San Diego Home Prices Keep Climbing

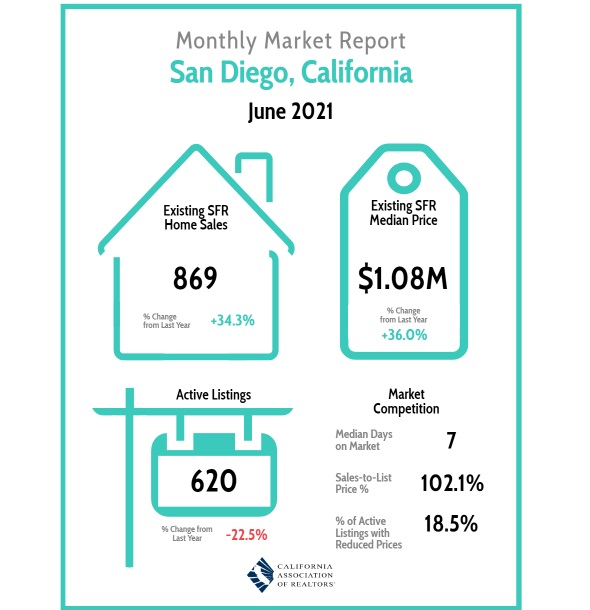

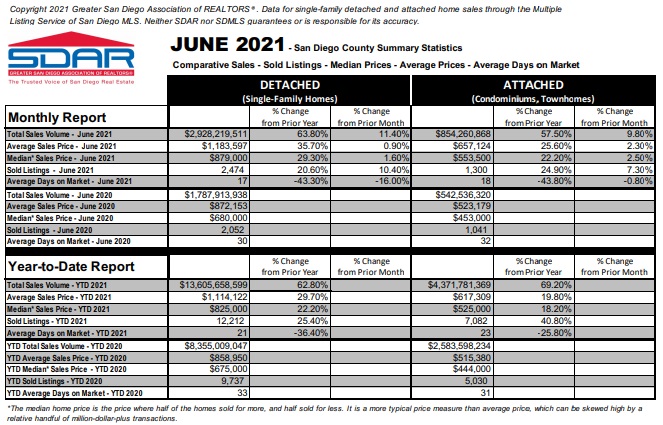

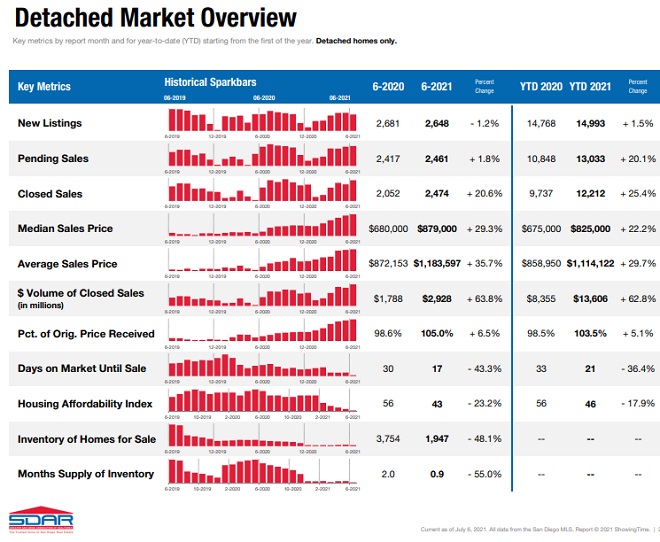

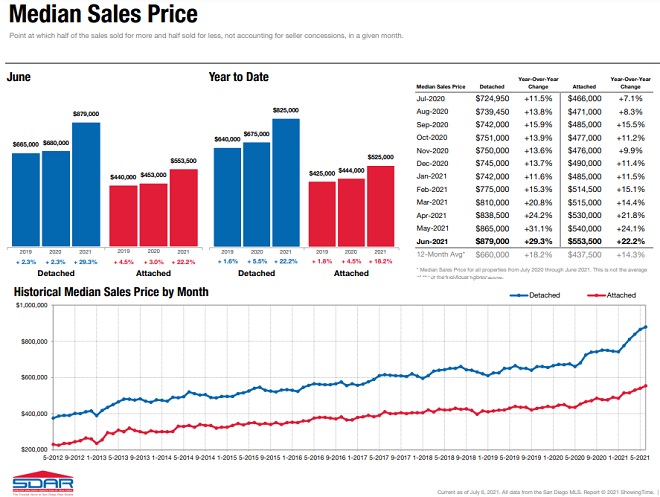

Pandemic or not, San Diego real estate is a much desired thing. House prices in the city of San Diego June rose to an average of $1,080,000 while it was $1,114,122 within San Diego County (up 29% from 12 months ago).

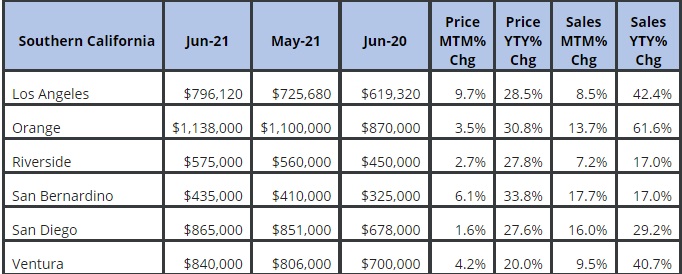

The median home price countywide in June was $865,000 up from $851,000 in May 2021. Foreclosures in SD are zero and the unemployment rate is dropping, while mortgage rates are holding steady. If San Diego is in a housing bubble, it looks like it’s going to get bigger.

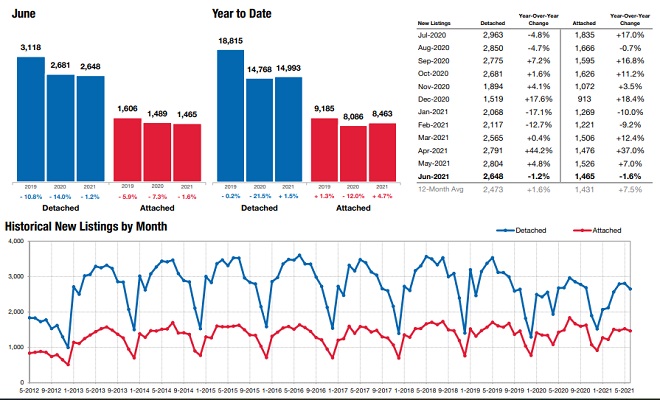

