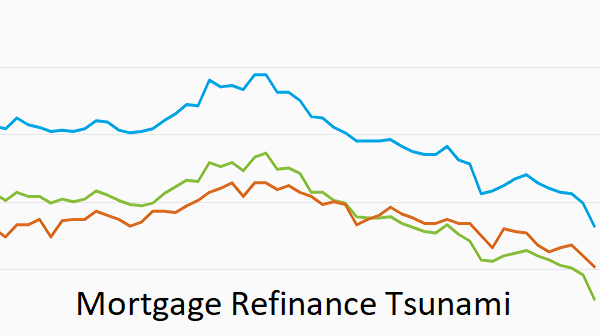

Mortgage Refinancing – Lowest Rates in History

Mortgage Refinancing Boom? Government’s are lowering interest rates to ride out the pandemic period and homeowners are very eager to refinance their mortgages, and buy homes or real estate during the record low period. Mortgage brokers and banks are competing by dropping mortgage rates to capture new clients and new refinance generated customers. Home buyers…