Housing as Canada’s Best Path to Growth and Affordability

The Canadian economy is beginning to slouch significantly and the Liberal government appears to lack any solutions to save it from further harm.

It’s a depressing scenario for all Canadians including those looking for a place to live, or a home to buy, or who need a job. A new government could save the day by opening up Canada’s vast wealth, now entombed in regressive legislation. It’s my view that President Trump will make a deal with a new Conservative government. And the party in waiting, lead by Pierre Poilievre, has promised a list of remedies for the Canadian housing and economic disaster that’s forming.

Given the Liberal media isn’t informing Canada of the dangers ahead, the housing market in particular could be headed for something unimaginable. Consumer debt is heavy and many Canadians are losing their jobs, facing mortgage refinancing they can’t afford, and a future of low trade with the Americans. If the Liberals stay in power and take Canada on this fantasy tour of Europe trade (Europe is crashing), and trading prospects that Canada has never developed, we will see the worst outcomes.

Liberal Prime Minister Carney’s list of 20 self-glamorized major “nation-building” projects do not involve exporting more oil and natural gas. There are housing initiatives that schedule construction over ten years. At the same time, he has said little about slowing or stopping the importation of migrants as the economy moves deeper into recession (last two quarters saw a GDP retraction, which will worsen this fall).

Liberal Prime Minister Carney’s list of 20 self-glamorized major “nation-building” projects do not involve exporting more oil and natural gas. There are housing initiatives that schedule construction over ten years. At the same time, he has said little about slowing or stopping the importation of migrants as the economy moves deeper into recession (last two quarters saw a GDP retraction, which will worsen this fall).

Taking Control and Opening Canada Up to Prosperity

Stimulating the housing market is an idea some, such as Pierre Poilievre are posing as a “Trump proof” domestic economic expansion strategy. It involves hiring Canadians, using Canadian technology and materials. It sounds infinitely doable to me. However, there are groups who don’t want more housing and to keep their real estate investment values high — and these are wealthy commercial investors who overleveraged on real estate. Resistors include Canadian home sellers who still demand their dream price for their property.

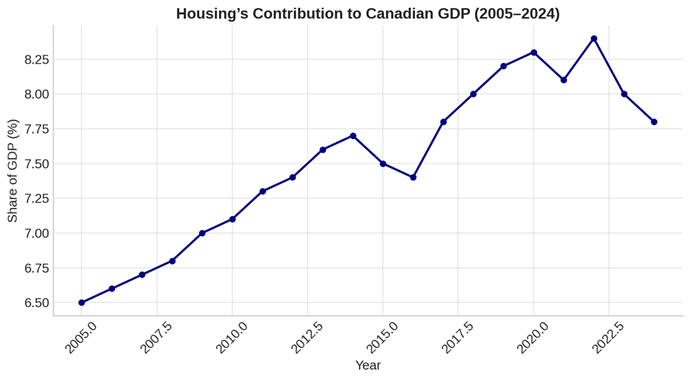

Could stimulating the housing market be enough by itself be sufficient to lift the economy? At the very least, it would be a significant stimulus added to massive growth in natural resource extraction/refining and exports, producing cheaper energy prices and construction materials for homes and industry. In 2024, the housing sector was associated with over 1.2 million jobs and roughly $143 billion of GDP activity in Canada. Double or triple home construction and the numbers look impressive. I’m not sure of the multiplier effect, some pose a 2X multiplier, but we can see it would be substantial.

The issue isn’t just big investment in the housing market though as you’ll read below, it’s in surmounting regulatory/cost blockades to development. There is a proposal for the provincial and Federal governments to provide rebates of $50k and $80k for new home purchases, but pouring more money on the demand side only pushes home prices up further.

Canadian Economy Needs a Lift in Late 2025

Stimulating the housing market comes at a good time, as thousands of homeowners are likely to lose their homes in the next 16 months as they renegotiate their mortgages. The payments will be too much and they’ll need to sell. All that hard-earned wealth flushed down the drain. It’s very sad. So is all the homelessness and suffering of low-paid Canadians who pay up to 70% of their net income for their home rental. Add on high food and energy prices and you see how Canadians need relief.

You might ask, how could you not stimulate the housing markets from Vancouver to Toronto to Halifax and relieve Canadians pain? Who do you think would stand in the way? The situation is particularly intense due to the fact the Liberals do not look competent or willing to resolve the trade issue with the US. If Carney and the Liberals can’t be defeated via a non-confidence vote, 2026 could be a deep dive for housing, jobs and the economy. We need to do something now. Their enacted legislation has thwarted supply of almost every material and form of energy needed, and we haven’t trained enough construction workers, thus the shortage has many causations.

