Toronto Housing Market Report

TRREB in its September housing market reports a rise in home sales with a price drop in the GTA region. More sellers listed their homes, with many of them deciding to give up on their “dream price” to get their home sold.

For home buyers, it’s an issue of affordability, down payments, fear and reluctance given the shaky economy, and whether locking in at high mortgage rates is a good long-term financial decision. If the economy does weaken, along with the 5-year economic outlook, the key 5-year Government of Canada bond yield, which lenders use as a benchmark for fixed-rate mortgages, could fall. This would drive mortgage rates down.

GTA homeowners urgency to sell comes from several avenues including:

- price trend downward

- worsening economy — manufacturing sector outlook dimming

- worsening employment picture — import tariffs, AI unemployment, slowing hiring due to uncertainty

- US import tariffs

- mortgage refinancing affordability

I can attest to the growth in listings in my city, and with a Realtor/investor’s experience whom I know, that the mortgage refinancing issue (high rates) is now hitting much harder. They could see their properties foreclosed if they can’t sell quickly. 2026 will see even more refinance-related emergency sales, which encourages informed sellers to sell faster at market price. The Toronto homeowner’s dream price might die completely in 2026. And there is a rising chance of a Toronto housing crash.

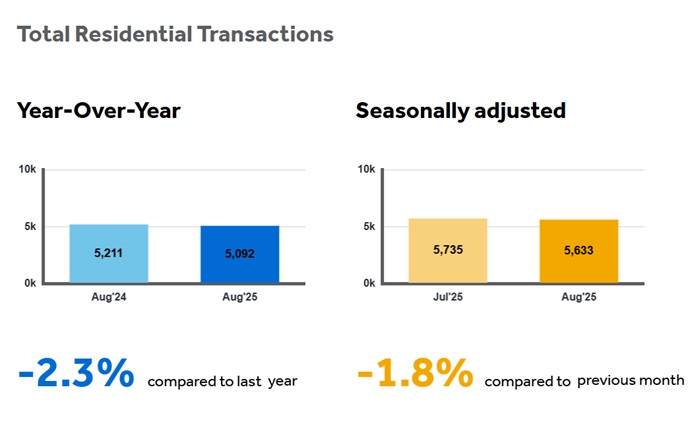

GTA Sales and Listings Grew in August

Not surprisingly then with sellers getting ancy, the Toronto area housing market saw a 4.7% increase year over year in sales to 5,211 home sales. However, compared to July 2025, the previous month, on a seasonally-adjusted basis, sales in the GTA fell for the first time in 5 months. This suggests a stalling housing market. The drop in home prices is what’s getting everyone’s attention.

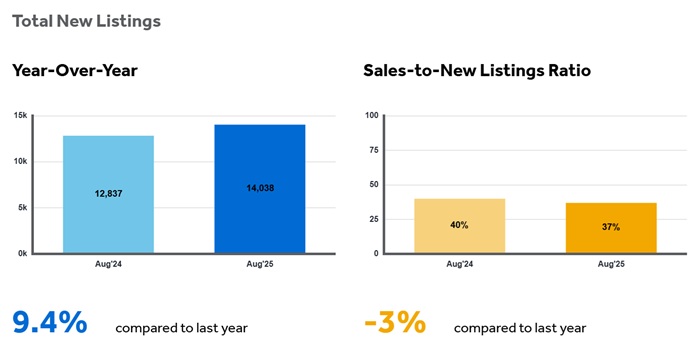

There was a 9.4% increase year-over-year in listings, now at 14,000 homes across the TRREB-covered region, from Oakville to Innisfil to Ajax. Active home listings are up notably from 22,000 12 months ago to 27,500 in August.

