NASDAQ Forecast

The good performance of the NASDAQ listed stocks show investors believe in the tech sector, and that it has the only path to profitability against Dow, Russell and S&P stocks.

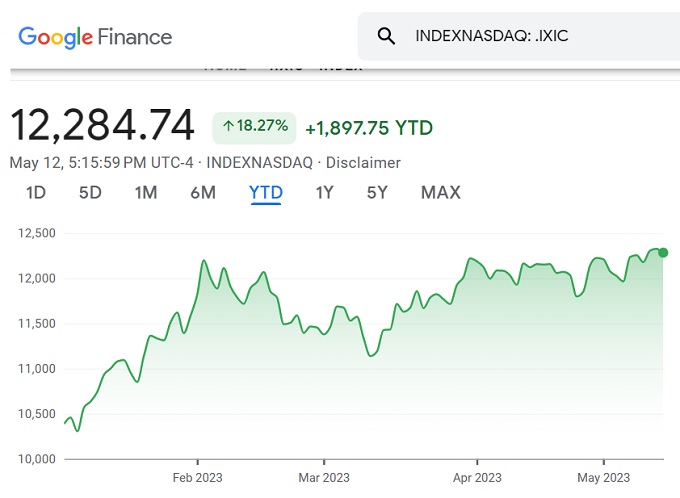

The NASDAQ’s 17.8% price growth year to date is surprising, but can it be sustained?

Tech can find a way to profitability with creative innovations and digital delivery, and it can of course make the world its marketplace. Many of the NASDAQ 100 companies are multinational corporations drawing revenue and profits wherever they can be made around the world. The products these companies create (software, hardware, service) such as cloud services, devices, and advertising generate trillions in revenue.

That is a difficult investment value proposition to pass by. Instead, the NASDAQ charts may uncover a big winner for you. A few stocks today jumped 37% simply on reports and news items, so day traders and buy and sell investors have plenty of opportunity to score with good stock selections. See the top NASDAQ performers below.

It’s hard to ignore NASDAQ mega tech stocks in your portfolio. Stocks like Facebook (FB) and GOOG have surged this year. Google in particular is churning some amazing earnings numbers this year vs last year, and investors are liking what they see. The company’s announcement today that it will integrate AI into its products is just PR, but investors like the sound of it.

Today’s Google stock price surge made shareholders $9 billion richer, which they like even more.

The tech heavy NASDAQ index is trailing only the S&P 500 thus far this year. It seems technology stocks are viewed as a safe haven (Goog, Facebook, Apple, Netflix, Amazon) that perform well in bad times, and not so bad in good times.

Keithen Drury for The Motley Fool believes the NASDAQ has lots of room to run and that the tech-focused companies listed in should also make for an excellent long-term investment.

If the NASDAQ was hit by high interest rates, credit tightening, labor shortages, and falling revenues, it’s not ailing too much and investors may think it won’t suffer too much anymore given Fed rate hikes are just about finished. With lower rates on the horizon, the cash rich, liquid tech companies are cutting the excess and waiting for cheap money in 2024. If 2024 if an off year for the economy, they should be well placed to whether that storm. In the meantime, Apple, Google, Facebook, Microsoft, and Amazon are reporting acceptable earnings.

Finding NASDAQ Best Stocks

You’re optimistic and you’re wondering about the NASDAQ potential and you’re wondering which stocks make the best sense. Even if anti-monopoly threats, Google’s stock price, Tesla’s stock price, Apple’s stock price, Facebook’s stock price, and Amazon’s stock price should hold well.

Tesla is the darling child of the NASDAQ. Barchart analysts give Tesla (TSLA) a sell rating. The stock is up the last few months, but a slow US and global economy is obviously subduing sales of the more pricey Tesla models. Tesla share price jumped $4 in late day trading today May 11th after Elon Musk said he will step down as CEO of Twitter. That had been a worrying and costly project that likely has stunted Tesla’s performance. Perhaps now is a good time to buy Tesla stock. The stock has upward price targets.

