August’s Price Drop May Present Opportunities

While stocks fell during August amidst a wave of bad news, including the deepening, widening rift with the communists in China, corporate profits are showing growth.

In fact, China’s downturn, US reshoring, and energy stocks are the key issues going into the fall. FED rates likely won’t fall until 2024, so retail stocks are good ones to sell. AI stocks were hot, but the upside from here might not be great. Profits from the AI boom are a long way off. Yes, Nvidia is an amazing company and hard to resist, but it won’t offer double or triple returns like some of the oil companies may. Oil prices may hit $100 for some time. Tesla is performing okay, with Big 3 Auto strikes, but spending on expensive cars will fall, thus helping inflation fall.

Investors appear to be trading in their FAANG/Magnificent 7 stocks for stocks that have hit bottom and are ready for a rise. But when will the rise happen? It may not matter if you’re buying with the future in mind.

You might be wise to dump Disney, Apple, and others given many investors parked their money in mega caps as a hedge against losses. Once the FED eases off on its repression of rates and capital availability, small to mid-sized stocks will surge.

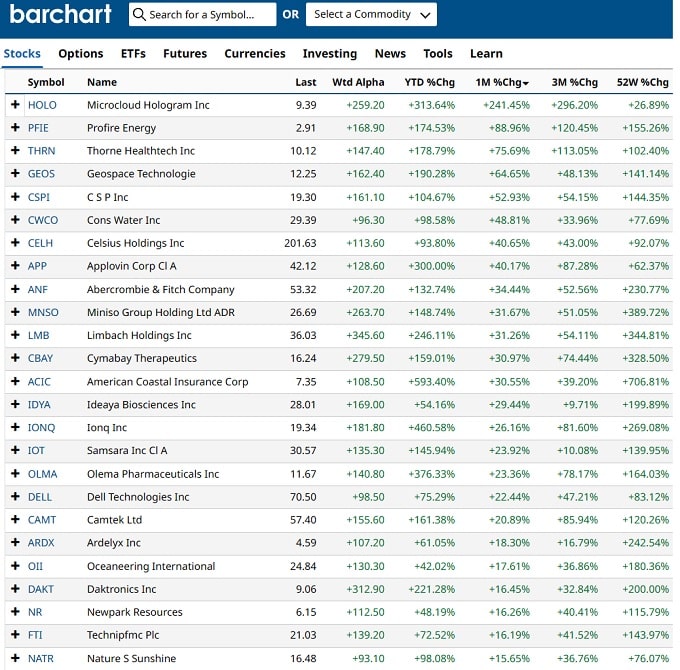

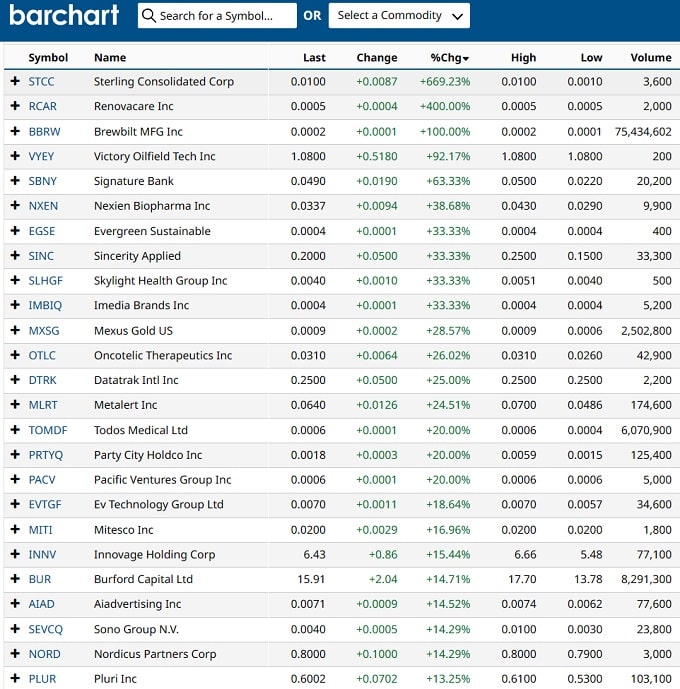

As you’ll see in the charts below, there are sectors to watch and individual stocks with momentum to buy. Of course, a deeper analysis of potential buys needs to be done before committing to them.

