Stock Market Forecast Part 2

Continued from the post: Stock Market Forecast

Stock Market Long Term Projections

The 2021 stock market forecast looks great for US-based companies which sell US-produced products. If the USMCA agreement is passed, it could bolster the US economy and brighten the housing market forecast.

However, the Democrats could see this as their opportunity to thwart Trump, thus taking the economy hostage.

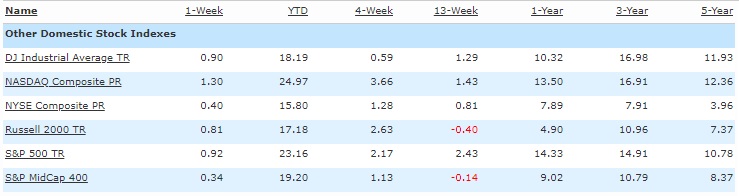

Market history: We’ve been talking stock market forecasts for a while now, so how have the indexes done in the last 5 years?

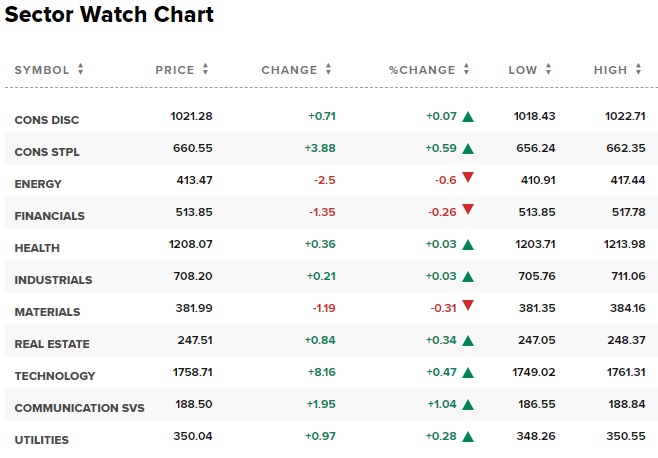

Technology the Hottest Sector of Late

We understood the Dow 30 industrials would get hit, but he focused on the S&P. How close are we though to the time that China’s markets collapse if a trade deal is not struck? See the best stock picks for October.

As long as the US stock markets are strong and the employment rate stays high, consumers will keep spending. The FED is expected to lower rates again and more US production is being ramped up. The indexes are up, and note that the Russell small business index is up 6.7% and is best performing in the last 2 weeks.

It’s a good outlook for small cap entrepreneurs when the big companies resume spending. The pain of refusal to invest in America will become too great, and the risk of losing market share will force CEOs and boards to act soon. President Trump is ensuring spending continues during the America First transition.

At this point, we can reassert our belief that China is disappearing from the American economic equation.

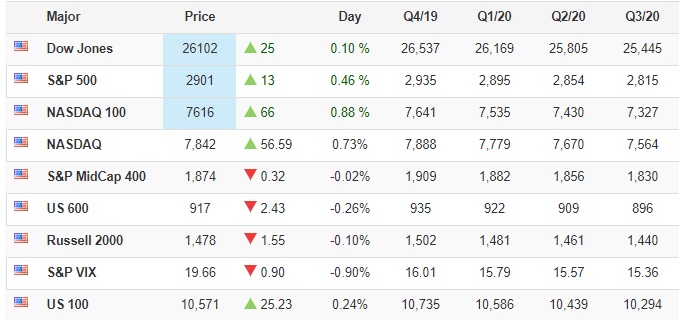

Trading Economics Projections are for all markets to sink through 2020 even as prices rise through the most troubled period.

Although the Dow listed companies suffer short term, they will recover in the next 4 years as they move production back to the US. This is what will drive the NASDAQ, DOW, S&P, Russell, and TSX to record highs in 2021.

Stock market predictions: As Trump tightens the screws on China, the Dow Jones forecast will drop. The true US focused companies listed on the NASDAQ exchange will likely shine this year and next.