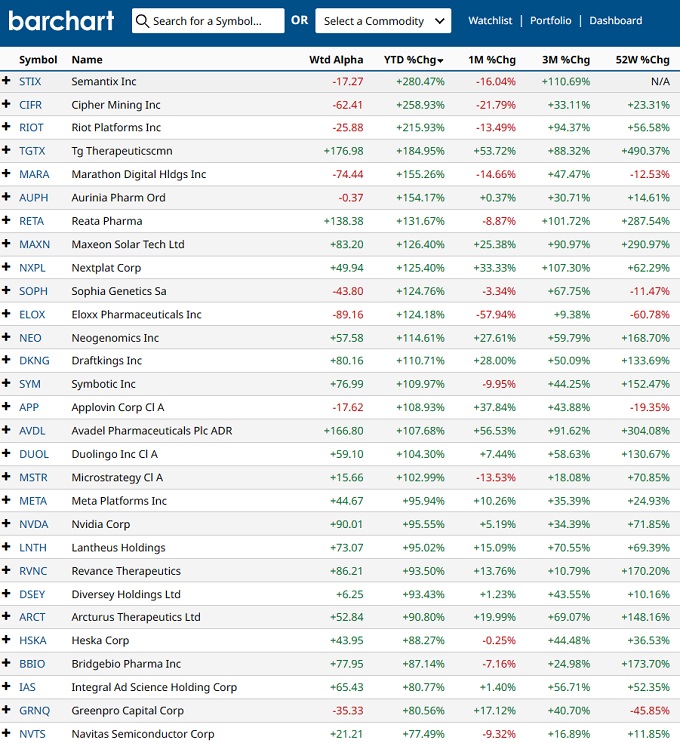

Top NASDAQ Performers This Week

The year to date price growth of some stocks reported this week is astonishing, as you can see courtesy of the Barchart top performers list. Biotech, therapeutics, software, Solar Tech, Sports Betting, are big attractions. Facebook is rocketing after pushing Metaverse fantasy to the back burner, which sensible investors enjoyed a lot. The issue with some tech companies is wasted spend, long time to launch and create profit, and vicious competition. Not all will be stellar performers. You must find the winners.