What is the State of Canada’s Housing Market?

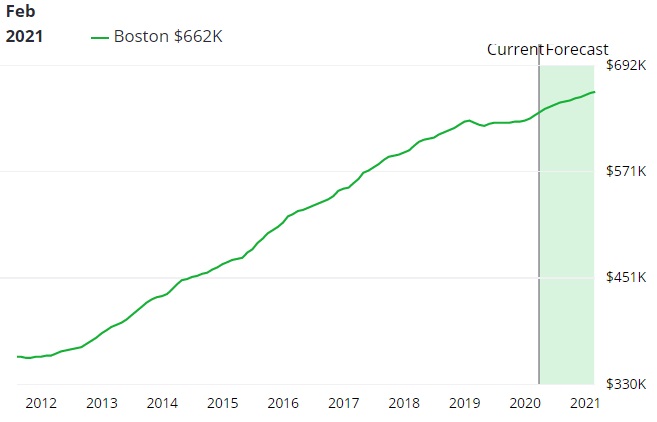

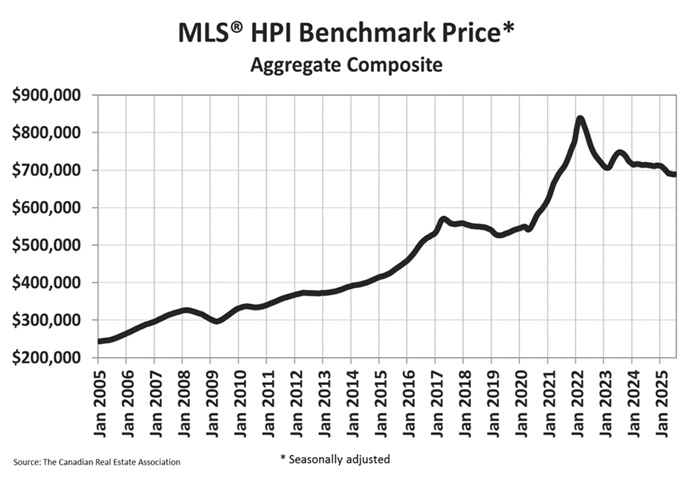

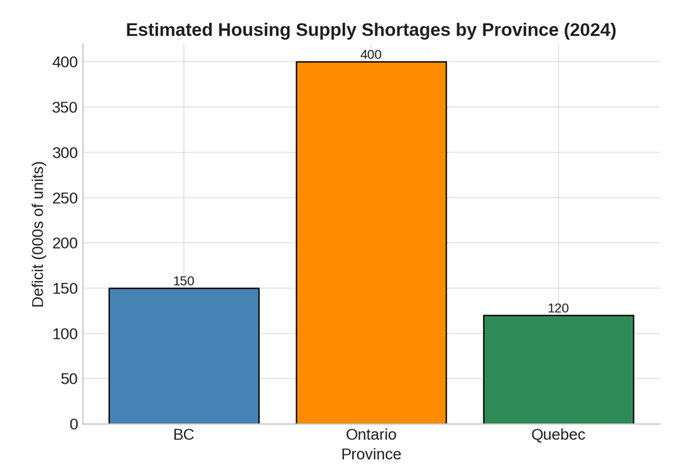

Canada’s housing market cooled during 2023–25 under the weight of higher interest rates, construction costs and higher home prices. Yet, despite the slowdown and easing supply problems, affordability and economic uncertainty are thwarting construction and sales. If Canadians can’t afford them, it makes builders pull away from the risk. The supply of homes remains far below what growing cities require, particularly acute in British Columbia, Ontario, and Quebec.

These three provinces hold two-thirds of the nation’s population, and in them, the crisis feels most severe. In Vancouver, young families find themselves priced out even of modest condos. In Toronto and Mississauga developers have shelved projects because costs and approvals make new construction financially unworkable. A flood of condos remains unoccupied in Vancouver and Toronto. And in Montreal, renters compete for limited vacancies as purpose-built rental construction lags. And purpose-built rentals are typically the most expensive form.

With a growing body of renters, including Gen Z’s and Millennnials who want to start families, the future being painted looks dim. They’re at risk of having their dreams of a good life dashed. Homes are critical assets that make lifestyles more affordable, credit worthy and create long-term wealth. Millions more Canadians will fall into the have-nots category — not a trend we want to see continue.