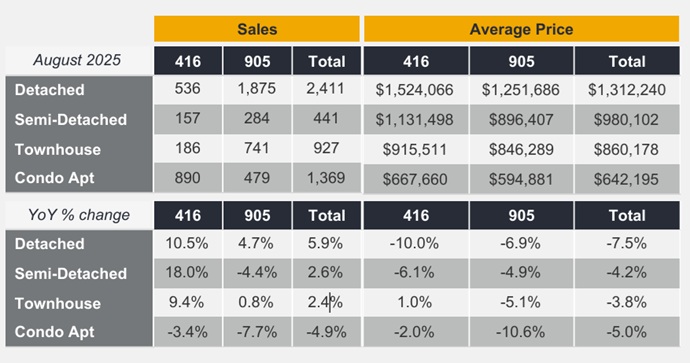

Sales-to-new-listings ratio (SNLR): The ratio was 37% in the GTA, confirming a buyer’s market. The City of Toronto’s SNLR was 39%, inching closer to the 40% threshold that indicates a balanced market. Average days on market before selling rose 5 days versus August of 2024. As you can see in the TRREB graphic, 416 area detached home prices have plunged 10.0% year over year, to a still unaffordable $1,524,066. Condo apartments outside of Toronto dropped a big 10.6% year over year, while semi-detached and townhouses have slid by about 5% from last year’s sales prices.

“Compared to last year, we have seen a modest increase in home sales over the summer. With the economy slowing and inflation under control, additional interest rate cuts by the Bank of Canada could help offset the impact of tariffs. Greater affordability would not only support more home sales but also generate significant economic spin-off benefits,” said TRREB President Elechia Barry-Sproule.

The Toronto area condo market is a separate market influenced by the large numbers of new build condo releases in the city of Toronto.

Toronto Home Prices Decline

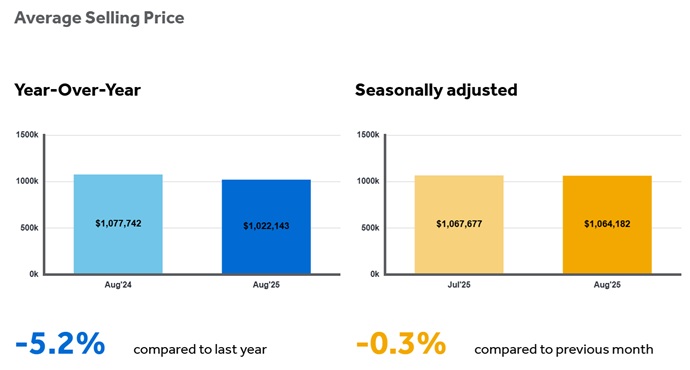

The composite benchmark price for the GTA in August 2025 fell 5.2% to $969,700, while the average price dropped 4.9% to $1,022,143, year over year. Specifically, in the City of Toronto, the average home price was $992,085, down 3.6% annually.

Price drops by property type (GTA, year-over-year):

- Detached homes: Down 7.2% to an average of $1.31 million.

- Semi-detached homes: Down 4.5% to an average of $980,102.

- Freehold townhouses: Down 4.5% to an average of $946,395.

- Condo apartments: Down 4.8% to an average of $642,195.

Canadian mortgage rates fell about a percentage point to 5.38 from 6.39 on a 5-year term for an average monthly payment of $3,524. However, there may be 5 year fixed rate mortgage available for 4.15% saving money for some buyers in the Toronto market. Overall, the reduction of rates this year wasn’t enough to reduce mortgage payments to an affordable level. The housing market remains one of excessive prices and insufficient supply.

Some housing experts believe 2024 was a transitional year as buyers saw some deals and interest rates began to fall. We’re seeing a big rise in listings which could rise dramatically this winter given the political turmoil with the United States.

It’s never a more nerve-wracking time to buy a million-dollar home in the GTA.

Canadian and Ontario Economy Decaying

Economic indicators including GDP and job losses show Canada’s and Ontario’s economy are ailing. With the bank of Canada unwillingly to help with lower rates, and with the potential of a stoppage of mass immigration by the Liberals, demand is being slowed.

The unemployment rate in Toronto, Ontario was 7.1 in August 2025, up .2% from July, but is down .4% from 7.5% last December of 2024, yet is still one of the highest unemployment rates among Canada’s 20 largest census metropolitan areas (CMAs).

While many in the Toronto housing market hope for lower mortgage rates, high home prices and mortgage qualification rules (debt to income) vs requested mortgage will make buying a home a tough prospect.

Nepo-Real Estate Era: Bank of Mom and Dad is the Foundation

In earlier reports, 36% of first-time homebuyers in Ontario as reported by CIBC economists, are getting financial help to cover their down payments. That “gift” is at $128,000 in Ontario, up 52% in the last 5 years. It suggests the market is dependent on young buyers borrowing money from the bank of mom and dad. As Gen X or baby boomer parents transfer wealth to younger generations, it may support home prices.

