Loss of Canadian Travelers Hurting the US Travel Sector

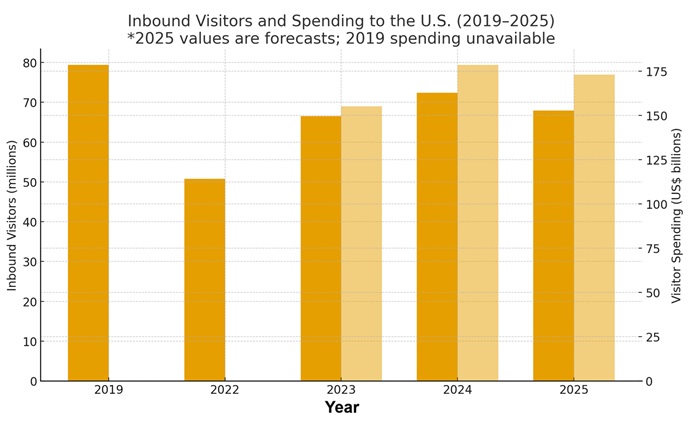

US inbound international travel is predicted to fall by about 6.3% in 2025, falling to an estimated 67.9 million visitors, which marks the first decline since 2020.

A sizable portion of that loss is attributed to missing Canadians, who look to be cutting out US travel even more. October’s cross-border travel by car or air showed a 24% decline from same time in 2024. Millions have cancelled their planned bookings. A number of factors are mounting to make this a prolonged concern for US travel companies, governments and destinations. There have been efforts to rekindle Canadian traffic but it likely won’t be sufficient to solve a tough PR and financial matter.

As President Trump’s tariffs bite harder into Canada’s GDP, US travel companies will need expert marketing to overcome the negatives and bring Canadian travelers back to the US.

There’s effort, strategy and funding are needed to recapture Canadian’s travel intent. As a US business owner, you’ll need to understand Canadians and focus on Canadian travel desires and what stops them from making these usual trips. They’re seeking their joy of travel but the vision is unique and intimate to them.

In this post, we get an update on the lost Canadian issue with some tips on how you can attract more Canadian travelers.

The Decline and its Lasting Impact

The pain of the market decline is hitting some cities and states much harder than others. California, Florida, Texas sunshine states so adored by Canadians are seeing much higher losses.

“Canadian cancelations included bucket-list and milestone experiences valued at over $10,000 CAD,” said a Flight Centre spokesperson.

Border states such as New Hampshire, Maine, Washington, and Michigan are also suffering in tourism losses, much of which are singularly important for them to survive. Canadians are their bread and butter and shuttered US businesses often don’t return. The travel industry has had it tough and there is a drop in 2025’s salesfforecast. Canadians have made up about a quarter of all international visitors to the US, spending over $20 billion a year, according to the US Travel Association.

Canadian’s Pain Comes Around

What Canadians find offensive is not only the trade war between the two countries and the massive tariffs President Trump has levied. His comments about making Canada the 51st state has disgusted the whole country. It’s apparent now, as time has passed, that Trump isn’t even serious about the comment. It’s a trade positioning tactic to pressure the Liberal Party of Canada, currently in office.

The reduction in Canada-US trade will likely deepen next summer as the USMCA trade deal could be renegotiated. Trump’s aim is likely to force a renegotiation through tariffs. The Canadian Liberal Party is fighting the lifting of some of its own tariffs on US imports, and is defending them staunchly. Some suggest Trump won’t return to talks anytime soon.

Canadians Aren’t Just Another Foreign Market

When we talk about inbound tourism to the United States, one simple fact often gets overlooked: Canadians aren’t “just another foreign market.” Below, we learn of the numerous benefits that optimize the entire US travel sector throughout the year.

Something to bear in mind is that both countries share the world’s longest undefended border, cultural affinity, strong economic integration, and decades of reciprocal travel. Canadian travelers bring huge value to U.S. states, especially those that depend on winter holidaying “snowbirds”, retail spending, short-hop road trips and high-frequency visits.

When Canadians travel to the US declines, the impact is real.

October’s Drop and the 8-month Decline

Recent data show a sharp drop in Canadian travel to the U.S. In October, air travel by Canadians to the U.S. reportedly fell about 24 % year-over-year; car/land travel dropped more than 30 %. Stats reveal showed double‐digit drops within a trend that’s persisted for around 8-10 months.

Canadians then are changing their travel habits, and as previously reported, they’re traveling much less to the US. Instead, they’re choosing Mexico, Caribbean, and Europe.

The comments about US travel too, speak of changing views of the US and a lasting boycott by Canadian travelers, many of whom make an annual trek to Florida, Arizona or California.

The damage then for US states, tourism destinations, hotels, airlines, and restaurants, along with local businesses is substantial and may be lasting. Of course, Canadians are forgiving, and the rebound from this political tiff would definitely be solid. Canadians like the US more than any place on earth. It is the preferred destination and many still travel to the US now regardless of tariffs, Presidential insults, USD/CAD exchange rate pain, or border rough ups.

