What Will Push Toronto’s Housing Market into a Slide?

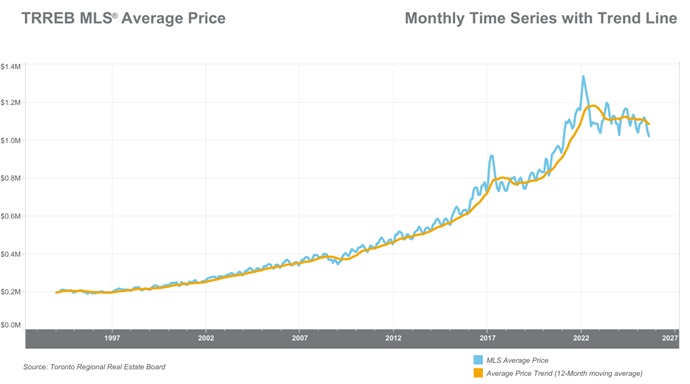

The GTA housing market has been on edge for months now. This is new for a market that has endless buyer demand but no supply. And you might think that a lack of supply will ensure no crash happens. But it’s on the other side where buyer demand is drying up that will drive a serious slide.

The fact is that price/income is a bubbled high for any city in North America, makes the TO market precarious if anything happens to the income of Torontonians. Mortgage payment default, more listings, lower rent, and higher unemployment are all precursors to a crash that might mirror the 90’s or potentially the financial crisis of 2008. The fact is, this is not the USA, it’s Canada where investment has been shunned and home prices inflated beyond belief.

Too much printed money in the economy, continued high government spending and excessive immigration, huge deficit spending in Toronto, the effects of the failed USMCA agreement looming ever closer, along with a failure of the Federal government with it being forced to cut spending and begin laying off thousands of Federal workers. When all the dominoes start wobbling, it’s hard to conceive it won’t crash.

And there are plenty of Torontonians who love a housing crash — renters and buyers.

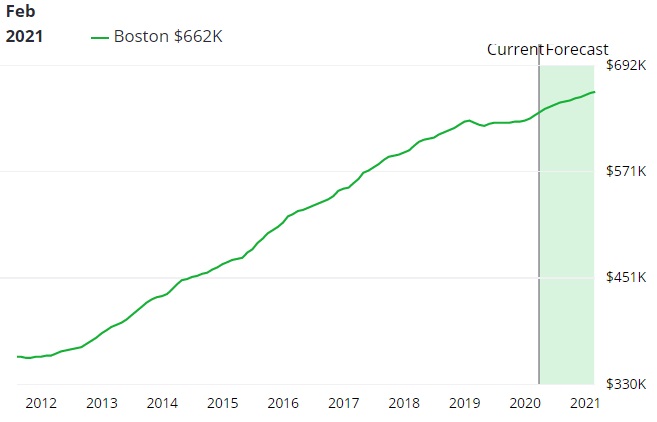

Crash Forecasts Haven’t Come Close at All

We’ve had plenty of forecasts and predictions about Toronto’s market crashing, but it hasn’t. That’s mostly because of continuous billion-dollar money printing and lavish spending by governments. What if Toronto, Ontario and Ottawa must restrict spending and the US trade news becomes particularly grim?

The key here is psychological, because the many factors are complex and intertwined, and it may come down to when the last straw breaks the camel’s back. It’s at a point of exhaustion when the bubble bursts. Promises of rejuvenating housing markets are worn out and with home building construction on the wane, AI unemployment worries growing, and the end of the USMCA and other manufacturing free trade, there is going to be a shock to the Toronto economy within the next 8 months.

The news is that governments, despite promises and big spending plans, won’t be able to rescue the housing market. The new construction decline is the canary in the coal mine, now lower than the miserable 1990s. More to come.

Signals: Builders see no reason to continue building: A report from BILD showed only 300 new homes were sold in August, down 42% from 12 months ago, and of those 300 homes, 118 were condos or stacked townhouses, while the remaining 182 sold were single-family homes.

The Liberals don’t want to make a deal with Trump, and Trump clearly doesn’t care. He’s stated frequently his intent to keep auto manufacturing in the US and bolster US independence. This hasn’t sunk in, and most Torontonians and Canadians believe Trump will back down or chicken out (TACO). Don’t count on it.

The Federal Non-Confidence Vote

For Canadians/Ontarians, the key precipitating factor here might be if the Liberals pass their massive budget spending proposal and remain in power for at least another year. It’s easy for the public to see Prime Minister Carney has no influence nor power to compensate for the bad relationship with Donald Trump and the US. My view is that his and the Liberal’s time is running out quickly. However, they could hang onto power in spite. This would lead to a catastrophic loss of business confidence. Business owners would give up and investors would be firm in holding onto their money.

Carney and the Liberals can only play act their way through much longer. Canadians and their governments are grossly over-leveraged and this leads to layoffs and spending cuts, bank troubles, mortgage troubles, higher taxes and lower GDP. The writing on the wall seems fairly clear.

