Dreaming of a Housing Market Crash?

Both buyers and sellers in the real estate market are sensitive to market crash indicators and hype in the media. And when we hear commercial real estate is at risk of a market crash, buyer’s are on the alert.

The exodus from urban areas, remote work, rising taxes in downtown regions, and continuous high lending rates, the spectre of a housing market correction is present.

Yet, we just passed through a pandemic downturn and the housing market didn’t collapse. It’s weathered all storms and demand remains. If anything, the US economic outlook is so positive (x-China) that demand for the low supply protects most markets from price collapses. Should an economic downturn occur, buyers with savings will enjoy a field day picking their next home.

And this is why some buyers do hope for a housing market crash in their cities. It would be a grand event provided they too don’t lose their jobs. And mortgages rates would fall, creating a vastly different marketplace. That doesn’t mean certain cities are off the crash list.

As the FED pushes the envelope on persistent high-interest rates, many buyer prospects will continue to hope for a housing market correction with lower prices. Yet experts do not expect a housing market crash, given the low housing inventory, stricter lending standards for sketchy buyers, and due to buyers themselves being wary of getting in over their heads as economic uncertainty persists.

The biggest threat would have to be Federal government policies and debt-financing failures. If the FED overshoots badly, a recessionary effect could put Americans in jeopardy, one Biden’s regime can’t undo through any measure.

No Rate Cuts Ahead, Means many could lose their Homes

Now in April, FED governors are moving toward no state cuts or just one single cut late in 2024. The latest jobs report is especially strong with strong wage gains.

And oil prices are up given rising geopolitical tensions and on growing energy demand. The hope for lower mortgage rates is weakening now, which means sales for 2024 might not be as strong. There is the possibility that neither buyers or sellers want to commit to a sale during 2024. Many are still asking whether home prices will fall or rise.

It seems as though the cities most likely to crash change frequently. Some of them on the list in years past are on the hottest cities list today. Places like Buffalo NY are good examples. Yet, the picture of the US economy is positive.

So the catalysts we’re really talking about are the FED rate disappointment and reaction to it, along with highly leveraged owners who won’t get lower loan refinancing anytime soon. So more homes will be foreclosed or sold as owners realize they can’t make their payments. And inflation may not be done. In fact, as rates are eased, the economy will roar forward. The possibility of further rate hikes isn’t off the table.

Drivers of higher inflation include $5 Trillion in money market funds moving into productive equities, oil prices rising higher, commodities prices rising up, and services costs continuing on an upward path (e.g., minimum wage in California hitting $20).

What Could Crash the Housing Markets?

Current theories involve housing price bubbles, that would suddenly collapse as demand disappears. Definitely, this is a price bubble caused by artificial supply restraints.

What Might be the Catalyst to give Buyers Worries?

- trade split with China becomes a cold war leading to supply issues

- government policy changes to deal with high rent prices

- consumer savings and confidence reach a tipping point to create a price bubble

- consumers lose confidence and withdraw suddenly

- war activity with Russian and China scares investors

Republicans won’t let Dem’s spending spree continue- Dems can’t pay big government debt interest payments coming due (covered to October)

- small businesses collapse in coming fall season due to mortgage/rent costs too high

- sudden re-rise of interest rates due to rekindled inflation and government financing crisis

- political mismanagement severely reduces confidence in the economy

- excessive new home construction

- some cities such as San Francisco, New York, New Jersey, Chicago lose their tax base and can’t fund operations (crisis)

- mortgage rates drop and a wave of homeowner decide to sell their properties before prices fall

Given more properties will be put up for sales given unaffordability, it removes pressure to avoid a collapse.

A market crash really needs a sudden economic shock such as debt repayment fail, war with Russia or China, or a commercial real estate crash. With respect to commercial properties, governments and others have been a lot to prop up that sector, and if that effort fails, we could see failure. Yet, banks are pretty solid. It’s the regional banks that could create concern as even J Powell has said there may be more regional bank failures as commercial fails and rates stay high.

Markets Bubbling Again?

Across the US, from California to Florida to Massachusetts, home prices aren’t bubbling up. The bubbling would only happen if mortgage rates fall, which the FED doesn’t want to happen. The Biden regime is in so much trouble financially, that the FED is between a rock and a hard place, and will stick to the status quo.

This summer selling season should be stronger than last, but not much can happen until rates fall. It’s after a surge of home buying where there an economic shock occurs that a housing crash could happen. Would that be 2025 in the midst of strong upward expectations? A big factor than might be the decoupling of the US from China. That would bring big prosperity to the US and rekindle US manufacturing for strong economic growth. But could some event cripple it then just as its fledgling? Would a resentful Xi act with evil intent at the worst time?