Artificial Scarcity: Enhancing Real Estate Values

This disconnect between Canadians and the ruling class reveals a troubling truth: Canada’s housing crisis is not simply a matter of market forces. Home prices and supply have been distorted by years of policy choices at every level of government.

Zoning restrictions, development charges, taxes, fees, slow approvals, and contradictory regulations have created an artificial shortage of homes. Housing construction, home improvement, and financing should be drivers of jobs and prosperity yet instead are a bottleneck holding back our economy and creating nationwide suffering.

Falling Mortgage Rates Won’t Resolve Much

This fall of 2025 brings the threat of an economic and housing market crash. Those who doubt this scenario base their view on improving trade, continued USMCA deal, and a strong consumer demand. However, President Trump is no friend to the Carney government opening the door to even more tariffs. And consumers are facing higher unemployment and the government is slowing their temporary foreign worker uptake. The possibility of a Toronto housing market crash is plausible as every month the Toronto real estate market suffers declines, with a cascade of events happening this fall.

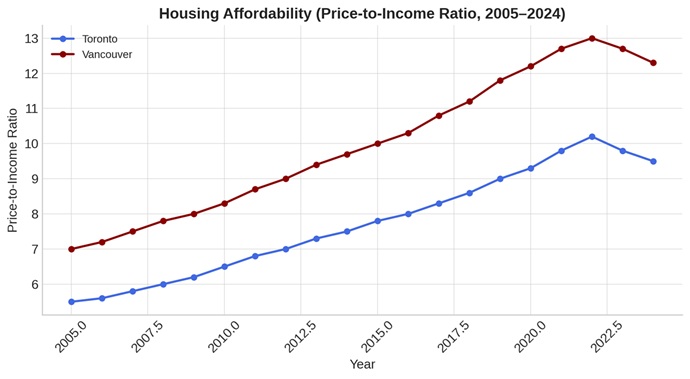

Housing affordability as seen here, is improving of late, but only because demand from buyers is decaying.

How We Got to This Point: Artificial Scarcity

Canadians often hear that the housing markets are blown by the prevailing winds through interest rates or global demand. But the reality is that much of today’s unaffordability has been manufactured by the Canadian government’s policies.

-

In BC, strict zoning rules keep most of Metro Vancouver locked into single-family housing, even near major transit corridors. Development approvals can take years, adding costs that discourage builders.

-

In Ontario, layered municipal bylaws and sky-high development charges push the cost of new housing far above what buyers can afford, delaying projects or killing them outright.

-

In Quebec, a combination of rent control policies and slow permitting has discouraged builders from expanding rental supply, leaving Montreal short of tens of thousands of rental homes.

These are not laws of economics. They’re choices by debt-ridden governments and the financial elite. The long-running anti-resource development policies of the Liberals have decimated our economy. It will take a loud voice of Canadians just like you to change this around to enforce investment, home building, lower home prices, and make them affordable enough to buy. Because Canadian paychecks aren’t going to grow 20% in the next year. They are likely to fall, which is one factor housing economists don’t even mention.

Housing’s contribution to GDP has risen, yet it hasn’t been allowed to grow.

A crashing economy means governments feel justified in “not bothering with home construction.”

How Canada’s Levels of Government have Made the Housing Problem Worse

Canada’s three levels of government each share responsibility for a crisis they promised to solve. Instead of working together, policies have often clashed or cancelled each other out. If one policy doesn’t stop building, then another one does. It’s the NBAA – no building anywhere anytime” policy. It’s made foreign investors give up on Canada.

Federal Government

Ottawa has focused heavily on demand-side programs — such as tax credits for first-time buyers and mortgage insurance schemes — for a little boost in purchasing power for a gifted few, without addressing supply needs. Federal funding for housing is often spread thin, tied up in bureaucracy, or aimed at programs that take years to materialize. Meanwhile, immigration levels have surged by millions putting intense pressure on limited housing stock and forcing large immigrant families to stuff themselves into houses or apartments, making living conditions unbearable for them.

Provincial Governments

Provinces hold the constitutional authority over municipalities and land-use planning, but too often they pass the buck. Ontario’s planning rules, for instance, still leave municipalities free to stall projects, jack up fees and taxes, even as the province acknowledges the need for 1.5 million new homes. British Columbia has been slow to open up zoning in Metro Vancouver, despite widespread recognition that density is needed near transit hubs. Quebec continues to emphasize tenant protections while neglecting the supply of new builds that would relieve pressure.

