How to Invest in Cryptocurrencies & Crypto-Equities: A Sensible Guide

2025 appears to be a boom year for cryptocurrencies and blockchain technology. Massive amounts of investment money is moving into this sector and inflating the prices of assets. Everyone is intrigued about how they might cash in on the boom.

Some buy for the long term promise while others trade on the volatile nature of the prices. And some say there’s no end to the upward prices of most cryptocurrencies including Bitcoin and Ethereum, given all the investment in computing and energy infrastructure taking place. It does have the appearance of becoming the world’s dominant type of currency. Few understand crypto’s full set of advantages for consumers or business, but they don’t care — they’re just buying.

Currently, the US economy (Q2 GDP +3.8% growth) and the stock market forecast look strong. An economic boom in 2026 seems a reasonable projection. The 5-year range is positive, but you’ll have to determine if this fall is the right time, or whether to wait. Certainly, the FED’s reduction of the FED rate is a helper, and we’ll see if that declines further.

Trump Gives the Cryptocurrency a Big Boost

This year, President Trump has signaled his administration’s support for Cryptocurrency integration into the financial/investment system and even the US banking system. His regulatory shift includes an executive order, strategic bitcoin reserve, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) and improved regulation, and US leadership in crypto and blockchain which minimizes regulatory friction, uncertainty, and promotes innovation.

The new effect of Trump’s legitimization and support of cryptocurrencies is the expectation that cryptocurrency will become an actual trusted currency, have lower risks for users, create institutional confidence, and be fully used within finance and the economy including areas such as real estate and travel. Of course, this is attracting investment money and increasing the use of cryptocurrency in ecommerce and banking, helping to raise the cryptocurrency price. Bitcoin and Ether have rocketed in price, reaching all-time highs. They are in rare supply and unlike paper currency, more can’t be printed.

For starters, remember that cryptocurrency investing and the stock market are actually two separate arenas, though they increasingly overlap. Here’s the distinction:

- Stock market → This is where you buy and sell ownership shares in companies (equities), exchange-traded funds (ETFs), or other securities regulated by government agencies (like the SEC in the U.S.).

- Cryptocurrency market → This is a digital-asset market where people trade tokens like Bitcoin, Ethereum, and thousands of others. It’s mostly decentralized, operates 24/7, and isn’t regulated in the same way traditional securities are.

Cryptocurrency Trading Platforms

Is buying cryptocurrency another way to invest in crypto? Yes, and there are many cryptocurrency platforms where you can buy and trade online. Outside of trading cryptocurrency stocks, this is one way of benefiting from cryptocurrency volatility trading including Bitcoin volatility trading.

Here’s a few platforms you might investigate:

Binance: As the world’s largest cryptocurrency exchange by trading volume, Binance is known for its high liquidity, which ensures users can quickly buy or sell assets. It offers a vast selection of over 450 cryptocurrencies and has some of the lowest fees in the industry. It’s a comprehensive platform with a wide range of advanced trading features, including futures and margin trading, and it also provides opportunities to earn passive income through staking and lending.

Coinbase: Coinbase is widely considered the best platform for beginners due to its user-friendly interface and strong reputation for security and regulatory compliance. It makes buying, selling, and storing a select range of major cryptocurrencies very simple. For more experienced users, Coinbase also offers “Advanced Trade,” which provides a lower fee structure and more powerful tools.

Kraken: Kraken is a veteran in the crypto space, known for its focus on security and low fees. It offers a wide variety of cryptocurrencies and advanced features like margin and futures trading. Its fee structure is tiered and can be very competitive for high-volume traders.

Gemini: With a strong emphasis on security and compliance, Gemini is a trusted platform, particularly for experienced and high-net-worth investors. It offers robust security standards, including two-factor authentication, and is one of the few exchanges to offer FDIC and crypto insurance. It also provides an “ActiveTrader” platform with advanced tools for serious traders.

Crypto.com: This platform stands out for its mobile-first approach, offering a user-friendly app and an extensive ecosystem of products. Its strengths include a wide selection of over 400 cryptocurrencies, competitive fees, and a popular Visa card program that offers crypto cashback rewards and other perks.

KuCoin: Often referred to as the “People’s Exchange,” KuCoin is a good choice for those looking to trade a vast number of altcoins, as it offers a selection of over 700 cryptocurrencies. It is known for its low trading fees and a variety of features, including futures and leveraged tokens, making it a good fit for experienced traders interested in a wide array of digital assets.

OKX: A major international exchange known for its low fees and extensive margin and futures trading options. It supports a large number of cryptocurrencies and offers high leverage on futures. OKX is a good choice for active and sophisticated traders who want access to a variety of derivatives products.

Uniswap: Unlike the other platforms on this list, Uniswap is a decentralized exchange (DEX). Its key strength is that it allows users to trade crypto directly from their own wallets without a central authority. This provides censorship resistance and self-custody of funds, as there is no intermediary holding your assets. It is a leading platform for trading new or less common ERC-20 tokens on the Ethereum blockchain.

