Is an AI Bubble About to Burst the Stock Market?

We’ve had massive market bubbles before — characterized by financial fiascos, stock overvaluation, greed, unrealistic expectations and major technology changes. Is the current market bubble any different?

It’s difficult to challenge the notion that this is a bubble. The P/E valuations of most of the best AI stocks are astronomical. And it’s hyped expectations based on insiders and analysts estimations. And few of them have presented solid proof that AI is creating the expected gains in productivity and revenues.

In fact, one report showed tech workers are 20% slower using AI. As time passes, investors will tire of excuses and small business may give up on its current AI binge.

One factor to consider, when it comes to future valuations, is that if AI replaces workers, how will the economy and investment itself be funded? It’s issues like this that suddenly rise to the foreground when doubts arise. Recessions always cause doubts.

Bubbles, Bubbles Everywhere

Pandemic-era spending unleashed massive amounts of cash into the economy, pushing inflation up and increasing the indebtedness of the US and other countries. That plus continued government overprinting and spending has allowed trillions to be pushed into AI technology. There is a lot of FOMO stock investors rushing into the market to catch the boom train before it leaves.

The AI tech boom has more than doubled the NASDAQ index in the last 3 years, with a particular surge after the Trump liberation day even in April.

AI Driving the Indexes Upward to Record Heights

And artificial intelligence technology has been driving the top heavy stock markets and some commodity markets for sometime now. 5 stocks in particular make up 30% of the NASDAQ. What if AI’s promise turns out to be non-productive and it’s unable to complete its assigned tasks reliably to support the world’s economic and business systems? We had mini-corrections in the past two years. Would investors dump their AI stocks?

Both retail and institutional investors have extreme confidence in the AI boom, and for good reason, since it’s already replacing human workers for higher profits and improved performance. The downside too, which everyone can see is AI unemployment – a trend that sees potentially millions of workers with no hope of employment. How then, without tax paying workers, does an economy perform well?

“it’s not just that AI is in a bubble, but one 17 times size the dot-com bubble, and even four times bigger than the 2008 global real estate one.” – Morningstar report on the AI bubble by Steve Goldstein.

“I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets,” Solomon said. “I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.” — Goldman Sachs CEO David Solomon.

The “AI bubble” thesis poses that investor expectations and capital flows into AI (and related tech) have outpaced what fundamentals can realistically support. The result will be obvious. What goes up fast will also deflate quickly if the right conditions exist.

Why the Markets are at Risk of an AI Market Correction

Too much too soon, to fast, and not in concert with the rest of the market.

Here are a few worrying reasons why the bubble is at risk:

- Many AI or AI-adjacent firms with minimal profits (or even revenue) are commanding very rich valuations. Startups are being valued aggressively on potential future growth rather than current financials.

- Momentum investing, algorithmic trading, trend-following, and herding can amplify both the ascent and the descent in valuations.

- Human emotion — investors become highly synchronized (e.g. everyone chasing “the next AI winner”), a reversal can trigger mass selling.

- Valuation bubbles in one domain often drag adjacent assets; even “non-AI” equities with weaker fundamentals can suffer contagion.

- Market concentration and crowding on the best AI stocks and companies: if many investors are leveraged or exposed to the same handful of tech/AI names, a reversal can cascade.

- There is massive investment in data centers, AI hardware, compute infrastructure, energy, and related supply chains—some of which may turn out to be unused or abandoned in a recession.

Which Factors are Most Likely to Trigger an AI-Powered Downturn or Crash?

While it’s impossible to predict timing, several “trigger events” or regimes are more likely to precipitate a decline. Some of the key ones you should monitor are:

| Trigger / Factor | Why it’s dangerous | How it could cascade |

| Disappointing earnings or growth misses | If leading AI names or “poster child” firms fail to deliver growth, it could shatter investor confidence | Re-rating of valuations, sector-wide de-risking, capital withdrawal |

| Rising interest rates or monetary tightening | Makes future earnings less valuable and increases debt servicing costs | Drives a rotation away from high-multiple growth stocks toward safer assets |

| Liquidity shock or credit squeeze | If financial markets get strained (e.g. banking stress, credit contraction) | Forced deleveraging, margin calls, fire sales |

| Regulatory, political, or sovereign risks | Governments might impose stricter regulation (AI safety rules, antitrust, data privacy), creating uncertainty | Could derail business models or slow adoption |

| Overcapacity or technology obsolescence | If many firms build infrastructure in anticipation of demand that doesn’t materialize | Some firms go bankrupt, negative spillover to suppliers and investors |

| Sentiment reversal / panic | If investor psychology turns (e.g. fear over valuation, macro risks), there can be a cascade of selling | Loss of liquidity, feedback loops, contagion to broader equity markets |

| External shock / black swan | Macro shock like war, energy crisis, global contagion, or financial sector stress | Correlates across assets, intensifies downside moves |

Two most likely bubble-deflating factors may be a growth or profitability disappointment (especially among the best AI stocks), in an environment of already elevated valuations and tight credit conditions, along with a loss of confidence in the US economy. If it looks like AI chipmakers and datacenters are at the end of their profit growth curve, investors may choose to broaden out into other small caps and equities, including the best AI small caps.

President Trump’s tariffs are a factor as supply chains are being dismantled. Continued government spending and lower supply of goods and materials could push inflation and FED rates back up. That misdirection could result in a massive selloff of AI stocks and stocks in general.

OpenAI CEO Sam Altman said we may be in a bubble and noted the risks of irrational exuberance, albeit with faith in AI’s long-term promise.

How bad could an AI bubble crash be? The dot-com crash in the early 2000’s saw the Nasdaq fall ~80% from its peak (2000–2002) and the overall S&P 500 lose ~45% (adjusted) over a couple of years.

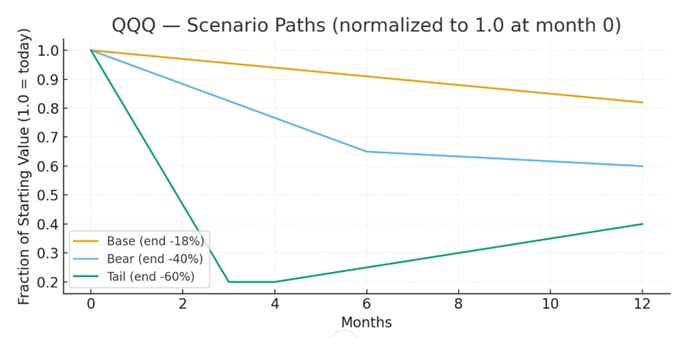

The bubble crash model as depicted in the above chart shows the risks over the coming winter months. The current debt crisis and US government shutdown in no way helps the outlook. Could the AI economy then become “much ado about nothing” with a corresponding crash reflecting the lofty weight and heights it has achieved so quickly. Many more events have to play out before the expected economic surge in 2026.

How a Weakened Consumer Market Might go Sour

Many businesses and consumers have shut down spending and hiring intentions due to the uncertainty of Trump economic policies. This could easily ramp up in the next 3 to 6 months.

Let us hope that the big AI companies (Tesla, Nvidia, Oracle, AMD, etc.) don’t suffer a big change in sales outlooks, as their influence is monumental.

See more on the forecasts for the stock market to guide your investment decisions over the next 5 years.