Stock Markets Faltering Ahead of the Holiday Season

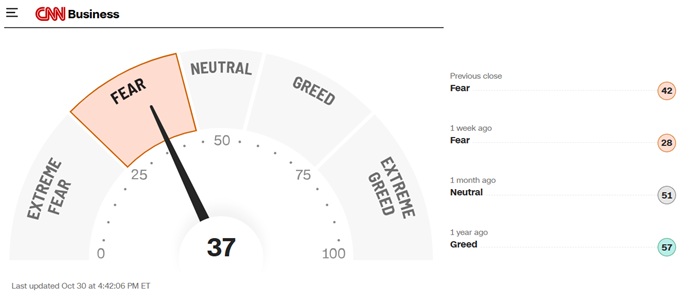

As we near the end of October 2025, the mood of the stock market is one of lingering optimism and renewed uncertainty. This week’s market pullback has created more volatility, challenging the latest record-setting rally, and putting some fear in the minds of investors, who might be impulsive and cut their losses.

Key factors influencing sentiment include:

- Federal Reserve interest rate decisions

- high-stakes trade negotiations

- mixed corporate earnings reports

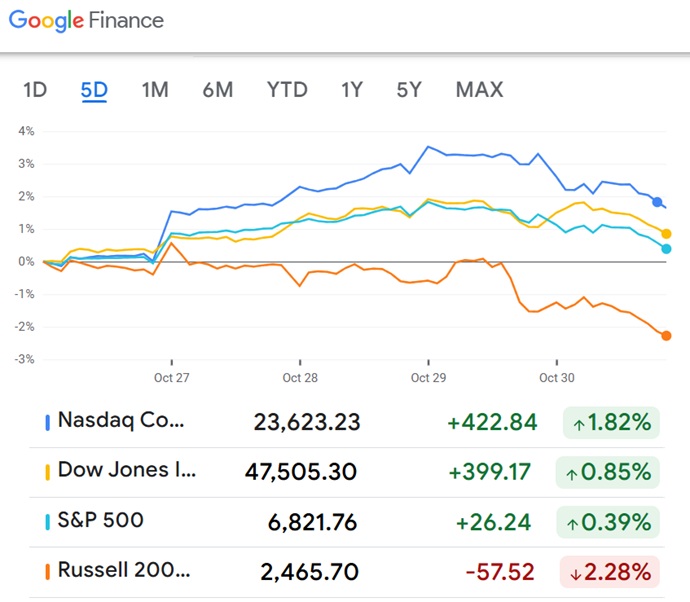

After a bullish upward lift during the last week, the Dow Jones, S&P 500, NASDAQ and Russell 2000 have begun to slide. You might call it a mini crisis of confidence with those 3 negative drivers just mentioned. After Powell’s speech yesterday, investors sold off, with the NASDAQ losing 1.55% on the day. The FED Chairman dashed hopes of another rate cut in December. Powell is yet one more part of the uncertainty that plagues everyone, including home buyers and builders.

Markets Slid to Session Lows Today

At end of trading today, the Nasdaq composite slid to session lows, Meta Platforms (META) shares plunged and Microsoft (MSFT) shares fell as investors apparently don’t like the escalating costs for these companies’ artificial intelligence investments.

And they now wait for the earnings reports of Apple and Meta. Of course, all of this comes on the heels of reports of a slowing US economy grinding down due to a number of trade-related standoffs, which cast a dark shadow in the next 3 months. As FED chair J Powell announced a FED rate cut, President Trump has been making tough talk with both Canada and China, two of its biggest trade partners.

The mood the last two trading days has soured somewhat and some investors are selling off and taking profits (just to be cautious). There is fear but not panic, as many believe the Trump Taco trade will be in effect, and markets will bounce back up. But let’s remember, that when AI’s outlook is hampered in any way, the markets (over-invested in AI stocks) investors get the jitters. The last two days shows they’re weary of Trump’s rhetoric and the continuous uncertainty. After threatening 100% tariffs last week, today he announced the tariffs on China would be reduced to 47%. Presumably, it’s to allow essential products that US companies need, while still hurting Xi and his communist party. Still, the big tariffs feed the inflation narrative, making J Powell’s speeches and views somewhat relevant.

