Should You Buy Penny Stocks?

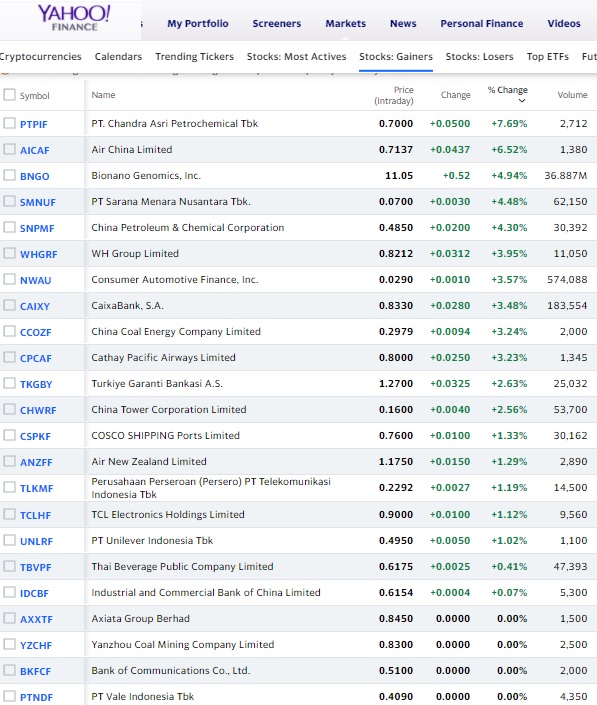

If you’re a stock market investor with a little vision, you might be wondering about investing in penny stocks. These are stocks whose shares are trading for less than a dollar.

Normally, a risky investment on companies with a very long shot at big success, there are times when they’ve got a better shot at success. And with zero commission trading, such as with Robinhood, TDAmeritrade, Tradezero, CharlesSchwab, etc., and with many investors cash rich or holding other stocks hitting their peaks, some investment in penny stocks isn’t a big gamble.

Buying a basket of the highest rated penny stocks might create a big winner down the road, and we’re in the post-pandemic era just ahead.

More investors are able to invest in penny stocks and more willing to buy speculative stocks. There’s no doubt there will be some new millionaires in the years ahead from penny stocks, however finding potential winners is one of the biggest investing challenges possible.

You will want to avail yourself of investing services with experience in penny stock investing strategies and big data capabilities. You may even want to see what the AI stock prediction tools.

Check out the small caps on the Russell index and S&P indexes for comparison.

Right now, there’s a lot of speculation in the markets, just as we could be entering a bull market and expanding economy. All that optimism and real growth, if it happens this summer, means some of these penny stock companies just might make it.

Consider small oil field companies just before the oil boom turned them into monster winners.

There’s more talk about penny stocks lately. Timothy Sykes on his blog notes 10 companies you may know of that started as penny stocks including: Amazon, Monster Beverage, Myland NV, AMD, Plug Power, NovaVax and Snap.

Other stocks to consider are 5G stocks, oil stocks, and the best tech stocks as 2021 evolves. See the best stocks to buy post and the best post pandemic stocks.

Top Penny Stocks

It’s a no brainer that penny stocks offer the best opportunity for big profit. Buying at 10 cents and selling at $100 5 years later means a thousand dollars turns into $100,000. But penny stock investing may not be much better than casino gambling. But if you have some gambling money, and use some good advice from experts, then you’re cutting down on the downside of penny stock investing.

Determining which penny stocks companies will succeed is exceedingly challenging and requires very good judgement. Investing in the S&P or Dow Blue chips might not bring much in the way of improvement in the next 5 years (recession is coming) so putting money down in really promising industries could pan out.

One thing to remember though as retail investing platforms see new clients moving from the big traditional brokerages is that they may be more likely to buy a basket of penny stocks.

One strategy you might use is with relying on a professional advisor service/brokerage that sends out alerts on penny stocks. For instance, see moneymorning’s penny stock alerts moneymorning.com/alerts/penny-stocks-alerts/:

Pros of Penny Stocks

- low share price

- big upside potential

- easy way to gamble

Dangers of Penny Stocks

- long shots at success

- risky given the company couldn’t raise money through other channels

- may not have accurate or honest reporting

- prices are volatile or pumped up

The Key to Buying Penny Stocks

The key is to have professional advisory services offer their estimate of the penny stocks company and it’s opportunity in whatever industry it’s in. Without really good investment guidance, you should buy penny stocks on the exchanges.

The reason penny stock buyers lose is because they’re buying the wrong stocks for the wrong reason at the wrong prices. Check out more on the full stock market forecast.

6 Month Stock Market Outlook | Tsla | Forecast for the 2023 Stock Market | Will the Stock Market Crash? | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions 2023 | Stocks Next Week | 6 Month Outlook | Stock Price Prediction Apps | US Housing Market | Stock Trading Platforms | Stock Trading | Reverse Mortgages