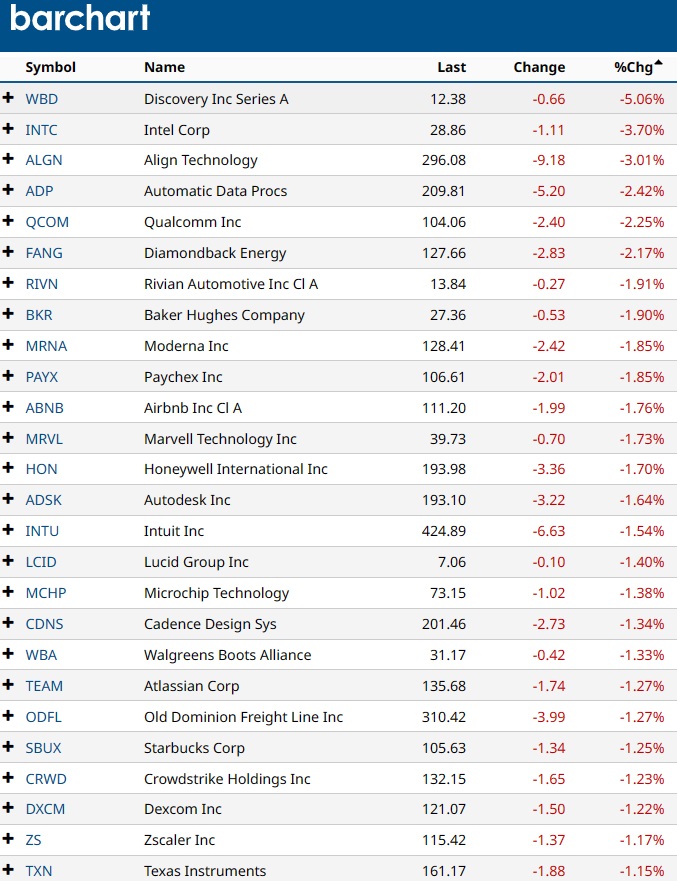

Worst Nasdaq Stocks of Late

The worst performing stocks on the NASDAQ are popular, high volume equities and owners are divesting. Out of these poor performers will come the big stars of 2024/2025 as the economy recovers as interest rates fall. $5.3 trillion is sitting in the money markets and being eaten by inflation. Investors are looking for promising stocks and to move money to get back on the bull market run.

What is the NASDAQ?

The NASDAQ stock exchange and indexes is a compendium of mostly technology stocks that provide a snapshot of the health of the technology sector in the US. It’s one of the most exciting and dynamic stock markets. The NASDAQ composite is considered the top indicator of US technology health. Not all NASDAQ listed stocks are part of the NASDAQ composite index.

A forecast for the NASDAQ hinges on political views, economic outlooks, and now on national health epidemics. That creates a diverse collection of NASDAQ predictions. The same can be said for DJIA forecasts and S&P forecasts.

Domestic spending, cultural changes, trade wars, commodity prices, wage levels, consumer confidence, and even media news reports and biased journalism can all affect the stock prices and profit outlook for tech stocks. The price of a tech stock on the NASDAQ exchange is a valuation of its future value — a guesstimate of the performance of the company and the dividends it might pay. Sentiment does play a role.

The NASDAQ composite index comprises about 3000 technology stocks. The NASDAQ 100 is a basket of the 100 largest actively traded U.S companies listed on the Nasdaq stock exchange. See our Best Stock Picks for 2020 and stock prices posts.

What is the NASDAQ 30?

The NASDAQ 30 is a small sampling of mega-sized companies and they can distract from other stocks with potential. One such stock is Robinhood which decided to do its IPO via the NASDAQ and not the S&P. See more on this week’s forecast and the 6 month forecast.

If investors are clinging to the tech monopolies Google, Facebook, Apple, Microsoft, and Amazon it could be out of a lack of confidence in the US economy and perhaps the overall stock market. And with the recent stock price volatility caused by even the slightest bad news (interest rate rumors, government bond yields, etc.), we know investors have weak confidence in the the current US administration.

The NASDAQ 100 Forecast

The NASDAQ 100 listed stocks are the prized collection of NASDAQ stocks. They are particularly sensitive to international trade. When imports to the US are curtailed, you can expect these stocks will suffer badly. Those NASDAQ index stocks that cater to US consumers alone will likely do well. The US economy is still doing well. As long as the forecast for interest rates and the mortgage rate forecast continues low, they will gain strength.

