How Will Tariffs Affect the US Housing Market

As we head into the spring buying season, buyers and sellers are confused and curious about the effect of Trump’s import tariffs and how it will play out. Aside from potential higher building costs are a host of other factors that are discussed below.

It’s not an easy calculation with so much going on. Home renovation, rebuilding and new home construction from Florida to California will be impacted by higher material costs, increased home prices, and potential delays in new housing developments.

Some economists, media news outlets and market forecasters feel inflation will rise, yet others see it falling. The FED says it regards inflation and wages as its key signals to adjust lending rates. Whether rates go up or down controls whether buyers can buy.

We have to acknowledge that if the tariffs remain, they will slow the economy, and suppress spending (down several months in a row already) which will lower inflation. And after the US reindustrialized economy gets rolling in 2026, more new housing will be built easing the affordability and homelessness problem. Home prices will likely rise in 2026 which should encourage builders to buy land and develop projects. Trump intends to deregulate which could stimulate the economy and free up land, reduce red tape — all conducive to an improving housing market.

In terms of long-term benefit for the housing sector, these tariffs could make it healthy again. However, Trump’s tariffs aren’t about the housing market, they’re about easing the trade deficit and managing debt so the US doesn’t crash financially.

Fear and Actual Job Loss Will Keep Buyers on the Sidelines

For sure, we’re going to suffer a slight setback in the US economy, jobs, income, and consumer spending in 2025. The recent stock market crash has hampered the forecast, given people will spend less when their investment portfolio suffers. Its value may determine whether the buy trigger for a home is clicked. Wealthy parents will be reluctant to finance their kid’s home purchase, and Americans will fear moving within all the uncertainty.

With lower demand and consumer credit/debt concerns, we’re likely to see some foreclosures and many more homes listed this year. It’s difficult to see how this won’t dampen homes for the rest of the year. However, there are a lot of factors at play.

NAHB reports that the tariffs could raise the cost of a new home considerably (estimate: +$9,200). Lumber imports are already tariffed and gypsum from Mexico will be tariffed. But is this added cost a big issue when buyers may not want to buy at all regardless of price. Home builder stocks are performing well right now for the time being.

Trump is responding by selling Federal land, and with coming deregulation executive orders, he can speed up housing development. So we have a number of influences that counter each other.

The housing market was already suppressed by a host of impeding factors, and the tariffs don’t do much to save it. If the economy slides we’ll see prices fall and more supply available. This might spur home sales from those who have the funds.

Overall though, buyers are likely to hold off this spring to see how the tariff fallout affects prices.

Tariff Factors to Watch

Let’s at the non-political factors that might influence home prices and sales:

1. Increased Construction Costs

• Building Materials: The U.S. housing market relies heavily on imported construction materials such as steel, aluminum, lumber (from Canada), cement, and appliances. Tariffs would raise the cost of these inputs, increasing homebuilding expenses. However, new US businesses and production would increase to supply the market, now protected from cheap imports.

• Supply Chain Disruptions: If tariffs lead to reduced imports, domestic suppliers may struggle to meet demand, causing construction delays and further price increases.

2. Higher Home Prices

• New Homes: Builders would likely pass increased material costs onto buyers, pushing up prices for new homes.

• Existing Homes: Higher construction costs could constrain new supply, increasing competition for existing homes and driving up their prices as well.

3. Reduced Affordability

• First-time and middle-income buyers may face higher mortgage costs due to inflation and rising interest rates, along with elevated home prices, thus eroding housing affordability.

• Renters could also see increases as landlords pass on higher maintenance and renovation costs.

4. Regional Variations

• Areas with high construction activity (e.g., Sun Belt cities) would feel the strongest impact.

• Regions reliant on specific imports (e.g., steel-intensive high-rises in coastal cities) could see sharper cost spikes.

5. Potential Domestic Industry Growth (Long-Term)

• If tariffs successfully boost domestic production of materials (e.g., steel, lumber), prices might stabilize or fall over time depend on how fast U.S. producers can scale up quickly enough to offset lost imports.

6. Mortgage Rate & Demand Effects

• If tariffs contribute to broader inflation, the Federal Reserve might keep interest rates higher for longer, increasing mortgage rates and dampening demand.