Toronto Condo Market Under Pressure

The Toronto condo market was the bigger story last summer. Condo prices fell 5.7% year over year in the 905 area code and down .5% in the 416 area code. In December, condo selling prices dropped 3.3% in the 4th quarter vs 3rd. Sales slipped by 4.4%.

TRREB reports that 17,400 condo apartment rentals reported through its MLS® System in Q2 2024. That was an increase of 25.2% versus the 13,896 rentals listed in Q2 2023. The average rent for a 1-bedroom condo apartment fell 3.1% to $2,452 monthly in Q2 2024, from $2,529 in Q2 2023. The average 2-bedroom unit rent fell 1.9% to $3,178 in Q2 2024 compared to $3,239 in Q2 2023.

Investors are being hit with losses as condo rents decrease against persistent high mortgage costs. Many face selling their units at substantial losses. Mortgage delinquencies have doubled year over year, the highest rate in 8 years. This makes investments in Toronto condos a risky and money losing proposition.

According to one report, Canadian real estate companies are going bankrupt in high numbers, up 57% from 2023, on track to include 240 companies. And this is 13% higher than during the 2009 financial crisis, making it very newsworthy.

Urbanation and CIBC reported that 77% of Toronto investors who secured a mortgage on a new condo last year are losing money on it. The average monthly loss is a staggering $597. Benjamin Tal says this is the biggest test of the Toronto condo market since 1991.

It’s an odd situation in a marketplace described as a “housing shortage crisis.”

It’s a crisis of living space too. Another issue is in demand for more space, as young buyers don’t want the over priced, micro-sized condos that builder/investors have created. Millennials in particular have little use for small condos as they marry and begin raising families. They want larger-sized units, which haven’t been built. Surveys show almost half of rentals are too small for the people inhabiting them.

The key question for real estate investors is what is preventing the Toronto condo market from collapsing?

It may be that investor owners are willing to keep making payments and refusing to sell at a loss. And with rates falling slightly, they may be willing to hold fort, with expectations that their fortunes will reverse in 2025. But will rent prices drop even further in the next few months resulting in a cascade condo sell off?

===========================

GTA City by city home prices (data courtesy of TRREB)

As the single detached home price chart for the GTA region below reveals, price rises for single detached homes have been steepest in Burlington, Halton Hills, Toronto West, and King. Over the previous 8 years, home prices have increased the most in Aurora, King, Georgina, Newmarket, Ajax and Oshawa.

| Toronto Region Cities | Aug-25 | Dec-24 | May-23 | Aug-17 | Price Change last 8 Months | Price Change last 8 years |

| Burlington | $1,483,236 | $1,245,000 | $1,495,300 | $944,564 | 19% | 57.03% |

| Halton Hills | $1,134,864 | $950,000 | $1,265,500 | $984,812 | 19% | 15.24% |

| Milton | $1,227,146 | $1,170,000 | $1,325,000 | $866,650 | 5% | 41.60% |

| Oakville | $1,898,700 | $1,170,000 | $1,870,000 | $1,314,363 | 62% | 44.46% |

| Brampton | $1,077,929 | $1,044,500 | $1,281,000 | $766,831 | 3% | 40.57% |

| Caledon | $1,284,139 | $1,282,000 | $1,455,000 | $1,028,591 | 0% | 24.84% |

| Mississauga | $1,362,799 | $1,325,000 | $1,480,000 | $1,066,015 | 3% | 27.84% |

| Toronto West | $1,372,165 | $1,215,000 | $1,350,000 | $919,916 | 13% | 49.16% |

| Toronto Central | $2,308,897 | $1,882,500 | $2,400,000 | $2,113,130 | 23% | 9.26% |

| Toronto East | $1,153,843 | $1,100,000 | $1,247,000 | $887,620 | 5% | 29.99% |

| Aurora | $1,586,630 | $1,745,000 | $1,550,000 | $1,144,094 | -9% | 38.68% |

| E Gwillimbury | $1,367,436 | $1,330,000 | $1,245,000 | $966,047 | 3% | 41.55% |