Municipal and Regional Governments

Cities bear the brunt of housing demand, yet local councils are most vulnerable to NIMBY (“Not In My Backyard”) opposition. Regional governments won’t make millions of hectares of available land open to subdivisions or new towns. And municipalities (the number one villain) impose height restrictions, parking minimums, lengthy consultation processes and more which delays projects for half a decade or more or ends them outright. Development fees — meant to fund local infrastructure — have ballooned not from need but for bloated bureaucracies with outrageous salaries. York Region in Ontario for instance, had its “Sunshine list” of $100k salaries rocket from 100 to over 1,000 employees. Now municipalities are resorting to automated speed cameras to capture millions to keep them afloat, instead of reorganizing and allowing low-cost housing construction projects.

The net effect is a broken system where federal money cannot unlock projects, provinces hesitate to confront restrictive local bylaws, and municipalities raise expenditures increasing debt loads while limiting approvals for new housing projects.

Why Fixing Housing is about More than Homes

Some Canadians may wonder: why prioritize housing development now, in an uncertain economy? The answer is that housing is not just about roofs over heads. It’s about jobs, investment, and long-term prosperity. These are activities we control and are difficult for other nations to meddle in.

Residential construction is one of the largest employers in the country, supporting more than a million jobs across trades, materials, and professional services. Every new home built triggers activity in manufacturing, finance, retail, and local services. The economic multiplier is enormous: when housing investment grows, the whole economy feels the lift.

In the AI unemployment growth years, jobs in trade are a healthy antidote to economic recession and joblessness.

In today’s world of volatile global trade and geopolitics, housing offers something rare — a domestically controlled growth engine. Unlike oil exports or auto manufacturing, housing demand comes from within Canada, and the policies that unlock it are entirely in our hands. It’s all internal and it supports a healthy, vibrant workforce, and it generates big economic gain.

What Needs to Change: A New Housing Plan for Canada

If Canadians want affordability and economic growth, governments must give up on the fake blame game, and show their own commitment to building a coordinated housing strategy. That requires transparency, empathy for Canadians, empowering legislation, and insistence on execution and accountability.

Federal Actions Needed

-

Tie funding to outcomes: Federal transfers for housing should only flow to provinces and cities that meet specific targets for new completions, not just announcements.

-

Expand financing tools: Broaden CMHC construction loans and guarantees to de-risk rental and multi-family projects.

-

Support workforce growth: Fund rapid training programs for trades to address labour shortages that slow construction.

Provincial Actions Needed

-

Override restrictive zoning: Provinces should legislate minimum density allowances near transit, universities, and major employment hubs.

-

Streamline approvals: Impose maximum timelines for municipalities to approve applications, with automatic approvals if deadlines are missed.

-

Reduce development charges: Cap or phase fees so they reflect infrastructure costs, not municipal revenue needs.

Municipal Actions Needed

-

End exclusionary zoning: Permit multi-family housing in most residential zones by default.

-

Digitize and accelerate permits: Replace paper-based, discretionary processes with transparent online systems.

-

Partner with builders: Use public land for joint-venture housing, prioritizing rental and affordable units.

Building Public Support

For too long, housing has been framed as a zero-sum game: one side fighting for affordability, another protecting “neighbourhood character” and another group protecting the value of their real estate wealth. This framing divides communities while ignoring fairness and the shared benefits of more housing.

Canadians should view housing as a vital national asset and economic driver, producing excellent, high-paying jobs and a positive economic climate. More homes means no homelessness, where children can live near their parents, workers can afford to stay in cities working near their workplace, and seniors can downsize without leaving their communities. A stronger housing sector means stable, homegrown economic growth that is not hostage to US or European politics or global market trends. We own it, we control it.

Conclusion: A Call for Commitment from All Canadians

Canada’s housing shortage is a problem of our government’s making, created by years of restrictive laws, costly fees, and slow approvals. But because it is a manufactured problem, it is also a solvable one. By reforming anti-development rules and demanding accountability from all three levels of government, we can unlock the housing supply Canadians need.

There are plenty of bills and changes to laws that can be implemented but it’s all conjecture (including Pierre Poilievre’s bill requiring muncipalities to build, or they forfeit Fed transfer payments).

Besides massive funding and tax breaks for building, is to reverse what was done by the Liberals, to completely open all supply chains and attract investment in Canada. If Canadians can commit to building again — to seeing housing not as a liability but as an engine — we can turn this crisis into the foundation for long-term prosperity.

See more on the Toronto housing market, Toronto condo market and the issues that might create a housing crash n in Toronto.