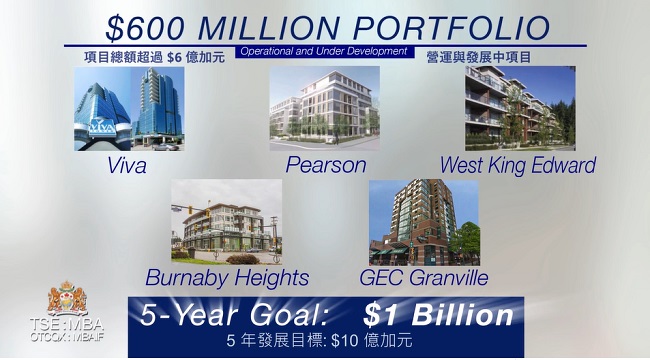

Student Housing Investment REITS – Investment Companies and Opportunities

Solving the Student Housing Crunch If you went to college 10 to 30 years ago, you might be a little envious of the luxury accommodations today’s generations might enjoy — if they can afford it. The college dorms of the past are aging, and post secondary institutions don’t necessarily see a profitable future for themselves in…