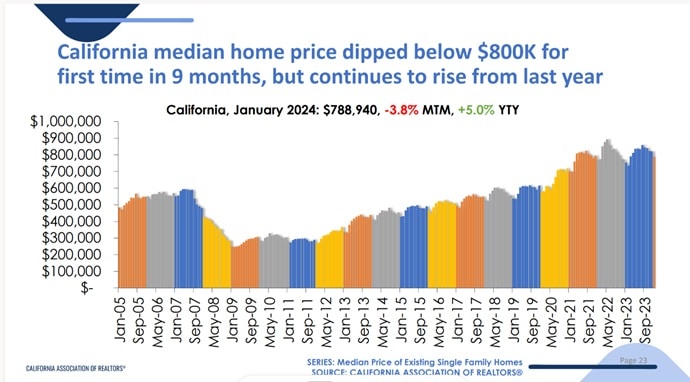

As this chart from California Association of Realtors shows the beleaguered state of California had its price rise slow in 2023. Yet whether California, Florida or Massachusetts, a severe shortage of homes also insulates the market from a price collapse. See more on the topic of home prices falling or rising in Florida.

No Real Case for a Housing Crash, Right Now

There really isn’t a solid case for a housing market crash right now. The FED might overshoot and push the economy into recession but even that wouldn’t be enough to obliterate demand and set a cascade of foreclosures and divestments goring forward. The biggest threat, and maybe a catalyst are high energy prices, government policy and large real estate investment firms exposed to commercial real estate. That could put a big crunch on consumer spending which in turn launches layoffs and the lower employment/wage effect. A $110 oil price could do it. It’s $85 a barrel now.

Yet, as I point out in the 2024 stock market outlook, there are many reasons why the high rates can’t continue, including the fact the US federal election is only 15 months away. No standing President can win an election in the midst of a downturn. Instead, with rates falling, taxes will flow, bills will get paid, and the infrastructure spending scheduled to begin in 2024 to 2027 will proceed.

See more on what’s happened during 2023 to America’s housing markets including California, Florida, Los Angeles, Boston, Dallas, Denver, Oregon, New York, and catch up on the housing market forecast for 2024.

What is Housing Crash Anyway?

And what exactly is a housing market crash?

A housing crash is a sudden devaluation of homes and a fleeing of more than just buyers, but instead a reduction that suggests something major has happened to the demand for homes.

See all 34 housing crash factors now.

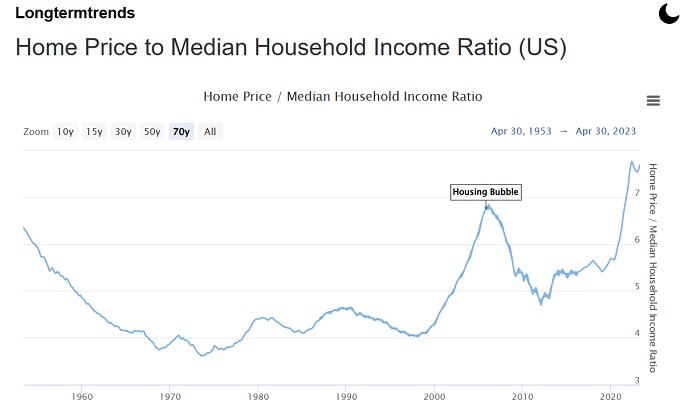

Bubbled up Pricing Meets Real Income

Key Emotional Drivers of a Potential Crash

Let’s get right to emotional drivers of a downturn:

- American consumer sentiment is down and en masse, buyers give up on considering a purchase

- deep fears of a recession begin being confirmed by rises in unemployment, poor earnings reports, and business bankruptcies

- cost of living rises faster and FED raises rates higher

- media hype as usual for clicks and ad revenue contributes to panic

- mortgage payments simply too high to consider buying a home

- Americans spending savings for daily living cost

- credit costs keep rising including credit cards, home equity lines, and mortgage debt pressuring worried mortgagees

- builder financing costs too high thus discouraging construction

- material and labor shortages make homes more expensive

- stock market downturn ruins American’s 401k holdings making them fear risk-taking

- homeowners find a place to move to, so they can finally unload their million-dollar properties

There are 33 signals/factors to watch below.

First Time Buyers Dropping Off

During the 12 first months of the pandemic home prices rose 15% on average across the US and that was repeated in the previous 12 months. First time buyers were hot in the mix at 34% of all sales in 2021, but dropped to 29% in August 2022.

