Best Cities to Invest in Real Estate

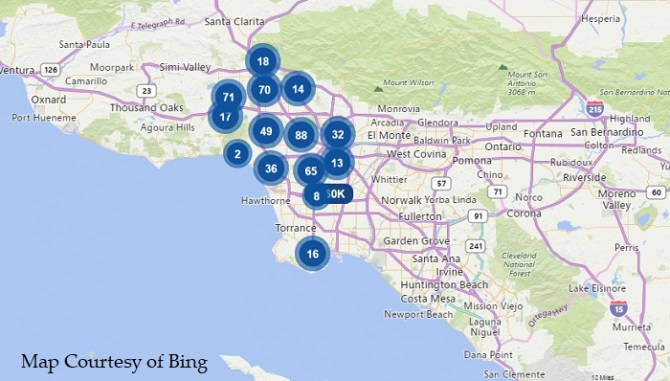

Best Cities to Buy Real Estate in 2024 Looking for the right cities to buy real estate in 2024? You’ve probably got your favorites in mind, but why not start again from scratch and find cities and towns that you might not have known are real gems? In this phase of your research why not…