Dow Forecast DJIA 2024

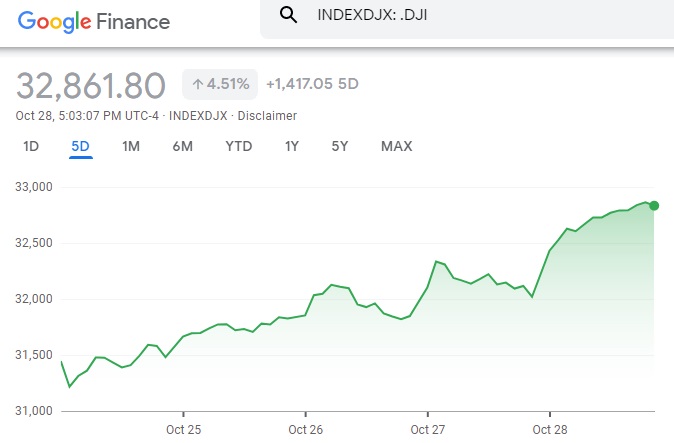

The Dow has been sluggish this hear, falling well behind the NASDAQ and S&P in growth. Yet of late, optimism about 2024’s economy is brightening investor’s outlook.

Last Friday’s big jump shows investors are a little less gloomy, and the a weak showing in the manufacturer’s index shows lots of potential for future growth. See more of the full outlook on the markets.

These big companies can profit well in an inflationary environment and provide sustainable wealth protection. But the Dow Jones index just suffered a lengthy losing streak, worst in 90 years. Today it’s dropped to its lowest point in two years.

Right now, investors are waiting for the Dow Jones to bottom out, for some nice bargain picking. But this week, more fear is shaking the market, and that with this downturn, the Fed might not be able to pull the markets out of a deep dive. The 3 month and 6 month views are dour but not disastrous.