If we look at just a handful of individually concerning trends — falling international student flows, rising listings, weak employment, household leverage, and a looming trade shock — it lines up in a way that makes a sizeable winter correction not just possible but plausible. Below we stitch these threads together to understand how a crash could happen, what sequence of triggers would be required, and the likely implications for investors, governments, buyers, renters and sellers.

The Startling Facts That Indicate Big Concerns

If you’re a buyer or seller, or a highly leveraged real estate investor, you’re likely not sleeping well. Buying before a downturn is the worst choice possible. And waiting too long to sell, means losing your dream price for perhaps a hundred thousand dollars less. Realtors are hurrying their clients to sell fast. The GTA condo market is a key indicator too, and a landslide there will leak into the residential house segment.

Here are a few worrying trends and data points that support a Toronto Housing Market downturn:

- Condo sales and prices are already falling. TRREB’s Q2 2025 condominium report shows average GTA condo prices fell 5.9% year-over-year, while active listings in the condo segment rose sharply (active listings up ~39% at the end of Q2). Sales volumes were materially weaker.

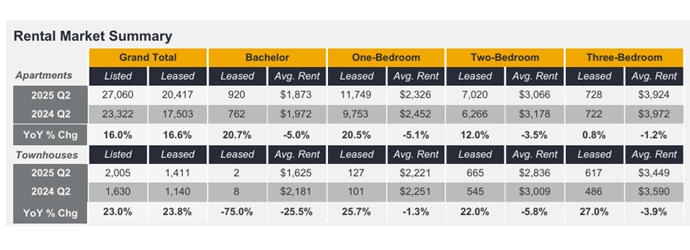

- Rents and vacancies are shifting. CMHC’s mid-year rental update finds a growing purpose-built rental supply drop and warns vacancy rates are expected to rise in most major markets this year; rent growth has cooled despite rents remaining elevated in Toronto. That weakens investor cashflow assumptions for many condo owners.

Toronto Rent Prices Falling. Screenshot courtesy of TRREB. - International student inflows have plunged. Multiple trackers report steep declines in study-permit approvals in 2025: approval rates and volumes are down sharply versus 2024, and IRCC’s 2025 cap is lower than prior years. That removes a large, concentrated source of rental demand and investor confidence for Toronto condos.

- The labour market is softer than headline optimism suggests. Ontario’s employment has slipped from earlier 2025 peaks and unemployment remains elevated (Ontario unemployment around the high 7% range in mid-2025), a quick and direct channel into housing demand. Higher unemployment equates to more listings and lower buyer confidence.

- Monetary policy is behaving like a swing factor. The Bank of Canada cut the policy rate 25 bps to 2.5% in mid-September 2025, but that does not neutralize the fact that funding spreads, mortgage renewals and local affordability pressures still leave many households vulnerable. Just because mortgage rates fall, doesn’t mean buyers will take a blind leap because when job losses hit the news, they’ll be wary.

The Domino Effect: One Thing Leads to Another

A crash doesn’t happen because of one headline or factor. The cascade happens because several shocks align, amplify each other, and break key market strengths.

- External shock to growth and jobs (the trigger). Imagine a material trade shock, a significant manufacturing slowdown, or a sudden cut in auto-sector orders. Ontario’s economy is exposed to cross-border manufacturing demand; a marked drop in factory activity would quickly bleed into payrolls and consumer confidence. Loss of jobs is the most direct and rapid way to remove buyers. (The Bank of Canada has explicitly cited risks from external demand in its deliberations.)

- Employment falls → mortgage stress rises. Even if unemployment rises modestly, the impact on marginal buyers and recently leveraged households is outsized. Many Canadian households still carry high debt relative to income; when incomes stall and mortgage renewals come up, households pull back or fail to make payments, nudging arrears higher. This raises the visibility of stress and raises caution among mortgage lenders. AI unemployment is increasing quickly, and by next summer, this issue will be more intense, even if the neighboring US economy surges. If it does, it would only serve to raise consumer and producer prices.

- Student & rental demand collapses → condo vacancy spikes. A continuing, steep fall in study-permit approvals and international student entrants removes a concentrated tenant pool for downtown condos and investor-owned units. That drop will happen because the Government can’t afford to bring them in as usual. With more unsold and unrented condos on the market, rents soften; investors facing lower cash flow choose to sell or default, increasing inventory further. The TRREB data already show condo new listings and active inventory are rising.

- Listings momentum raises price discounts. As sellers — investors and owner-occupiers — increase supply while buyer volumes fall, days-on-market lengthens and price reductions become the norm. In markets where comparable sales start to print 5–10% lower than prior comparable transactions, appraisal values reset downward. That reduces home-equity cushions and forces some owners (especially leveraged investors) to sell at a loss.

- Psychology and contagion. Once a condo-led correction hits headline numbers (double-digit percentage declines in pockets), prospective buyers delay purchases waiting for “the bottom.” Banks tighten underwriting and interest-rate spreads widen. That withdrawal of marginal demand accelerates declines in entry-level and townhome markets as well — the contagion effect that turns a segmental correction into a broader average-price drop.

If these steps occur over a compressed window of a few months — aided by rising unemployment and a sudden rout in investor confidence — the term “crash” becomes appropriate rather than alarmist.

