GenZ and Millennial Best Homes to Buy

Right now in 2026, cold winds are howling in the housing market. The conversation around the dinner table for young couples and single women who are most interested in buying a home, has gone from “where do we want to live?” to “how is this even possible?”

Young buyers (anyone under 40) frustration and outrage at the system for breaking everyone’s expectations about quality of life, access to housing and jobs, and ability to capture equity is palpable. Young people today are much more aware of the long term consequences of not owning a home. Relief from this market’s misery will not ease anytime soon.

I don’t need to tell you about what you feel every day. What our governments have created is a catastrophe, that’s only just beginning. With housing supply and high mortgage rates seemingly stuck, the opportunity to purchase a house or condo seems remote, but let’s not give up too easily. Educating yourself and becoming clever in property search, financing, tax benefits, and sales negotiating means you’re tilting the table back to your favor.

I don’t need to tell you about what you feel every day. What our governments have created is a catastrophe, that’s only just beginning. With housing supply and high mortgage rates seemingly stuck, the opportunity to purchase a house or condo seems remote, but let’s not give up too easily. Educating yourself and becoming clever in property search, financing, tax benefits, and sales negotiating means you’re tilting the table back to your favor.

Don’t assume the housing market is opaque and inflexible with few options for affordable housing for first time buyers.

Feel Optimism that the Market Can Work for You

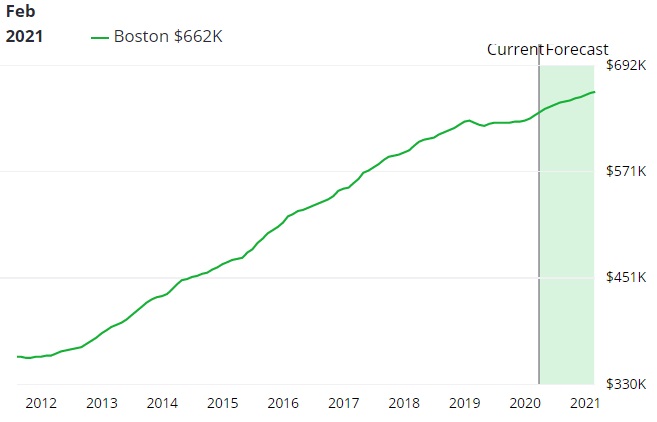

And no one knows for certain what house prices will be in 5 years. We had a 20% dip before, and homes are extremely overpriced with artificial factors causing it. Re-examine the housing market update and take a quick look at the 5 year housing market forecast to see the road ahead.

This will free you up mentally and emotionally. All the techniques and tactics you’re finding here help you position yourself to save money for a down payment and qualify for financing. Then you can search for and connect with a competent real estate agent who has empathy for your situation. It’s time for ingenuity, connections and resourcefulness.

Find a Property that Thaws out your Frozen Dream

Among the acquisition opportunities that are out there, there is one that may stand out as providing the ideal short term and long term outcomes for Millennial and Gen Z buyers. It’s the two-unit conversion.

The Two-Unit Conversion

My niece just accomplished this type of purchase (side split for two-unit conversion) and it’s working well. In this young couple’s case, they occupy the upper half, while her brother is co-owner of the lower half (a nice fixer upper too) on a good-sized property. It’s brilliant thinking, adjusting to what the market will offer, and speeding up the process of building equity and wealth. Add on bank of mom and dad, and there’s real opportunity.

Why is the two-unit conversion option the best? It’s mostly obvious with its extra unit which can be a rental, or a co-owned unit. Co-ownership is a big trend right now. The rental income angle is something to take seriously, because prices may not fall, and renters remain in a desperate situation, which means rents will remain high – high enough to help you buy your first property (it’s a big thing to bankers).

Making your Pivot to “Asset Engineer”

If the traditional path is blocked, you can pivot to being entrepreneur. The most resilient buyers have stopped looking for a “finished” home and started looking for a convertible asset.

This is especially true for single female buyers, who are currently outpacing single men in the market. For a woman buying solo, a home isn’t just shelter; it’s a stake in her own financial sovereignty. You are creating a “Mortgage Helper” that turns a liability into a self-funding asset. And if you are a single male, changes in the job market makeup signals that your turn may not be far off too.

The Blueprint—Finding the “Hidden Second Home” in a Property

So, how do you find the right property to convert? This is where your Realtor, with their tools and experience becomes your most valuable strategic partner. You aren’t looking for the prettiest kitchen, you’re looking for the best bones for a conversion.

The Anatomy of a Suite-Ready Home

When touring properties with your agent look for these three “gold-mine” features:

- The Side-Split or Walk-Out: those who might have or could have a secondary entrance that doesn’t require walking through the house’s main living room are the “holy grail.” In 2026, privacy is the highest-value commodity for renters.

- Vertical Plumbing Alignment: Look for a basement area located directly beneath the main floor kitchen or bathroom. This “vertical plumbing” can save you $10,000 to $15,000 in renovation costs during the conversion.

- 7-Foot Ceilings: To create a legal, bank-approvable suite in 2026, ceiling height is non-negotiable. If the basement feels like a cave, it will likely never be a legal unit. If it’s 7 feet or higher, you’re looking at a rental income paycheck.

