Best US Tech Stocks

Given the big correction that’s hitting the DOW, S&P, NASDAQ and Russell right now, you’d have to question buying tech stocks. Tech is getting hit hard this week and the cyber attacks on the Colonial pipeline is not helping.

The fact is, investors are moving away from speculative growth stocks and into value stocks. Most tech stocks are speculative and aren’t generating the earnings investors want for the long run. Investors can find better performance in industrials, however the DOW Jones is getting hammered this week too.

Yet, this too shall pass and there will be a buy the dip opportunity for those who haven’t panicked, as usual. Check Google, Facebook, Amazon and Tesla and although they’re down this week, they’re still very profitable companies. of course the anti-trust/anti-monopoly hearings are continuing.

Becky Swift of CNBC speaks with 2 investment strategists about where you might consider buying. They mention 5G stocks and AI as long term plays in technology.

Tech is down on inflation fears which will hamper consumer spending on digital products. Why is inflation such a negative for Tech companies? Inflation also suggests higher financing costs, lower profit, and lower customer bases will erode profitability. See the Fool’s technology picks below and keep your eye on the long game, and pick up some great tech stocks during this dip.

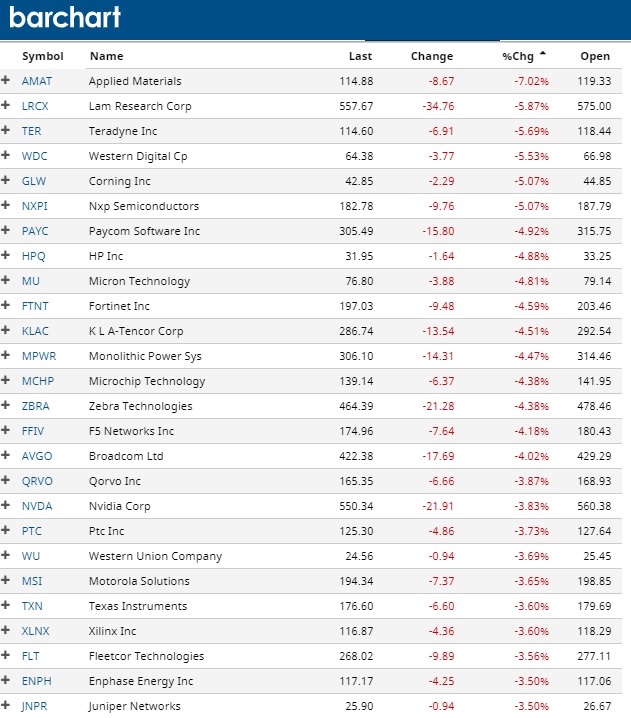

S&P Tech Stock Losers Today

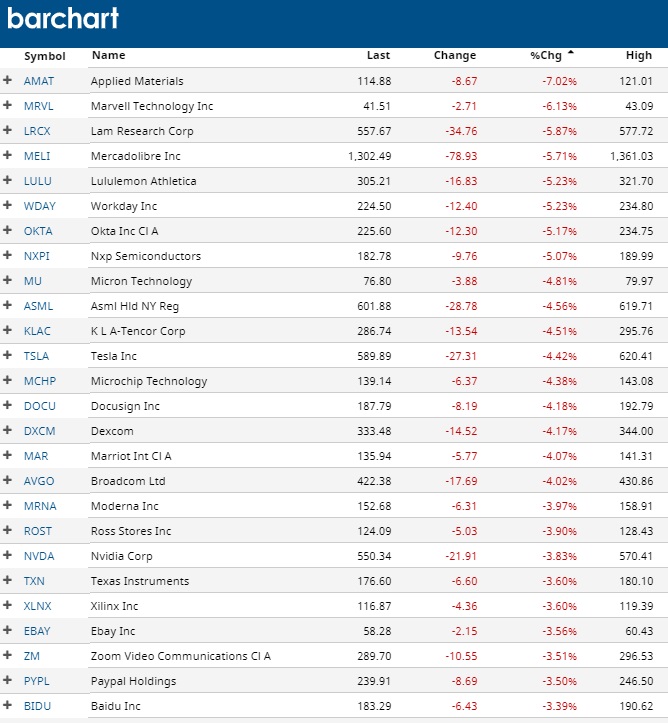

Top NASDAQ Losing Stocks Today

The introduction of AI and 5G opens up endless products and services, which will replace outdated current business services. Take a closer look at what’s driving the stock market today.