Tom Lee is all in on Cryptocurrency

With top analysts such as Tom Lee of Fundstrat taking a bigger role in supporting cryptocurrency as well as helping us understand it, and forecasting massive increases in asset prices, there is still big potential to the upside. Yet there is risk in this investment sector, and it’s wise to get educated, beginning with general awareness of what cryptocurrency is. Tom is particularly bubbly about Ethereum.

If you’re considering getting exposure—whether by owning crypto directly, investing in crypto-related companies, or via funds—here’s how to approach it wisely, what to watch out for, and how to pick good assets.

Why the Hype—and Why the Risk

Crypto has features that attract investors:

- Decentralization, scarcity (especially for Bitcoin), innovation in smart contracts, DeFi, etc.

- Potential for very high returns, especially when adoption accelerates or speculative interest is high.

But there are strong counterbalances:

- Volatility: Prices can swing wildly, sometimes in short spans of hours or days.

- Regulatory risk: Governments are still figuring out how to regulate crypto. Rules can change quickly, affecting exchanges, custody, taxation, etc.

- Security risk: Hacks, theft, loss of private keys, platform failures. You may lose access permanently.

- Lack of protections: Many crypto assets are not securities; many platforms are not insured or regulated like banks.

- Illiquidity, project risk, and failure: Many lesser-known cryptos or startups fail, have weak teams, unclear use case, or poor execution.

FOMO investing? So the key is: don’t jump in because of fear of missing out. Plan, understand, and limit your downside.

Avenues for Investing in Crypto

There are several paths to getting exposure to crypto or crypto economics. Each has trade-offs.

| Method | Pros | Cons / Key Risks |

| Buying crypto directly (coins/tokens, e.g. Bitcoin, Ethereum) | Full exposure; huge upside if adoption grows; ability to use features like staking, DeFi, etc. | Extreme volatility; custody/security burdens; regulatory and tax complexity; potential for hacks or losing keys. |

| Crypto-ETFs, ETPs, trusts | More regulated; easier to access via brokerages; less hands-on (no wallet management); often diversified or focused on major assets. | Fees; maybe less upside than direct holding; some tracking error; regulatory or custody risk still nonzero. |

| Crypto-related stocks / equities (mining companies; exchanges; hardware providers; companies with big crypto holdings) | Potential for indirect exposure with possibly lower volatility; ability to tap into traditional investing instruments; maybe dividends; easier to analyze via financial statements. | Company specific risks; correlation with crypto but also with equities/other sectors; financial risks (e.g. energy or regulatory costs for miners); sometimes overvaluation; dependent on how much crypto exposure is real vs. speculative. |

| Funds, mutual funds, specialized trusts | Diversified, professionally managed; might provide exposure to several crypto companies or assets; ease of investing. | Fees; less control; sometimes less transparency; might include underperformers. |

| Derivatives / futures / options | Can hedge; can leverage; sophisticated exposure or speculation. | High risk; potential for large losses; complexity; margin calls; regulatory restrictions for retail in some places. |

How Much of Your Portfolio to Allocate

Because of the high risk, most advisors suggest limiting how much of your total portfolio you allocate to high-volatility assets like crypto. Some common guidelines:

- Consider only using disposable income (money you can afford to lose).

- Perhaps no more than 5-10 % of your portfolio allocated directly to crypto or crypto‐heavy assets, depending on your risk tolerance.

- The rest of your portfolio should be diversified across more stable assets (stocks, bonds, etc.).

Criteria for Choosing Good Crypto & Crypto-Stocks

If you decide to invest, here are some factors to evaluate so you pick wisely.

For Crypto Assets (coins/tokens):

- Market cap & liquidity: Big, liquid cryptos tend to be safer (though still risky). Less chance of being frozen out or losing value dramatically from low volume.

- Use case & network strength: Is there actual demand for what it does? Smart contracts, DeFi, payments, etc. Developer activity, community, adoption.

- Security / technology robustness: Has it been audited? Are there known vulnerabilities? How is the consensus mechanism (Proof of Work vs Proof of Stake etc.)?

- Regulatory clarity: Is the token clearly legal in your country? Any upcoming regulation that might impact it?

- Governance and tokenomics: Inflation rate, supply cap, distribution, incentives, how upgrades are managed.

- History of performance & volatility: How has it done in bear markets, stress tests, etc.

For Crypto Stocks / Equities:

In addition to standard stock analysis, also check:

- How much exposure the company has to crypto (e.g., miners whose value depends on crypto price, exchanges, companies holding Bitcoin on balance sheet).

- Cost structure: energy costs for miners; regulatory costs; competition.

- Profitability / margins; balance sheet strength (because downturns in crypto price will hit earnings).

- Management quality and track record.

- ESG & sustainability concerns (especially energy usage).

- Correlation with crypto assets, but also with broader equity markets—some stocks move more with crypto, some less.