23 Factors to Pay Attention To

Below are 23 major housing crash factors that could play into falling home prices in 2023.

23 Major Crash Factors for the US Housing Market (revised)

- buyer fatigue builds to a truly precipitous point where any event could stop all home buying

- rising unemployment makes buyers give up on dream

- rising interest rates adds too much to the typical monthly mortgage ($690 now)

- refinancing schemes get culled by the government and foreclosures begin in 2024

- inventory in some high-tax cities begins to be dumped (New York, Boston, Chicago, Los Angeles, San Francisco)

- government enacts new tough lending rules for mortgage companies

- high rates hit small businesses hard as consumers finally pull back hard on spending

- tech sector plunges on falling consumer spending and trade issues with China

- sellers seeing all chances of making their big real estate fortune disappear with perhaps foreclosure a possibility and they’ll begin dumping homes on the market

- stock market downturn damages personal wealth estimates and some sell their real estate assets

- oil and energy prices soar and inflation rises raises cost of living

- glut of new construction multifamily units without buyers plummets prices

- speculators believe it’s time to fully back out of the housing market

- China/US conflict sends stock markets crashing (Taiwan invasion/war maneuvers)

- Russia steps up careless behavior in the Ukraine and confrontation with NATO happens

- economy goes into high-speed wobble inviting drastic government intervention for its debt problems

- big rise in tax on corporations and billionaires causes more wealth to flee the country

- stock market at peak volatility and earnings outlooks dive (investors tuned to earnings now only)

- bankers quickly anticipate trouble and begin tightening mortgage lending with higher rates

- the Fed has to raise interest rates too quickly in 2022 to cover debt/capital needs, and given the size of home loans, a 1% increase would create defaults and panic selling

- debt in some cities most likely to crash hits a critical point

- massive student loan and personal debt defaults as unemployment rises

- yield curve inverts again severely thus scaring the financial community

It’s Not the Same as the Financial Crisis/Crash

Economic and lending circumstances today are different. There are no mortgages to zero income zero down payment people, fewer mortgage holders are underwater, homeowners have more savings and stock market portfolios are hefty.

Technical financial factors are often spoken about by economists and brokerage companies and bankers. But in each case, the issue is dissolved when the government prints money and kicks the problem down the road. Like someone in Vegas with a credit card, the consequences are waiting for them back home later on.

A Few Housing Market Experts Expected Demand to Fall

The US administration as mentioned, could take a hard line to crash the economy, but it would cost the election. Biden has woven such a complex web of problems, that there’s no way out. Crushing the economy would take demand way down to ease inflation, home prices, and more. Yet inflation is likely not to fall so fast.

Should you sell your house fast this summer? Well, you should hire a Realtor with a solid real estate marketing capability to help you get what the market will bear. 2023 poses a threat in that stimulus money may slow in that year. As things slow, speculators may give up on real estate. Construction may pick up and interest rates could rise thus easing the competition for houses for sale.

The Timeline of Housing Market

This scary looking roller-coaster timeline of market corrections and crashes indicates that when the next one does happen, it could be horrific. We have to consider what keeps the cart on the track and what will send it plunging.

Some homebuyers still haven’t recovered from their losses in the 2008 collapse (caused by defaults on consolidated mortgage-backed securities). Their home values plunged 30% and over 9 million lost their homes. Right now, 2.7 million homes are in mortgage forbearance.

Those who wish to refinance will be looking at big hikes, and a good portion of mortgage holders are deeply indebted. And we’re not at the end of rent moratoriums, and we know most renters won’t be able to pay back the rent they owe.

Crash forecasts are revolving around interest rates and government bankruptcy, but the real threat this time is government meddling. The US administration thinks it has control of the macroeconomic factors, and that a mountain of debt and regulation squeezes, high energy costs, and rising taxes aren’t a problem.

Commercial real estate is in severe trouble without stimulus because cities won’t be the same after the pandemic. That debt issue isn’t going away, when companies realize workers aren’t coming back to their highly overpriced offices. And many businesses are buried in huge debt going into the economic recovery.

The economy is rocketing (will reach 10% growth) but putting the breaks on just your dragster is ripping down the runway is not good. Some would call this a high speed wobble, where there is no control.

Once the governments get really scared (will New York City go bankrupt?) they’ll restrict mortgage qualifications, raise interest rates, which begins the process. Once everyone sees where the economy’s headed they start bailing out.

When Do Housing Bubbles Burst?

