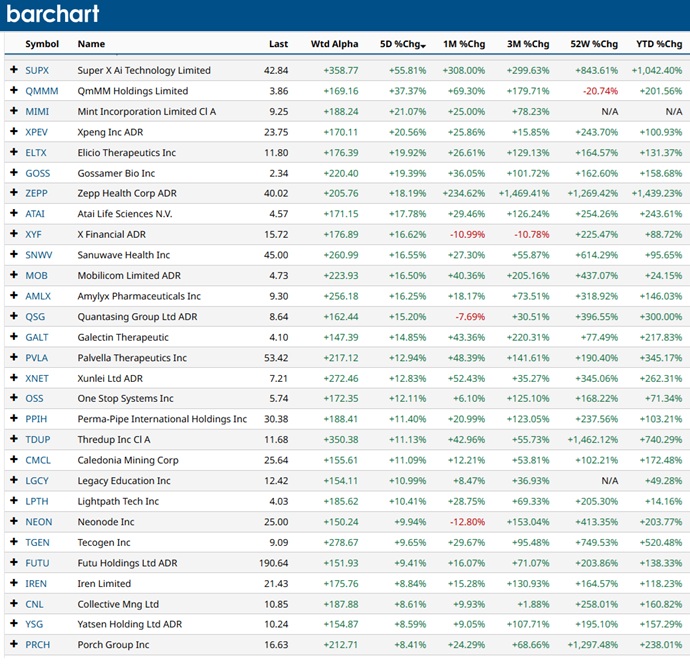

Top Performing Stocks for the Last 5 Days

Barchart offers up its chart of best-performing stocks for the last 5 days. Therapeutics and pharmaceuticals lead the way. Super X Ai Technology Limited, a Singapore-based company, looks like a company that should be more widely known. Their stock SUPX is up 1200% in the last year.

See more on the stock market forecast for 2026, 3 months and next 5 years.