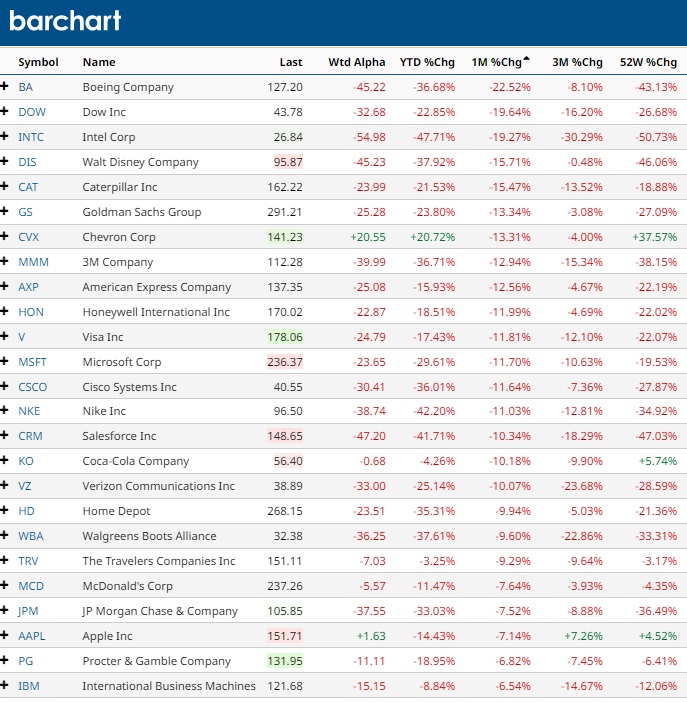

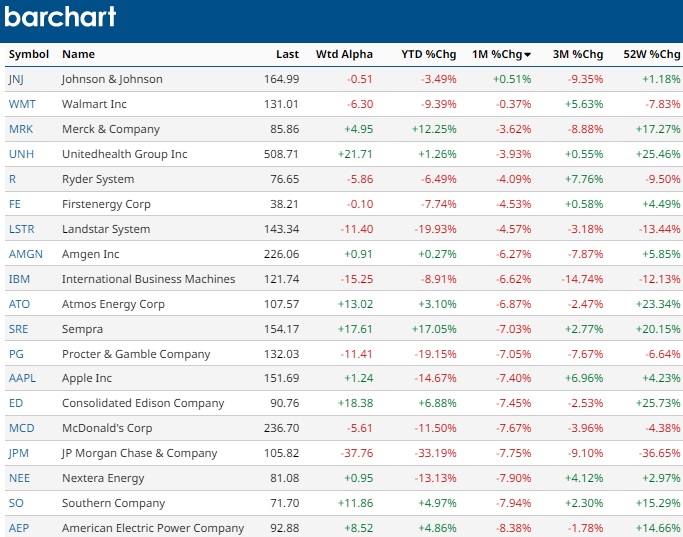

The nice thing right now, is the Dow Jones stock charts are giving us some hints about which stocks will collapse and which might be damaged least by the coming recession. See the best Dow stocks to buy or sell below.

Experts are indicating that 2023 could bring a recession with perhaps with some stagflation given Russian energy is disappearing from global markets. Today, the gas pipeline in the Baltic Sea was apparently blown up and will not be repaired anytime soon. Investors look at the fundamentals with the Dow stocks and feel nothing can touch them.

This quarter, Dow S&P and NASDAQ stocks are under tremendous pressure from high interest rates, supply chain disruptions, rising costs, rising regulations, and trade embargoes. Apple, Google, and many other Dow listed companies might be a better bet during a recession. Other small caps such as S&P and Russell index stocks are the ones with big risk.

So are the Dow Jones big 30 stocks the gold standard for investors plumbing the stock market to survive what might be a recession? Learn more about the Dow stocks and predictions on where it might be headed below.

It must be noted that top economists and stock advisors haven’t had much luck in forecasting the trends and prices on most stocks, not just Dow stocks. Most indexes drop and rise at similar rate, yet of late, the Dow is performing better than the S&P, NASDAQ and Russell Index.

Of course, there are thousands of other industrial stocks to pick, if this is what you’re really after. If stagflation and a recession hit, Google, Facebook and Amazon will be hit hard too.

Best Manufacturer/Producer Stocks to Buy

Dow Jones stocks are generally stable, low risk, high value assets based on industry, and these are the darlings of many long term investors. Review the top gainer Dow Stocks listed below. They may be the best of October’s market rally.

Stocks to Sell on the Dow Jones

Buy recommendations for the DOW for a sell: Boeing (BA), DOW Inc (DOW) Walt Disney (DIS), Goldman Sachs (GS) and Microsoft (MSFT) have the worst performance during the last 3 months.

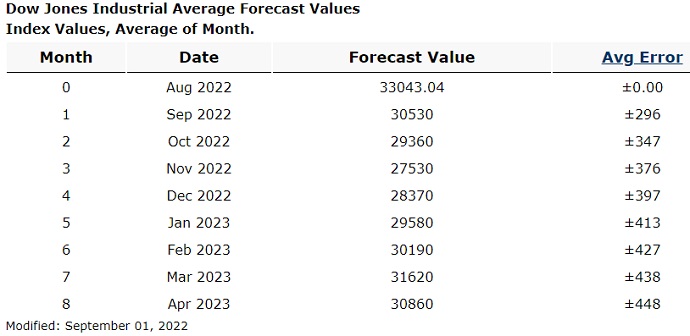

Dow Jones IA Forecast to 2023

The DJIA has slumped given the GDP of most nations has dropped. Europe is in a terrible recessionary situation and the US is struggling to accept the truth about the latest stock market forecast. However, with Russia shut out of the global trade market, certain commodities such as oil, diamonds, wheat, palladium could become places to be invested. And commodities are the blue chips stock in trade at every part of that supply chain to consumers and businesses.