Big Tech Idols

US Tech is more than the big tech monopolies. S&P and Russell has many smaller tech stocks you might buy. The two are confused. Big tech is about monopolization, not true value generation. They’re about to be broken up because companies such as Facebook, Amazon and Google are actually strangling the incredible gains real tech could give us. Tech needs to be free to expand and optimize, and Big Tech is just a noose around its neck.

The advantages that Google, Facebook and Amazon monopolize, when distributed to all other tech companies will create an explosion of innovation, investment and productivity.

US Tech Stocks Will Lead the World

Today’s political, medical, social and business problems are complex and challenging, and US tech companies look like the ones who are creating the right solutions. And they’ll have some protection, an incubator to grow in.

Why invest in tech stocks? Because technology drives everything and it’s profitable. Even the commodity stocks that perform well are driven by technology success and trends.

While we’re all waiting for the Covid 19 virus vaccine to arrive, we should stop and think about how vital technology is now during this persistent pandemic and will be into 2021. The forecast for tech is bullish.

This horrible pandemic has changed everything in our personal and business lives and technology is how we compensate and get work done now. In fact, the stock market itself is being categorized in terms of the stocks purpose such as Corona Virus stocks, vaccine stocks, social distancing stocks, work at home tech stocks, and vaccine stocks.

Some suggest the investment in vaccine stocks is creating a $200 billion bubble, but almost every stock is being measured against it value in helping us with the Corona Virus threat.

Small, Medium and Large Cap Tech Stocks

Usually when we talk of technology, we think of IT tech companies such as Google, Facebook, Amazon, Microsoft and others but technology itself is a much broader field. And the profit potential of some of these small cap and medium cap companies who are unknown and underrated is far greater.

Big caps are on the NASDAQ and S&P indexes while small caps are on the Russell Index. Check out the Russell index forecast and see what the NASDAQ forecast looks like.

Would you rather invest in industrials, oil and energy, banking, travel, retail, or the housing markets? The only thing that will revive all of those industries is technology and powerful tech solutions. US technology stocks stand to grow the most. And US Corona Virus stocks might be the best of those.

What About BIG TECH?

The Big Tech companies as they’re called, are still generating a lot of profit via AI, the Cloud, advertising, and app development. However their market presence is so extreme that the US government will need to do something about them. They’re too big and too controlling, so investing in them may be a gamble.

However, if they are split up, you’ll likely still get your money back. But what is the upside compared to a small tech company going into US growth period? The risk for small caps will be falling.

The price of Google Alphabet stock, price of Facebook stock and price of Amazon stock might be on the decline when current anti-trust lawsuits are filed. The battle between Twitter and the President means it will be a tough summer for the Big Tech companies. They’re starting to take on an anti-American flavor which will eventually deflate their stock prices.

It is hard to defend these mega cap companies on the charges of political bias too, so their downside is big.

The monopolies will not be able to prove they’re not monopolies. It’s pretty obvious that Google is a monopoly when it has 90% share of search engine market and 50% as well, of the online advertising market. The two can be used simultaneously to squeeze small business budgets and unfairly limit innovation in technology in the vast sized marketplace.

Google is only involved in a small part of the technology marketplace although the company looks to be wanting to expand broadly in a large number of areas where AI can be applied. That means it could control much more than searches and ads and seize control of other sectors, given its financial might.

Best US Tech Stocks to Buy (Motley Fool)

The Motley Fool offers up its top tech stocks to buy:

- Amazon

- Microsoft

- Apple

- Intel

- Cisco Systems

- Netflix

- Alphabet

Other US tech stocks they mention to watch include:

- DocuSign

- CrowdStrike

- Zoom Video

- Square

- Paypal

- Greendot

Kiplinger mentions these tech stocks:

Shopify

Wayfair

Check out the US Stock market forecast and predictions of the 2021 stock market and which might be the best stocks to buy. Do you still think there’s a chance of a stock market crash?

Catch up on the Stock Market Today , where Stock Prices are, and the history of Stock Market Crashes .

Rooftop Swiming Pools | Rocky Mountaineer Train Tour | Banff Lake Louise Alberta | Coffee Shops Near Me | Car Insurance | Best Cities for Digital Nomads | Sell House Now | Backyard Offices | New Home Construction | Luxury Travel Maldives | Wineries | 5G Phone Plans | Best Smartphones | Luxury Car Insurance | Solar Energy Systems