Day Trading

The last 10 years has created very favorable opportunities for stock trading. Call them day traders or active traders or stock market speculators, they focus on how they buy and sell within the next minute, hour, day or month and make a profit.

And as fate would have it, technology has enabled day stock trading for the masses and enabled zero commission trading. Along with the infusion of cash from the stimulus, plus time and desire of new day traders (pandemic shutdown) and you have a revolution in stock trading.

Millions investors have opened self-directed stock trading accounts on a number of stock trading platforms (Robinhood, etrade, etc) which allows them to buy and sell quick with almost zero commissions. Sounds like a sweet opportunity to make easy money if you know what you’re doing.

There are commentators who say these day traders are going to lose their shirts, but they seem to be faring okay so far since they’re still going. If a stock market crash were to happen, these same investors would lose the same amount in traditional investment accounts where commissions are extracted.

Most investors with their retirement savings plans and 401ks would would never dream of making money this way. But increasingly, self-directed trading is becoming the norm.

The Stock Trading Constraints Disappear

As a stock exchange clerk way back, I reconciled the daily trades of stocks and option puts and calls and managed clients accounts. I always wondered about how the outrageous commissions on each trade and how day traders could still earn a profit. The desire was there but the system wasn’t.

Today, it’s electronic execution, leveraging and easy credit, having accessible trade and market data, erasing of broker commissions and increased stock price volatility that makes successful day trading possible. There’s so much more information available.

Of course, fintech companies have created computer algorithms that can monitor volatility and make timely buys and sells to earn a profit. I’m not an expert, but having an AI stock trading system to execute and monitor sounds like a handy asset. You should look into stock prediction software.

There’s no replacing your own due diligence on studying stocks but even professional stock traders, brokers, and hedge fund manages all use these systems. And it just seems the AI prediction tools are getting better and better.

Trends are surprisingly consistent and predictable, which is why technical stock analysis is a thing. Some of these trends have names, while others haven’t been named. They are strange correlations and patterns that stock traders or day traders want to know about.

AI stock prediction tools have the power to analyze and find price trends so you can take advantage. Some of these patterns are general and others more specific. So, even with AI stock trading tools, you have to decide which will be more profitable.

Companies that offer these AI predictive trading software are FinBrain, Iknowfirst, and Danel Capital. Quite a few people are checking out reviews of their platforms. The jury is still out on their reliability however, the companies themselves self-report some outstanding returns. You can see more on Danel, Finbrain and iknowfirst here.

It seems the risks of day trading are paramount. Control the risks and perhaps it’s all gravy.

It’s never easy to make money from the stock markets, including via day trading. Investors need quick, reliable market intelligence, good guidance and feedback from an expert stock advisor. And day trading is an art and science that requires expert execution.

Day Trading is risky. Even the SEC says so.

And today, with electronic trading and artificial intelligence stock prediction algorithms, who in their right mind would want to do trade using their own wits during the day? Can you possibly beat an all knowing AI stock trading system? Or is day trading simply a matter of leveraging predictable trends? Can anyone do it, but knowing what to look for?

How about if you get an AI stock trading system working for you, advising you, letting you test your assumptions and giving you detailed performance feedback? Maybe there are some opportunities?

Day Trading Exposed

And with sports gambling shutdown lately, new entrants have found their way into the stock market day trading space.

There are pro and casual day traders who buy and sell stocks with the intention of profiting on hourly or by the minute divergences of stock prices. With AI day trading, they can scan and execute trades instantly at the exact moment there’s an opportunity. If it’s automatic, where is the downside? I admit, it is fascinating.

Here is a Youtuber Day Trader (Humbled Trader) who documents her adventures. She claims that $58,000 profit per month is below her normal. That translates to $700k per year. If you’re making trades of many millions of dollars, then such profits are possible. However, if the market tanks at some point, then day trading is risky. And for those involved in shorting stocks, it becomes perilous.

Day trading is intimately involved with stock price volatility. And in these very uncertain times, there’s a lot of volatility for many reasons. Economic reasons, political, cultural, media, Internet, social media, and just the simple business of demand vs supply. You never know when someone needs to buy out a company or sell its stock at any point during the day?

Day Traders might not even know why price surges happen, they have a blind faith that they’re going to happen.

AI Day Trading Systems

Ultimately, a day trader must hand the buying and selling process over to the AI trading software platform. AI systems are live testing and learning systems. They’re going to zero in on what is actually moving prices, and giving you the trader into what’s driving those stock price changes.

Increasingly, all stock market exchanges are using fully automated trading. No one is on the floor. The trading floor doesn’t exist. Automated trading algorithms have been around for a while yet AI stock trading is new. Many believe this is the future.

It’s absolutely the future for day trading. Can you still make a profit in the maelstrom of AI trading? Possibly, but that would be pure luck. All other investors would be making more.

AI systems are limited only by the data they get to work with. As long as trade data is available to them, they can assess the patterns and isolate the best stocks to buy.

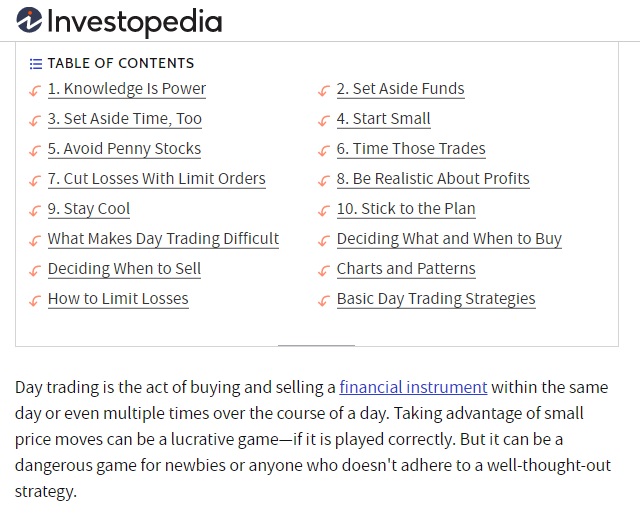

Go deeper on Day trading on Investopedia. and how to get started in day stock trading.

For more information stock day trading and self-directed investing, please consult experts with the major stock investing advice websites including lightspeed.com, Marketwatch, Bloomberg, Fool.com, Merrill Edge, TDAmeritrade, Ally.com, Nerdwallet, Questrade.com, Schwab.com, etrade.com, Wellsfargo.com, Investorvest, Warriortrading.com, InteractiveBrokers.com, jasonbondtrading.com, wealthsimple.com, Barrons.com, fidelity.com, zacks.com, Robinhood, fortrade.com, stockinvest.us, investors.com, investorjunky.com, kiplinger.com, investorplace.com, investorplace.com, BMO Nesbitt Burns, Royalbank.com, CIBC.com, and benzinga.com.

2024 Stock Market Forecast 2023 | Stock Market Crash 2023 |3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | Oil Price | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Trading Sites | Stock Trading | Lines of Credit | Reverse Mortgages | Mortgage Rate Forecast