Why the Condo Selloff Matters More Than Its Share of Housing Stock Would Suggest

Condominiums are often the first to move and the loudest in a downturn for several reasons:

- Concentration of leveraged small investors. Many condo owners are small-scale landlords whose cashflow depends on rental income; they are less able to carry prolonged vacancies or declining rents.

- International-student exposure. A sizable share of downtown rental demand flowed from students and short-term newcomers — a sharply policy-driven drop in that flow creates a near-immediate vacancy shock. ICEF Monitor+1

- Visible inventory and comparables. Condo towers create many proximate comparables; a few price reductions quickly shift perceived market value for neighboring units.

Because condos are the entry point for many first-time buyers, a deep condo correction can poison buyer sentiment everywhere.

Implications for Stakeholders

Investors (small-scale landlords, funds)

- Short-term pain for leveraged investors. Expect cashflow pressure, longer time-to-rent, and the possibility of forced sales. Investors who relied on student tenants or yield compression are most at risk. Stress-test any portfolio to a 10–25% rent decline and a 6–12 month increase in vacancy. Canada Mortgage and Housing Corporation

- Opportunity for well-capitalized buyers. Distressed sales may create bargains for institutional or private equity buyers who can weather vacancies and rework assets — but only if lending remains available and they can underwrite lower rents.

Buyers (first-time & owner-occupiers)

- Delay vs opportunity. Many first-time buyers will delay purchases hoping for bigger declines; that worsens the demand drop. But if you’re a buyer with secure income and low-debt profile, a correction can create a multi-year buying opportunity — selectively, in markets with solid long-term fundamentals.

Renters

- Short-term relief in some submarkets. Rising vacancy should stabilize or reduce rents in student- and investor-heavy pockets; but cities with persistent affordability issues may still see little real relief. CMHC expects vacancy pressure to increase, but rents remain high in many areas. Canada Mortgage and Housing Corporation

Sellers and real-estate agents

- Price discipline matters. Sellers who price aggressively will fare better; those who hold out for “last year’s peak” risk long listings and lower closing prices later. Agents need to re-orient marketing to owner-occupiers and quality buyers rather than speculative investors.

Governments and public finances

- Fiscal pain for municipalities and provinces. Lower property values reduce new assessment growth; construction slowdowns and fewer developer contributions (and possible layoffs in construction) hit GTA area municipal revenues and Ontario’s tax bases at a time of massive spending commitments. At the same time, unemployment and demand for social services rise. Provincial and municipal budgets — already stressed in some jurisdictions — would face harder choices.

Alerts: What to Watch For

- Toronto region employment & unemployment trends — sustained declines or a sudden spike in unemployment will be the fastest feed into housing stress.

- TRREB condo new listings & months-of-supply — big, sustained increases in listings → price momentum shift is underway.

- IRCC study-permit flow and university enrolment figures — a continued collapse in permits is a direct hit to downtown rental demand.

- CMHC vacancy and rent data — rising vacancy + falling rents confirm the cashflow shock to investors.

- Bank of Canada policy and mortgage spreads — if policy easing stalls and spreads widen, affordability remains constrained even if the BoC cuts.

- New Home construction — employment and spending on new home construction is a significant contributor to the Toronto economy. Falling employment/projects point to a recession.

Okay, After our Review, is a Crash Still Plausible?

The preconditions are already in place: rising condo supply, falling student flows, a softer labour market, high household leverage, and uncertainty about the policy and trade outlook. A crash requires a confluence — a trade or manufacturing shock that meaningfully dents employment, reduced spending by all governments, a continuing collapse in student-driven rental demand and increasing mortgage stress. If those align this winter, Toronto could see a sharp correction that extends beyond condos into entry-level freehold segments.

As the housing market in the GTA fails, overall capital investment in the region would fall as well. This one compounding factor could add big weight to the crash scene, and make it a loud one.

Would the election of the PC Party in a snap election this winter or next spring change anything? Consider what would be handed to them, and if they can’t swing a trade deal that would save the Ontario auto sector. And if the Chinese can produce $12,000 electric automobiles, many will wonder if it’s time to phase out auto production in Canada. Australia went through this same situation years ago (2017) and now does not make automobiles.

Toronto Perched at a Scary Height

Toronto could be going through a significant change in its economy. And the Federal PCs would likely not continue with the Liberal’s high-cost urban density program, and actually push to open up new land to build on and punish municipalities who restrict zoning for home building and punish develops and buyers with ridiculous fees.

No one can predict the 2026 Toronto housing market given all the variables and the jockeying of governments. But it’s looking grim across the GTA with some areas more worrisome. A Wexit separation worry too, means investors will stay away from Ontario until the Canada breakup issue is firmly resolved.

By January, we should know if there will be a Toronto housing market crash. Let’s hope it’s just a retraction in prices and sellers will just a loss on paper before they finally let go of properties that might cost them everything. I’m not advising you to buy or sell, but the evidence leans toward getting out of this market soon – to avoid the crash scene.

See more on the topic of a Toronto real estate downturn, and forecasts for the Toronto housing market and the Toronto condo market, and