Zoning and “By-Right” Density

2026 has brought a wave of zoning reform. Many municipalities now allow Accessory Dwelling Units (ADUs) or secondary suites “by right.” This means you may not need a year-long battle with the city council to build your rental unit. A savvy Realtor will help you filter for these specific zones, ensuring your investment is protected by law from day one.

The 2026 Financing Magic for American Home Buyers

Mortgage Interest Deduction (Federal)

- If you itemize deductions on your federal tax return, you can deduct the interest you pay on your mortgage for your primary residence up to certain limits.

- PMI has become deductible again for 2026 tax filings, even if you were required to buy PMI because your down payment was below 20%.

- In some states, Mortgage Credit Certificate (MCC), Mortgage Credit Certificates (MCCs) lets you claim a dollar-for-dollar tax credit for a portion of the mortgage interest you pay — up to a yearly limit (often $2,000).

- Recent federal law increased the SALT deduction cap to up to $40,000 (from a previous $10,000 limit) for many taxpayers in 2025–2029.

Other potential helpers:

- Bipartisan American Homeownership Opportunity Act (2025): Aims to offer a tax credit equal to your down payment up to $50,000 (with income limits). This could be taken at purchase or up front.

- First-Time Homebuyer Tax Credit (2025): Another proposal would offer a refundable tax credit of up to $15,000 to qualifying first-time buyers.

- President Trump’s newly announced policy will let Americans use funds from their 401(k) retirement accounts to help pay for a home down payment — potentially without the usual early-withdrawal penalties and taxes that apply today.

2026 Property Conversion Checklist

Here is the 2026 Property Conversion Checklist. Your Realtor can use this buyer checklist during a walk-through to help a buyer visualize the “math” of the house. It focuses on the “Three Pillars” of a legal conversion: Legal/Zoning, Physical Infrastructure, and Financial Viability.

The Two-Unit Conversion Checklist

Use this during your initial property tour to separate “emotional buys” from “strategic assets.”

| Category | Feature to Inspect | Why it Matters (The 2026 Standard) | Your Rating (1-5) | |

| LEGAL & ZONING | “By-Right” Zoning | Check if the property is in a 2026 Reform Zone (allows up to 3 units without a public hearing). | ||

| Parking Ratio | Most 2026 bylaws require 1 designated spot per unit. Is there room for a tandem driveway or pad? | |||

| Setback Minimums | If you plan on a side-entrance addition, ensure there is 1.2m of clearance from the property line. | |||

| STRUCTURE | Ceiling Height | Critical: Must be min. 1.95m (6’5″) for a legal unit. If it’s lower, you’ll need to “dig down” ($$$). | ||

| Separate Entrance | A dedicated exterior door (not through the main house) is the #1 privacy and legal safety requirement. | |||

| Egress Windows | Bedroom windows must be large enough for a person to crawl through (min 0.35m² opening). | |||

| UTILITIES | Plumbing Stack | Look for “Vertical Alignment.” Is the main floor kitchen directly above the basement kitchen area? | ||

| Electrical Panel | A 100-amp panel is usually insufficient for two kitchens; look for 200-amp or space for a sub-panel. | |||

| HVAC / Ducting | Does the basement have independent heat control? 2026 tenants expect separate thermostats. | |||

| LIFESTYLE | Soundproofing | Check for joist depth. You’ll need “Resilient Channels” or Rockwool to keep the “Village” quiet. | ||

| Shared Laundry | Is there a “neutral” zone (mudroom/hall) where both units can access laundry without entering the other’s space? | |||

| Outdoor Space | Can the yard be partitioned? Private outdoor space can increase rental income by 15% in 2026. |

How to Score the Property

How do you evaluate a property?

- 18–30 Points: The “Wait” Zone. High renovation costs. Unless the purchase price is significantly below market value, the “math” may not bridge the gap.

- 31–45 Points: The “Strategic” Buy. Good bones. The conversion is straightforward and will likely qualify for “As-Improved” financing.

- 46–60 Points: The “Unicorn” Asset. This house is essentially a duplex waiting to happen. Move fast—these are the most competitive properties in 2026.

The Realtor’s Handshake—Your Strategy Team

You shouldn’t be doing this alone. A Realtor in 2026 is no longer just a person with a key to the front door; they are your advisor.

When you find the right agent, focused on your specific life challenge, they won’t just show you “nice neighborhoods.” They will bring a contractor to the viewing. They will pull the zoning bylaws before you make an offer. They will help you run a “Pro Forma” (a mini business plan) to see if the rent from the basement will cover 40% of your mortgage.

For a single woman or a young couple, this partnership is the difference between a stressful purchase and a confident investment. Your Realtor’s job is to see the potential in a “tired” bungalow that everyone else is passing on.

Reclaiming Your Dream of Home Ownership

The “traditional” home-buying dream itself might be under renovation, but it isn’t dead. By choosing the path of the two-unit conversion, you’re building a productive asset that might offer a financial buffer, lower down payments, tax write-offs, and a quicker route to equity.

In 2026, resilience and strategy are the new status symbols. Buying a home with a rental suite is a declaration that you won’t let the market dictate your future. You’re not just a buyer anymore—you’re the architect of a more secure future, where you keep the wealth you generate.

Wondering about buying a house during a downturn? Buying the dip can bring big savings in price and mortgage payments. Is the 2026 housing market looking better or worse? Realtors, discover how to create persuasive content to grow your lead conversion rate. Get the best real estate marketing services at an affordable price.