| Georgina | $864,305 | $955,000 | $900,000 | $604,838 | -9% | 42.90% |

| King | $2,386,038 | $2,752,000 | $2,000,000 | $1,768,333 | -13% | 34.93% |

| Markham | $1,573,623 | $1,570,000 | $1,788,000 | $1,319,860 | 0% | 19.23% |

| Newmarket | $1,160,560 | $1,570,000 | $1,355,000 | $901,055 | -26% | 28.80% |

| Richmond Hill | $1,694,098 | $1,735,000 | $1,840,000 | $1,466,884 | -2% | 15.49% |

| Vaughan | $1,604,602 | $1,575,000 | $1,725,000 | $1,348,649 | 2% | 18.98% |

| Stouffville | $1,385,941 | $1,396,000 | $1,395,000 | $1,024,941 | -1% | 35.22% |

| Ajax | $972,043 | $1,085,000 | $1,120,000 | $708,185 | -10% | 37.26% |

| Brock | $848,623 | $621,000 | $747,450 | $508,615 | 37% | 66.85% |

| Oshawa | $825,761 | $805,000 | $861,000 | $550,677 | 3% | 49.95% |

| Pickering | $1,149,616 | $1,165,000 | $1,280,000 | $812,643 | -1% | 41.47% |

| Scugog | $894,895 | $900,000 | $945,000 | $719,375 | -1% | 24.40% |

| Uxbridge | $1,258,912 | $1,380,000 | $1,350,000 | $792,233 | -9% | 58.91% |

| Whitby | $1,127,589 | $1,145,000 | $1,161,000 | $733,811 | -2% | 53.66% |

| Orangeville | $856,869 | $846,000 | $890,000 | $612,974 | 1% | 39.79% |

| Bradford | $1,010,189 | $1,155,000 | $1,180,000 | -13% | ||

| Innisfil | $931,172 | $876,500 | $900,000 | $549,492 | 6% | 69.46% |

Toronto Housing Predictions

CMHC Housing Forecast for Toronto

CMHC forecasts a decline in housing starts for both 2024 and 2025 due to high construction costs. This should sink supply at a time when buyer demand is increasing. It means sellers might try to hold off until house prices peak in 2025/2026. A condo glut and market mismatch with buyers, should see condo price. They project an increase in prices.

| Resale Market | ||||||||

| 2023 | 2024 | 2025 Low Forecast | 2025 High Forecast | 2026 Low Forecast | 2026 High Forecast | 2027 Low Forecast | 2027 High Forecast | |

| MLS® Sales | 66,311 | 67,985 | 56,000 | 64,000 | 67,300 | 82,700 | 69,000 | 91,000 |

| MLS® Average Price ($) | 1,127,426 | 1,118,137 | 1,037,000 | 1,103,000 | 1,032,000 | 1,168,000 | 1,072,000 | 1,288,000 |

| Starts | ||||||||

| Single-Detached | 4,721 | 4,723 | 2,600 | 3,400 | 3,200 | 4,600 | 3,200 | 5,000 |

| Multiples | 42,707 | 32,995 | 20,400 | 24,200 | 19,700 | 24,500 | 19,800 | 26,000 |

| Starts — Total | 47,428 | 37,718 | 23,000 | 27,600 | 22,900 | 29,100 | 23,000 | 31,000 |

| Rental Market | ||||||||

| Vacancy rate (%) | 1.4 | 2.5 | 3.5 | 3.8 | 3.8 | |||

| Average Rent Two Bedrooms ($) | 1,961 | 1,974 | 2,050 | 2,090 | 2,150 | |||

Residential Real Estate Outlook

Given the current trade relationship with the US and the Liberal majority in the Federal Government, we might expect worsening economic performance. Persistent high mortgage rates, high taxation, high consumer debt, reduced government spending, weakening exports, and anti-development regulations should hamper the outlook for the Toronto real estate market. Both housing and condo markets are at risk of a more severe downturn.

Residential Housing Construction Outlook

Housing starts actually increased nationwide in July according to the CMHC. However, opinions are that the building trades are slowing.

“We’re in the process of laying off thousands of people right now,” he said. “So, a year from now, give or take, those people that are working on all those high-rise projects that are getting finished are going to be unemployed, which is terrible.” — Richard Lyall, CEO RECCO.

Richard Lyall, CEO of the Residential Construction Council of Ontario, said new housing projects are slowing and builders are struggling to make the finances work and get shovels in the ground. Experts believe many housing projects now are simply not feasible financially.

See also: US housing market forecast.