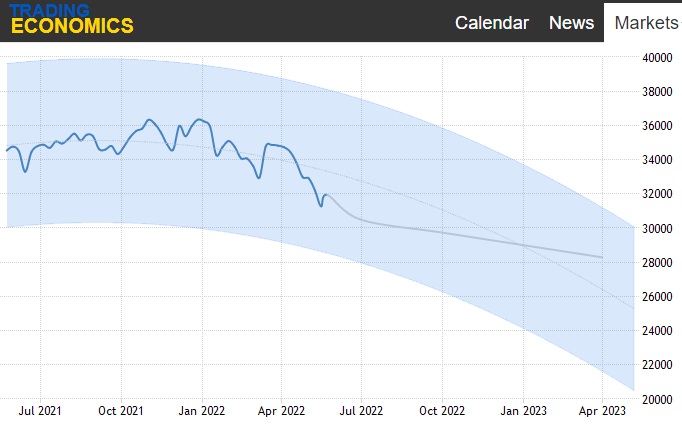

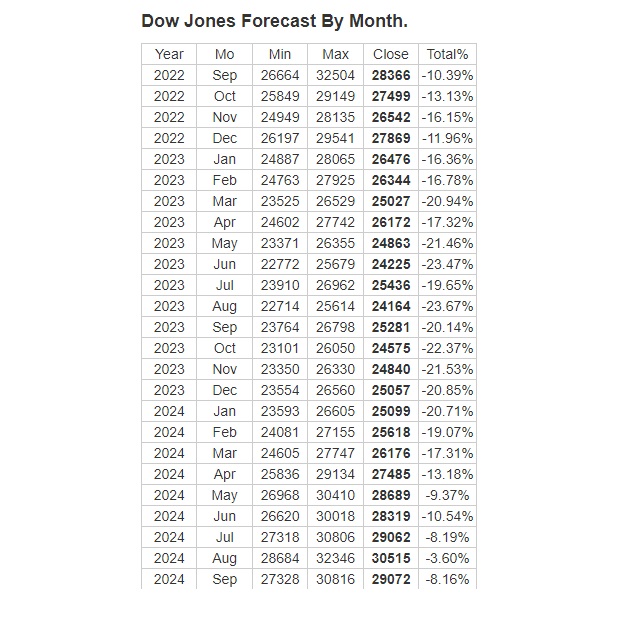

As Trading Economic’s forecast of the Dow it shows a steady drop to levels most investors will not like. The S&P and NASDAQ have worsening outlooks given issues related to digital threats, regulation, and rising interest rates.

The DOW 30 might be the group that offers the best investment during the recession of 2023. See the price outlook for Google, Apple, Amazon, and Facebook.

Forecast for Next Month and Next 6 Months

The DOW Jones forecast for the next 3 months and next 6 months. The DOW might be the best part of the stock market outlook overall for 2022. Rising inflation and commodity prices will only feed the DOW listed companies even further. They’re large companies that appeal to risk averse investors looking for equities that will retain their value over the next 5 year to 10 year forecast period.

What Factors Drive the DJIA Price?

As a weighted index of only 30 stocks, some might question whether the DJIA is a relevant index.

Dow Jones 30 Stocks include Apple, Pfizer, Walmart, Johnson & Johnson, Walt Disney, Nike among other huge corporations. Calling them industrials is a little misleading. Transportation and utilities stocks are not included in the DJIA and instead are in the Dow Jones Transportation Average (DJTA).

Whereas the Dow Jones average is a measure of the biggest companies, the S&P 500 index is more about the stock prices of big, but healthy companies — those with high market cap above $8.2 billion and a public float of 50%, and which have had positive earnings for the last 4 quarters. The S&P has 500 stocks which makes it a more reliable reflection of the stock market.

The Russell Index in contrast is a measure of 2000 small cap stocks. It provides a look at performance of small business in America.