What’s driving home prices in SD is demand for the lifestyle, lack of houses listed for sale, growing American wealth, and the quality of single detached homes. As immigration returns, it seems likely the San Diego County area will attract many thus putting more pressure on homes prices in the next 6 months.

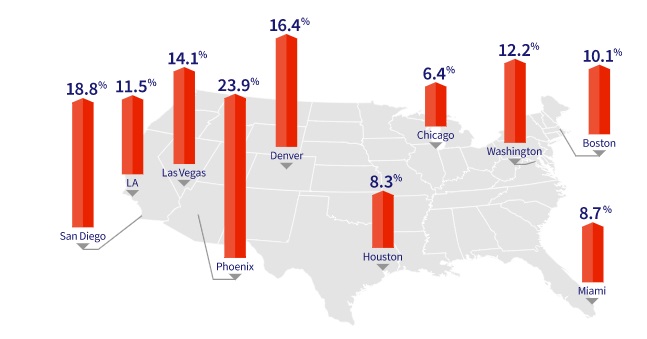

San Diego has experienced one of the highest rates of price growth nationwide.

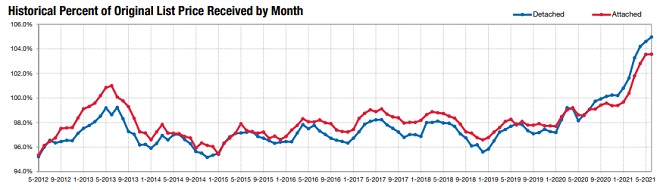

Buyers will have to work harder to compete for any new listings that appear. Rising prices and so few sales opportunities make it a frustrating market even for the most experienced real estate agents and homebuyers. It’s a seller’s market and home sellers are receiving much more than their list price.