Economic and Trade Uncertainty Hurts

Uncertainty is a huge issue because business owners can’t decide how to conduct business or invest in this environment. One hand, Trump’s strong pro-USA, protective initiatives provide a wealth of confidence for investing in the US, his erratic trade negotiations tactics simply cause hesitation for investors, home buyers, home builders, SMB manufacturers, and others. The US is still dependent on imports, thus these large tariff increases do more harm to Americans than they do to their intended targets.

However, for long-term investors, those who buy low and wait for the top, the 5 year stock market forecast doesn’t change much. The US is ramping up over a rocky mountain road, up to a future only experienced by the British Empire and the China revolution. Those who lose confidence at any time, end up offering up their wealth to rich investors who arent’ upset by the things going on. You might want to be patient and don’t sell off now.

CNN Investor Fear Index

The Russell 2000 gets hammered in these trade wars given SMBs must borrow from banks and their supply chains are much more affected by trade friction. Small business owners are not happy, and many wonder if this high interest rate, high tax rate era is going to end. The rally is great, but the negative signals are fatiguing for many investors.

The year-end and the Xmas holiday season are not far off. The Conference Board predicts US consumers’ holiday spending will be down this season compared to 2024. The believe consumers will spend 3.9% less on gifts and 12% less on non-gifts. The small business confidence index fell in September after a strong showing in summer months, given the stock market was also strong.

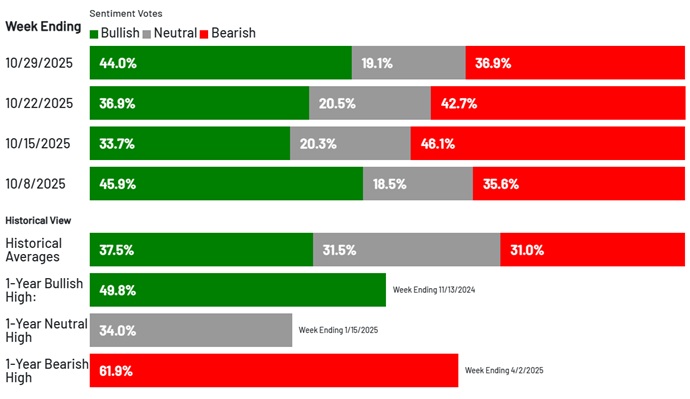

The latest AII investor survey shows investors are increasingly bullish and less bearish of late. Today, October 30, 2025, the percentage of bullish individual investors rose to 44.0%, notably above its historical average of 37.5%. Do they know something we don’t?

While the markets wobble, the price of Gold is surging to ridiculous, record-breaking heights of $4100 an ounce. Gold is a flight to safety, which says the gloomy crowd are more convinced than ever, that the economy and the US stock market will crash. Ultra-high P/E ratios certainly doesn’t help fend off that argument.

Yet, some of the leading stock market analysts and gurus believe there will be a year end stock market rally.

President Trump is Constantly Making Investors Worry

Today, President Trump eased his tariff threats to speak with President Xi of China. It didn’t ease investors’ concerns which might be becoming crystallized with a view that the market could undergo a correction, if not a small crash. The volatility is the factor that puts everyone ill at ease, and when AI and cryptocurrency hype gets cold water thrown on them, we see the market get the jitters all round.

Today, Tobin Marcus, Wolfe Research firm’s head of U.S. policy and politics, was quoted by CNBC that “What markets need is stability on U.S.-China trade tensions, and we largely accept at face value that today’s agreement will stabilize the relationship for the next year.It’s certainly possible we see some flare-ups in the year ahead, but we don’t see much risk of a total blow-up. And with other tailwinds for markets, from rate cuts to stimulus to earnings, a year’s worth of stability should clear the way for the rally to continue.”

What should you make of the stock market now? Is this downturn in stock prices one of those big buy signals for buying the best ai stocks, cryptocurrency stocks, pharmaceuticals, rare earth stocks, and financials? We all know that there are very few days in the stock market that create most of the gains in price. If you miss these low points pushed down by negative sentiment and fear, you end up with mediocre returns.

Yes, fear and negativity and talk of stock market crashes, can create great buying opportunities. With so many negative influences from Trump to Powell, and the frustrations of US business owners trying to launch during such uncertainty, there are signals that US stocks might be ready for another leg up.

See more on the 2026 stock market forecast and answer those questions about selling your stocks and buying gold.