Where Can You Buy the Cheapest Auto Insurance?

Which States and Cities boast the lowest auto insurance rates? Let’s look at the studies done and find the best and the worst, just so you don’t think your high rate is “just me.” Of course, the insurance companies are free to provide whatever pricing and coverage they like, regardless of which city or state you reside in.

And you’re free to switch providers). Your neighborhood and credit rating may actually have more impact on your automobile, truck, or motorcycle insurance rates.

These are the latest average yearly prices for auto insurance as per insure.com’s annual survey. These results aren’t positively validated, however they’re a good indicator of auto and truck premiums across the US.

Insure.com used a company to create auto insurance quotes from 6 large carriers (Allstate, Farmers, GEICO, Nationwide, Progressive and State Farm) in 10 ZIP codes per state.

We all know Michigan has the highest rates due to their lack of limits on liability. Looks like the gap has closed quite bit from Michigan’s rates to that of Montana and New Jersey.

| National Average Premium | $1,325.00 | |

| 1 | Michigan | $2,738.00 |

| 2 | Montana | $2,297.00 |

| 3 | New Jersey | $1,905.00 |

| 4 | Louisiana | $1,842.00 |

| 5 | Oklahoma | $1,778.00 |

| 6 | DC | $1,773.00 |

| 7 | California | $1,752.00 |

| 8 | Florida | $1,654.00 |

| 9 | Maryland | $1,610.00 |

| 10 | Rhode Island | $1,608.00 |

| 11 | Delaware | $1,607.00 |

| 12 | Georgia | $1,559.00 |

| 13 | Texas | $1,510.00 |

| 14 | West Virginia | $1,456.00 |

| 15 | Wyoming | $1,421.00 |

| 16 | Colorado | $1,393.00 |

| 17 | Connecticut | $1,367.00 |

| 18 | South Carolina | $1,353.00 |

| 19 | Arkansas | $1,345.00 |

| 20 | Alabama | $1,337.00 |

| 21 | Massachusetts | $1,325.00 |

| 22 | Pennsylvania | $1,305.00 |

| 23 | Kentucky | $1,295.00 |

| 24 | New Mexico | $1,277.00 |

| 25 | Mississippi | $1,277.00 |

| 26 | Oregon | $1,267.00 |

| 27 | Minnesota | $1,257.00 |

| 28 | Nevada | $1,221.00 |

| 29 | North Dakota | $1,200.00 |

| 30 | Nebraska | $1,188.00 |

| 31 | Arizona | $1,188.00 |

| 32 | South Dakota | $1,168.00 |

| 33 | Washington | $1,168.00 |

| 34 | Tennessee | $1,145.00 |

| 35 | Kansas | $1,135.00 |

| 36 | Indiana | $1,113.00 |

| 37 | Alaska | $1,078.00 |

| 38 | Utah | $1,061.00 |

| 39 | Missouri | $1,056.00 |

| 40 | New York | $1,050.00 |

| 41 | Hawaii | $1,049.00 |

| 42 | Illinois | $1,035.00 |

| 43 | Virginia | $1,020.00 |

| 44 | Iowa | $989.00 |

| 45 | North Carolina | $987.00 |

| 46 | Vermont | $942.00 |

| 47 | New Hampshire | $941.00 |

| 48 | Idaho | $935.00 |

| 49 | Wisconsin | $912.00 |

| 50 | Ohio | $900.00 |

| 51 | Maine | $808.00 |

Do you need luxury car insurance quotes?

Best Auto Insurance Rates by US City

Nerdwallet conducted a study of car insurance rates by city and published their findings. How do these rates compare to what you’re paying?

| Rank | City | State | Population | Average Car Insurance Premium |

|---|---|---|---|---|

| 1 | Winston-Salem | NC | 232,397 | $969.10 |

| 2 | Greensboro | NC | 273,419 | $1,089.58 |

| 3 | Raleigh | NC | 416,126 | $1,098.48 |

| 4 | Durham | NC | 233,210 | $1,100.50 |

| 5 | Charlotte | NC | 751,074 | $1,123.09 |

| 6 | Boise City | ID | 210,151 | $1,221.65 |

| 7 | Rochester | NY | 210,850 | $1,249.26 |

| 8 | Fayetteville | NC | 203,922 | $1,294.80 |

| 9 | Spokane | WA | 210,107 | $1,307.68 |

| 10 | Montgomery | AL | 213,132 | $1,375.82 |

| 11 | Des Moines | IA | 206,577 | $1,420.07 |

| 12 | Birmingham | AL | 211,458 | $1,429.36 |

| 13 | Albuquerque | NM | 552,801 | $1,442.01 |

| 14 | Anchorage | AK | 295,570 | $1,449.39 |

| 15 | Mobile | AL | 194,887 | $1,470.68 |

| 16 | San Diego | CA | 1,326,183 | $1,474.71 |

| 17 | Chesapeake | VA | 225,050 | $1,479.11 |

| 18 | San Jose | CA | 967,478 | $1,483.83 |

| 19 | Madison | WI | 236,889 | $1,490.36 |

| 20 | Chula Vista | CA | 247,514 | $1,490.56 |

| 21 | Virginia Beach | VA | 442,707 | $1,494.24 |

| 22 | Irvine | CA | 215,511 | $1,498.10 |

| 23 | Fremont | CA | 216,912 | $1,502.47 |

| 24 | Huntington Beach | CA | 192,868 | $1,510.83 |

| 25 | Pittsburgh | PA | 307,498 | $1,514.27 |

| 26 | Oxnard | CA | 199,917 | $1,519.11 |

| 27 | Fort Wayne | IN | 258,803 | $1,532.76 |

| 28 | Bakersfield | CA | 352,429 | $1,560.93 |

| 29 | Tallahassee | FL | 182,955 | $1,573.02 |

| 30 | Norfolk | VA | 242,628 | $1,591.95 |

(Chart above courtesy of Nerdwallet)

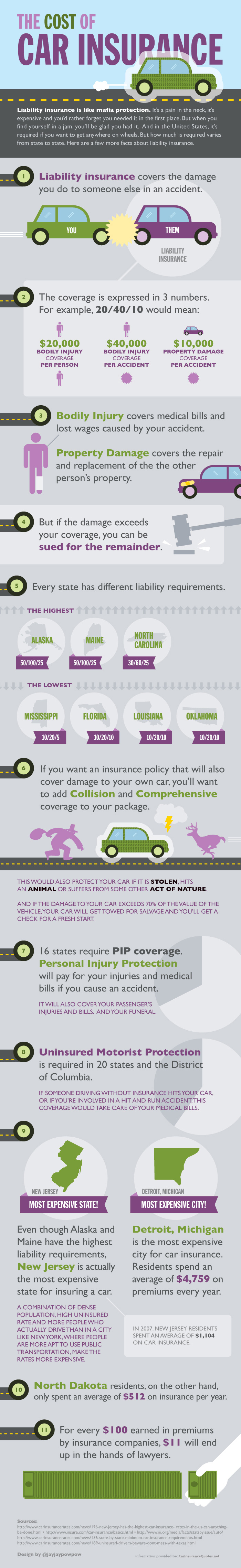

The Cost Breakdown of Car Insurance Premiums and Sources

This infographic provides a handy breakdown of costs related to auto insurance premiums.