In fact, an experienced Realtor is vital in this difficult real estate market and the best are talented marketers able to reach home sellers in SD county. Those looking for their dream homes, are advised to focus on luxury home specialists. Availability in the sub $500k price point is very limited.

Buyers in California are constantly asking if the housing market will crash and whether home prices will fall. Given a NIMBY enforced shortage of homes, and fast growing demand for homes in beautiful San Diego, prices could soar.

It’s important to remember that home prices in San Diego are luxury priced homes and they lag the general price rises. Luxury homes are in intense demand, and of course, San Diego is where every wealthy person wants to live.

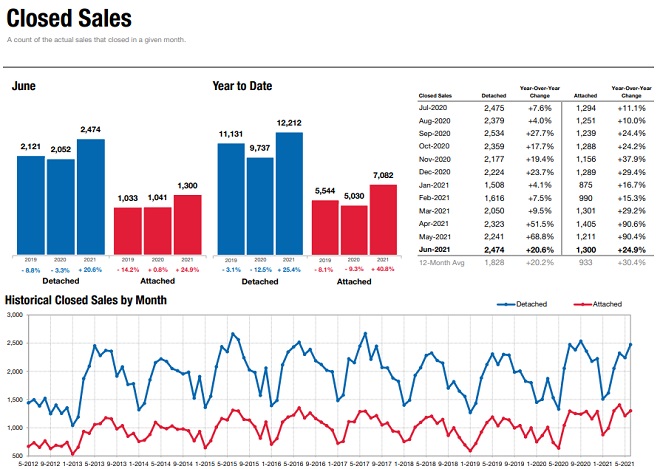

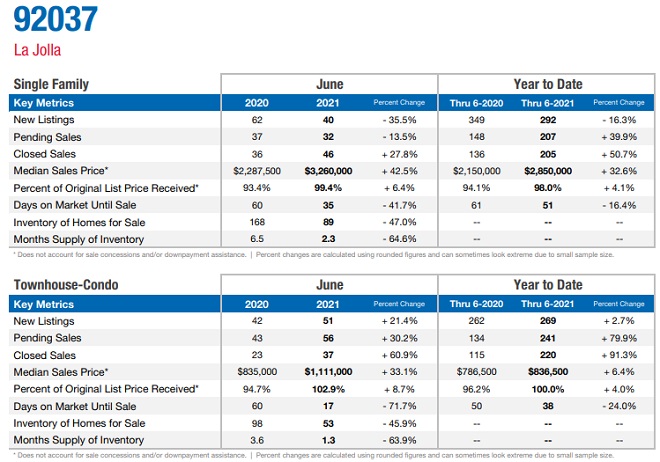

During April 2021, single family home sales grew 46.3% and sales of attached homes rose 82.4% despite the fact that supply decreased 60.4% for detached homes and 59.9% attached homes pending. Amazingly detached house sales increased 76.9% while detached home sales grew 110.9% year over year.

San Diego homebuyers and smart real estate agents are trying to use housing market forecasts intelligently to time purchases and find the best neighborhoods to focus on. The median home prices rose 24.4% to $840,000 for detached homes and went up 21.8% to $530,000 for attached homes.

San Diego housing market stats April 2021. Screenshot courtesy of SDAR.

Wealthy Buyers looking for Homes

The economic recovery in California this month will really heat up home sales. High taxes, high unemployment, and a lack of affordable housing is leading to out-migration of residents, just as it is in Los Angeles, San Francisco, Sacramento, and the Bay Area.

As you can see from the timeline charts, home sales and prices in the next 3 months will be lower than last year too.

That might suggest that a lack of listings is the key factor driving home prices and sales.