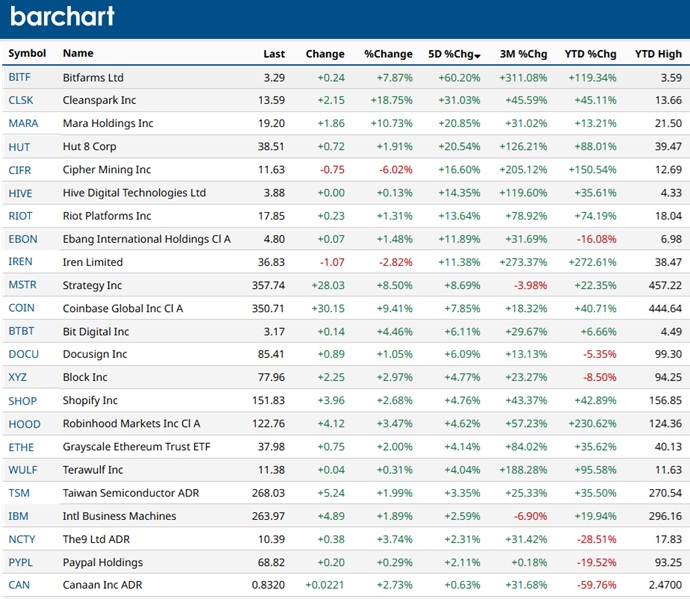

Examples: Crypto-Exposed Stocks & ETFs

Here are some of the more commonly cited companies and instruments that give exposure to the crypto space. (This is not investment advice, just examples to illustrate.)

- Mining companies: Marathon Digital Holdings (MARA) is one.

- Crypto exchanges: e.g. Coinbase (COIN).

- “Holding companies” or firms with crypto on their balance sheet: MicroStrategy (MSTR) is famous for holding large amounts of Bitcoin.

- Hardware / infrastructure providers: companies that supply mining machines, semiconductors, or data centres. These sometimes give indirect leverage to crypto price.

- ETFs / crypto‐ETPs: Funds that track Bitcoin, Ethereum, or baskets of crypto‐exposed firms.

Risk Management Strategies

To reduce downside and avoid getting caught off guard, these are good rules to follow:

- Only invest what you can afford to lose: This is classic but essential.

- Diversify: Don’t put all your exposure into one coin, or one stock, or one sector.

- Have a horizon / decide whether you’re investing or trading: Long-term investors do better often when they ride through volatility; traders need discipline, exit strategies, and risk thresholds.

- Use stop-losses or other downside protection for equities or even some crypto platforms.

- Rebalance occasionally: If your crypto investments run up and grow to be a much larger share of your portfolio than you intended, you may want to trim.

- Stay informed: Regulation, technology, security incidents—all can shift risk quickly.

- Security practices: If holding crypto directly, use reputable exchanges, secure wallets (especially hardware or cold wallets), keep private keys safe.

What to Watch Out For / Red Flags

- Projects or coins with overpromised features but weak or missing delivery.

- Exchanges or platforms that are not regulated or well audited.

- Excess energy-intensive miners with rising energy costs or unsecure supply chains.

- Poor transparency in management, insider ownership, or token supply.

- Unrealistic promises of returns; marketing hype; pump-and-dump behavior.

Putting It Together: Safe Cryptocurrency Investing Limits

Here’s how someone with moderate risk appetite (comfortable with some volatility, but not wanting wild swings) might structure exposure:

| Asset Type | Percentage of Total Portfolio* | |

| Stable full-market equities / index funds / bonds etc. | ~70-80 % | |

| Crypto / crypto-related assets | ~5-10 % direct coins (e.g. BTC, ETH) | |

| Crypto-stocks / equities (mining, exchanges, etc.) | ~5 % | |

| Crypto-ETFs or diversified funds | ~2-5 % | |

| Cash reserve (for opportunistic buying / emergencies) | ~5-10 % |

* Adjust all this depending on your age, financial situation, risk tolerance. Someone younger might take more, someone closer to needing capital might take less.

Final Thoughts about Cryptocurrency Investing

Investing in crypto and crypto equities can offer exciting upside, especially in bull markets and with rising institutional interest and adoption. But it’s not for the faint of heart. It requires doing your homework, managing risks deliberately, and being prepared for volatility, regulatory surprises, and sometimes losses.

If you approach it with humility, limit the amount you allocate, diversify, and pick assets with strong investment value fundamentals (good teams, real use cases, good analyst ratings, transparent operations), you increase your chances of positive long-term outcomes. And remember: it’s perfectly reasonable to take a small exposure just to learn, rather than betting the farm.

All that’s left after your learning process, is choosing the currencies or assets you want to buy.

See more on the 5 year stock market outlook, the Bitcoin price forecast, and whether to invest in AI stocks. Discover the best stocks to buy right now.

Title image courtesy of Stockcake.