Here’s the best performing stocks of late and notice how much green visible, even over the last 52 weeks.

See more on today’s top stocks at Barchart.com perhaps the best site for retail investors to open an account.

Keeping on the right sectors is a big factor in smart investing. Right now, energy is hot so definitely take a look at the oil stocks and natural gas stocks. Pipelines by the way, in the US are the biggest deficit, given the government has stopped them from being built. As energy prices rise this fall, there will be a push to get them built. Investment money will pour into the pipeline companies.

Overall however, institutional investors and retail investors will find energy stocks irresistible and prices will rise. They’ll be moving their money out of hedging mega caps and into these high cashflow, high-profit companies which have ridiculously low P/E ratios. See more on the best-performing US oil stocks and also, Canadian oil stocks, which typically lag but have big upside potential. Check out oil and gas stocks such as Exxon, BP, Athabasca Oil, and Southwestern Energy.

If you search online for the “hottest stocks to buy” you won’t find oil and energy stocks recommended even though performing well. Even natural gas stocks which were denigrated were up. This is because Democrat ESG investors won’t include energy stocks in their lists, regardless of their price growth, dividends, or balance sheets. That’s ludicrous, and you should definitely investigate energy sector equities. The price of oil is expected to rise and we’re headed into winter which deplete active reserves and rev up exploration and delivery of more products.

See more on the general stock market forecast, the 3 month predictions, 6 month predictions, and the 5 year outlook. If you’re an average investor or stock trading enthusiast, it might be wise to buy the dip, and hang on for another 5 years. The 5 year outlook might also position you for solid growth for 10 years and the long term outlook.

Check out Price Earnings Ratios

Review stocks typical price to earnings ratio on the S&P. such as these during the last 7 days:

Investors Business Daily Picks

- General Electric (GE)

- Schlumberger (SLB)

- Visa (VS)

- Oracle (ORCL)

- Marsh & McLennan (MMC)

Fool.com Stocks to Buy Today

- Eli Lilly (LLY)

- Regeneron Pharmaceuticals (REGN)

- Vertex Pharmaceuticals (VRTX)

Kiplinger’s Top Stock Picks to Buy Now

- Halliburton (HAL)

- Advanced Micro Devices (AMD)

- Amazon (AMZN)

- Rexford Industrial Realty (REXR)

- T-Mobile US (TMUS)

- Deckers Outdoor (DECK)

- Matador Resources (MTDR)

- Merck (MRK)

- Workday (WDAY)

- Lululemon Athletica (LULU)

- Amgen (AMGN)

- Archer-Daniels-Midland (ADM)

And Morningstar offers their most undervalued, best stock picks for September:

The 10 most undervalued stocks from our Best Companies to Own list, as of Aug. 29, 2023, were:

- Yum China (YUMC)

- Estee Lauder (EL)

- Anheuser-Busch InBev (BUD)

- GSK PLC (GSK)

- Roche Holding (RHHBY)

- Imperial Brands (IMBBY)

- Zimmer Biomet (ZBH)

- Wells Fargo (WFC)

- Campbell Soup (CPB)

- Taiwan Semiconductor Manufacturing (TSM)

Remember to investigate stocks that you feel you have some knowledge in, and don’t buy until you’ve checked the company’s earnings, history, P/E Ratio, and for recent news about the company. See the buy/sell recommendations on Barchart and analysts reports, before buying any stock today.

Being well read, and up on the latest stock market drivers is the way to go.

Stock Price Quote | Oil Stocks | Oil Price Futures | Gasoline Futures | Natural Gas Futures | Stock Market Today | Google Stock Forecast | Tesla Stock Price | Long Term Stock Forecast | Stock Prices in 2024 | AI Stock Forecasts | ChatGPT Stock Forecasts 2024 | Stock Market Crash | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast | NASDAQ Forecast | S&P Predictions | Stocks Next Week | Stock Market Today | Google Finance | Author Gord Collins