Coinbase – Gateway to the Crypto Economy

Coinbase Global, Inc. (NASDAQ: COIN) is one of the world’s most recognized cryptoasset companies and one of the major cryptocurrency trading platforms.

For many individual investors, it has served as the entry point into digital currencies like Bitcoin and Ethereum. Since its founding in 2012, Coinbase has grown into a publicly traded firm with millions of users worldwide, positioning itself as both a crypto trading platform and a broader infrastructure player in the digital asset economy.

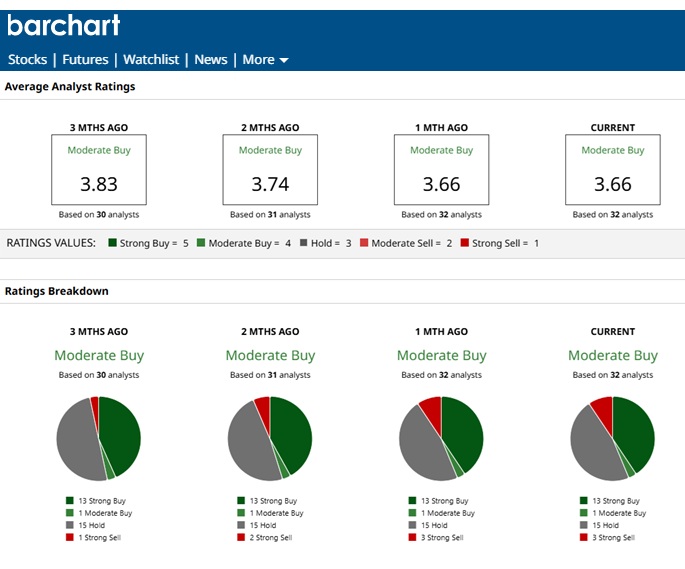

The company has seen its stock rise and fall, creating big wins or losses for investors. Most analysts have a moderate rating for the coming periods (see below). Of late, the stock is performing well on the heels of a few business strategies including storing cryptocurrency (store of value), lower transaction fees and loyalty points CEO Brian Armstrong says his company’s goal is for Coinbase to become a super app to become consumers’ primary banking account. This means they’d like to replace the major banks.

Company Background

Founded by Brian Armstrong and Fred Ehrsam, Coinbase started with a simple mission: to make buying and selling Bitcoin safe and easy. Over time, the company expanded its offerings to include trading for hundreds of crypto assets, custodial services for institutions, staking, a crypto wallet, and educational resources.

Coinbase went public in April 2021 through a direct listing on the Nasdaq. Its stock made headlines with a debut valuation near $100 billion, though it has since experienced volatility in line with the broader crypto market cycle.

Coinbase Products and Services

- Retail Exchange: User-friendly platform for buying, selling, and holding digital currencies.

- Coinbase Wallet: A self-custody wallet giving users full control over their crypto.

- Coinbase Prime: Institutional-grade trading and custody services for hedge funds, asset managers, and corporations.

- Staking & Yield Products: Allows users to earn rewards on crypto holdings like Ethereum.

- Blockchain Infrastructure (Base): Coinbase launched Base, a layer-2 blockchain designed to lower costs and improve scalability in crypto applications.

Their product mix positions Coinbase not just as an exchange, but as a key piece of infrastructure for the emerging Web3 ecosystem.

Market Position

Coinbase is one of the few US-regulated, publicly traded crypto companies, which gives it credibility and transparency compared to offshore competitors. However, it faces stiff competition from global exchanges like Binance and Kraken, as well as new decentralized finance (DeFi) platforms that bypass intermediaries.

Challenges

- Regulatory Scrutiny: Coinbase is under constant oversight from U.S. regulators such as the SEC, which has created uncertainty around which tokens can legally be traded.

- Crypto Volatility: Revenues are closely tied to trading volumes, which rise and fall with crypto prices and investor sentiment.

- Competition: Both centralized and decentralized exchanges are innovating rapidly.