• Conversely, if tariffs slow economic growth, the Fed could cut rates, potentially offsetting some demand-side pressure.

7. Business and Employment Changes

• If a counter-tariff wars hit U.S. exports (e.g., agricultural products), then state and local economies tied to those industries could see reduced employment and income, weakening housing demand in affected regions.

Not All Regions Will Face the Same Conditions

1. Fast-Growing Sun Belt Markets (South & Southwest) – High Vulnerability

Examples: Texas, Florida, Arizona, Georgia, North Carolina

Why? These states have high population growth, rapid construction, and reliance on imported materials (e.g., steel, cement, appliances).

Impact:

• Higher new home prices (due to elevated construction costs).

• Delayed projects (supply chain bottlenecks could slow development).

• Affordability crisis worsens (many buyers are already stretched by rising prices).

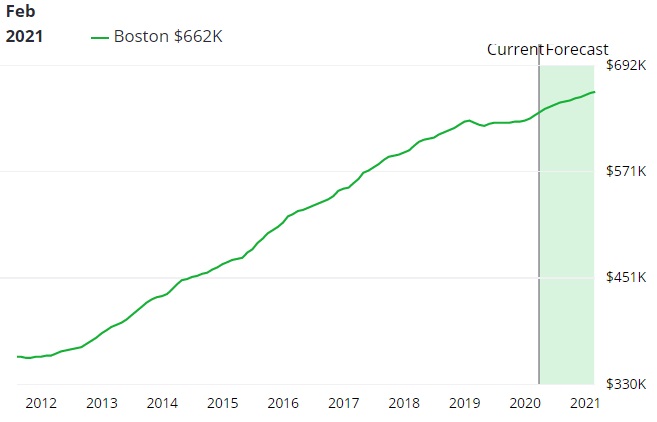

2. Coastal Metros with High-Rise Construction (Northeast & West Coast) – Moderate to High Vulnerability

Examples: New York City, Miami, Los Angeles, San Francisco, Seattle

Why? These cities depend on imported steel, glass, and specialized materials for high-density housing.

Impact:

• Skyscraper and condo projects become more expensive, slowing urban housing supply.

• Rent spikes (landlords pass costs to tenants in supply-constrained markets).

• Foreign investment risks (if tariffs trigger economic uncertainty).

3. Rural & Manufacturing-Dependent Regions – Mixed Effects

Examples: Midwest (Ohio, Michigan, Pennsylvania), parts of the South (Alabama, Tennessee)

Why? These areas have more domestic steel/lumber production but rely on imports for machinery and appliances.

Impact:

• Short-term pain: Higher costs for home repairs and appliances hurt lower-income homeowners.

• Long-term potential gains: If tariffs boost domestic manufacturing jobs, local housing demand could rise.

• Risk of retaliation: If foreign tariffs hurt U.S. agricultural/auto exports (e.g., soybeans, cars), rural economies could suffer, weakening housing demand.

4. Pacific Northwest (Lumber-Dependent Markets) – Wildcard

Examples: Oregon, Washington, Idaho

Why? These states produce lumber domestically but rely on Canadian imports (which could face tariffs).

Impact:

• If Canadian lumber tariffs return (like in 2017-2018), homebuilding costs rise sharply.

• Local sawmills may benefit, but overall housing supply could shrink.

5. Energy Boom Towns – Depends on Oil Prices

Examples: Texas Permian Basin, North Dakota, Wyoming

Why? These areas need imported steel for pipelines and drilling equipment.

Impact:

• Higher energy sector costs could slow job growth, reducing housing demand.

• Lower energy sector costs would lower cost of living, construction costs, and spur job growth which would stimulate home sales.

• If oil prices rise enough to offset tariffs, the local economy may stay strong.

Impact on the California Housing Market

The California housing market is one of the most expensive and supply-constrained in the U.S. Tariff supply and price changes would pose significant pressure from new tariffs on imports. California is highly exposed to foreign construction materials, high construction costs, and dense urban development. Here’s how different aspects of the California market could be affected:

1. Sharply Higher Construction Costs (Biggest Immediate Impact)

California relies heavily on imported steel, cement, glass, and appliances for both single-family homes and high-density urban projects. Key impacts:

• Steel & Aluminum Tariffs: High-rise construction (L.A., S.F., San Diego) would get more expensive—potentially delaying projects.