Why Canadian visitors are vital for U.S. tourism:

- Volume and spending – In 2024, Canadians made approximately 20.4 million visits to the U.S. and spent about US$20.5 billion. Canadian visitors support approximately 140,000 jobs in the U.S. travel sector and related industries.

- High-value, high-frequency travellers – Many Canadians come for short trips (weekend breaks, road trips) but also the “snowbird” extended-stay market (e.g., Florida, Arizona). They spend on accommodation, food & beverage, retail, activities, and tend to favor U.S. destinations they know. For example, the top U.S. states visited by Canadians include Florida, California, New York, Nevada and Texas.

- Complementarity & calendar spread – Because of proximity, Canadians fill shoulder-season gaps, border-region destinations, car travel routes, cross-border shopping, and excursions that don’t require long-haul flights. That helps smooth out peaks and supports secondary tourism economies (border towns, road-trips, same-day trips).

- Cultural and relational value – Canadians are the easiest visitors to serve, creating efficiencies and less grind for tourism staff. The Canada–U.S. travel relationship has traditionally been friendly and “natural”. That means less friction (visa, language, familiarity) and more loyalty. Losing them is a deeper hit than just losing a “far-away” tourist.

- Tail-winds for other segments – The presence of Canadian visitors also helps local tourism ecosystems: hotels, car rentals, restaurants, retail, duty-free, border-town economies, day-trip excursions. When Canadian flows shrink, the ripple effects damage local economies.

- Competitive advantage for U.S. destinations – Many U.S. states market specifically to Canadians, eg., with tailored offers. Losing them raises the cost of creating a new travel customer and forcing re-investment in other markets which may take longer to yield and be less effective. Again, Canadians are an easier, eager and larger audience, proven to bring tourism profit.

Without Canadians, the US travel market isn’t the same. The culture, demand, and consistent change. And are you okay about where all of that is going?

What’s the loss in spending traveler volume? Estimates for October, just in, show an estimated loss of $5.7 billion. If this continues, the annual losses could easily surpass $70 Billion.

And the erosion of this key customer brings more uncertainty for travel agency owners, tourism boards, and hotels who are trying to cope with inflation, AI incursion, and labor shortages.

What U.S. DMOs, Governments and Travel Business Owners Should do?

Given the Canadian traveler erosion, U.S. destinations and tourism marketers should dig in deeper into the Canadian traveler profile, what they feel about the US and what each traveler type prefers in their trip. Understand Canadians more deeply, from east to west. Then launch and engage them in a continuing dialogue that taps into the full intent they feel about a US trip.

And big reach and visibility via SEO, PPC and social media is the route to go. Lean on your travel analytics reports to view Canadian engagement with your content, images, messaging and offers.

Consider These Tactics to Help you Recover Your Canadian Audience:

- Re-prioritize Canadian outreach: refresh messaging for Canadians, emphasize value-proposition (exchange rate, family travel, road-trip ease, snowbird value).

- Use messaging that refers to the US/Canada relationship, and “we didn’t ask Trump to do this” to distance themselves from him and his turmoil.

- Rather than just marketing to Canadian tourists, U.S. destinations need to learn about Canadian tourists. By understanding how Canadians perceive safety, value and inclusivity, destinations can tailor their approach appropriately. When you speak to the Canadian market in an informed and caring way, it creates more trust and feels less generic — Canadian Millennials hate generic too.

- Promote the energy of the place or event. Create emotion boosting storytelling to help Canadian travelers feel the energy of these destinations that offer an escape and an inspiration for Canadians (escaping cold, snow, and too much Canadian life).

- Lobby, market and promote an exemption for Canadian travelers.

- Promote the benefit of an easy vacation, compared to long trips to places of culture shock and discomfort.

- Use social media platforms to highlight visually appealing “Instagrammable” spots and create buzz for your destination appeal to younger travelers.

- Monitor travel stats for the eight-month decline carefully by segment: road trips vs. flights, family vs. leisure vs. snowbird, by state/region. Tailor offers accordingly.

- Strengthen “soft relationship” messaging: reinforce the friendly Canada-U.S. travel bond; emphasize destination welcomes Canadian visitors.

- Diversify but don’t abandon: while emerging markets matter, the loss of Canadians is harder to replace in the short term because they were high-frequency, familiar, and relatively lower-acquisition-cost.

- Capture “return when ready” demand: they will return when conditions change and it doesn’t hurt to promote a positive visual of the future, to ease their resentment. Building goodwill now means you’re better positioned when they decide to come back.

Canadian travelers are massive in volume, the US’s greatest source of travel consumers and perhaps your number one repeat travel customer.

Being proactive about your Canadian customers protects your long-term viability, keeping these handy “gap fillers” and US experience-loving crowd top of mind. It’s no easy task to bring them back or stop the current bleeding, but letting this group go, into the arms of Mexican, European, and South American tourism businesses, helps them create a new engaging relationship where they will spend more money and vacations with them.

Protect your tourism business and build a Canadian digital marketing strategy and win it!

See more on the 2026 travel sector outlook, Travel Market Reports, and choose an affordable travel marketing service designed by a Canadian content strategist just for you. Let’s launch your business into 2026 the ideal way.