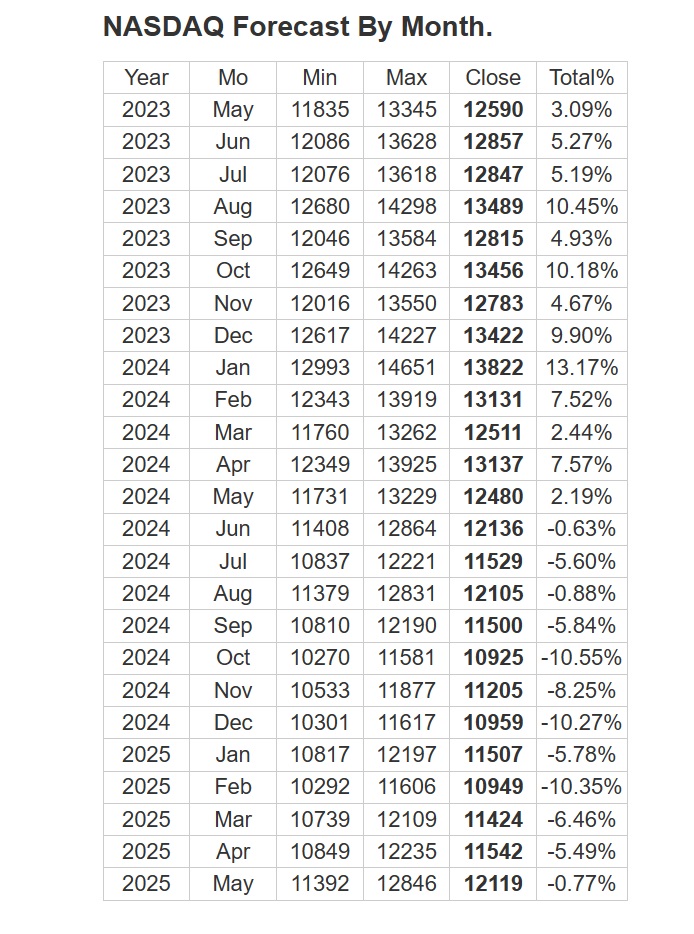

Longforecast Sees the NASDAQ Decaying to 2025.

See more about the 3 month, 6 month and 5 year stock market outlook.

What Causes NASDAQ Volatility?

Stock market price volatility is a hot topic and not many researchers are able to test their theories about why the NASDAQ seems to be the most volatile. A 2001 study surmised that it is composed of smaller companies than the S&P, and these have less secure income streams, and are more exposed to business deals, investor whims, and bad news. But today, the tech companies are much better capitalized and are some of the largest companies in the world.

The expert also cited the NASDAQ having too many Internet Stocks, yet these Internet stocks are now big, fairly successful companies such as Amazon, Google Alphabet, Tesla, Amazon, and Facebook. And they’re very stable and profitable. Many of the IPOs of tomorrow’s best companies appear on the NASDAQ. And technology will always be king.

The smart investor might invest in pools of NASDAQ stocks rather than reading financial reports and gambling on individual stocks. The downside risk is high with individual companies. Even Facebook, Tesla, Amazon, and Google face anti-trust investigations that could ruin them, or benefit them even more. That volatility fits perfect with NASDAQ investors. There is money to be made on the ups and downs.

NASDAQ weekly volatility draws investors, who are more like gamblers. Is gambling online illegal? Yes, unless you’re buying and selling NASDAQ stocks. Then it’s okay.

When Volatility Increases

NASDAQ stock prices have been volatile of late and it’s that volatility that draws many traders to buy and sell NASDAQ stocks. Most traders are using computer algorithms and automated trading to perfect how they win in swinging stock prices. If you’re not using automated systems, you’re likely not going to keep up.

The NASDAQ volatility reflects the tug of war in US trade agreements, particularly in response to import tariffs levied on China.

NASDAQ 100 prices give a picture of large tech brands who are deeply affected when their products made cheaply in Asia can’t be imported freely into the US. In fact, they may face import tariffs into India, UK, Germany, Canada, Australia, Russia and South America as well.

Check out the latest stock prices and quotes for Apple Stock price, Google stock price, Facebook stock price, Amazon stock price, Tesla stock price, and Netflix stock price.

Please do Share this Post on Facebook and your blog!

More from the Housing and Stock Market Forecast Blog: What will be the correct S&P 500 Forecast? Find out more about the 2023 2024 2025 Stock Market Forecast and more about Stock Investing. Find out more about the Stock market today.

Stock Market Forecast 2024 | Stocks with Best P/E Ratios | Best S&P Sectors | 2024 Outlook on US Equities | Oil Price Forecast 2024 | Stock Market News | Alphabet Stock Price | ChatGPT Stock Market Forecast | Stock Trading Platforms | USD Exchange Rate | Market Rally | Stock Trading | Tsla Stock Price Now | Mortgage Rates | Stock Market Next Week | Stock Market Next 3 Months | 2024 2025 2026