With fall approaching, it remains to be seen if President Trump can use taxes and low interest rates to keep the resurgent US economy rolling. Are we on the precipice of a major correction? I predict the US economy will be fine and that unmet consumer demand will ignite US service providers and manufacturing. That could be enough stimulus to reignite the 2020 housing market too.

A glut of natural gas and oil globally could ensure low energy prices and low inflationary pressures. The US was pumping out 13 million barrels of oil per day now and Trump’s threat to take OPEC to court over price fixing is undermining the Saudis attempt to raise oil prices.

The recent stock market crisis was a transition and what’s transpired is new record levels for the NASDAQ, DOW and S&P. Investors are calming down as recession fears fade, inflation is subdued, the Federal Reserve is pausing on raising interest rates, and the economy is showing resilience. China-U.S. trade talks are progressing although Brexit issues still exist.

The Feds pulled back on damaging interest rate rises, trade war fears dissolved, GDP was up. Democrats won’t like it, but the markets are poised for much more growth in the last half of 2020.

Here’s how the DOW, S&P, and NASDAQ markets rebounded earlier, yet fallen of late.

Stock Market Forecast Signals

The NASDAQ, S&P, DJIA, and Russell index are 4 key signals in the new American economy. Those analysts who suggested getting out of equity markets might be having second thoughts. See the S&P forecast.

If all you’ve been hearing is doom and gloom global politics, trade retaliation, interfering Fed chairman, price rises, government standoffs, stock market crashes, and housing corrections, you’ll be relieved that the worst is over. Let’s see a common sense look at the stock markets free from media hype and propaganda.

Please do share this with your friends on Facebook

Best Stock Picks?

Wondering about stock market trends and the best stocks to buy as we move toward 2021? US stocks are gold. The most recent US jobs report, 2020 economic forecast and consumer intent index level in February were okay, surprisingly. That would us make an easy, obvious projection that the economy and stock markets can turn around by August. That’s important for President Trump to get reelected. This biggest threat to your stock investments, amidst this continued Bull run, is the Democrats don’t win.

The Democrats are anti-business and pro-China which obviously won’t bode well for US small business. And with the recent rebellion about back to work, we’re seeing an awakening of the rights of small business in America.

To help you see the real, big picture context, and make good better decisions on volatile exchanges, here is a big picture look at some the best stocks for 2020.

He advises high revenue growth firms, and that has to favor US companies. There’s still some value in investing in Faangs, such as Facebook or Google. Get the latest Google Stock price, and Facebook stock price. See our best stocks picks for 2020.

All of the companies in the DOW, NASDAQ and S&P can still make money in the new US-based economy (auto and chip producers for instance), but it might be smaller American companies and those in the Russell 2000 index you should watch.

Questions to Ask About the Markets?

It’s all about questions, because your questions reveal the depth of your understanding. Learn more and make your own market projections. Some simple questions might generate better insight and decisions. It’s your money so there’s no end to your questions.

- what is the likelihood of a stock market crash?

- are US Stocks rising because foreign stocks are falling?

- will SMB stocks outperform the large caps in 2020?

- how is the US government protecting the development of US-based businesses?

- which US economic sectors have the best potential for American businesses?

- are US economic indicators positive (GDP 1.8% and better than expected)?

- what will happen to sectors when interest rates eventually climb?

- is a US-only based stock portfolio offering the best potential, at least until the elections in 2020?

- will FAANG stocks sink further downward if pro-US agenda persists?

- are the DOW, NASDAQ, S&P, and Russell indexes only reflecting the death of the old economy?

- is volatility is a sign of how investors are adjusting/transitioning to US business and away from global business?

- if a recession happens in 2019, could stocks could slide by as much as 20%?

- which us stocks will revive in the last 6 months of 2020 and which of those make a good buy for the longer term?

- trade war would only benefit US business even more because it would solely own the US consumer who are very positive at this time

- should you invest in China, with its 750 million internet users in stocks such as China’s version of Netflix (IQ)? or is everything in China doomed along with its crashing housing market?