The housing market trends in San Diego are similar of course to other big cities in California. Los Angeles, San Francisco, San Jose, and Oakland share the same dynamic of outbound population migration and a lack of houses, which are in big demand.

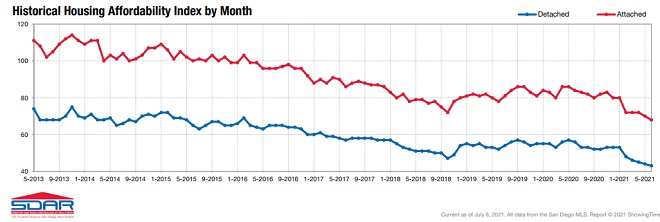

Housing Affordability in San Diego

The matter of housing affordability is a big matter in California, and in San Diego County as well. Yet, just like the rest of California, including the Los Angeles housing market, San Francisco housing market along with the Florida housing market, it’s all about demand for affordable units. In San Diego, such housing is very limited. Although San Diego’s economy is fine, it could heat up in 2020, beginning a long stretch of fast-rising housing prices.

Too many San Diego residents are considering leaving or have left for Austin, San Antonio, Tampa, Fort Worth, Dallas, Colorado Springs, Denver or Plano. The high cost of living is too stressful for many. This all points to a lack of housing being built in the region. Too much red tape to keep people out of paradise. It will be a battle with local politicians until buyers get tired of it. Giving up on buying in San Diego isn’t a good way to go. Stay and fight the politicians, get red tape cut, and let builders know you’re on their side.

Lot’s of reasons to love San Diego, with so much to do with its beautiful climate.

If you’re selling an upscale home in SD County, Dream Homes Magazine is the premier way to showcase the value and prestige of your property.

What’s San Diego’s achilles heel? Lack of housing development and a urban intensification plan. Another problem might be NIMBYS and politicians trying to suppress growth in this little piece of heaven. But San Diego’s smack dab in the middle of everything. They’ll be under extreme pressure to stop the resistance and net migration into SD County.

What’s San Diego’s achilles heel? Lack of housing development and a urban intensification plan. Another problem might be NIMBYS and politicians trying to suppress growth in this little piece of heaven. But San Diego’s smack dab in the middle of everything. They’ll be under extreme pressure to stop the resistance and net migration into SD County.

Political Resistance to Population Growth

In the face of huge demand, politicians will be under the gun about putting the Kibosh on SD’s amazing real estate fortune. This factor will ensure prices will rocket out of control. Are local SD County politicians and the California government doing much to grow housing developments inland? Will the exodus of illegal Mexicans ease the issue? Are illegals buying homes?

Demand for homes in San Diego County will never subside. It is one the best places on earth and prices will stay high. For homeowners here, it is one of those infrequent opportunities to cash out and make a killing. You only need a dream and somewhere to go.

Here’s an easy to understand Forecast of San Diego’s real estate future.

High home prices are driven by the California housing shortage crisis. Because of that, we’ll see big home prices right through the spring and really heat up in the summer. The same outlook applies to Los Angeles, Orange County, San Jose, Sacramento, Oakland, and the San Francisco Bay Area.

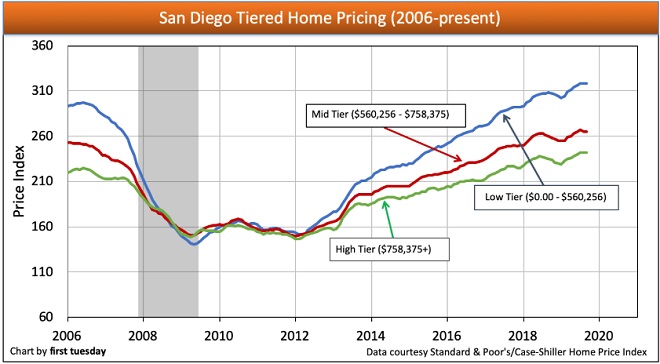

The 3 Tiered Market in SD

This excellent chart below courtesy of First Tuesday, shows how demand for lower-priced properties is almost a separate world.