Growth Drivers and Opportunities

- Institutional Adoption: More hedge funds and corporations are exploring digital assets, and Coinbase Prime could benefit.

- Blockchain Infrastructure: Base could open new revenue streams in transaction fees and developer adoption.

- Diversification: By expanding into stablecoins, staking, and international markets, Coinbase aims to reduce reliance on trading fees.

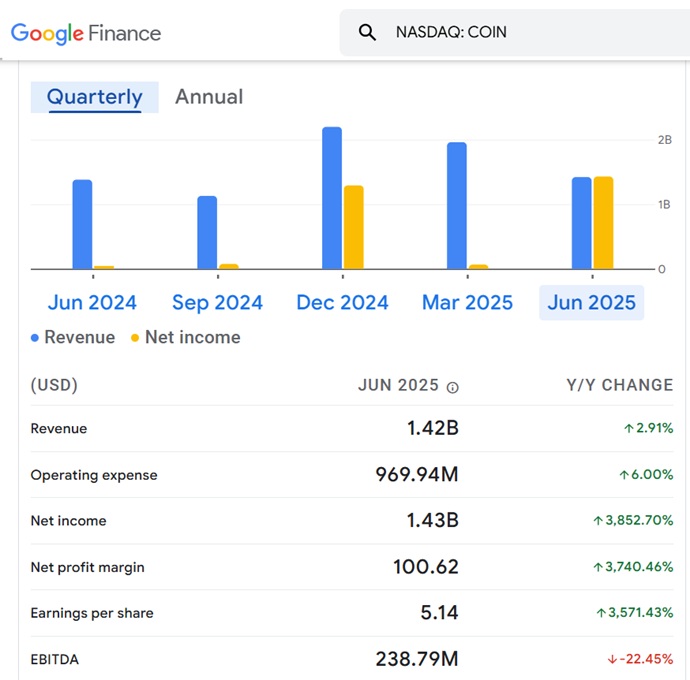

Financial Snapshot (as of 2025)

- Revenue: Still heavily dependent on transaction fees, though subscription and services revenue is growing.

- Profitability: The company has experienced losses in down cycles but is working toward more sustainable, recurring income streams.

- Balance Sheet: Strong with substantial crypto holdings and cash reserves, though tied to crypto market performance.

Coinbase Revenue Forecasts

| Period | Analyst / Consensus Estimate | Key Drivers / Comments |

| Full Year 2025 | ~$7.03-$7.64 billion total revenue. | Subscription & services revenue expected to grow strongly, but transaction revenue dependent on crypto volatility. |

| Full Year 2026 | Slightly higher; analysts expect modest year-over-year growth from 2025’s base. (~ In the same general ballpark but higher). | Growth assumed from expanding non-transaction segments (staking, subscription, stablecoins, derivatives business like the Deribit acquisition) and possible market tailwinds. However headwinds include regulation, competition, and crypto market cycles. |

Stock Price Forecasts / Targets

Here are the latest analyst estimates:

- 12-month median / average price target: ~$365-$375 per share.

- High end: Up to ~$510.

- Low end: As low as ~$185.

Investor Takeaway

Coinbase offers exposure to the growing digital asset economy without requiring investors to directly hold cryptocurrencies. However, the stock comes with high volatility and regulatory risks. For long-term investors who believe in the mainstream adoption of crypto and blockchain, Coinbase can be seen as a strategic play. For those more risk-averse, it may be better treated as a small, speculative position within a diversified portfolio.

See more on how to invest in cryptocurrency and on investing in Bitcoin.

Analysts still like the outlook for the stock market and a strong equities market bodes well for investment in cryptocurrency. If trends continue, it supports the use of cryptocurrencies in the retail, ecommerce and business sectors. Yet with uncertainties, Bitcoin and other coins are volatile in price.

* This post is not a recommendation of cryptocurrency trading or stock purchases, but only an educational aid to those who might be venturing in this market segment.

See more on the 2026 stock market forecast and which may be the best stocks to buy.

Title image courtesy of Stockcake.