The Secret to Building New Clients in Remote Locations – New Business Development Series

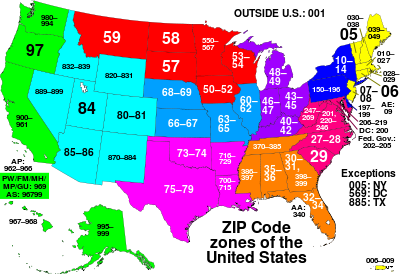

Your Best Clients may not be in your Home City They might be anywhere out there, and you’ll need a plan/strategy to reach them and work with them. Have you avoided doing this because you couldn’t visualize how to do it? Well, let’s fix that shall we. Creating new clients in remote locations seems daunting…