Fresh Look at the US Housing Market

In his most recent announcement in December, NAR’s Chief Economist Lawrence Yun said he believed the US resale housing market would see prices surge 3% and sales grow by in 2026.

All told, they see a housing market showing signs of a rebalance—and a notable rebound—in 2026.

This excerpt from the NAR website’s post on the reawakening housing market is very promising from an industry standpoint:

“We are seeing a little better condition for more home sales … with more inventory and the lock-in effect steadily disappearing—because life-changing events are making more people list their property to move on to their next home. Next year should be better with lower mortgage rates, and that will qualify more buyers. We are expecting home sales to increase by about 14% nationwide in 2026.”

He continued, “Home price growth will be minimal—roughly 2% to 3%—about the same as overall consumer price inflation. Generally, wage growth will be above that. So, it’s a year where people’s income begins to rise a little faster than consumer price inflation and home prices.”

Yun believes a 3% home price increase is healthy and with rising wages, buyers will have a better opportunity this year to purchase a home. With listings up 20%, we might see many Americans buying a home for the first time, or moving onto another home.

Yun believes a 3% home price increase is healthy and with rising wages, buyers will have a better opportunity this year to purchase a home. With listings up 20%, we might see many Americans buying a home for the first time, or moving onto another home.

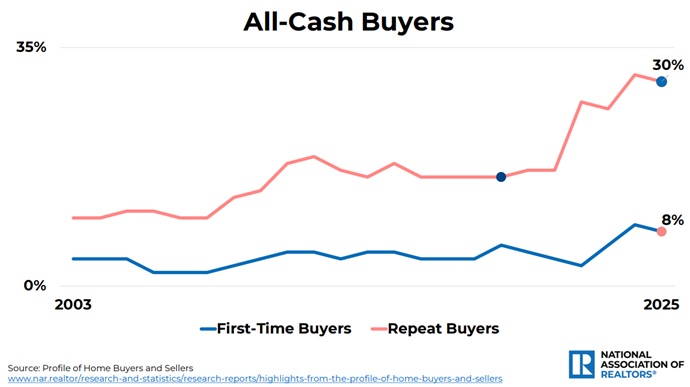

NAR 2026 outlook report focuses on lower mortgage rates and inventory gains, which they expect will draw more buyers back to the market in 2026. December stats show first time buyer interest has grown in the last two months. As this new char shows, all cash buyers are finding it an ideal time, given they’re not having to pay the lofty 6% mortgage rates. Demand from young buyers with kids has sunk from 68% to 24%, a not-surprising and but significant stat to be aware of.

The buyer profile has changed dramatically from 1980’s. Now unmarried couples and single women represent much more of the buyer market. Single women might be a good demographic for Realtors to focus on this year.

NAR’s report shows selling agents are enjoying strong demand while FSBO is sinking like a rock.

Zillow Housing Forecast

Alternatively, Zillow brought out its forecast last month. They predict:

- Home prices to rise 1.2% in 2026, despite many seeing annual price declines.

- 4.26 million existing home sales— a 4.3% growth over 2025 (still below 2019 inventories).

Zillow points out that fewer mortgage holders will be underwater this coming year, in contrast to 2025 when home values fell, putting homeowners in risky waters.

Their experts believe mortgage rates won’t fall below 6%. If the FED doesn’t lower rates (new FED Chairman only 4 months away) then it would put a damper on market recovery. President Trump’s announced executive order on limiting credit card rates may have an impact on consumer spending and even home purchases. Lower CC payments may free up considerable income for some buyers. We’ll see if the 9.9% interest rate limit affects HELOCs and other types of financing.

Sadly, new home construction is not expected to add to housing inventory. Zillow expects new construction this year to be 5% less than 2025, and one of the lowest since 2019.

Zillow suggests that inflation-Savvy home features will be a selling point this year. Low energy, whole home batteries and EV charging stations, and improved food refrigeration systems will be much more prominent in listings.

Which Cities Expected to be Hottest Markets?

It might be in region’s and cities that are hot now.

December 2025: Top 20 Hottest Housing Markets

(Chart courtesy of NAR)

| Hottest Metros | Hotness Rank | Hotness Rank YoY | Viewers per Property vs. U.S. | Median Days On Market | Days On Market YoY | Median Listing Price If Active Within Period |

| Kenosha, WI | 1 | -1 | 3.1 | 44 | 0 | $384,000 |

| Springfield, Mass. | 2 | -2 | 2.9 | 45 | -3 | $344,000 |

| Manchester-Nashua, N.H. | 3 | 0 | 3 | 48 | 1 | $550,000 |

| Racine, Wis. | 3 | -6 | 2.7 | 44 | -3 | $346,000 |

| Hartford-West Hartford-East Hartford, Conn. | 5 | 0 | 4 | 51 | 2 | $422,000 |

| Lancaster, Pa. | 5 | -1 | 2.6 | 41 | -5 | $397,000 |

| Rockford, Ill. | 7 | 6 | 2.6 | 48 | 5 | $246,000 |

| Wausau, Wis. | 8 | -88 | 2.7 | 50 | -24 | $367,000 |

| Norwich-New London, Conn. | 9 | -2 | 2.8 | 52 | -1 | $446,000 |

President Trump’s planned interest rate relief and pressure on the FED to lower the central rate are promising developments. He’s setting a clear tone and bias toward home building and consumer affordability. The tariff rebates, if they happen, would provide a big boost to some American’s hope of buying a home.

Additionally, he’s pushing a new executive order to allow Americans to dip into their retirement or college savings accounts, without penalties, to help with a down payment on a home. Collectively, in the second half of 2026, these measures compounded could have an effect on home buying, one that perhaps NAR isn’t taking into account.

Let’s not forget the 4.3% GDP growth and income growth stats either. On the downside is the threat of a more extended government shutdown. The massive government debts as an issue will never go away. It’s hard to gloss over 38 Trillion in debt with $2 trillion interest payments. Trump’s reduction of Federal spending could help on that front.

Overall, right now, there is a trend to rising inventories of houses for sale and an improving economy. Your question of “is now the right time to buy house” really depends on your time frame. Many young Americans pressured by life events are said to be much more intent on buying a home. Their biological and youth clock is ticking and they feel the pressure of falling too far behind on building financial equity. That pent up demand has been discussed for quite a while now, and as incomes rise, and employment stabilizes, NAR’s forecasts might prove accurate.

See more on the factors driving the US housing forecast while keeping in mind the potential of a housing market downturn.

Check out local market demand for Boston, Los Angeles, Florida and California.