• Cement Shortages: California already imports cement (especially from Mexico and Asia); tariffs could worsen supply crunches.

• Appliances & Fixtures: Many cabinets, HVAC systems, and solar panels come from abroad—raising renovation and new home costs.

Result: Builders pass costs to buyers, worsening already extreme home prices.

2. Urban vs. Suburban Divide

a) Coastal Cities (L.A., S.F., San Diego) – High-Rise & Luxury Market Strain

• High-rise condo/apartment projects become less profitable, slowing supply growth in cities where density is critical.

• Foreign buyer demand could dip if tariffs spark economic uncertainty or retaliatory measures (e.g., Chinese investors pulling back).

b) Inland & Suburban Markets (Sacramento, Riverside, Fresno) – Affordability Crisis Deepens

• Middle-class homebuyers face even higher prices for new suburban developments

Tariff Impact on the Florida Housing Market

The Florida housing market is cooling fast given the exodus of Canadians and foreign tourists. Orlando and Miami could see significant economy downturns. The impacts would differ from California due to Florida’s unique economic drivers, international buyers, reliance on international trade, rising home insurance rates, and its steep construction costs.

The Florida housing market is cooling fast given the exodus of Canadians and foreign tourists. Orlando and Miami could see significant economy downturns. The impacts would differ from California due to Florida’s unique economic drivers, international buyers, reliance on international trade, rising home insurance rates, and its steep construction costs.

Here’s how tariffs could reshape the Florida market:

1. Construction Costs Surge (Especially for Single-Family Homes)

Florida’s booming housing market relies on imported steel, cement, lumber (from Canada), and appliances—all vulnerable to tariffs.

• Lumber: Florida imports most of its lumber supply from Europe which has been hit with a 20% tariff. Tariffs on Canadian softwood lumber has tariffs but did not increase last week.

• Steel & Aluminum: Impacts high-rise condo projects in Miami, Fort Lauderdale, and Tampa, raising costs for rebar, beams, and fixtures.

• Concrete & Cement: Florida already faces supply shortages; tariffs on Mexican/Asian imports could delay projects.

• Roofing Materials (e.g., tiles, shingles): Many come from abroad—hurricane-resistant upgrades get pricier.

• Appliances & Fixtures: Import-dependent HVAC systems, cabinets, and lighting raise home prices.

Result: Builders pass costs to buyers, worsening affordability in a market where prices and insurance costs are already soaring.

2. Coastal vs. Inland Divide

a) Coastal Cities (Miami, Tampa, Naples, Orlando) – High-Rise & Luxury Markets Hit Hard

• Luxury condo projects slow down (foreign buyers may pull back as tariffs spark economic uncertainty).

• Insurance + tariffs = “Double Squeeze”—already high insurance costs compound with pricier materials.

• Short-term rental markets (Airbnb): Higher renovation costs could deter investors and Airbnb properties were already being converted back to long term rentals.

b) Inland & Suburban Markets (Jacksonville, Ocala, The Villages) – Affordability Crisis Worsens

• Middle-class buyers face higher prices for new subdivisions.

• Domestic migration cushion? Northerners may stay put and not migrate to the south which could lower prices.

3. Foreign Buyer & Retaliation Risks

• Miami’s Latin American & European buyers may resent the tariffs and decide not to buy.

• Retaliation from trade partners (e.g., Brazil, Canada, Europe) could hurt Florida’s agriculture (citrus, seafood) and tourism, thus raising unemployment and reducing earnings in the state.

4. Rent Inflation Accelerates

• New supply constraints (due to pricier construction) push rents up in cities like Miami, Orlando, and Tampa.

• Landlords raise rents to cover higher repair/replacement costs (imported AC units, windows, etc.).

5. Hurricane Rebuilding & Insurance Chaos

• Post-storm reconstruction gets more expensive (imported materials + labor shortages).

• Insurance companies may further raise premiums if rebuilding costs spike, pushing some homeowners out.

Overall, the US import tariffs affect all housing markets from Florida to Massachusetts to California.

Find out more about Trump’s tariffs and view a post-tariff analysis.

Title Image by rawpixel.com