Markets always slide right after they reach big bubbly price highs which don’t match what consumers can afford, and as supply increases and buyers and mortgage holders lose their jobs. And buyers keep spending big with bubble cash. An event or series of small uncontrollable financial events can cause housing purchase demand to retreat as people withdraw from big-ticket purchases.

A stock market crash could coincide with the housing event and stock prices are highly inflated, not supported by real earnings.

This could be all about hyperinflation, political mistakes, and baffling complexity. This situation is novel, just like Covid 19, which means fear and misunderstanding will sweep in like a cold winter wind. The fact is, most Americans cannot protect themselves. They are at the full mercy of the economic machine.

This out of date graphic from NAR shows a trend that is continuing — high rent growth with wage stagnation. The situation for renters is unbearable, as more Americans find themselves homeless.

Printing Money Out of Control

By printing trillions of hand out money, inflation was the result. Biden isn’t done doing that sort of thing which feeds dependency, inflation, higher home prices, higher mortgage payments, higher US debt payments and a conflict with conservatives.

The issue of money printing is only one factor. The out of control spending now taking place, was well beyond the imagination of financial experts when they warned about spending. The national debt is about $32 Trillion now, a number no one forecasted or imagined, so the issue of US crashes is real, not a fear tactic.

The US is maxxing out its credit cards. What happens now?

Cities such as Austin, Dallas, Houston, Los Angeles, San Diego, Los Angeles, Baton Rouge, Bismarck, Anchorage, Casper, Midland, Lafayette, Bakersfield, are cities most likely to crash. The cities of New York, Chicago, and San Francisco are in a poor financial state so floating these cities will drain state and federal funding. In California, the debt troubles and social malaise are shocking. That beautiful place looks more and more like a battle zone with homeless encampments throughout the state.

Which are the cities most likely for a housing crash? Which cities should you buy property in 2019?

How Vulnerable is Your City?

Yet, investors and homebuyers should still be concerned about a housing bubble in their cities. Not all states have recovered from the last recession, nor benefited from any Obama era Federal government policies.

In late 2021, could the Fed ratchet up interest rates to pay for all the stimulus? In fact, almost every recession, housing downturn, or major catastrophe has been aided by fast rising interest rates. These rate spikes kill off business and put extreme pressures on mortgage holders. Markets collapse quickly then interest rates are quickly lowered.

This transition to a US centered economy over many many years, still puts the country into a vulnerable period of uncertainty and GDP risk. Will companies build factories here or instead hold off and hope for a Trump loss in 2020?

Unfortunately, “soft landings” after rate hike cycles are as rare as unicorns and virtually all modern rate hike cycles have resulted in a recession, financial, or banking crisis. There is no reason to believe that this time will be any different — Forbes report.

Crashes Historically Follow Price Bubbles

Markets fail when you least expect them to. After reading this post, you’ll see how easy it could happen from California to Texas and New York to Chicago. What will stop the dominoes from falling?

“Don’t we learn from history?” Perhaps history can only tell us whether the housing market 2020 is headed on a downward path, but can’t really say when or how it will happen, which cities might crash.

Zillow polled 100 economic experts about the economy and they believed a recession was coming in 2020. It would have happened if the Covid pandemic hadn’t occurred. Have we seen the end of stimulus inflation? More stimulus would create more inflation and trillions more are already stuffed into the money supply. That money still in stocks, crypto, and bank accounts could start chasing too few houses in 2022 leading to an event in 2023.

Check the stats and forecasts for the Denver housing market crash, Chicago housing market crash, Boston housing market crash, San Francisco housing market crash, Philadelphia housing market crash, and New York housing market crash.

Cities Most Likely for a Downturn

Are you looking for the best cities to invest in real estate or to avoid those metros most likely to crash? The best cities to buy rental properties gives you a peak at the potential of rental property investment.

Is this the right year to buy a rental income property? Should you sell your house, and when is the best time to sell it?

Rising mortgage rates, inflation, reduced housing supply and high home prices threaten the markets, it appears 2002’s real estate scene will stay strong. Realtors may want to build their presence this year as house prices decline in 2023. Lower prices will bring plenty of homes onto the real estate market and boost your opportunities.

See sales and price stats on other cities, including Denver, Austin, San Diego, Los Angeles, Dallas, New York, Boston, Atlanta and in the Florida housing market in Miami and Tampa.

Housing Market 2024 | Real Estate Housing Market | California Housing Forecast | Florida Housing Market | New York Real Estate | Boston Housing Market Forecast | Los Angeles Housing Market | Stock Market Forecast | Homebuilder Stocks | 5 Year Housing Outlook | Google Finance | Travel Marketing Tips | Travel Company Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel | Author Gord Collins