- us economic performance so strong in 2017/2018 and investors wonder if the market has peaked

- some experts are pushing the idea of the end of business cycle button

- china/asian companies/stocks are losing their market

- china economy losing its supports — turning inward now

- EU is trying to hang to UK and other departing members

- Saudis indicating they will pump out more oil now so can you expect an oil glut and prices flattening out?

- will shaky relations with the middle east result in major market changes?

- is there still a huge demand for housing markets if economic management wants to support construction?

- is negative sensationalist Democrat media strong enough to talk down the market — and change the focus back to pro-Asia, pro-multinational international corporate perspectives?

- how will volatility affect nervous investors will get little guidance about what what is really happening

- should investors profit on the volatility (VIX index) with market timing?

- will this US midterm result in the usual witn non-incumbents getting elected?

- Is the Fed chairman trying to move the market back to fundamentals and traditional behaviors?

- Is the Fed chairman pushing up rates suggesting his belief the economy will improve in 2019/2020?

- will the Fed raise interest rates and move to end this business cycle?

Bad Advice: “If Trump were able to successfully pressure the Fed into adjusting course, it could have sudden and unpredictable effects on the U.S. economy. Markets have long seen the independence of the central bank as a critical ingredient in stability, and Powell has vowed to uphold it” — from a Portland Herald Story. Trump has managed to get Powell to hold off on interest rate rises which we now know would have crippled the economy terribly.

- Is the economy adjusting to new technology such as AI, automation, heartland growth, Internet of Things, G5 wireless?

- will volatile, AI robot-controlled ETF funds could cause a market crash – ETFs valuations trading is dictated more by the buying and selling of the funds, rather than by company’s own profit fundamentals?

- Is AI stock prediction about to revolutionize the stock market?

- do artificial intelligence systems really understand Trump and the new US-based markets?

- as international companies/economies weaken, will the desperate move to US markets grow pushing the dollar higher?

- how effective can the Democrats be in taking down US growth, small business growth, American consumer optimism, and tax benefits for US businesses, low rate business environment in the US, can they hide/downplay the dangers of moving business back to Asia?

- will the EU finally fall to pieces without tariff-free access to easy US markets and fend off China dumping?

- how much could inflation and high interest rates erode US GDP?

- how much will rising wages (forecast 4.8%) help improve demand for US goods/services?

- how much will the national deficit and trade deficits slow economic performance?

- is your financial/stock market advisor a democrat or republican?

Old Market Forecasting Models Don’t Cut It

If the experts looked at their models more accurately, they’d see huge unfulfilled demand, disappearing regulations and drag on the US economy, tax and tariff positives in the US, technology cultural changes, confidence in jobs and higher wages, and an investor/US citizen base just about fed up with Democrat media reporting.

For instance investment experts liked SNAP, Amazon, Facebook, and disliked Tesla. How’s that advice looking right now? There are experts still advising investing in China companies. What does the technical and emotional indicators suggest how that will likely turn out?

US and global investors have plenty of tough questions about where to invest their 401k, and other retirement funds, and how to profit from all the turmoil going on, and whether traditional investing advice is wise during a Trump-lead market. These are uncertain and volatile times with the polarization of the Democrats and Republicans, and with multinational corporations trying to hold onto the old international trade system.

The stock market and economic experts aren’t taking into account political and emotional signals (emotional intelligence?) and not taking threats to US economic growth seriously enough. EU and China opposition along with Democrat media (creating negative events) can scare investors, even though the US economy is booming. es opinions of the author and do not connote recommendations of any kind regarding stocks to invest in. The material is provided as general information only. For all your stock investment decisions please refer to your financial investment advisor.

Please bookmark this post for frequently updates on best stock picks and market forecasts, projections, predictions and outlooks. Share with your friends on Facebook. It’s good for your social health!

3 to 6 month Forecast for the Dow S&P NASDAQ | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News