Predictions for Dow 30?

The 30 DJIA stocks by themselves offer a very skewed perspective of US stock markets and the economy as a whole. See the 2021 stock market forecast for more perspective. In fact, many of these companies operate globally, and are therefore outside the real US economy, deeply affected by International trade deals.

As the global trade channels slowly awaken, it’s predictable that the large cap Dow 30 stocks are going to be investor favorites. Keep your eye on the best performing DOW stocks above. Perhaps slower growth than other hot tech stocks, consumer discretionaries, and oil stocks, but likely far safer. The possibility of a stock market crash is slim for the next few years, but it is something to encourage you to hedge against.

Here are the Current 30 DJIA Stocks:

- 3M (NYSE:MMM)

- American Express (NYSE:AXP)

- Apple (NASDAQ:AAPL)

- Boeing (NYSE:BA)

- Caterpillar (NYSE:CAT)

- Chevron (NYSE:CVX)

- Cisco (NASDAQ:CSCO)

- Coca-Cola (NYSE:KO)

- The Walt Disney Company (NYSE:DIS)

- Dow DuPont (NYSE:DWDP)

- ExxonMobil (NYSE:XOM)

- General Electric (NYSE:GE)

- Goldman Sachs (NYSE:GS)

- The Home Depot (NYSE:HD)

- IBM (NYSE:IBM)

- Intel (NASDAQ:INTC)

- Johnson & Johnson (NYSE:JNJ)

- JPMorgan Chase (NYSE:JPM)

- McDonalds (NYSE:MCD)

- Merck (NYSE:MRK)

- Microsoft (NASDAQ:MSFT)

- Nike (NYSE:NKE)

- Pfizer (NYSE:PFE)

- Procter & Gamble (NYSE:PG)

- Travelers Companies (NYSE:TRV)

- United Technologies (NYSE:UTX)

- UnitedHealth (NYSE:UNH)

- Verizon (NYSE:VZ)

- Visa (NYSE:V)

- Wal-Mart (NYSE:WMT)

Forecast.com Dow Jones Forecast to 2024

Longforecast.com’s adjusted outlook to 2024 sees the Dow sinking by 24,000 by next August. The question for investors is when will the bottom appear, and how well will the market recover by end of 2024.

Dow Jones volatility mimics the same path the prices and forecasts for the S&P or the NASDAQ. DJIA are all about political power and the primacy of the monopolies. Within Free Trade, the monopolies could do as they pleased and name their price.

The threat of data privacy legislation and punishment from Europe, Asia, and North American governments casts a shadow over Dow companies. Anti-monopoly action by the DOJ too threatens these big companies revenue picture.

Politics Determines DJIA Predictions

With respect to US industrials on the Dow, the high US dollar, widening trade deficit and ballooning debt means the downward projection curve in the chart above makes sense. Moving production and fulfillment channels is not an easy thing to do. It’s unlikely the current President will have any greater luck trying to bring jobs back to the US. A sliding US dollar is the only hope, but now the US dollar has rocketed to 114.

Is it wise to invest in Dow Jones stocks? At this point, some selected US stocks on the S&P, or Dow Jones is a wise bet. Others are highly exposed to a big drop in consumer demand. The NASDAQ index holds stocks that could continued lower values, leaving you to hunt for safer large caps on the Dow.

See more on the US stock more forecast as well as 3 or 6 month forecasts, and forecasts for tomorrow and next week, along with a look at the 5 year and 10 year long term picture. Also take a good look at oil stocks, and best recovery stocks, along with the best penny stocks to buy. High performing investments will be much harder to come by this year and you’ll be wise to hire a talented, high performing investment advisor to pick some winners.

See more insight on the Forecast for the Stock Market including the current Market Rally, Stock Market Predictions for Tomorrow , the 6 Month Forecast and 3 Month Forecast along with opinions of an impending Stock Market Crash.

Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today |