It’s an excellent opportunity for rental property investors who want to capitalize on the severe housing and rental property shortage. Property owners near the I5 with waterfront views in La Jolla, Del Mar, Claremont, Solana Beach, and Encinitas may not have much to be concerned with.

As long as the Trump economic surge continues, San Diego’s outlook should be bright.

Factors Driving Real Estate in San Diego?

Here’s 13 factors you should be weighing when buying or selling in San Diego County:

- Housing Demand – High overall demand with new military and Hong Kong buyers

- Housing Supply – Throttled, supply is far from what’s needed

- Mortgage Rates – Continuing Low, especially in light of global economic slackening

- Down Payment and mortgage rules – Banks are withdrawing FHA loans however some are offering down payments as low as 3%

- Regional Employment – Very low and falling

- Buyer Income – low yet rising quickly

- Home Prices – High and rising – out of reach for most buyers – many consider San Diego County homes grossly over-priced

- Demographics – Millennials coming into family and home buying years and their income is growing fast

- Number of Renters – increasing fast

- New Home Construction: slow (100k to 140k per year) and illegal workers being chased out

- Economic-Foreign Trade – Trump expected to raise US GDP and add fuel to incomes and home prices

- President Trump – uncertainty of what Trump will create and how much interference he’ll see

- Taxes on Sale of Home – Tax situation is great for sellers

With the new Trump Era fully engaged, job growth will pick up steam in Southern California. This will drive growth in places like Escondido, Del Mar, Oceanside, Carlsbad, and San Diego.

If you’re thinking of selling, this might be the best time to contact a San Diego Realtor and begin the process. There is no vertical price rise on the graph, or glut of first time buyers with underwater mortgages.

My guess is that we’re in for good times for a while in San Diego. Please do review and share the 2018/2019 Los Angeles housing report , San Francisco housing report and Sacramento reports for info on California’s housing demand.

San Diego is in Demand

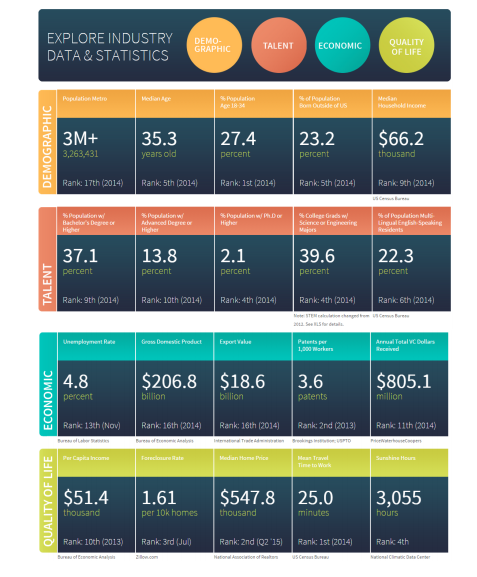

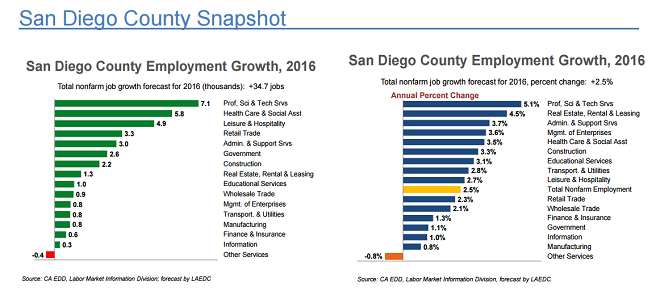

California was just named the 5th largest economy in the world and it’s had a great year in 2016. That’s amazing, but does San Diego’s small business and startup growth compare to that of LA and silicon valley? Some of the data below suggests that despite growth in manufacturing and professional services, talented workers may not want to move to SD county. With the Trump presidency firmly launched, San Diego, San Francisco and Los Angeles may be headed for boom times.

Which industries are best for startup businesses in San Diego?

Team Up with the Right Partners

Should San Diego Chamber of Commerce and San Diego Regional Economic Development be doing more? Although some startups have found success, it isn’t easy to succeed especially in digital marketing against tough competition.

Companies would be wise to get connected with companies and investors in other cities, perhaps Canada or the UK to build a wider base of success. By networking and accessing those components that don’t and never will exist in San Diego, SD might be able to compete equally with LA, NY, Boston and Silicon Valley. What shouldn’t be underestimated is the desire of companies in Vancouver or Toronto or London to work with SD companies. Motivation is a key factor in performance.

San Diego’s wonderful leisure climate and opportunities are a powerful draw to bring smart talent, business entrepreneurs, and investors from around the world. All that’s needed are people who believe in San Diego!

Check out SDEDC’s downloadable infographic of the current economic stats (June 2016)

Should SD be Leveraging the 4 Pillars instead of Leaning on Them?

San Diego has 4 key industries including maritime/naval, healthcare, tourism, and research.

US naval fleets and operations are the biggest engine of business and tax revenue in San Diego. The Trump government is spending hundreds of billions of dollars on defense. San Diego still needs to grow and diversify to generate greater opportunity, investment and of course jobs.

According to dot.ca.gov, in 2012, most employment sectors in San Diego enjoyed job growth. And the city’s current 4.2% jobless rate is extraordinary. Most cities can only dream of that. The largest gains occurred in professional services (+5,700 jobs), leisure and hospitality (+5,400 jobs), and retail and wholesale trade (+4,500 jobs), and education and healthcare (+4,300 jobs). The only sector that lost jobs was government (-1,400 jobs).

It’s expected that from 2013 to 2018, growth will average 1.9 % per year and the fastest rates of growth will occur in information and professional and business services with annual rates of 3.8% and 2.9%

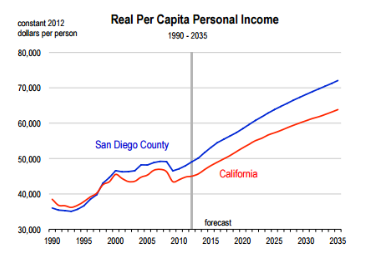

Compare SD’s per capital income growth to San Francisco’s pictured here at right, and you can expect more skilled, creative talented IT related workers to choose Palo Alto and Mountainview rather than San Diego to work and live. But for startups, it might be better to stick to Toronto (see Entrepreneur.com’s vote), Vancouver or Charlotte. Boston, LA, San Francisco, and Silicon Valley are expensive. And Sergei Brin of Google agrees.

Don’t launch your startup in Silicon Valley. During the boom cycles, the expectations around the costs – real estate, salaries – the expectations people and employees have … it can be hard to make a scrappy initial business that’s self-sustaining. Silicon Valley is good for scaling that opportunity, providing more capital and allowing more risk.” — Sergei Brin stated at the Global Entrepreneurship Summit June 27, 2016

From 2016 to 2020, SD’s population will grow about 180,000 and per capita income will grow about $4,000 to an average of $58,428. The professional services sector will see the strongest job growth in total of more than 20,000 new jobs.

High wages in San Francisco, Palo Alto, Mountainview, Santa Clara, San Jose will draw high skilled IT workers like flies. However the Bay Area is pricey and the cost of doing business there will eat away at capital and profits. Silicon Valley looks to India for alleys but Donald Trump might throw a monkey wrench into their machine.

Where will you find San Francisco apartments for rent? Are you looking for the best cities to invest in real estate in 2019? Where is the best Vacation destination: Costa Rica or San Diego? Is this he right time to sell your home? Reports suggest people don’t intend to sell their homes so what impact will that have on the US housing construction forecast? In 2020 the mortgage rate forecast is excellent so first time buyers might now get the mortgage financing they need to buy.

SEO Consultant California

Digital Marketing Services for businesses in California: Looking to improve your company’s marketing success online? An SEO consultant San Diego uses advanced search engine optimization and authority building content strategy to dominate rankings.

Find out more on The Real Estate Housing Market and San Diego California along with Homes for Sale San Diego.

Software Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO